Tax Paperwork Deadline Dates

Understanding Tax Paperwork Deadline Dates

As the tax season approaches, it’s essential to stay on top of the critical deadline dates to avoid any penalties or fines. The deadline for submitting tax paperwork can vary depending on the type of tax return, the entity filing, and the specific requirements of the tax authority. In this blog post, we will delve into the world of tax paperwork deadline dates, exploring the key dates, consequences of missing deadlines, and tips for staying organized.

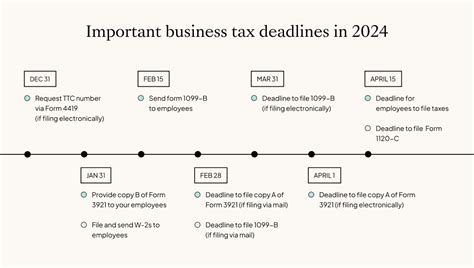

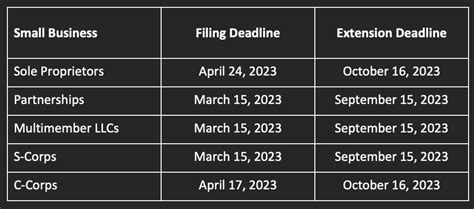

Key Deadline Dates for Tax Paperwork

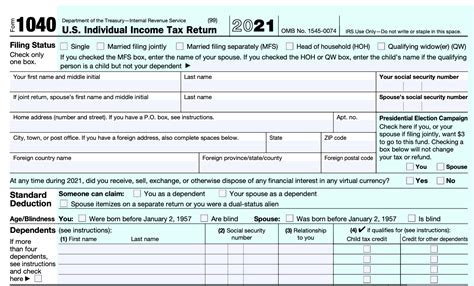

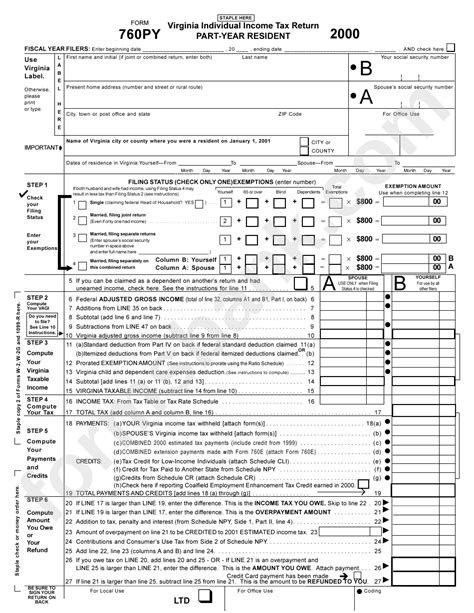

The following are some of the most critical deadline dates for tax paperwork: * January 31st: Deadline for employers to provide employees with W-2 forms and for financial institutions to provide 1099 forms to recipients. * February 1st: Deadline for furnishing 1099-MISC forms to recipients for payments made in the previous tax year. * March 15th: Deadline for S corporations and partnerships to file their tax returns (Form 1120S and Form 1065). * April 15th: Deadline for individuals to file their tax returns (Form 1040) and for C corporations to file their tax returns (Form 1120). * April 15th: Deadline for first-quarter estimated tax payments for the current tax year. * June 15th: Deadline for second-quarter estimated tax payments for the current tax year. * September 15th: Deadline for third-quarter estimated tax payments for the current tax year. * January 15th of the following year: Deadline for fourth-quarter estimated tax payments for the previous tax year.

Consequences of Missing Deadline Dates

Missing tax paperwork deadline dates can result in severe consequences, including: * Penalties and fines: The tax authority may impose penalties and fines for late filing or payment. * Interest on overdue taxes: The tax authority may charge interest on any unpaid taxes, which can accrue over time. * Loss of refunds: If tax returns are not filed on time, refunds may be delayed or even forfeited. *

Tips for Staying Organized and Meeting Deadline Dates

To avoid missing critical deadline dates, consider the following tips: * Create a tax calendar: Keep track of important deadline dates using a tax calendar or planner. * Set reminders: Set reminders for upcoming deadline dates to ensure timely filing and payment. * Gather necessary documents: Collect all necessary tax documents, such as W-2 forms, 1099 forms, and receipts, to facilitate timely filing. * Seek professional help: Consider consulting a tax professional to ensure accurate and timely filing of tax returns. * Take advantage of extensions: If needed, take advantage of extensions to file tax returns, but be aware of any associated penalties or interest.

Additional Tips for Businesses

For businesses, it’s essential to: * Maintain accurate records: Keep accurate and detailed records of financial transactions, including income, expenses, and tax-related documents. * Stay informed about tax law changes: Stay up-to-date with changes in tax laws and regulations to ensure compliance and avoid any potential penalties. * Consider outsourcing tax preparation: Consider outsourcing tax preparation to a reputable tax professional to ensure accurate and timely filing.

📝 Note: It's crucial to verify deadline dates with the relevant tax authority, as dates may be subject to change.

As the tax season approaches, it’s essential to stay organized and informed about critical deadline dates. By understanding the key deadline dates, consequences of missing deadlines, and tips for staying organized, individuals and businesses can ensure timely and accurate filing of tax returns, avoiding any potential penalties or fines.

In summary, staying on top of tax paperwork deadline dates is crucial for avoiding penalties and ensuring timely filing of tax returns. By creating a tax calendar, setting reminders, gathering necessary documents, seeking professional help, and taking advantage of extensions, individuals and businesses can stay organized and meet critical deadline dates.

What are the consequences of missing the tax filing deadline?

+

The consequences of missing the tax filing deadline can include penalties, fines, interest on overdue taxes, and delayed processing of tax returns.

Can I file for an extension if I miss the tax filing deadline?

+

Yes, you can file for an extension, but be aware that an extension to file is not an extension to pay, and any taxes owed are still due on the original deadline date.

How can I stay organized and meet tax paperwork deadline dates?

+

To stay organized, create a tax calendar, set reminders, gather necessary documents, seek professional help, and take advantage of extensions if needed.