5 Tax Paperwork Dates

Understanding Tax Paperwork Dates: A Guide to Compliance

As the tax season approaches, it’s essential to stay on top of the critical deadlines to avoid penalties and ensure a smooth filing process. Tax paperwork dates can be overwhelming, but with a clear understanding of the key milestones, individuals and businesses can navigate the tax landscape with confidence. In this article, we’ll delve into the five crucial tax paperwork dates that you need to know, highlighting the importance of each and providing valuable insights to help you stay compliant.

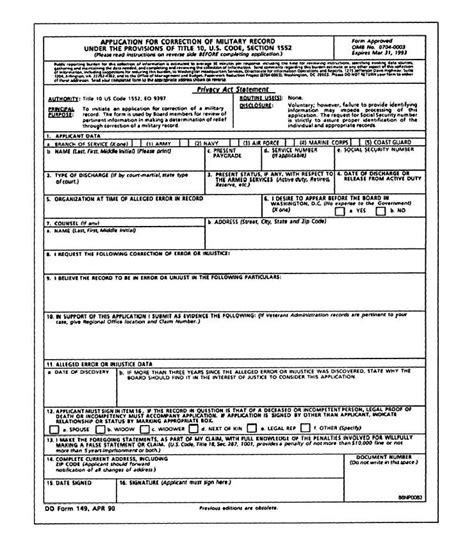

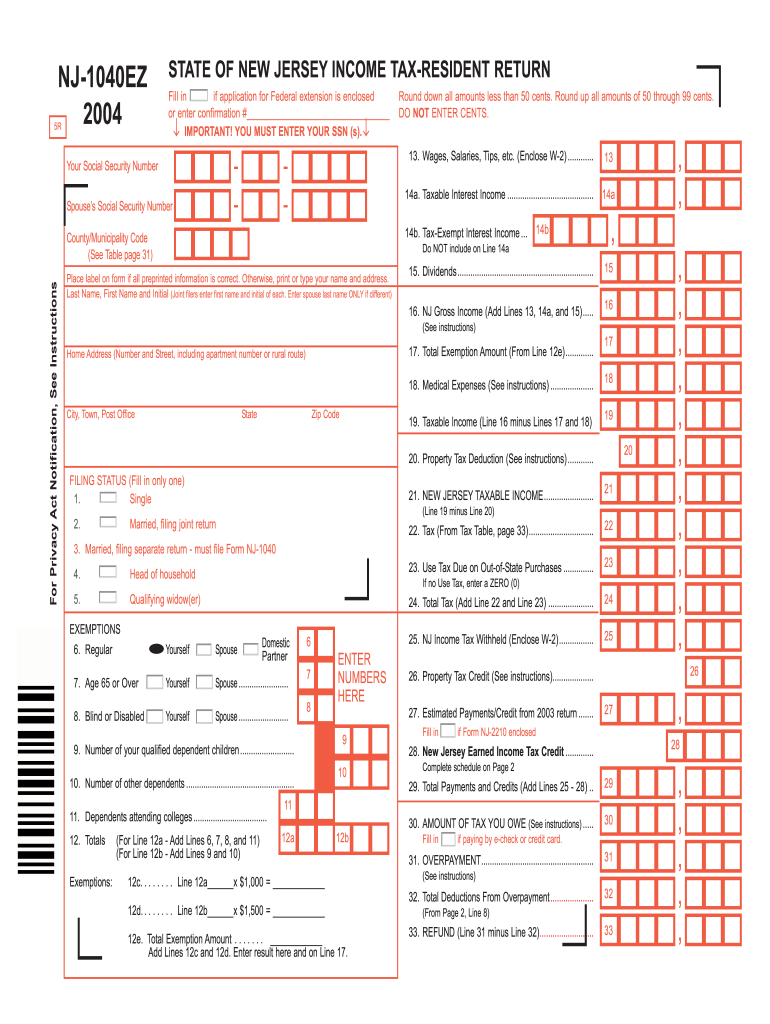

January 31st: Receipt of Tax Documents

The first critical date is January 31st, by which employers and financial institutions must provide tax documents to taxpayers. These documents include:

- W-2 forms for employees, detailing their income and taxes withheld

- 1099 forms for independent contractors and freelancers, outlining their earnings

- 1098 forms for mortgage interest paid

- 1099-INT and 1099-DIV forms for interest and dividend income

February 1st: IRS Begins Accepting Tax Returns

The Internal Revenue Service (IRS) typically starts accepting tax returns on February 1st. This marks the beginning of the tax filing season, and taxpayers can begin submitting their returns electronically or by mail. It’s crucial to file your tax return as soon as possible to avoid delays and ensure prompt processing of your refund, if applicable.

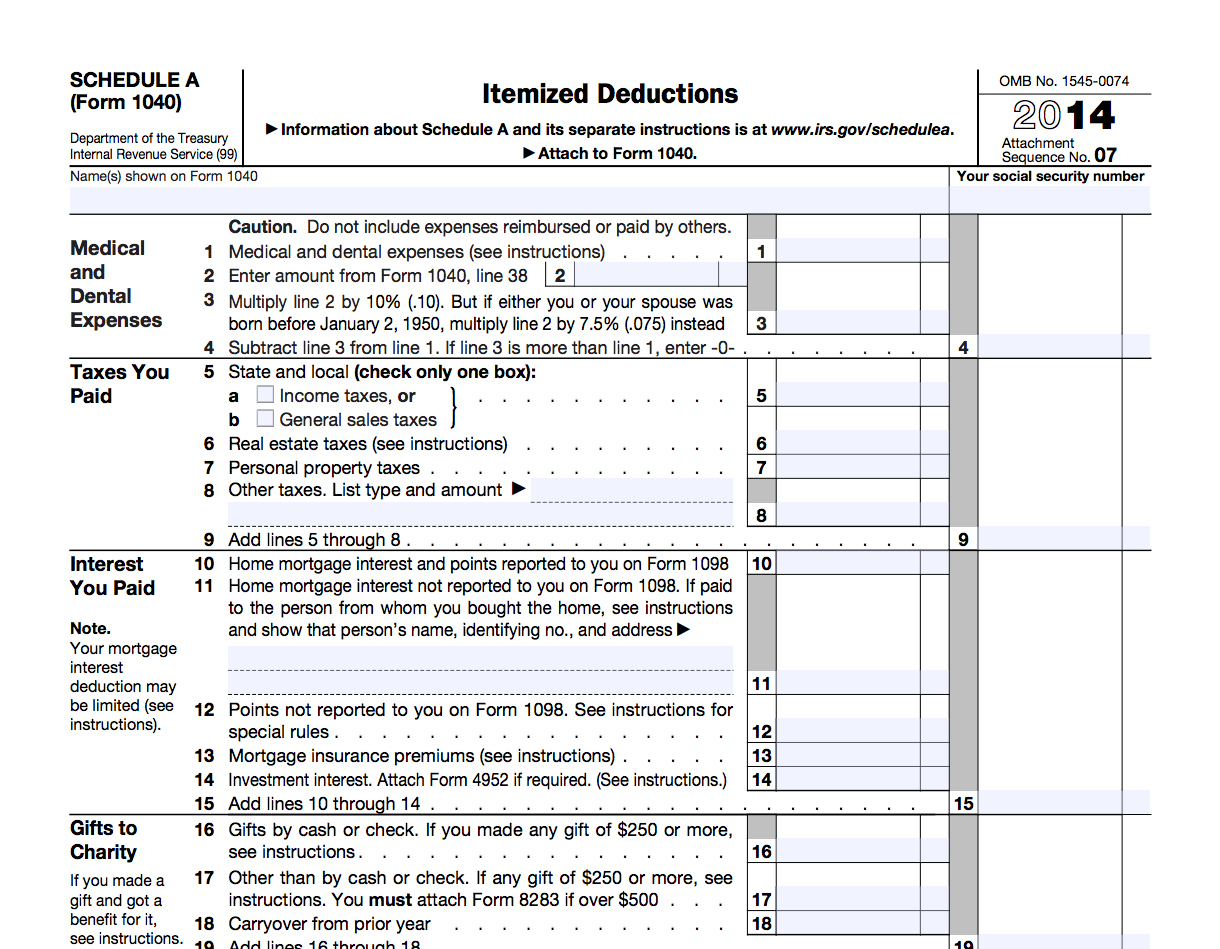

April 15th: Tax Filing Deadline

The most critical tax paperwork date is April 15th, the deadline for filing individual tax returns. This is the last day to submit your tax return and make any necessary payments to avoid penalties and interest. If you’re unable to file by this date, you can request an automatic six-month extension by filing Form 4868. However, keep in mind that this extension only applies to the filing deadline, not the payment deadline. You’ll still need to estimate and pay any owed taxes by April 15th to avoid penalties.

June 15th: Extended Tax Filing Deadline for Expats

For expatriates and individuals living abroad, the tax filing deadline is automatically extended to June 15th. This additional time allows those with foreign-earned income to gather necessary documents and file their tax returns. However, it’s essential to note that this extension does not apply to the payment deadline, and any owed taxes should still be paid by April 15th to avoid penalties.

October 15th: Final Extended Tax Filing Deadline

The final extended tax filing deadline is October 15th, which applies to individuals who requested an automatic six-month extension by filing Form 4868. This is the last chance to submit your tax return and make any necessary payments to avoid penalties and interest. If you’re still unable to file by this date, you may be subject to additional penalties and interest on your owed taxes.

📝 Note: It's crucial to stay informed about tax paperwork dates, as they may be subject to change. Always check the official IRS website or consult with a tax professional to ensure you're meeting the necessary deadlines.

To stay organized and ensure compliance with tax paperwork dates, consider the following tips:

- Mark your calendar with the critical tax deadlines

- Gather necessary documents and tax information throughout the year

- Consult with a tax professional if you’re unsure about any aspect of the tax filing process

- Take advantage of electronic filing and payment options to streamline the process

| Date | Event |

|---|---|

| January 31st | Receipt of tax documents |

| February 1st | IRS begins accepting tax returns |

| April 15th | Tax filing deadline |

| June 15th | Extended tax filing deadline for expats |

| October 15th | Final extended tax filing deadline |

In summary, understanding the critical tax paperwork dates is vital to ensure compliance and avoid penalties. By staying informed and organized, individuals and businesses can navigate the tax landscape with confidence. Remember to mark your calendar with the essential deadlines, gather necessary documents, and consult with a tax professional if needed.

What is the deadline for filing individual tax returns?

+

The deadline for filing individual tax returns is April 15th.

Can I request an extension for filing my tax return?

+

Yes, you can request an automatic six-month extension by filing Form 4868. However, this extension only applies to the filing deadline, not the payment deadline.

What is the final extended tax filing deadline?

+

The final extended tax filing deadline is October 15th, which applies to individuals who requested an automatic six-month extension.