5 Bankruptcy Forms

Introduction to Bankruptcy Forms

When individuals or businesses are overwhelmed by debt and cannot pay their creditors, they may consider filing for bankruptcy. The bankruptcy process involves completing and submitting various forms to the court, which can be complex and time-consuming. In this article, we will discuss five essential bankruptcy forms that individuals and businesses need to understand.

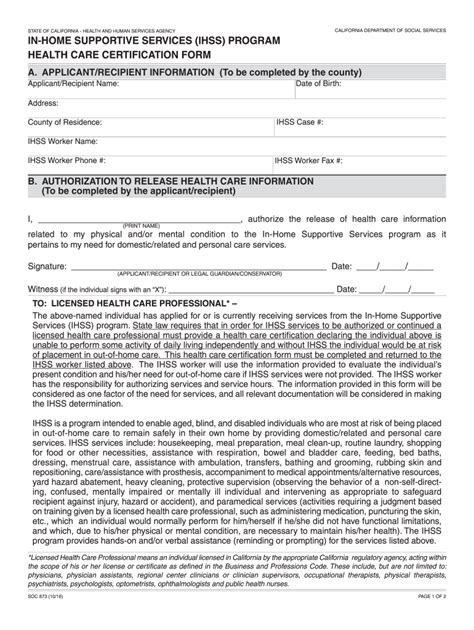

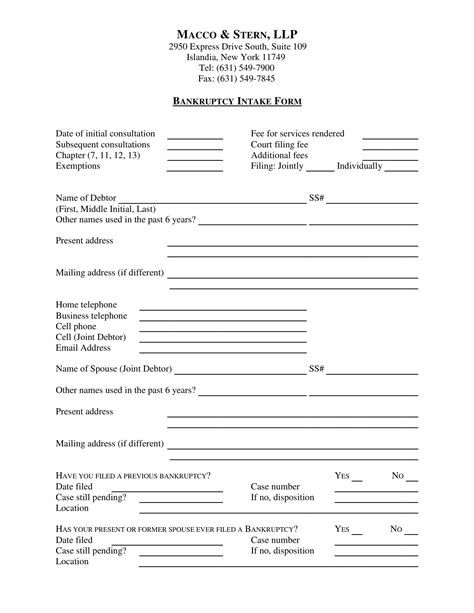

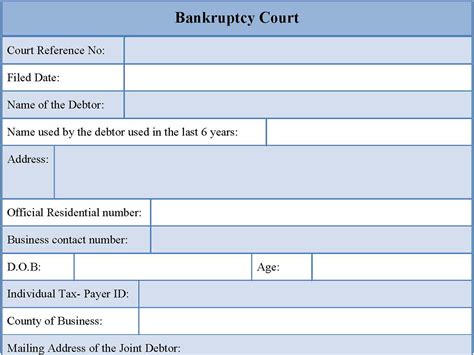

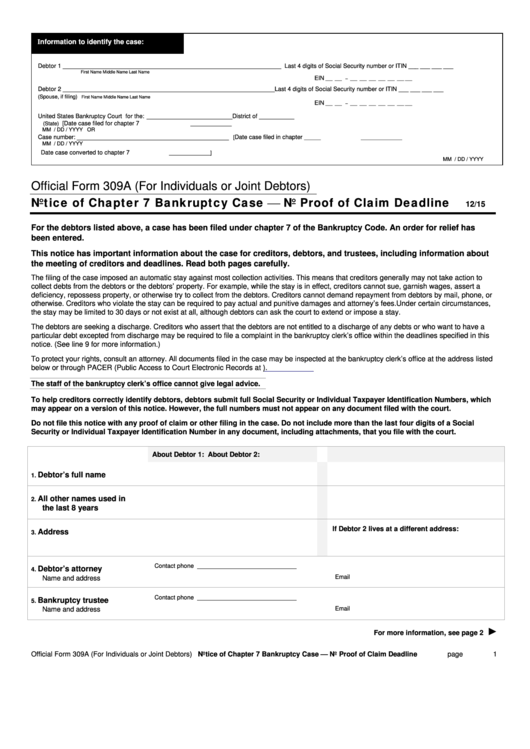

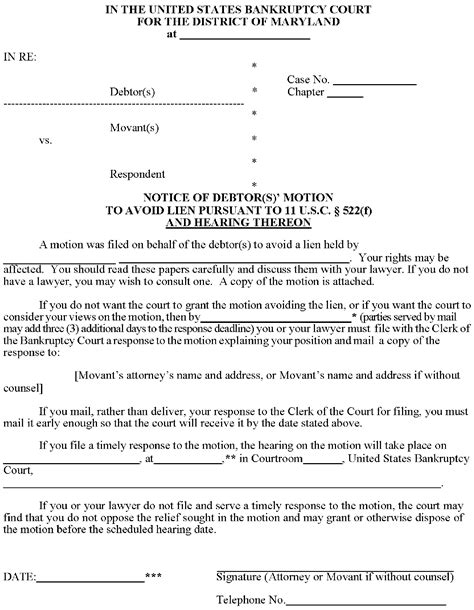

Form 1: Voluntary Petition

The Voluntary Petition is the initial form that individuals or businesses file with the court to begin the bankruptcy process. This form provides basic information about the debtor, including their name, address, and social security number. It also requires the debtor to indicate the type of bankruptcy they are filing for, such as Chapter 7 or Chapter 13. The Voluntary Petition is usually accompanied by other forms, such as the Certificate of Credit Counseling and the Statement of Financial Affairs.

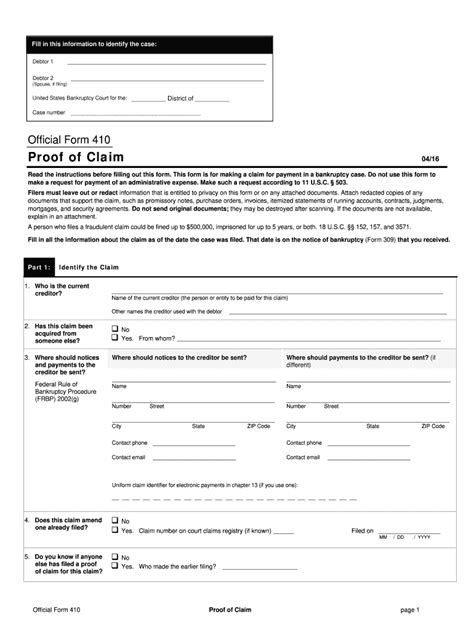

Form 2: Statement of Financial Affairs

The Statement of Financial Affairs is a critical form that requires debtors to provide detailed information about their financial situation. This form asks debtors to disclose their income, expenses, assets, and liabilities, as well as any financial transactions they have made in the past two years. The Statement of Financial Affairs helps the court understand the debtor’s financial situation and determine whether they are eligible for bankruptcy.

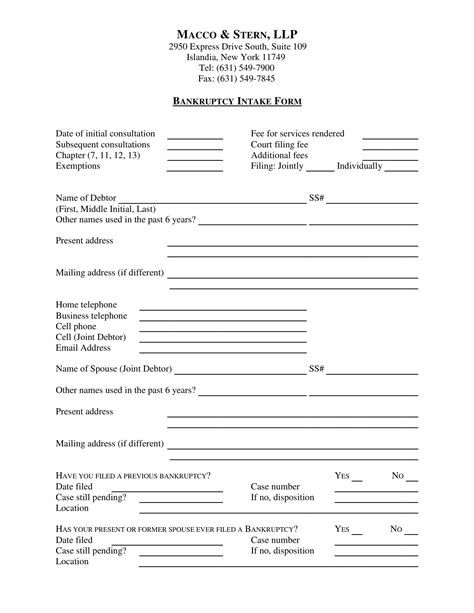

Form 3: Schedules A-J

Schedules A-J are a series of forms that debtors use to list their assets, liabilities, and other financial information. These forms include: * Schedule A: Real property * Schedule B: Personal property * Schedule C: Exemptions * Schedule D: Secured creditors * Schedule E: Unsecured creditors * Schedule F: Unsecured non-priority creditors * Schedule G: Executory contracts and unexpired leases * Schedule H: Co-signers * Schedule I: Income * Schedule J: Expenses These schedules help the court understand the debtor’s financial situation and determine which assets are exempt from the bankruptcy estate.

Form 4: Means Test

The Means Test is a form that debtors use to determine whether they are eligible for Chapter 7 bankruptcy. This form requires debtors to calculate their income and expenses to determine whether they have sufficient disposable income to repay a portion of their debts. If the debtor’s income is above the median income for their state, they may be required to file for Chapter 13 bankruptcy instead.

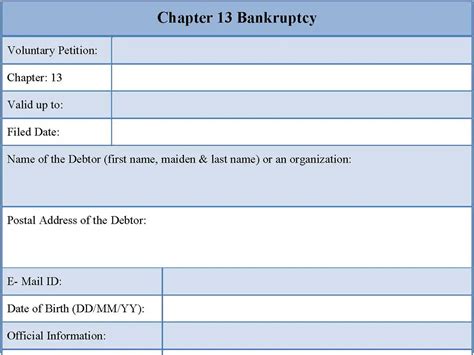

Form 5: Plan and Disclosure Statement

The Plan and Disclosure Statement is a form that debtors use to propose a plan to repay their creditors. This form is required for Chapter 13 bankruptcy and outlines the debtor’s plan to repay a portion of their debts over time. The Plan and Disclosure Statement must include information about the debtor’s income, expenses, and assets, as well as a detailed plan for repaying creditors.

📝 Note: Debtors should carefully review and complete all bankruptcy forms to ensure accuracy and completeness. Inaccurate or incomplete forms can lead to delays or even dismissal of the bankruptcy case.

To summarize, the five essential bankruptcy forms are: * Voluntary Petition * Statement of Financial Affairs * Schedules A-J * Means Test * Plan and Disclosure Statement These forms are critical to the bankruptcy process and require debtors to provide detailed information about their financial situation.

In the end, understanding these bankruptcy forms is crucial for individuals and businesses who are considering filing for bankruptcy. By carefully reviewing and completing these forms, debtors can ensure a smooth and successful bankruptcy process.

What is the purpose of the Voluntary Petition?

+

The Voluntary Petition is the initial form that individuals or businesses file with the court to begin the bankruptcy process. It provides basic information about the debtor and indicates the type of bankruptcy they are filing for.

What is the Statement of Financial Affairs?

+

The Statement of Financial Affairs is a form that requires debtors to provide detailed information about their financial situation, including income, expenses, assets, and liabilities.

What is the purpose of the Means Test?

+

The Means Test is a form that debtors use to determine whether they are eligible for Chapter 7 bankruptcy. It requires debtors to calculate their income and expenses to determine whether they have sufficient disposable income to repay a portion of their debts.