PFD Paperwork Due Date

Understanding PFD Paperwork and Due Dates

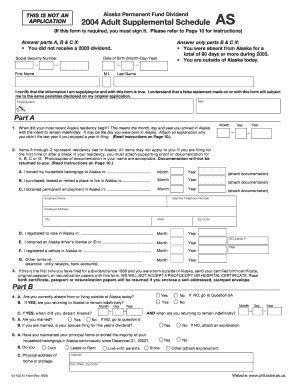

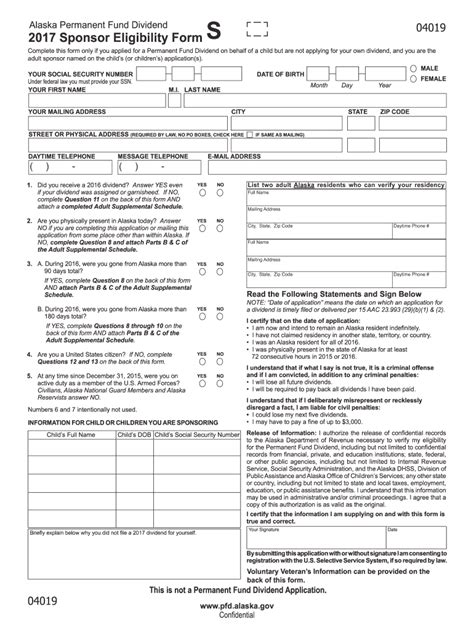

Managing permanent fund dividend (PFD) paperwork can be a daunting task, especially when it comes to meeting the due dates. It is essential to stay on top of the application process to ensure that you receive your dividend on time. In this article, we will delve into the world of PFD paperwork and due dates, providing you with a comprehensive guide to help you navigate the process.

What is PFD Paperwork?

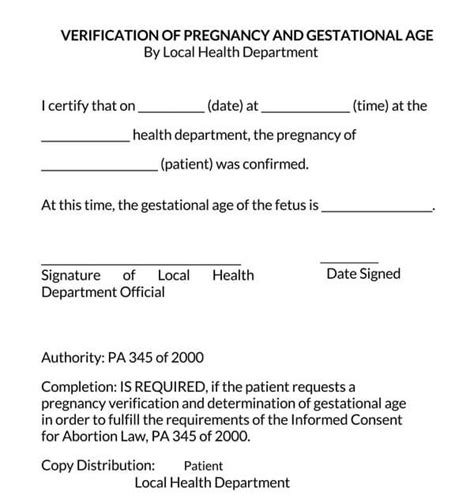

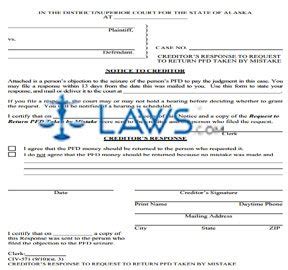

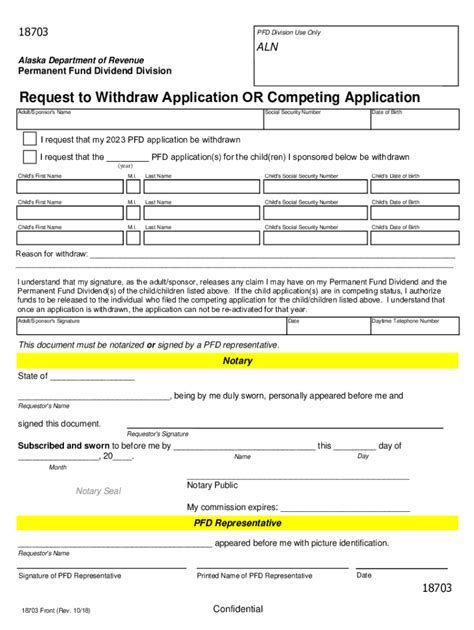

PFD paperwork refers to the application and documentation required to apply for the permanent fund dividend. The dividend is an annual payment made to eligible residents of a state or country, typically funded by the state’s oil revenues. The paperwork involves providing personal and financial information, as well as meeting specific eligibility criteria. It is crucial to accurately complete the paperwork to avoid any delays or rejections.

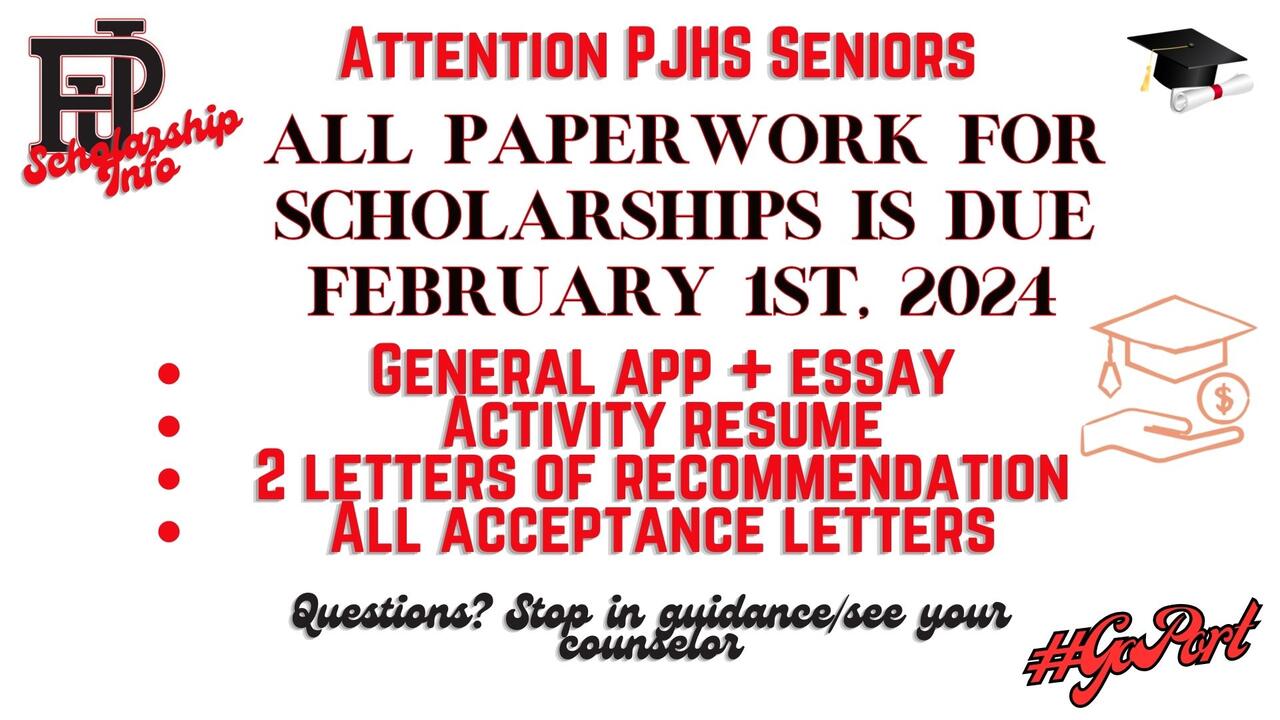

Due Dates for PFD Paperwork

The due dates for PFD paperwork vary depending on the state or country. Typically, the application period opens in January and closes in March of each year. However, it is essential to check with the relevant authorities for the specific due dates, as they may be subject to change. Missing the due date can result in a delayed payment or even disqualification from receiving the dividend.

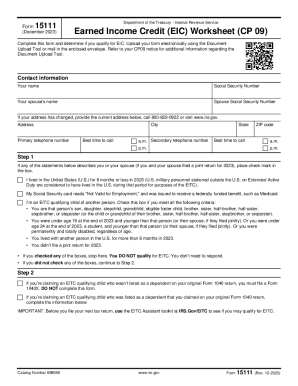

Eligibility Criteria for PFD

To be eligible for the permanent fund dividend, applicants must meet specific criteria, including: * Being a resident of the state or country for a certain period * Meeting income and resource requirements * Having a valid social security number * Not being a recipient of certain government benefits * Meeting other requirements as specified by the authorities

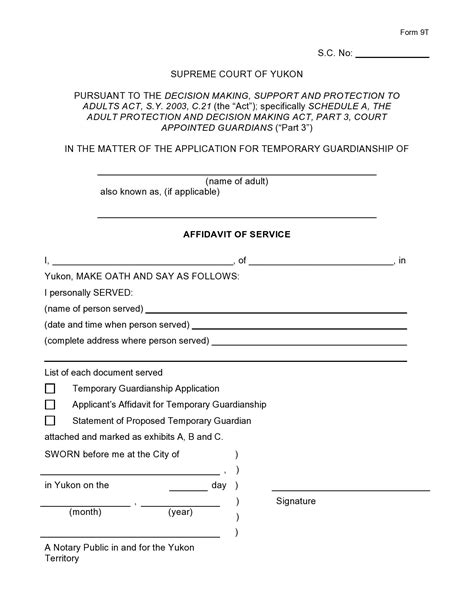

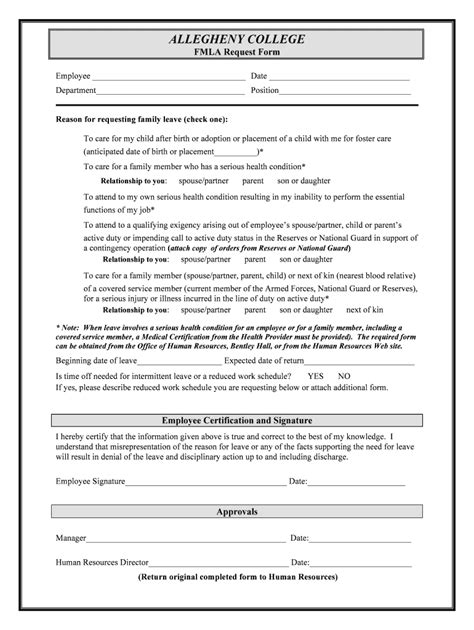

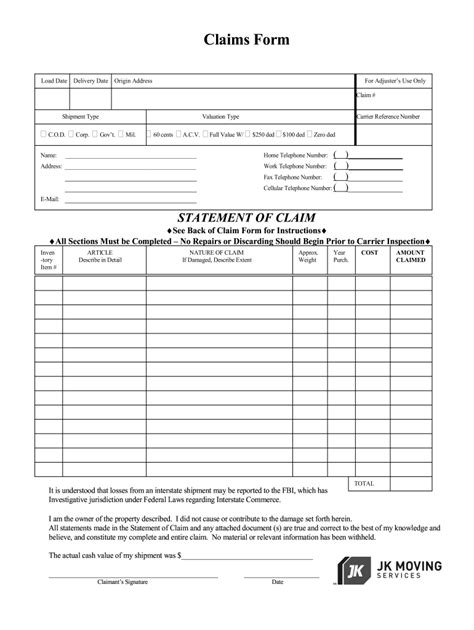

How to Apply for PFD

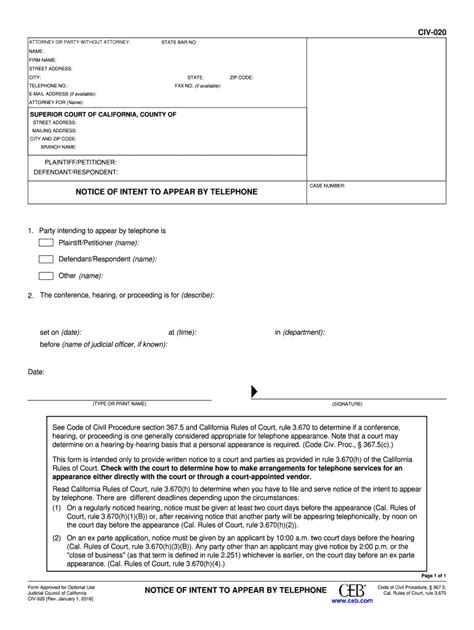

The application process for PFD involves the following steps: * Gathering required documents, such as proof of residency and identification * Completing the application form, either online or by mail * Submitting the application and supporting documents before the due date * Verifying the application status and receiving the dividend payment

Common Mistakes to Avoid

When completing PFD paperwork, it is essential to avoid common mistakes, such as: * Inaccurate or incomplete information * Missing deadlines * Failing to provide required documentation * Not meeting eligibility criteria

📝 Note: It is crucial to carefully review the application and supporting documents to ensure accuracy and completeness, as errors can result in delays or rejections.

Benefits of PFD

The permanent fund dividend provides numerous benefits to eligible residents, including: * A source of income to support living expenses * An incentive to reside in the state or country * A boost to the local economy, as residents are more likely to spend their dividend within the community

Table of PFD Application Timeline

| Month | Application Period | Due Date |

|---|---|---|

| January | Application period opens | |

| March | Application period closes | March 31st |

| June | Dividend payment |

In summary, understanding PFD paperwork and due dates is crucial to receiving the permanent fund dividend. By following the application process, meeting eligibility criteria, and avoiding common mistakes, eligible residents can receive their dividend on time. It is essential to stay informed about the application timeline and due dates to ensure a smooth and successful application process.

What is the permanent fund dividend?

+

The permanent fund dividend is an annual payment made to eligible residents of a state or country, typically funded by the state’s oil revenues.

How do I apply for the permanent fund dividend?

+

To apply for the permanent fund dividend, you can complete the application form online or by mail, and submit it along with the required documents before the due date.

What are the eligibility criteria for the permanent fund dividend?

+

The eligibility criteria for the permanent fund dividend include being a resident of the state or country for a certain period, meeting income and resource requirements, and having a valid social security number.