Paperwork

PPP Forgiveness Deadline

Introduction to PPP Forgiveness

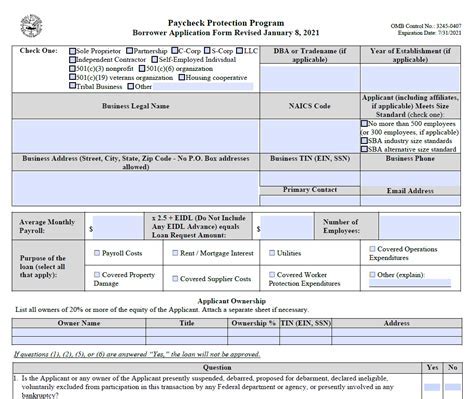

The Paycheck Protection Program (PPP) was established by the CareS Act to provide financial assistance to small businesses and other eligible entities affected by the COVID-19 pandemic. One of the key benefits of the PPP is the potential for loan forgiveness, which allows borrowers to have their loans partially or fully forgiven if they meet certain conditions. In this post, we will delve into the details of PPP forgiveness, including the deadline, eligibility criteria, and application process.

Understanding PPP Forgiveness

To be eligible for PPP forgiveness, borrowers must use at least 60% of the loan amount for payroll costs, which include:

- Salary, wages, and commissions

- Payment of cash tips

- Payment for vacation, parental, family, medical, or sick leave

- Allowance for separation or dismissal

- Payment required for the provisions of group health care benefits, including insurance premiums

- Payment of any retirement benefit

- Payment of state and local taxes assessed on the compensation of employees

- Mortgage interest

- Rent

- Utilities

- Interest on other debt obligations incurred before February 15, 2020

PPP Forgiveness Deadline

The Small Business Administration (SBA) has set a deadline for borrowers to apply for PPP forgiveness. Borrowers have until 10 months after the end of the covered period to apply for forgiveness. The covered period is either:

- 8 weeks (56 days) after the loan disbursement date

- 24 weeks (168 days) after the loan disbursement date

PPP Forgiveness Application Process

To apply for PPP forgiveness, borrowers must submit a completed application to their lender, which includes:

- PPP Loan Forgiveness Application Form 3508 or 3508EZ

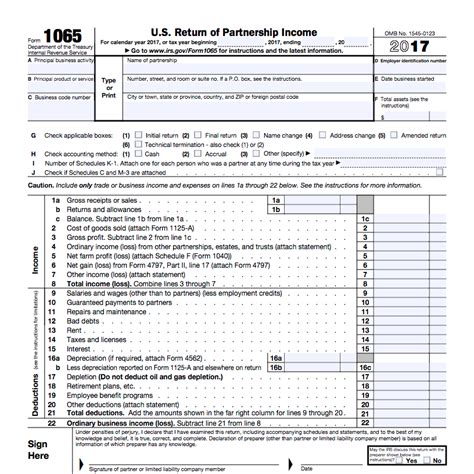

- Supporting documentation, such as payroll records, bank statements, and tax returns

Eligibility Criteria for PPP Forgiveness

To be eligible for PPP forgiveness, borrowers must meet the following criteria:

- Maintain employee headcount and salaries: Borrowers must maintain their average weekly full-time equivalent (FTE) employees during the covered period, compared to the period from February 15, 2019, to June 30, 2019.

- Use loan funds for eligible expenses: Borrowers must use the loan funds for eligible expenses, such as payroll costs, mortgage interest, rent, and utilities.

- Document expenses: Borrowers must maintain accurate records of expenses, including payroll records, bank statements, and tax returns.

Supporting Documentation for PPP Forgiveness

Borrowers must provide supporting documentation to demonstrate their eligibility for PPP forgiveness. The required documentation includes:

| Category | Documentation Required |

|---|---|

| Payroll Costs | Payroll records, including payroll tax filings and bank statements |

| Mortgage Interest | Lender amortization schedule, showing the interest paid during the covered period |

| Rent | Lease agreement, showing the rent paid during the covered period |

| Utilities | Utility bills, showing the payments made during the covered period |

📝 Note: Borrowers should maintain accurate records and documentation to support their PPP forgiveness application, as the SBA may request additional information during the review process.

Conclusion and Final Thoughts

In conclusion, PPP forgiveness is a critical component of the Paycheck Protection Program, providing borrowers with an opportunity to have their loans partially or fully forgiven. To take advantage of this benefit, borrowers must meet the eligibility criteria, use loan funds for eligible expenses, and provide supporting documentation. By understanding the PPP forgiveness deadline, application process, and eligibility criteria, borrowers can navigate the forgiveness process with confidence and avoid potential issues.

What is the PPP forgiveness deadline?

+

The PPP forgiveness deadline is 10 months after the end of the covered period, which is either 8 weeks or 24 weeks after the loan disbursement date.

What are the eligibility criteria for PPP forgiveness?

+

To be eligible for PPP forgiveness, borrowers must maintain employee headcount and salaries, use loan funds for eligible expenses, and document expenses.

What documentation is required for PPP forgiveness?

+

Borrowers must provide supporting documentation, including payroll records, bank statements, tax returns, and other documents that demonstrate their eligibility for PPP forgiveness.