PPP Loan Forgiveness Due Date

Introduction to PPP Loan Forgiveness

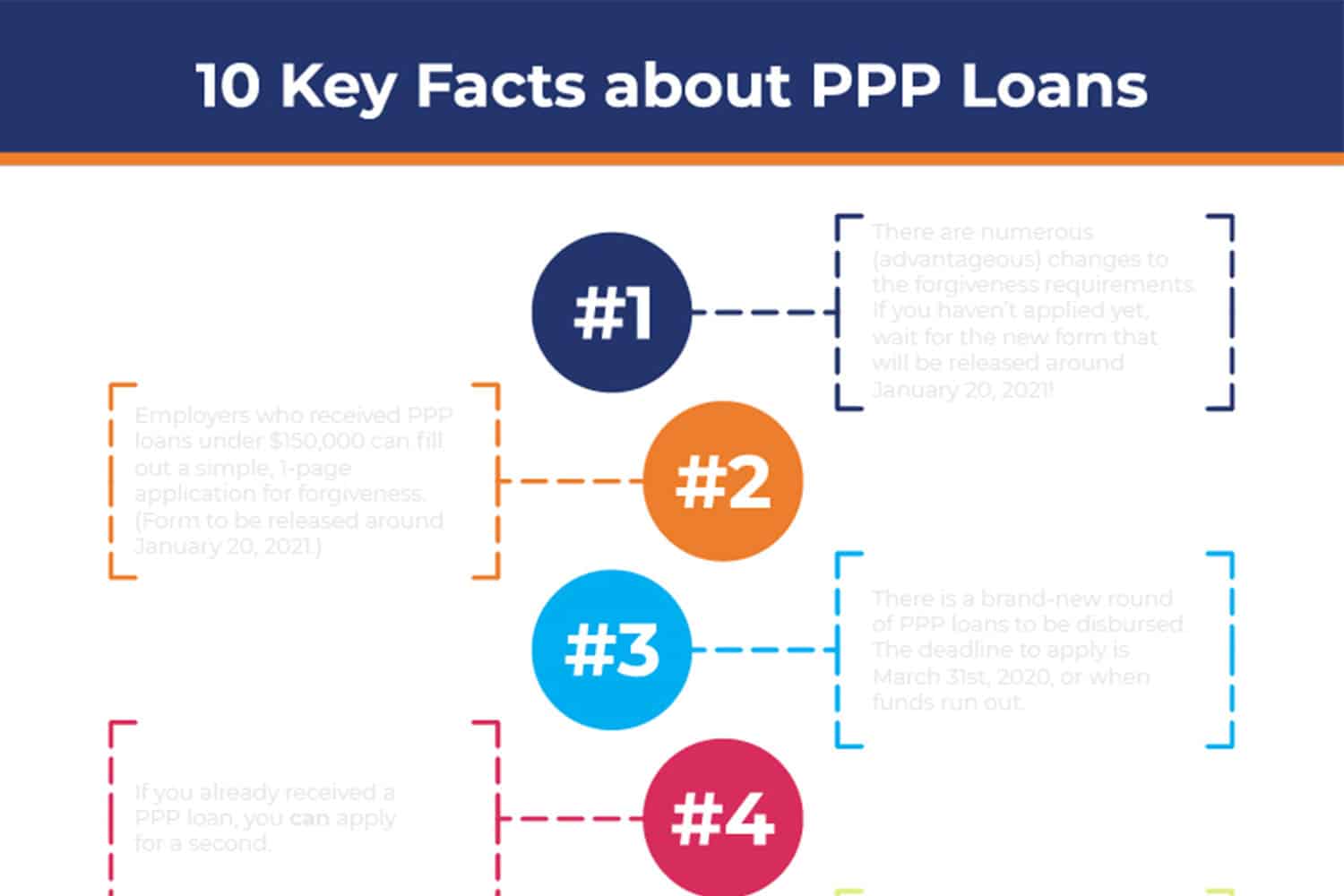

The Paycheck Protection Program (PPP) was introduced as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help small businesses and other eligible organizations affected by the COVID-19 pandemic. One of the key benefits of the PPP is the potential for loan forgiveness, which allows borrowers to have their loans fully or partially forgiven if they meet certain conditions. Understanding the PPP loan forgiveness due date and the process involved is crucial for borrowers seeking to maximize their forgiveness amounts.

Eligibility for PPP Loan Forgiveness

To be eligible for PPP loan forgiveness, borrowers must use at least 60% of their loan proceeds for payroll costs and the remaining amount for other eligible expenses, such as rent, utilities, and mortgage interest. The covered period during which these expenses must be incurred depends on the borrower’s loan disbursement date and the election they make regarding the length of their covered period. Borrowers have the option to choose an 8-week or 24-week covered period, starting from the date they received their loan proceeds.

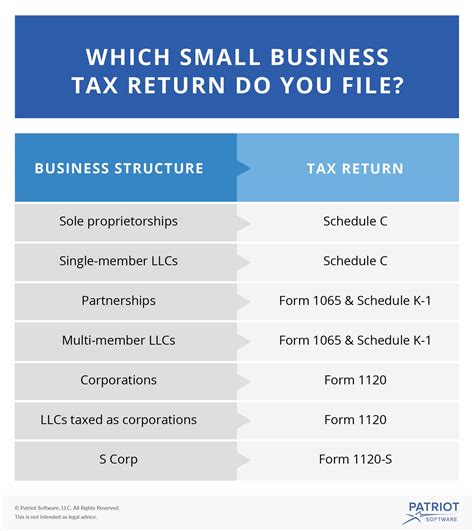

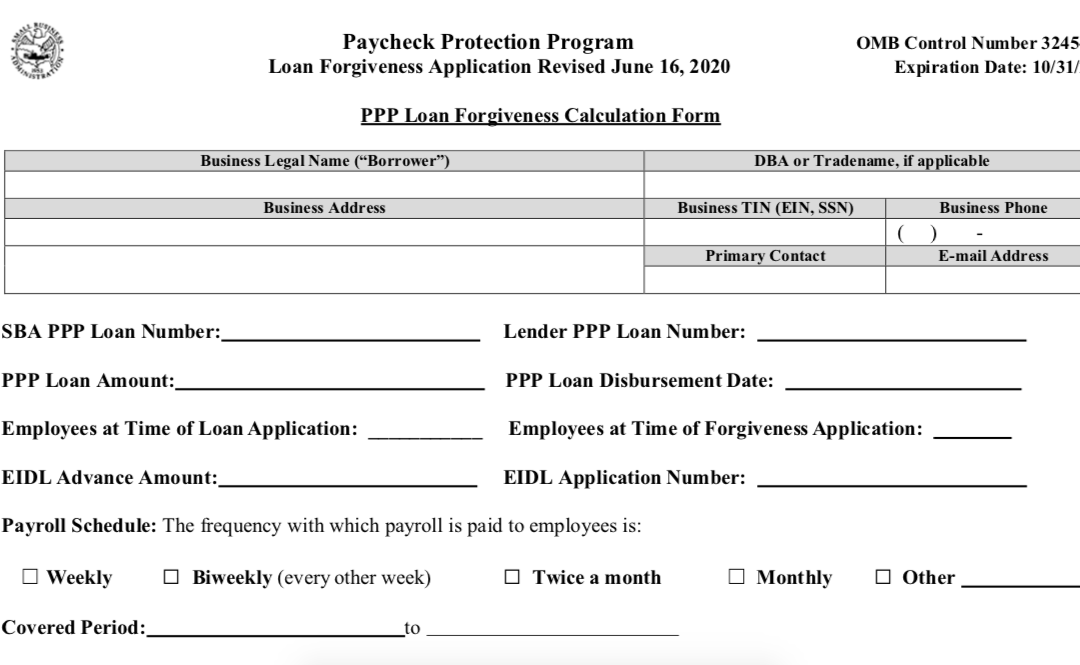

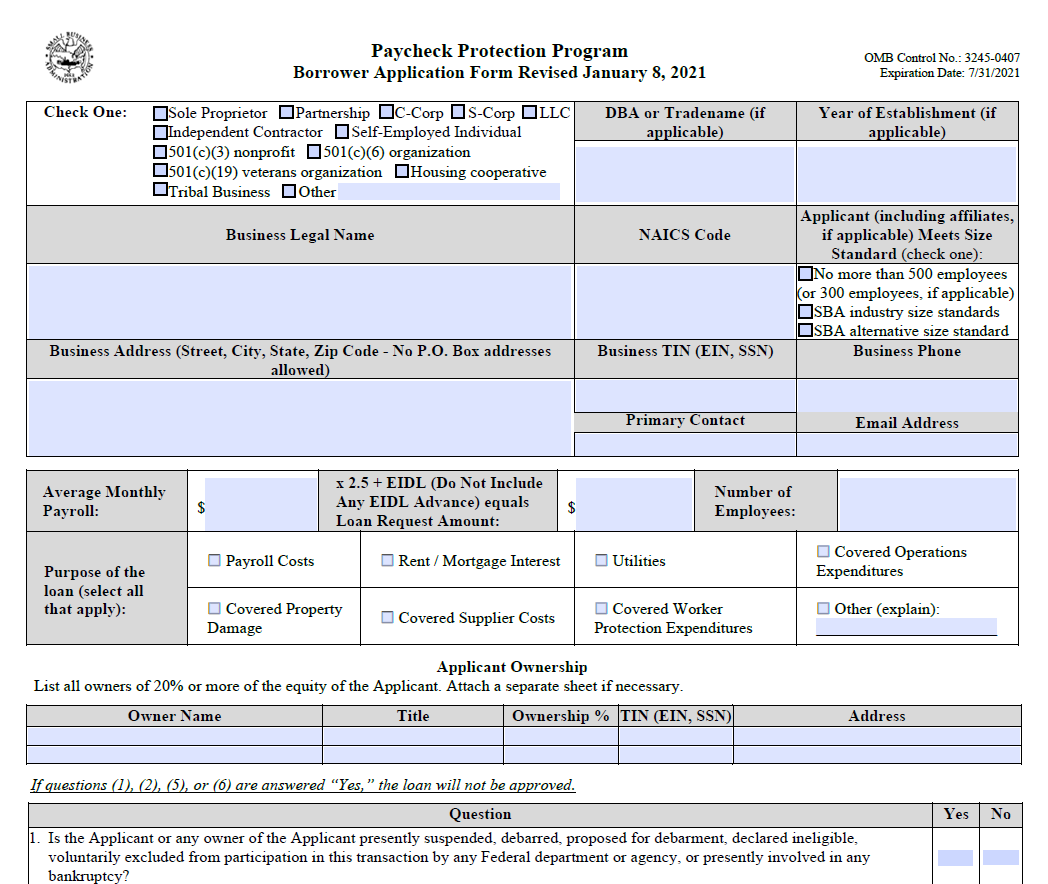

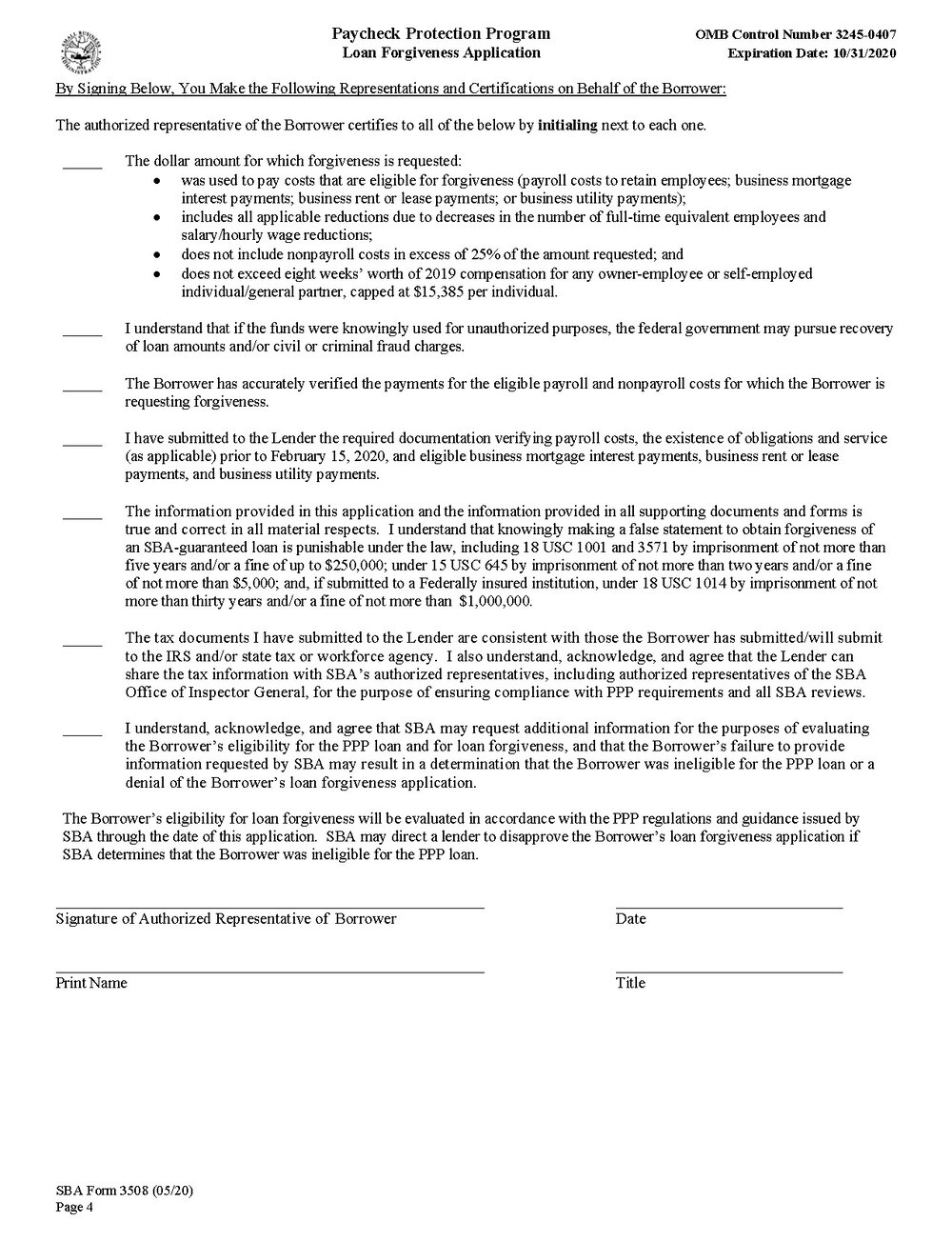

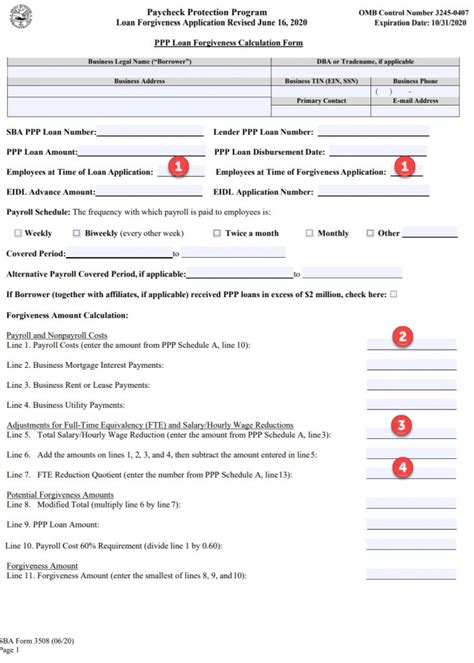

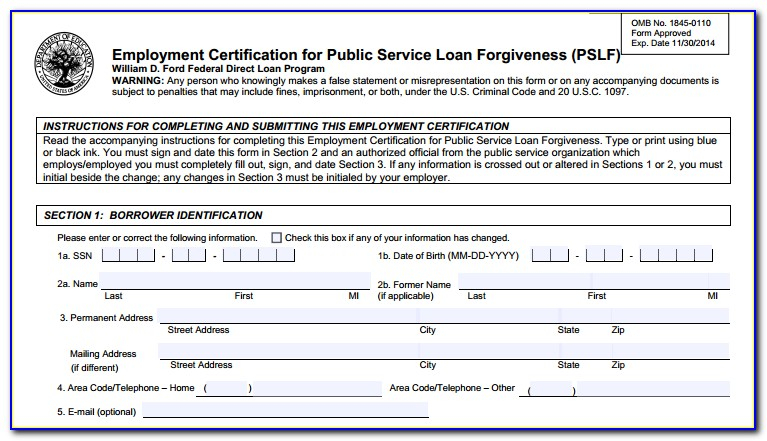

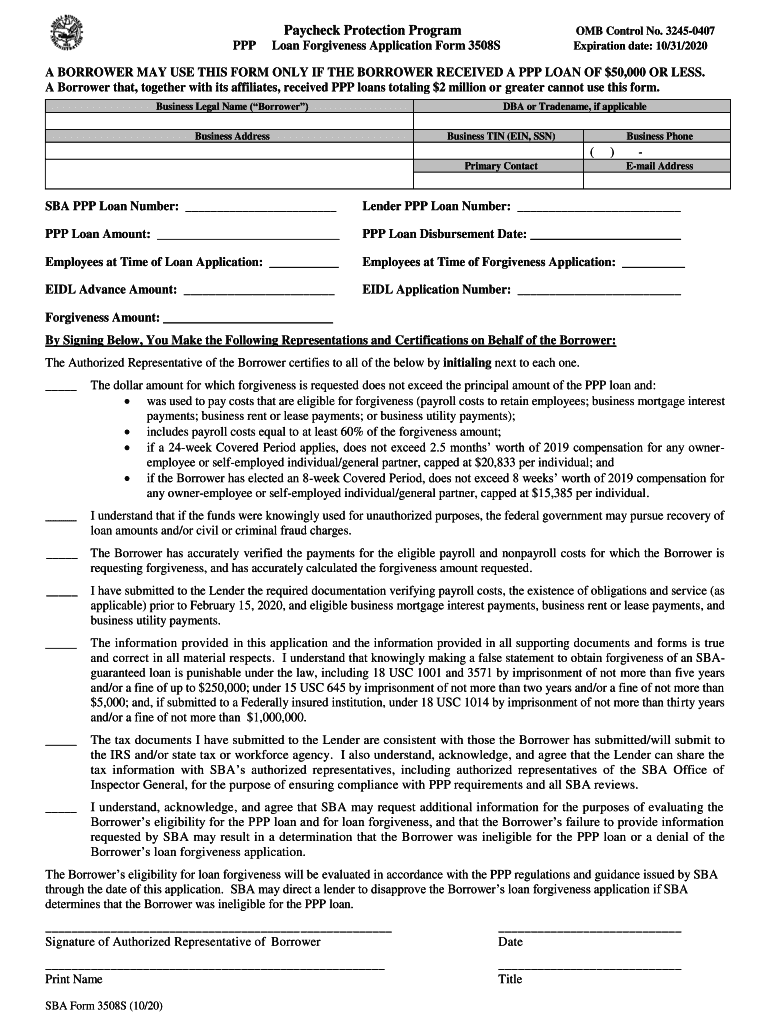

PPP Loan Forgiveness Application Process

The PPP loan forgiveness application process involves submitting a forgiveness application to the lender that serviced the PPP loan. The application requires detailed documentation of how the loan funds were used, including payroll records, bank statements, and receipts for eligible non-payroll expenses. There are two main forgiveness application forms: Form 3508 and Form 3508S. Form 3508 is the standard application, while Form 3508S is a simplified version for borrowers who received loans of $150,000 or less.

Key Dates and Deadlines for PPP Loan Forgiveness

Borrowers must apply for loan forgiveness within 10 months after the last day of their chosen covered period. If a borrower fails to apply for forgiveness within this timeframe, they will be required to begin making payments on their loan. It’s essential for borrowers to keep track of their specific due dates to ensure they submit their applications on time.

Forgiveness Calculation and Potential Reductions

The forgiveness calculation involves determining the total amount of eligible expenses incurred during the covered period. However, the forgiveness amount may be reduced if the borrower reduced their full-time equivalent (FTE) employees or decreased salaries and wages by more than 25% during the covered period compared to a specified baseline period. Borrowers can avoid these reductions by restoring their FTE count and salary levels to the baseline period amounts before the end of their covered period.

Notes on PPP Loan Forgiveness

💡 Note: Borrowers should carefully review the instructions for the forgiveness application and ensure they have all necessary documentation before submitting their application. Additionally, borrowers should be aware of any updates or changes to the PPP loan forgiveness program and should consult with their lender or a financial advisor if they have questions or concerns.

Preparing for the PPP Loan Forgiveness Application

To prepare for the forgiveness application, borrowers should: - Gather all relevant documentation, including payroll records, bank statements, and receipts for eligible expenses. - Review the forgiveness application forms and instructions carefully. - Calculate their potential forgiveness amount and identify any potential reductions. - Submit their application to their lender within the required timeframe.

Implications of Missing the PPP Loan Forgiveness Due Date

Missing the due date for applying for PPP loan forgiveness can have significant implications for borrowers. If a borrower fails to apply within the 10-month window, they will be required to begin making payments on their loan, which can strain their cash flow and impact their ability to recover from the economic effects of the pandemic. It’s crucial for borrowers to prioritize submitting their forgiveness applications on time to avoid these consequences.

Table of Key PPP Loan Forgiveness Dates and Requirements

| Event | Description | Deadline |

|---|---|---|

| Loan Disbursement | Date loan funds are received | Varies by borrower |

| Covered Period | Period during which expenses must be incurred | 8 weeks or 24 weeks from loan disbursement date |

| Forgiveness Application Submission | Deadline to submit forgiveness application | Within 10 months after the last day of the covered period |

Conclusion and Final Thoughts

In summary, understanding the PPP loan forgiveness due date and process is essential for borrowers seeking to have their loans forgiven. By meeting the eligibility criteria, submitting a complete and accurate forgiveness application, and avoiding potential reductions, borrowers can maximize their forgiveness amounts and alleviate some of the financial burdens imposed by the pandemic. It’s crucial for borrowers to stay informed about the program’s requirements and deadlines to ensure a successful forgiveness outcome.

What is the deadline for submitting a PPP loan forgiveness application?

+

The deadline for submitting a PPP loan forgiveness application is within 10 months after the last day of the borrower’s chosen covered period.

What are the eligible expenses for PPP loan forgiveness?

+

Eligible expenses for PPP loan forgiveness include payroll costs, rent, utilities, and mortgage interest. At least 60% of the loan proceeds must be used for payroll costs.

What happens if a borrower misses the deadline for applying for PPP loan forgiveness?

+

If a borrower misses the deadline for applying for PPP loan forgiveness, they will be required to begin making payments on their loan, which can impact their cash flow and ability to recover from the economic effects of the pandemic.