Employers Send Cobra Paperwork

Understanding COBRA Paperwork: A Guide for Employees

When an employee experiences a qualifying event, such as a job loss, reduction in work hours, or divorce, they may be eligible to continue their health insurance coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA). Employers are responsible for sending COBRA paperwork to eligible employees, which can be a complex and time-sensitive process. In this article, we will explore the importance of COBRA paperwork, the responsibilities of employers, and the options available to employees.

What is COBRA Paperwork?

COBRA paperwork refers to the documents and notices that employers must provide to eligible employees, informing them of their right to continue their health insurance coverage. This paperwork typically includes:

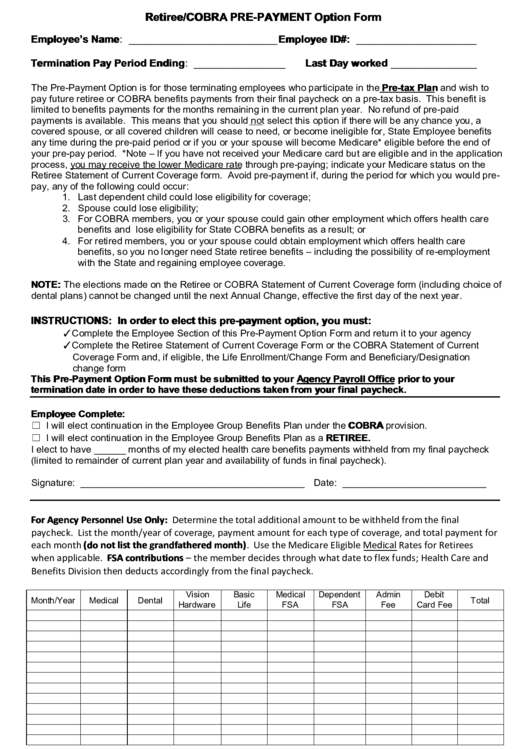

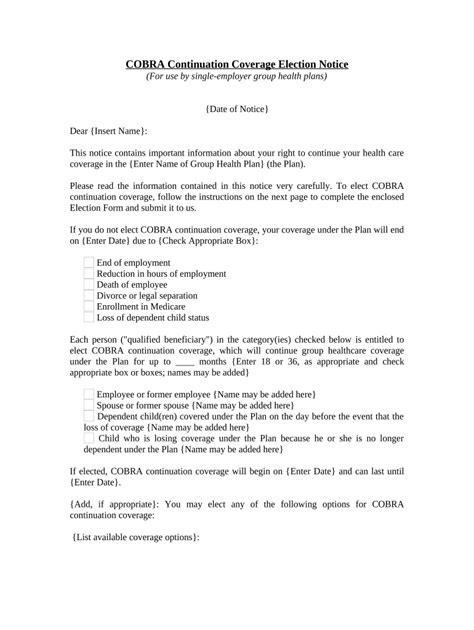

- A COBRA election notice, which explains the employee’s rights and options under COBRA

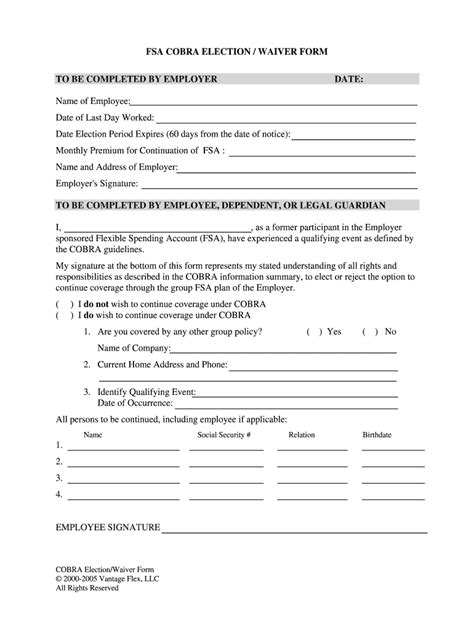

- A coverage election form, which allows the employee to elect or decline COBRA coverage

- A premium payment schedule, which outlines the amount and due date of premium payments

Employer Responsibilities

Employers have several responsibilities when it comes to COBRA paperwork, including:

- Identifying eligible employees and qualifying events

- Preparing and sending COBRA paperwork within the required timeframe

- Ensuring that COBRA paperwork is accurate and complete

- Providing ongoing support and administration of COBRA coverage

Employee Options

When an employee receives COBRA paperwork, they have several options to consider:

- Election of COBRA coverage: The employee can choose to continue their health insurance coverage through COBRA, usually for a period of 18 or 36 months

- Declination of COBRA coverage: The employee can choose to decline COBRA coverage, which may be a more cost-effective option if they have alternative coverage

- Alternative coverage options: The employee may explore alternative coverage options, such as Medicaid, Medicare, or private insurance plans

📝 Note: Employees should be aware of the 60-day election period, during which they must make their COBRA coverage election. If they fail to make an election within this timeframe, they may forfeit their right to COBRA coverage.

Table of COBRA Coverage Periods

The following table outlines the typical COBRA coverage periods for different qualifying events:

| Qualifying Event | COBRA Coverage Period |

|---|---|

| Job loss or reduction in work hours | 18 months |

| Divorce or legal separation | 36 months |

| Death of the covered employee | 36 months |

| Dependent child reaches age 26 | 36 months |

In summary, COBRA paperwork is an essential document that employers must send to eligible employees, informing them of their right to continue their health insurance coverage. Employers have several responsibilities when it comes to COBRA paperwork, and employees have various options to consider when receiving this paperwork. By understanding the COBRA process and their options, employees can make informed decisions about their health insurance coverage.

As we wrap up this discussion, it’s clear that COBRA paperwork plays a vital role in ensuring that employees have access to continuous health insurance coverage during times of transition. By being aware of their rights and options, employees can navigate the COBRA process with confidence and make informed decisions about their health insurance coverage.

What is the purpose of COBRA paperwork?

+

The purpose of COBRA paperwork is to inform eligible employees of their right to continue their health insurance coverage after a qualifying event.

How long do employers have to send COBRA paperwork?

+

Employers typically have 44 days to send COBRA paperwork to eligible employees after a qualifying event.

Can employees decline COBRA coverage?

+

Yes, employees can decline COBRA coverage, which may be a more cost-effective option if they have alternative coverage.