5 Documents Needed

Introduction to Essential Documents

When it comes to managing personal, financial, or business matters, having the right documents in place is crucial. These documents not only help in maintaining transparency and accountability but also ensure that all parties involved are protected legally and financially. In this article, we will explore five essential documents that everyone should have, whether you’re an individual, a business owner, or part of an organization.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how you want your assets to be distributed after your death. It is a critical document for ensuring that your wishes are respected and that your loved ones are taken care of. This document should include: - Executor: The person responsible for carrying out the instructions in the will. - Beneficiaries: The individuals or organizations that will receive your assets. - Guardians: If you have minor children, you should name guardians for them in your will. - Assets: A list of your assets and how you want them to be distributed.

2. Power of Attorney

A Power of Attorney (POA) is a document that gives someone you trust the authority to act on your behalf in financial and legal matters if you become incapacitated. There are different types of POA, including: - General Power of Attorney: Gives broad powers to the attorney-in-fact. - Special Power of Attorney: Limits the powers to specific matters. - Durable Power of Attorney: Remains in effect even if you become incapacitated.

3. Advance Directive

An Advance Directive, also known as a living will, is a document that specifies the medical treatment you want to receive if you become unable to communicate your wishes. This includes: - Do Not Resuscitate (DNR) Orders: Instructions not to perform CPR if your heart stops or if you stop breathing. - Life-Sustaining Treatments: Specifications for treatments such as ventilation, dialysis, and tube feeding.

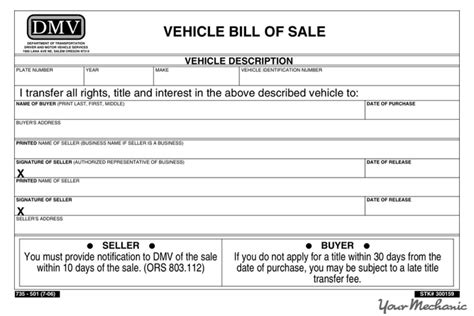

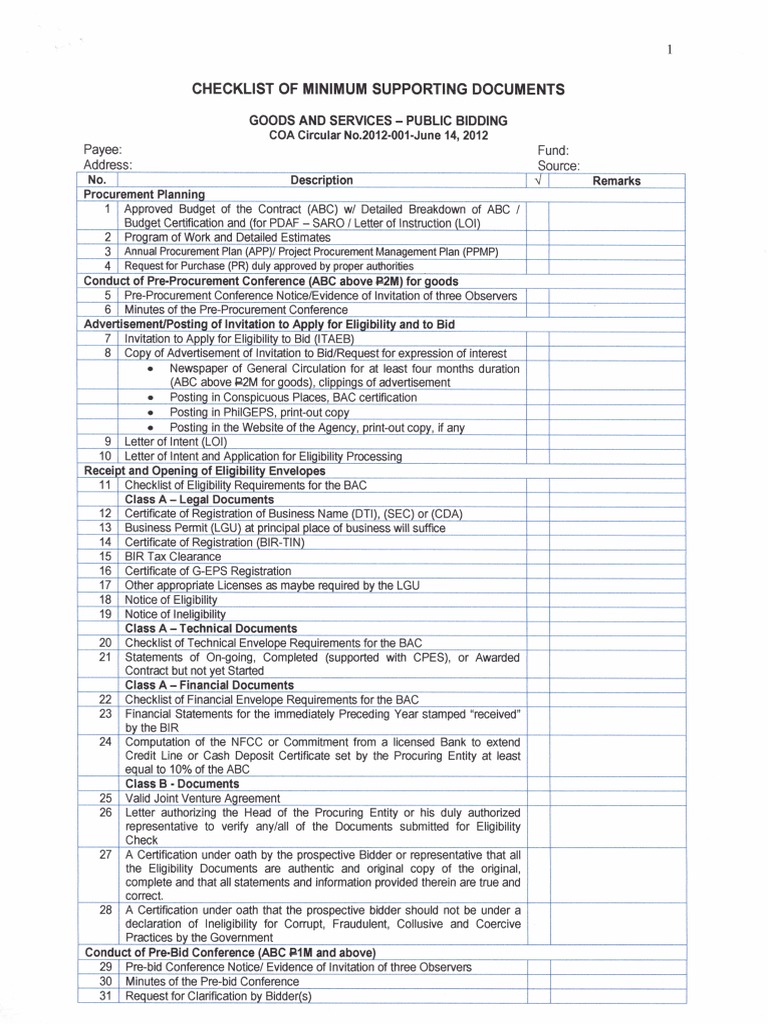

4. Business Agreement

If you’re a business owner or partner, a Business Agreement is essential. This document outlines the terms of your business relationship, including: - Roles and Responsibilities: Defines each partner’s or member’s role in the business. - Profit and Loss Sharing: Specifies how profits and losses will be distributed. - Decision-Making Process: Outlines how business decisions will be made.

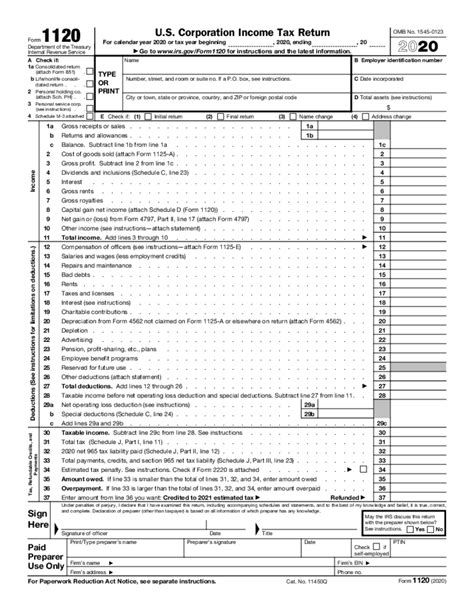

5. Insurance Policies

Insurance Policies provide financial protection against various risks. Key policies to consider include: - Life Insurance: Provides a death benefit to your beneficiaries. - Health Insurance: Covers medical expenses. - Disability Insurance: Offers income replacement if you become unable to work due to illness or injury. - Liability Insurance: Protects your assets in case you’re sued.

📝 Note: It's essential to review and update these documents regularly to ensure they reflect any changes in your circumstances or wishes.

To summarize, having the right documents in place is vital for protecting your interests and those of your loved ones. Whether it’s a Last Will and Testament, Power of Attorney, Advance Directive, Business Agreement, or Insurance Policies, each document plays a crucial role in different aspects of life and business. Taking the time to understand and prepare these documents can provide peace of mind and ensure that your wishes are carried out as intended.

Why is having a Last Will and Testament important?

+

Having a Last Will and Testament ensures that your assets are distributed according to your wishes after your death, protecting your loved ones and avoiding potential legal disputes.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants someone the authority to make financial and legal decisions on your behalf, while an Advance Directive specifies your medical treatment wishes if you become incapacitated.

Why do business owners need a Business Agreement?

+

A Business Agreement outlines the terms of the business relationship among partners or members, reducing the risk of misunderstandings and disputes by clarifying roles, responsibilities, and profit-sharing arrangements.