Paperwork

FMLA Doctor Fees Explained

Understanding FMLA Doctor Fees

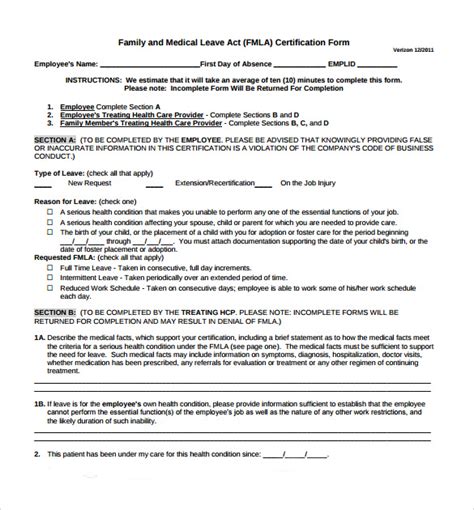

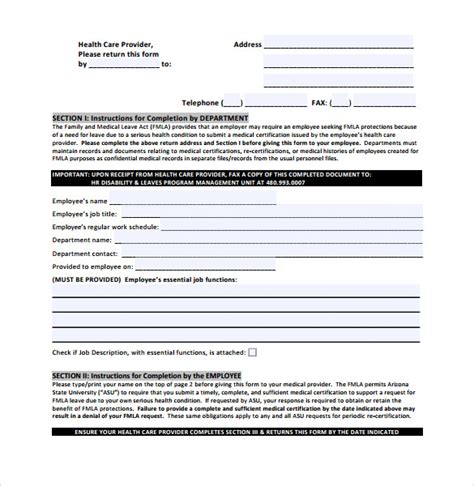

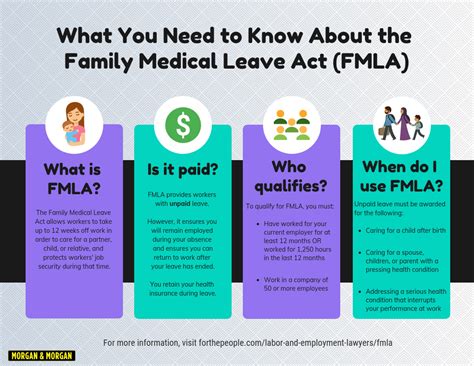

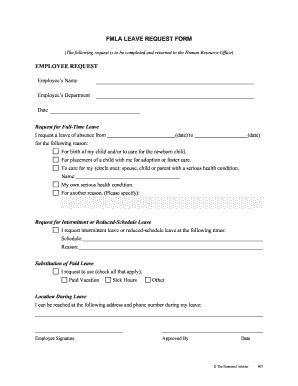

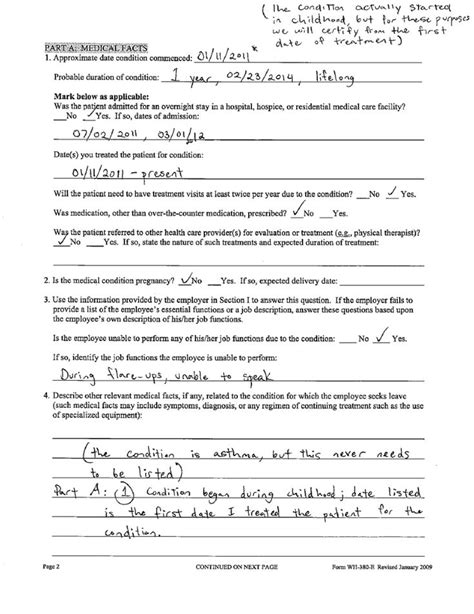

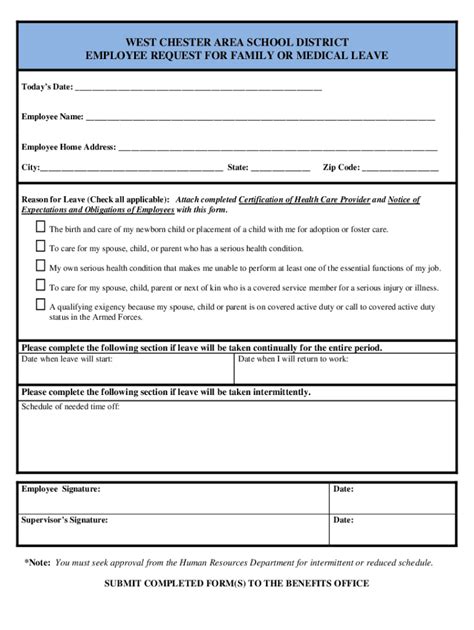

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. One of the key aspects of the FMLA is the requirement for employees to provide medical certification from a healthcare provider to support their leave request. In this context, FMLA doctor fees refer to the costs associated with obtaining medical certification from a healthcare provider.

What are FMLA Doctor Fees?

FMLA doctor fees are the costs that employees may incur when they visit a healthcare provider to obtain medical certification for their FMLA leave. These fees can vary depending on the healthcare provider, the type of medical condition, and the employee’s health insurance coverage. Employees are responsible for paying these fees, which can include copays, coinsurance, or deductibles. In some cases, employees may also need to pay for additional medical tests or procedures to support their medical certification.

Types of FMLA Doctor Fees

There are several types of FMLA doctor fees that employees may incur, including: * Copays: A fixed amount that employees pay for each doctor visit or medical service. * Coinsurance: A percentage of the medical costs that employees pay after meeting their deductible. * Deductibles: The amount that employees must pay out-of-pocket before their health insurance coverage kicks in. * Medical testing fees: The costs associated with medical tests or procedures, such as lab tests or imaging studies. * Medical record fees: The costs associated with obtaining medical records or documentation to support the employee’s FMLA leave.

How to Reduce FMLA Doctor Fees

While employees are responsible for paying FMLA doctor fees, there are several ways to reduce these costs: * Check with your health insurance provider to see if they cover any of the medical services or tests required for FMLA medical certification. * Choose a healthcare provider who is in-network with your health insurance plan to reduce out-of-pocket costs. * Avoid unnecessary medical tests or procedures that may not be required for FMLA medical certification. * Keep track of your medical expenses to ensure that you are not overpaying for medical services or tests.

Table of Estimated FMLA Doctor Fees

| Medical Service | Estimated Cost |

|---|---|

| Office Visit | 50-200 |

| Lab Tests | 100-500 |

| Imaging Studies | 200-1,000 |

| Medical Records | 20-100 |

💡 Note: The estimated costs listed in the table are approximate and may vary depending on the healthcare provider, location, and other factors.

Conclusion and Final Thoughts

In summary, FMLA doctor fees are an important aspect of the Family and Medical Leave Act that employees should be aware of. By understanding the types of fees associated with medical certification and taking steps to reduce these costs, employees can better navigate the FMLA process and minimize their out-of-pocket expenses. It is essential for employees to plan ahead and research their options to ensure that they are prepared for any potential costs associated with their FMLA leave.

What is the purpose of FMLA doctor fees?

+

The purpose of FMLA doctor fees is to cover the costs associated with obtaining medical certification from a healthcare provider to support an employee’s FMLA leave request.

Are employees responsible for paying FMLA doctor fees?

+

Yes, employees are responsible for paying FMLA doctor fees, which can include copays, coinsurance, deductibles, and other medical expenses.

Can employees reduce their FMLA doctor fees?

+

Yes, employees can reduce their FMLA doctor fees by checking with their health insurance provider, choosing an in-network healthcare provider, avoiding unnecessary medical tests or procedures, and keeping track of their medical expenses.