Paperwork

Home Loan Paperwork Requirements

Introduction to Home Loan Paperwork

When considering purchasing a home, one of the most critical steps in the process is navigating the home loan paperwork requirements. This can be a daunting task, especially for first-time homebuyers, due to the complexity and the volume of documents involved. Understanding what is required and being prepared can significantly simplify the process and reduce the stress associated with applying for a home loan.

Understanding the Basics

Before diving into the specifics of the paperwork, it’s essential to understand the basics of a home loan. A home loan, also known as a mortgage, is a loan from a bank or other financial institution that allows you to borrow money to purchase a home. The loan is secured by the property itself, meaning that if you fail to repay the loan, the lender can sell the property to recover their losses.

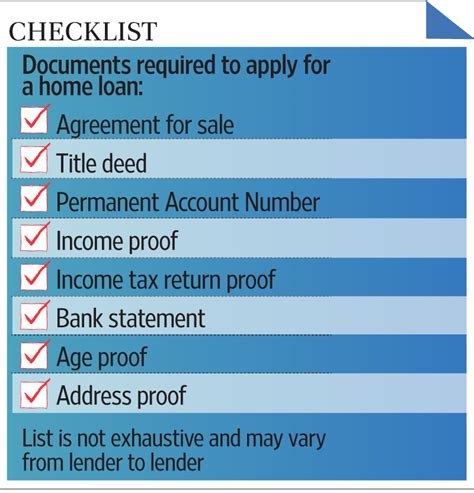

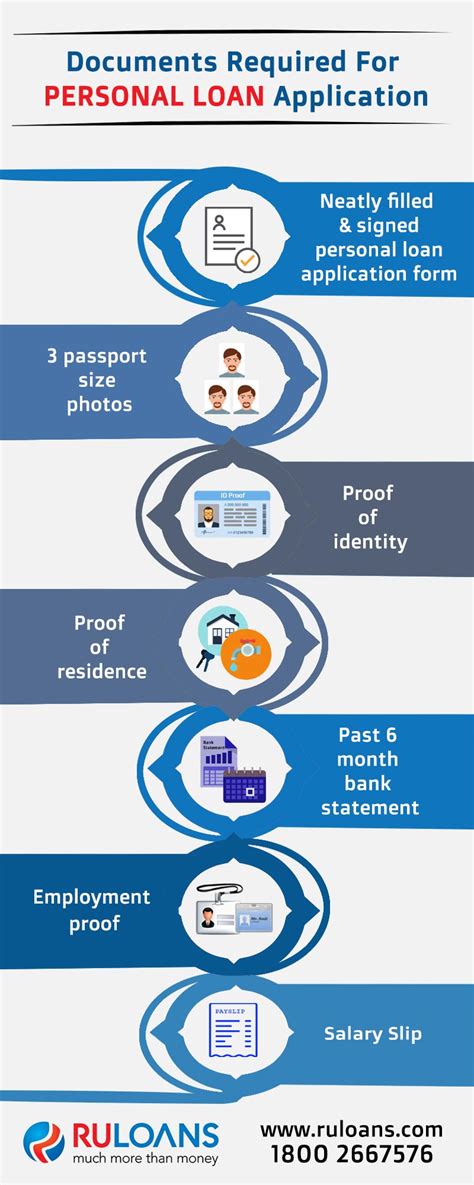

Key Documents Required

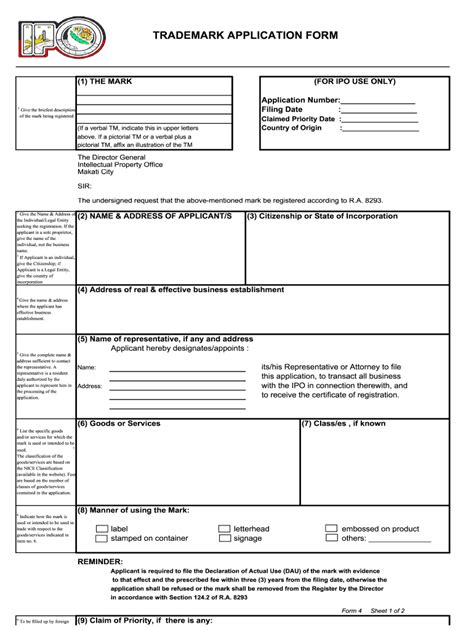

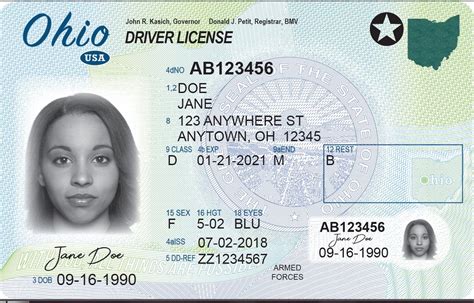

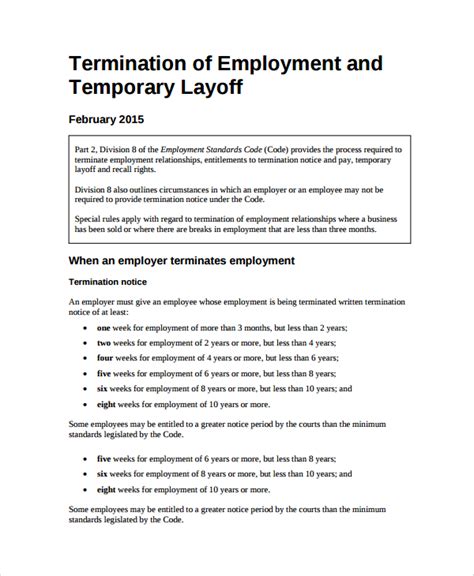

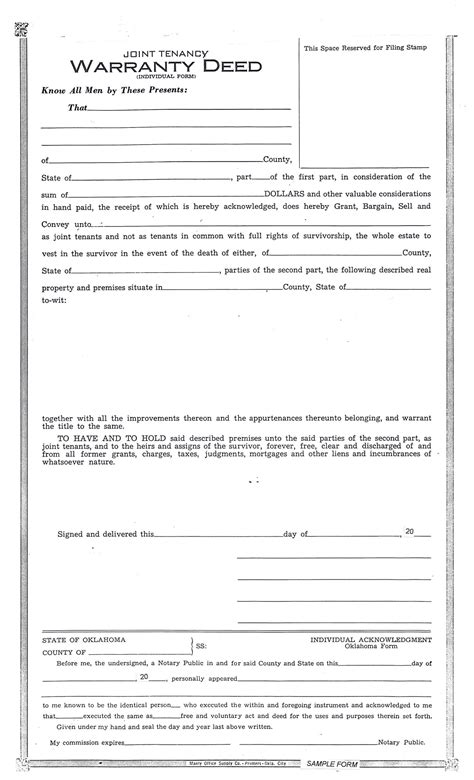

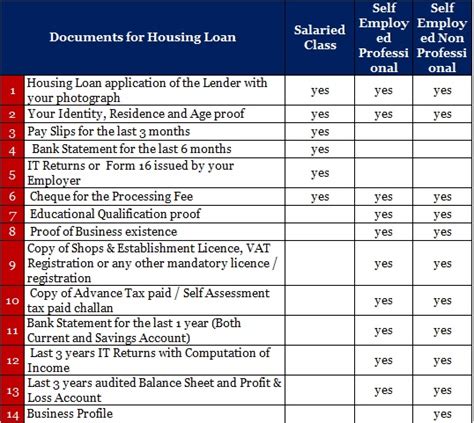

The paperwork required for a home loan can vary depending on the lender and the specific loan program. However, there are certain key documents that are almost universally required. These include: - Identification Documents: Such as a driver’s license, passport, or state ID. - Income Verification: Pay stubs, W-2 forms, and tax returns to verify your income. - Employment Verification: A letter from your employer confirming your employment status. - Credit Reports: Lenders will pull your credit report to assess your creditworthiness. - Bank Statements: To verify your savings and cash flow. - Title and Insurance: Documents related to the property’s title and insurance.

Additional Requirements

In addition to the basic documents, there may be additional requirements based on your specific situation. For example: - Self-Employed Individuals: If you are self-employed, you may need to provide additional documentation such as business tax returns and financial statements. - Investment Properties: If you are purchasing an investment property, you may need to provide rental agreements, property management contracts, and other documents related to the rental income. - Government-Backed Loans: For loans backed by the VA, FHA, or USDA, there may be specific requirements such as a Certificate of Eligibility for VA loans.

Preparing Your Paperwork

To streamline the home loan application process, it’s crucial to have all your paperwork in order before applying. Here are some tips: - Gather Documents Early: Start collecting the necessary documents well in advance to avoid last-minute rushes. - Organize Your Documents: Keep all your documents organized and easily accessible. - Double-Check for Accuracy: Ensure all the information on your documents is accurate and up-to-date.

The Application Process

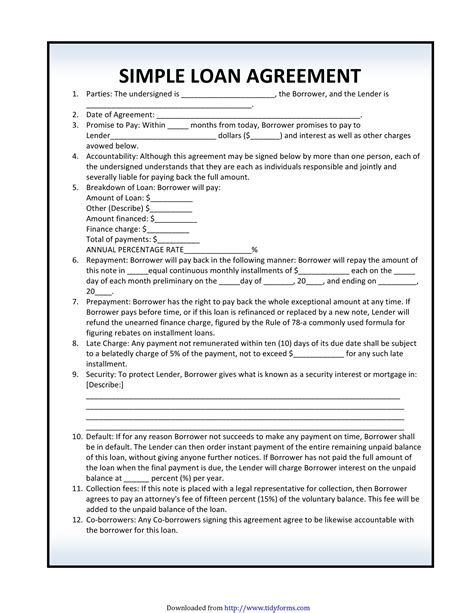

Once you have all your paperwork ready, you can proceed with the application process. This typically involves: - Pre-Approval: Getting pre-approved for a loan to understand how much you can borrow. - Loan Application: Submitting your loan application along with all the required documents. - Processing and Underwriting: The lender reviews your application, orders an appraisal, and underwrites the loan. - Closing: The final step where the loan is disbursed, and you complete the purchase of the property.

📝 Note: It's essential to work closely with your lender and other professionals involved in the process to ensure that all paperwork is correctly filled out and submitted on time.

Conclusion Summary

In summary, navigating the home loan paperwork requirements is a critical part of the home buying process. By understanding what documents are needed, preparing them in advance, and working closely with your lender, you can make the process smoother and less stressful. Remember, each situation is unique, and the specific documents required may vary. Always consult with your lender to understand their specific requirements and to get personalized advice tailored to your circumstances.

What are the basic documents required for a home loan application?

+

The basic documents include identification, income verification, employment verification, credit reports, and bank statements.

How long does the home loan application process typically take?

+

The process can vary but typically takes several weeks to a few months from application to closing.

What is the difference between pre-approval and pre-qualification?

+

Pre-qualification is an estimate of how much you can borrow based on a cursory review of your financial situation, while pre-approval is a more formal commitment from the lender after a thorough review of your financial documents.