Changing Beneficiary After Final Paperwork

Introduction to Beneficiary Changes

When dealing with legal documents, such as wills, trusts, or insurance policies, beneficiaries are individuals or entities that receive benefits or assets after the policyholder or grantor passes away. However, circumstances may change, and it may become necessary to modify the beneficiary designation. This can be a complex process, especially if the initial paperwork has already been finalized. In this article, we will delve into the process of changing beneficiaries after the final paperwork has been completed, exploring the various scenarios, challenges, and solutions involved.

Understanding Beneficiary Designations

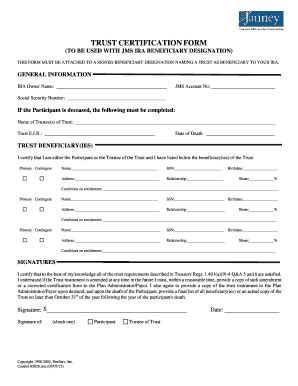

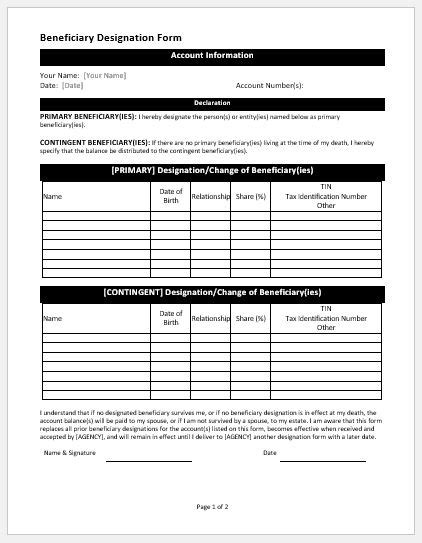

Before we dive into the process of changing beneficiaries, it’s essential to understand the different types of beneficiary designations. These include: * Primary beneficiaries: The first in line to receive benefits or assets. * Contingent beneficiaries: Alternate beneficiaries who receive benefits if the primary beneficiary predeceases the policyholder. * Revocable beneficiaries: Beneficiaries who can be changed or removed by the policyholder at any time. * Irrevocable beneficiaries: Beneficiaries who cannot be changed or removed without their consent.

Scenarios for Changing Beneficiaries

There are several scenarios where changing beneficiaries may be necessary: * Divorce or separation: If the policyholder gets divorced or separated, they may want to remove their ex-spouse as a beneficiary. * Birth or adoption of a child: The policyholder may want to add a new child as a beneficiary. * Death of a beneficiary: If a beneficiary passes away, the policyholder may need to update the beneficiary designation. * Change in financial circumstances: The policyholder’s financial situation may change, requiring an update to the beneficiary designation.

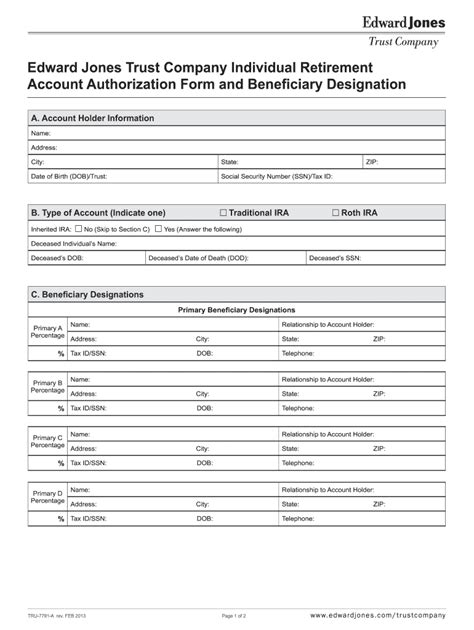

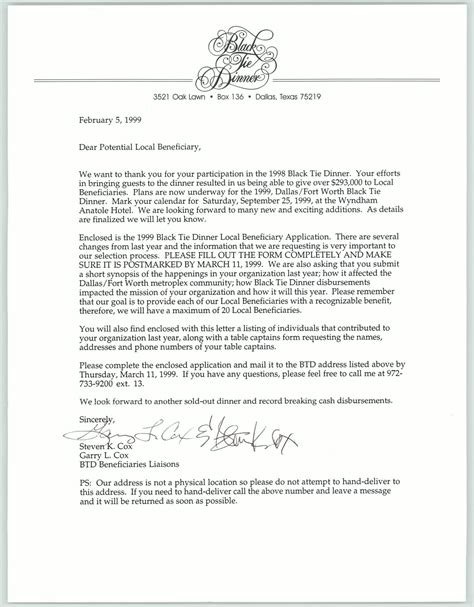

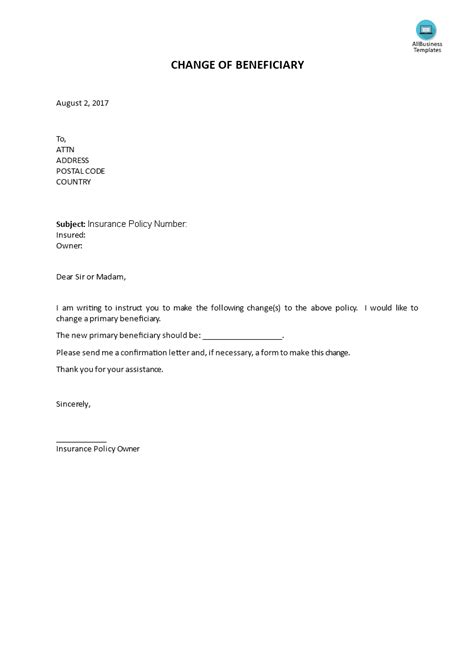

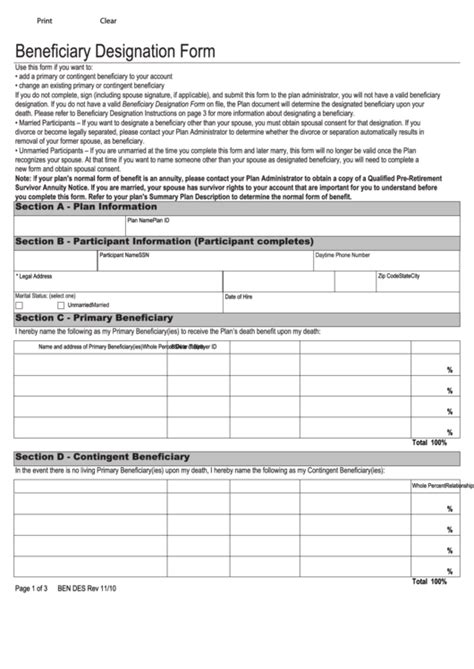

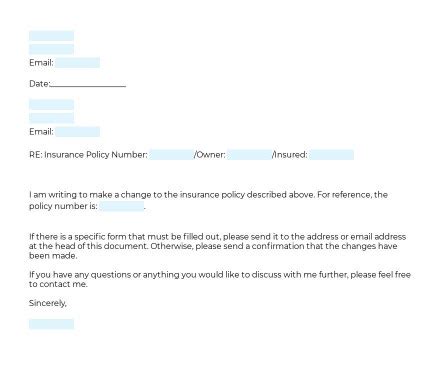

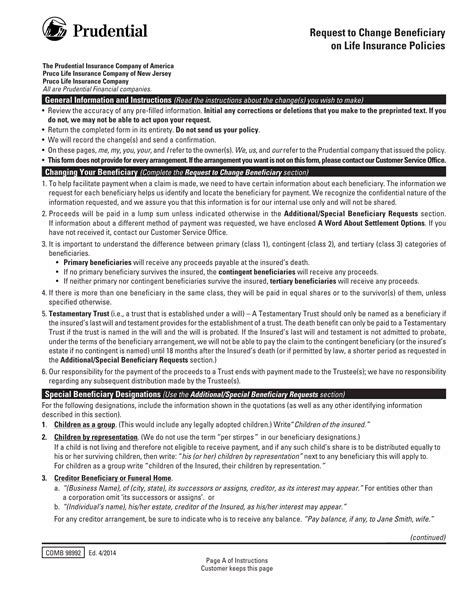

Steps to Change Beneficiaries

To change beneficiaries after final paperwork has been completed, follow these steps: * Review the policy or document: Examine the policy or document to determine the process for changing beneficiaries. * Obtain the necessary forms: Request the required forms from the insurance company, financial institution, or attorney. * Complete the forms: Fill out the forms accurately, ensuring that all required information is provided. * Submit the forms: Return the completed forms to the relevant party, following their specific guidelines. * Verify the changes: Confirm that the changes have been made and are in effect.

📝 Note: It's crucial to follow the specific procedures outlined by the insurance company, financial institution, or attorney to ensure that the changes are made correctly and are legally binding.

Challenges and Solutions

Changing beneficiaries can be a complex process, and several challenges may arise: * Resistance from existing beneficiaries: Existing beneficiaries may resist changes to the beneficiary designation. * Lack of clarity in the policy or document: The policy or document may not clearly outline the process for changing beneficiaries. * Inability to locate the policy or document: The policy or document may be lost or difficult to locate. To overcome these challenges, consider the following solutions: * Seek legal advice: Consult with an attorney to ensure that the changes are made correctly and are legally binding. * Communicate with existing beneficiaries: Inform existing beneficiaries of the intended changes and address any concerns they may have. * Obtain a copy of the policy or document: Request a copy of the policy or document from the insurance company, financial institution, or attorney.

Table of Beneficiary Designation Types

The following table summarizes the different types of beneficiary designations:

| Beneficiary Type | Description |

|---|---|

| Primary Beneficiary | First in line to receive benefits or assets |

| Contingent Beneficiary | Alternate beneficiary who receives benefits if primary beneficiary predeceases the policyholder |

| Revocable Beneficiary | Beneficiary who can be changed or removed by the policyholder at any time |

| Irrevocable Beneficiary | Beneficiary who cannot be changed or removed without their consent |

In the end, changing beneficiaries after final paperwork has been completed requires careful consideration and attention to detail. By understanding the different types of beneficiary designations, following the necessary steps, and addressing potential challenges, individuals can ensure that their wishes are carried out and their loved ones are protected. The key is to stay informed, plan carefully, and seek professional advice when needed to navigate the complex process of changing beneficiaries.

What is a primary beneficiary?

+

A primary beneficiary is the first in line to receive benefits or assets after the policyholder passes away.

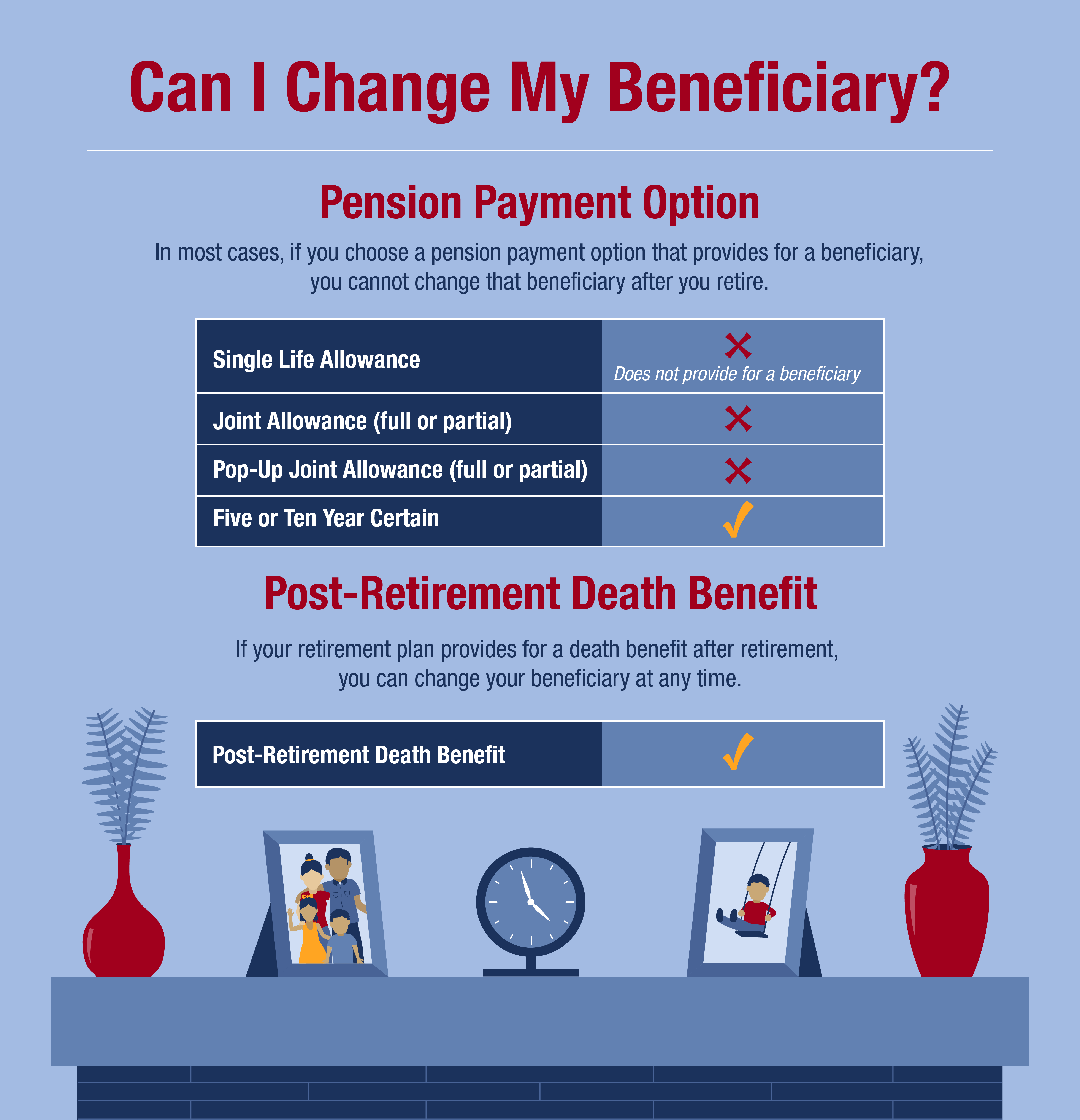

Can I change my beneficiary designation at any time?

+

It depends on the type of beneficiary designation. Revocable beneficiaries can be changed or removed at any time, while irrevocable beneficiaries require consent to make changes.

What happens if I don’t update my beneficiary designation after a divorce or separation?

+

If you don’t update your beneficiary designation, your ex-spouse may still be entitled to receive benefits or assets, which could lead to unintended consequences.