5 Tips On FMLA Fees

Understanding FMLA Fees and Their Implications

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law itself does not directly impose fees on employees, there are associated costs and considerations that both employees and employers should be aware of. In this article, we will delve into 5 key tips regarding FMLA fees, aiming to clarify the financial aspects and responsibilities tied to FMLA leave.

Tip 1: Health Insurance Premiums

One of the primary costs associated with FMLA leave is the continuation of health insurance premiums. Under the FMLA, employers are required to maintain the employee’s health coverage during the leave period, as long as the employee was covered under the employer’s group health plan before taking the leave. However, employees are responsible for paying their share of the health insurance premiums while on leave. Failure to pay premiums can result in loss of coverage. It’s essential for employees to understand their obligations regarding premium payments to avoid any gaps in health insurance coverage.

Tip 2: COBRA and FMLA

In cases where an employee’s leave extends beyond the 12-week FMLA period, or if the employee is no longer eligible for FMLA, they may be eligible for COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation coverage. COBRA allows employees and their families to continue their health insurance coverage for a specified period (usually up to 18 or 36 months) after the loss of coverage due to certain qualifying events. However, COBRA coverage comes at a cost; employees may be required to pay up to 102% of the premium. Understanding the transition from FMLA to COBRA is crucial to maintain uninterrupted health insurance coverage.

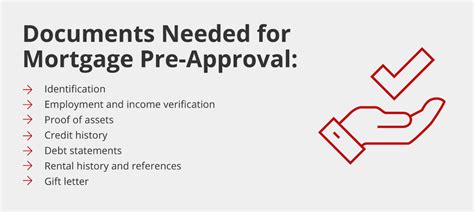

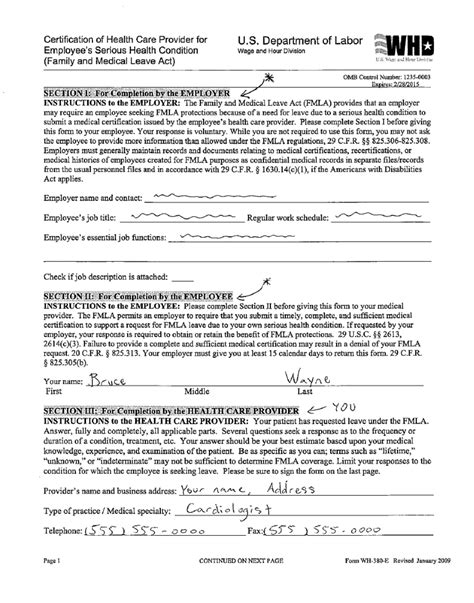

Tip 3: Documentation and Administrative Fees

While not directly a fee, the process of applying for and managing FMLA leave can involve administrative costs for employers. Employers may incur expenses related to the administration of leave, including the cost of paperwork, medical certifications, and the time spent by HR personnel in managing leave requests. For employees, ensuring that all paperwork and medical certifications are completed accurately and on time can help minimize delays and potential disputes regarding the leave.

Tip 4: Substitution of Paid Leave

The FMLA allows employees to substitute paid leave (such as vacation or sick leave) for unpaid FMLA leave. This can be a strategic way for employees to receive pay during their leave period. However, the rules regarding the substitution of paid leave can be complex, and not all types of leave may be eligible for substitution. Employees should consult with their HR department to understand their employer’s policies on substituting paid leave for FMLA.

Tip 5: Return to Work and Reinstatement Fees

Upon return from FMLA leave, employees are entitled to be reinstated to their original job or an equivalent position with the same pay, benefits, and other terms and conditions of employment. However, in some cases, employers may require employees to provide a fitness-for-duty certification before returning to work. The cost of obtaining this certification may be borne by the employee. Understanding the requirements for returning to work and any associated costs can help employees plan their transition back to the workplace.

📝 Note: Employers must adhere strictly to FMLA regulations to avoid legal and financial repercussions. Employees should also be aware of their rights and responsibilities under the FMLA to ensure a smooth leave and return-to-work process.

In summary, while the FMLA itself does not charge fees, there are several financial considerations and potential costs associated with taking FMLA leave. From health insurance premiums and COBRA coverage to administrative fees and the substitution of paid leave, understanding these aspects can help both employees and employers navigate the FMLA process more effectively.

What happens to my health insurance during FMLA leave?

+

Your employer must continue your health coverage during FMLA leave, but you are responsible for paying your share of the premiums.

Can I use paid leave during my FMLA leave?

+

Yes, you can substitute paid leave for unpaid FMLA leave, but the rules can be complex, and not all types of leave may be eligible.

What happens if I don’t pay my health insurance premiums while on FMLA leave?

+

Failure to pay premiums can result in the loss of health insurance coverage.