5 Tips On Withheld Paychecks

Introduction to Withheld Paychecks

When employees receive their paychecks, they expect to get the full amount they have earned. However, in some cases, paychecks can be withheld, which can cause financial difficulties for the employees. Withheld paychecks can occur due to various reasons, including errors in payroll processing, disagreements over wages, or as a result of legal actions. In this article, we will explore five tips on how to handle withheld paychecks and provide guidance on the steps to take when faced with this situation.

Understanding the Reasons for Withheld Paychecks

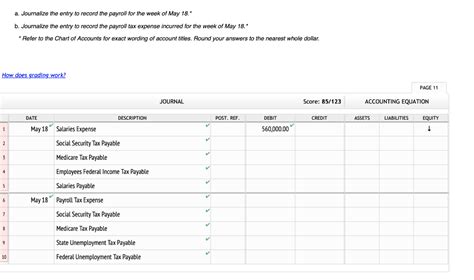

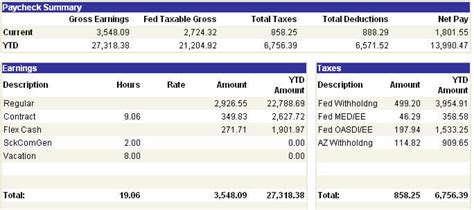

Before we dive into the tips, it’s essential to understand the reasons why paychecks can be withheld. Some common reasons include: * Payroll errors: Mistakes in payroll processing can lead to withheld paychecks. * Wage disputes: Disagreements over wages or benefits can result in withheld paychecks. * Legal actions: Court orders or garnishments can cause paychecks to be withheld. * Company policies: Some companies may have policies that allow them to withhold paychecks under certain circumstances.

Tips for Handling Withheld Paychecks

If you’re facing a situation where your paycheck has been withheld, here are five tips to help you navigate the situation: * Communicate with your employer: Reach out to your employer to understand the reason for the withheld paycheck. It’s possible that the issue can be resolved through communication. * Review your employment contract: Check your employment contract to see if it addresses the situation. Your contract may outline the procedures for withheld paychecks and provide guidance on how to resolve the issue. * Seek support from HR: If you’re unable to resolve the issue with your employer, consider reaching out to the HR department. They may be able to provide guidance and support to help resolve the situation. * Consider seeking legal advice: If you believe that your paycheck has been withheld unfairly, you may want to consider seeking legal advice. A lawyer can help you understand your rights and options for resolving the situation. * Explore alternative payment options: If your paycheck has been withheld, you may need to explore alternative payment options to cover your living expenses. This could include borrowing money from friends or family, or seeking assistance from a financial advisor.

Additional Considerations

In addition to the tips outlined above, there are several other considerations to keep in mind when dealing with withheld paychecks. These include: * Time limits: Be aware of the time limits for resolving the issue. If you don’t take action quickly, you may miss the opportunity to resolve the situation. * Documentation: Keep detailed records of all communication and correspondence related to the withheld paycheck. This can help you track the progress of the situation and provide evidence if needed. * Support networks: Don’t be afraid to reach out to friends, family, or support networks for help and guidance. They may be able to provide valuable advice and assistance.

📝 Note: When dealing with withheld paychecks, it's essential to stay calm and professional. Avoid confrontations or aggressive behavior, as this can escalate the situation and make it more challenging to resolve.

Resolving the Issue

Resolving a withheld paycheck situation can be a challenging and time-consuming process. However, by following the tips outlined above and being aware of the additional considerations, you can increase your chances of resolving the issue successfully. Remember to stay calm, communicate effectively, and seek support when needed.

| Reason for Withheld Paycheck | Steps to Take |

|---|---|

| Payroll error | Communicate with employer, review employment contract |

| Wage dispute | Seek support from HR, consider seeking legal advice |

| Legal action | Seek legal advice, explore alternative payment options |

In the end, handling withheld paychecks requires a combination of communication, patience, and persistence. By understanding the reasons for withheld paychecks and following the tips outlined above, you can increase your chances of resolving the situation successfully and getting back to your normal financial routine.

What should I do if my paycheck is withheld due to a payroll error?

+

If your paycheck is withheld due to a payroll error, you should communicate with your employer to understand the reason for the error and work together to resolve the issue. You may also want to review your employment contract to see if it addresses the situation.

Can I seek legal advice if my paycheck is withheld unfairly?

+

Yes, if you believe that your paycheck has been withheld unfairly, you may want to consider seeking legal advice. A lawyer can help you understand your rights and options for resolving the situation.

How can I avoid withheld paychecks in the future?

+

To avoid withheld paychecks in the future, make sure to review your employment contract carefully and understand the company’s policies and procedures. You should also communicate regularly with your employer and HR department to resolve any issues promptly.