Paperwork

Withholding Paycheck for Uncompleted Paperwork

Understanding the Issue of Withholding Paycheck for Uncompleted Paperwork

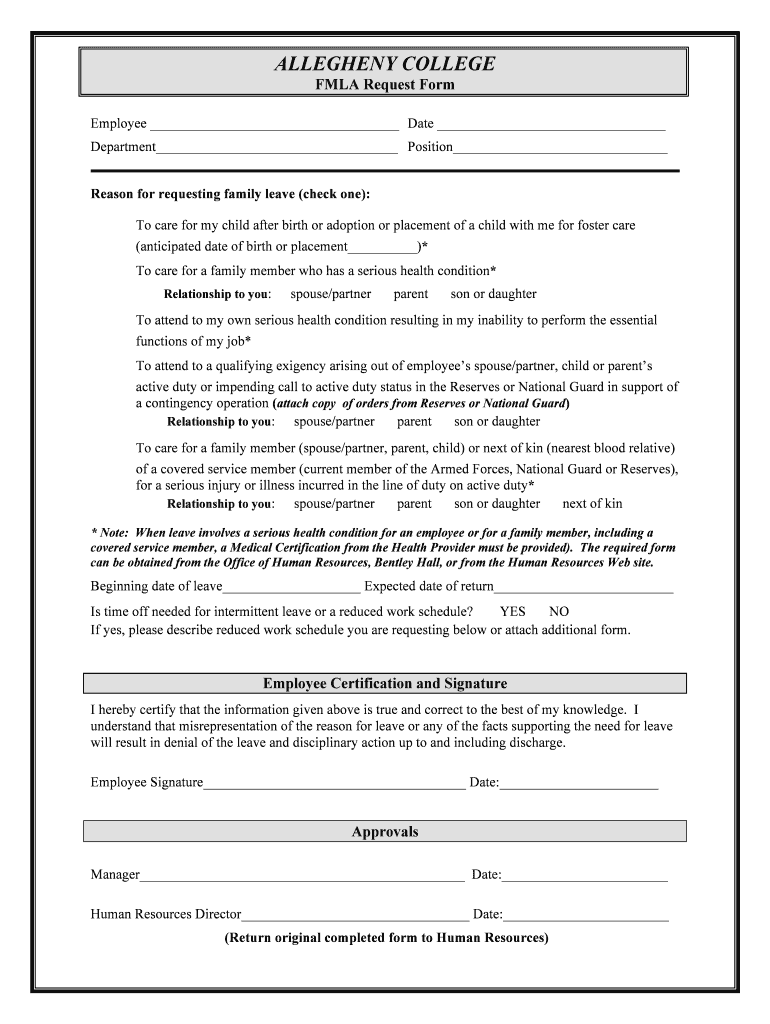

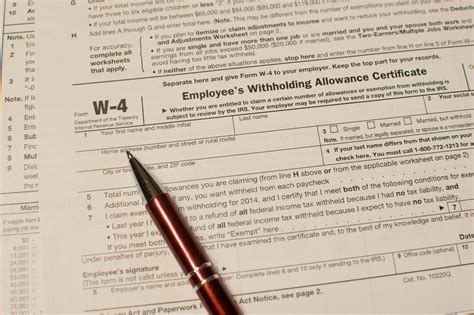

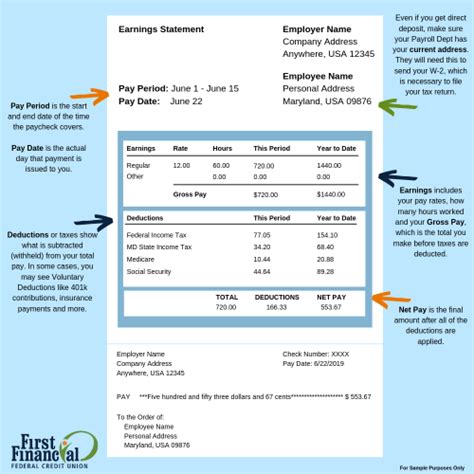

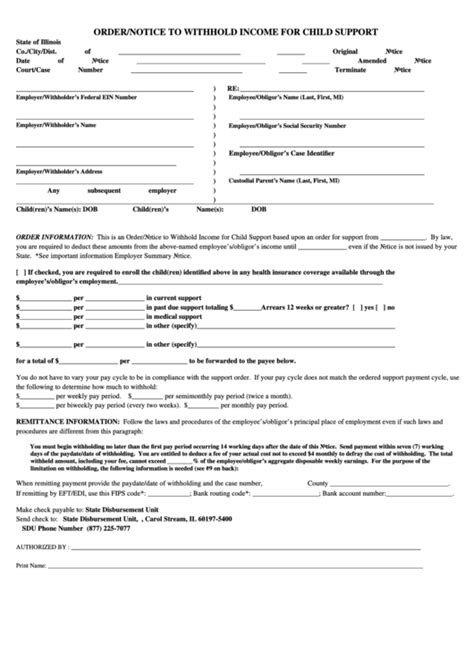

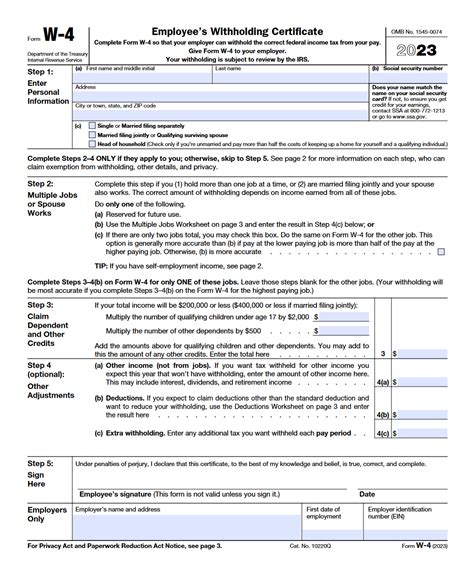

When an employee starts a new job, there are various documents and paperwork that need to be completed. These can range from tax forms to health insurance enrollment. Sometimes, due to oversight or delay, this paperwork might not be completed immediately. In some cases, employers might withhold an employee’s paycheck until all necessary paperwork is completed. This practice raises several questions about employment law, employee rights, and the responsibilities of employers. In this discussion, we will delve into the legality and implications of withholding paychecks for uncompleted paperwork.

Legal Perspective

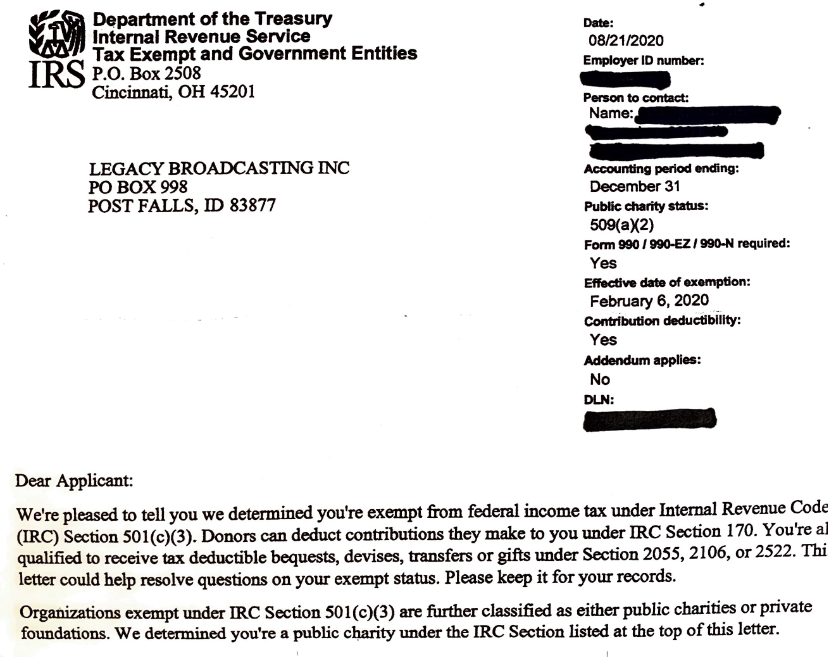

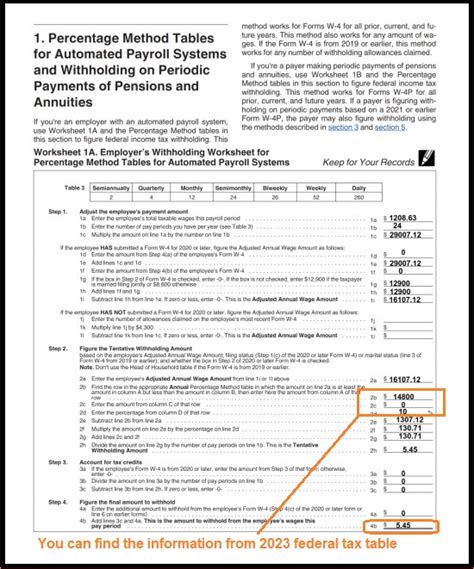

From a legal standpoint, the practice of withholding paychecks for uncompleted paperwork is generally considered unacceptable and potentially illegal under many jurisdictions’ labor laws. The Fair Labor Standards Act (FLSA) in the United States, for example, requires employers to pay employees for all hours worked in a timely manner. The FLSA does not permit employers to withhold wages as a form of punishment or to force employees to complete paperwork. Similar laws exist in other countries, emphasizing the importance of prompt payment for work performed.

Employer Responsibilities

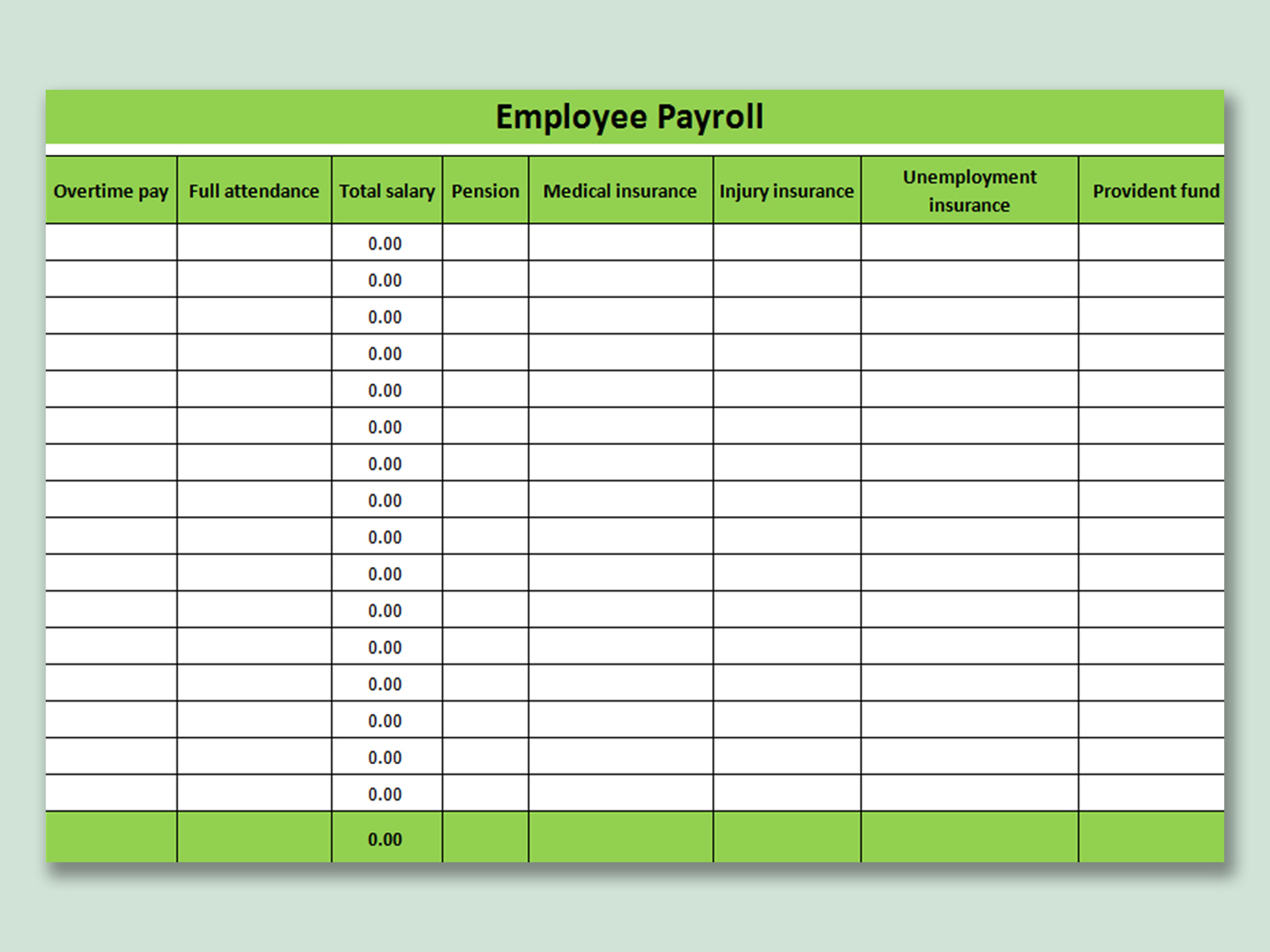

Employers have a responsibility to ensure that all necessary paperwork is completed in a timely manner. This includes providing clear instructions and deadlines for completion. However, the onus of ensuring that paperwork is completed should not be used as a pretext to withhold wages. Employers should have systems in place to track the completion of paperwork and to follow up with employees who have not completed their documents. Effective communication is key to avoiding misunderstandings and ensuring that both parties understand their obligations and responsibilities.

Employee Rights

Employees have the right to be paid for their work. If an employer withholds a paycheck due to uncompleted paperwork, the employee may have grounds for a complaint. Employees should understand their rights under local labor laws and not hesitate to seek advice if they feel their wages are being unfairly withheld. Knowing your rights as an employee can empower you to navigate such situations effectively and ensure that you are treated fairly by your employer.

Resolving Disputes

In cases where a paycheck is withheld due to uncompleted paperwork, it is essential to resolve the dispute as quickly as possible. Employees should first try to communicate with their employer to understand the reasons for the withholding and to complete any outstanding paperwork. If the issue cannot be resolved through internal channels, employees may need to seek external advice or file a complaint with the relevant labor authorities. Seeking mediation or using grievance procedures can often provide a swift and satisfactory resolution to such disputes.

Best Practices for Employers

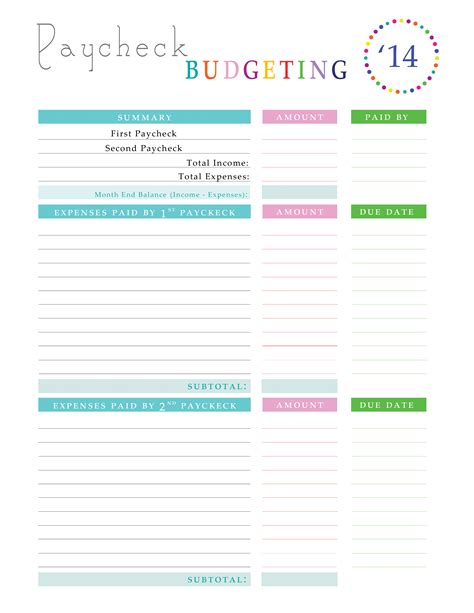

To avoid disputes over withheld paychecks, employers should adopt best practices that prioritize clear communication and timely payment. This includes: - Providing comprehensive onboarding processes that clearly outline the necessary paperwork and deadlines. - Offering support and resources to help employees complete paperwork efficiently. - Implementing a system for tracking the completion of paperwork and following up with employees. - Ensuring that paychecks are issued on time, regardless of the status of paperwork, unless legally permitted to do otherwise.

| Best Practice | Description |

|---|---|

| Clear Communication | Inform employees about necessary paperwork and deadlines from the start. |

| Supportive Onboarding | Provide resources to help employees complete paperwork efficiently. |

| Timely Payment | Issue paychecks on time, according to the pay schedule. |

📝 Note: Employers should consult with legal advisors to ensure their practices comply with local labor laws and regulations.

Conclusion and Final Thoughts

The practice of withholding paychecks for uncompleted paperwork is a complex issue that intersects with labor laws, employee rights, and employer responsibilities. While employers have a legitimate interest in ensuring that all necessary paperwork is completed, this should not come at the expense of violating labor laws or unfairly treating employees. By understanding the legal frameworks, adopting best practices, and maintaining open lines of communication, both employers and employees can navigate these situations effectively, ensuring a fair and respectful working relationship.

Can an employer legally withhold my paycheck if I haven’t completed all the paperwork?

+

Generally, no. Under most labor laws, employers are required to pay employees for all hours worked in a timely manner, regardless of the status of paperwork.

What should I do if my employer withholds my paycheck?

+

First, try to communicate with your employer to understand the reasons and complete any outstanding paperwork. If the issue persists, consider seeking advice from labor authorities or legal professionals.

How can employers avoid disputes over withheld paychecks?

+

Employers can avoid disputes by providing clear communication about necessary paperwork, offering support during the onboarding process, and ensuring timely payment of wages.