Bring Loan Paperwork for Title

Understanding the Importance of Loan Paperwork for Title

When it comes to securing a loan, especially for a significant purchase like a vehicle or property, the paperwork involved can be overwhelming. One crucial aspect of this process is the loan paperwork for title, which serves as the legal documentation of the loan and the transfer of ownership. In this article, we will delve into the world of loan paperwork, exploring its significance, components, and the steps involved in completing it.

Significance of Loan Paperwork for Title

The loan paperwork for title is essential for several reasons:

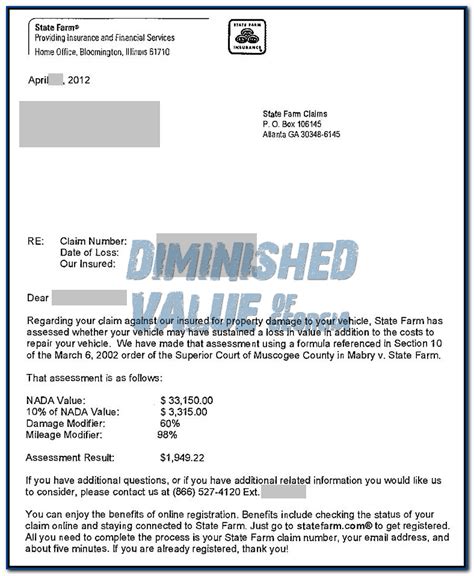

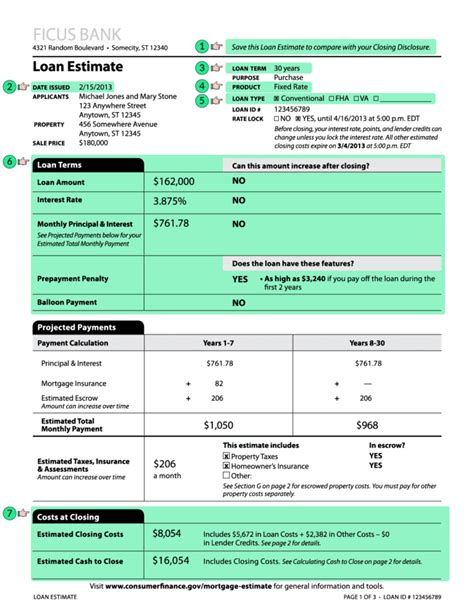

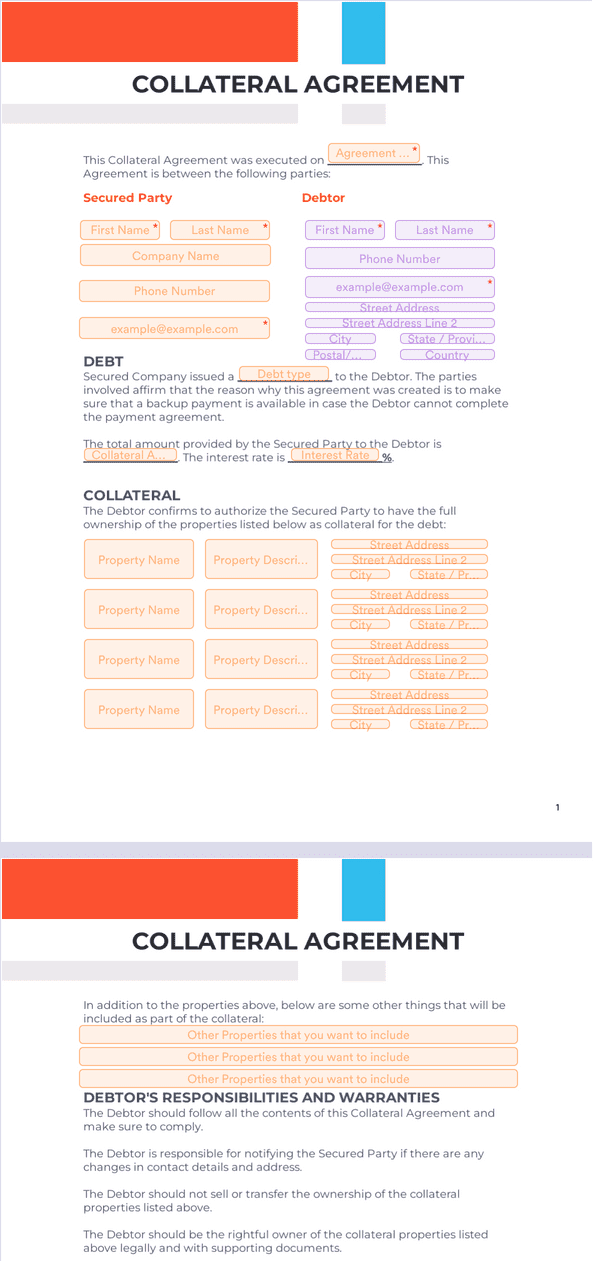

- Legal Documentation: It provides a legal record of the loan agreement, including the terms and conditions, the amount borrowed, the interest rate, and the repayment schedule.

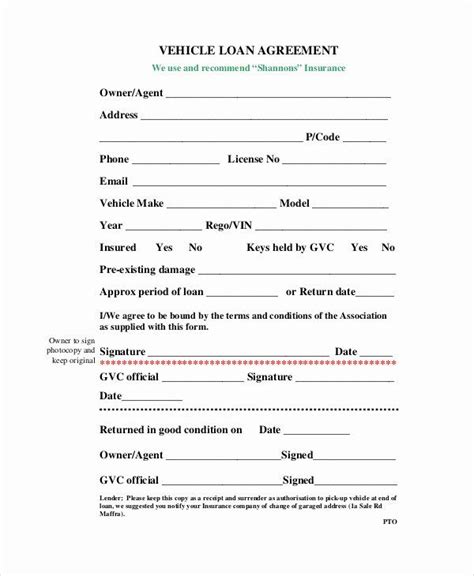

- Ownership Transfer: It facilitates the transfer of ownership from the seller to the buyer, ensuring that the buyer has clear title to the property or vehicle.

- Security Interest: It allows the lender to establish a security interest in the property or vehicle, giving them the right to repossess it if the borrower defaults on the loan.

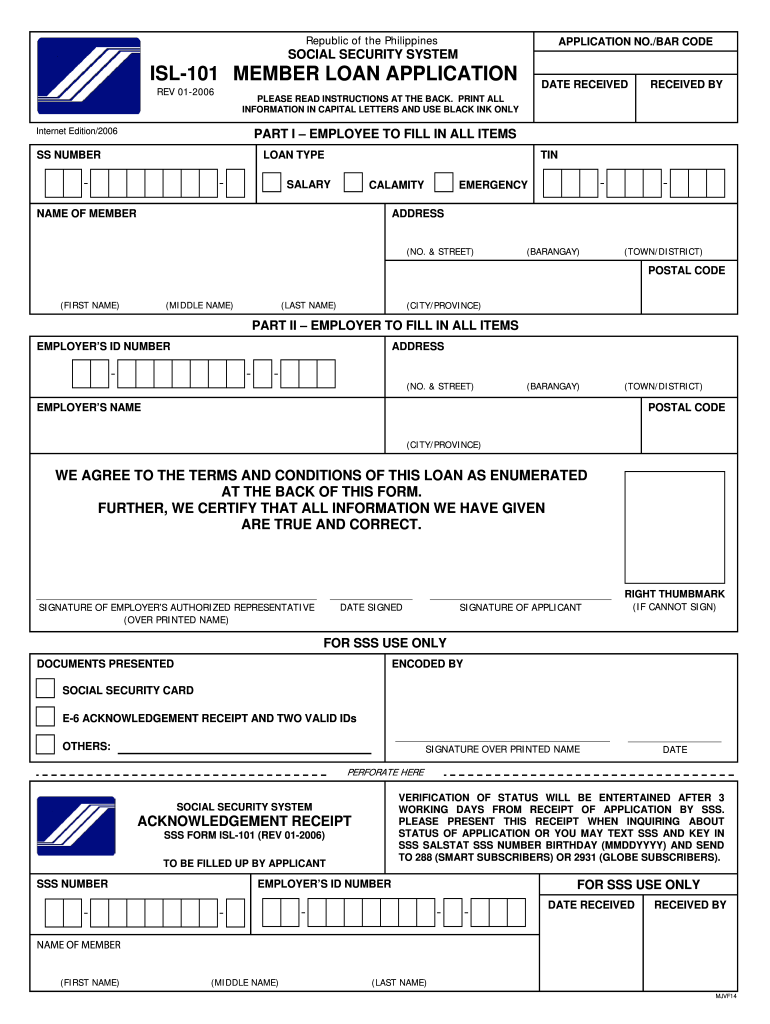

Components of Loan Paperwork for Title

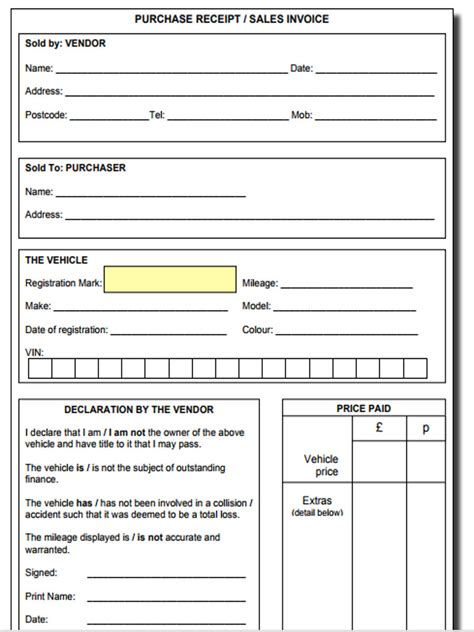

The loan paperwork for title typically includes the following components:

| Component | Description |

|---|---|

| Promissory Note | A written promise to repay the loan, including the amount borrowed, the interest rate, and the repayment schedule. |

| Security Agreement | A document that grants the lender a security interest in the property or vehicle, allowing them to repossess it if the borrower defaults. |

| Title Application | A document that applies for a new title in the buyer’s name, transferring ownership from the seller to the buyer. |

| Loan Agreement | A document that outlines the terms and conditions of the loan, including the amount borrowed, the interest rate, and the repayment schedule. |

These components work together to ensure that the loan agreement is valid and enforceable, and that the transfer of ownership is complete.

Steps Involved in Completing Loan Paperwork for Title

Completing the loan paperwork for title involves several steps:

- Application: The borrower applies for the loan, providing financial information and documentation to support their application.

- Approval: The lender reviews the application and approves the loan, providing the borrower with a loan offer that includes the terms and conditions.

- Documentation: The borrower reviews and signs the loan paperwork, including the promissory note, security agreement, title application, and loan agreement.

- Disbursement: The lender disburses the loan funds to the borrower, and the borrower uses the funds to purchase the property or vehicle.

- Recording: The lender records the security interest in the property or vehicle, providing public notice of their interest in the property.

📝 Note: It's essential to carefully review and understand the loan paperwork for title before signing, as it can have significant financial implications.

In summary, the loan paperwork for title is a critical component of the loan process, providing a legal record of the loan agreement and facilitating the transfer of ownership. By understanding the significance, components, and steps involved in completing the loan paperwork for title, borrowers and lenders can ensure that the loan agreement is valid and enforceable, and that the transfer of ownership is complete.

To wrap things up, the key points to take away are the importance of loan paperwork for title, the components involved, and the steps required to complete the process. By being informed and prepared, individuals can navigate the loan process with confidence, ensuring a successful and stress-free experience.

What is the purpose of loan paperwork for title?

+

The purpose of loan paperwork for title is to provide a legal record of the loan agreement and facilitate the transfer of ownership from the seller to the buyer.

What components are typically included in loan paperwork for title?

+

The components typically included in loan paperwork for title are the promissory note, security agreement, title application, and loan agreement.

What are the steps involved in completing loan paperwork for title?

+

The steps involved in completing loan paperwork for title include application, approval, documentation, disbursement, and recording.