Paperwork

Diminished Value Claim Paperwork

Introduction to Diminished Value Claims

When a vehicle is involved in an accident, its value can significantly decrease, even after repairs. This decrease in value is known as diminished value. Diminished value claims are a way for vehicle owners to recover the loss in value from the at-fault party’s insurance company. The process of filing a diminished value claim can be complex and requires thorough documentation. In this article, we will explore the paperwork required for a diminished value claim and provide guidance on how to navigate the process.

Understanding Diminished Value

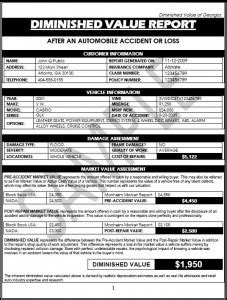

Before diving into the paperwork, it’s essential to understand what diminished value is and how it’s calculated. Diminished value is the difference between the vehicle’s value before the accident and its value after the accident, even after repairs. There are several types of diminished value, including: * Immediate diminished value: The decrease in value immediately after the accident. * Repair-related diminished value: The decrease in value due to poor repairs. * Inherent diminished value: The decrease in value due to the vehicle’s history of being in an accident.

Gathering Necessary Documents

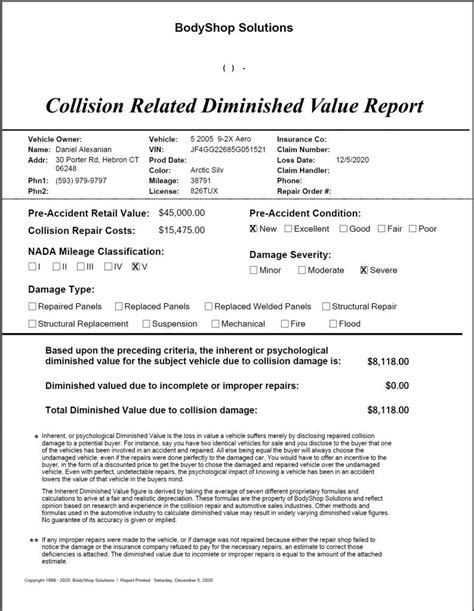

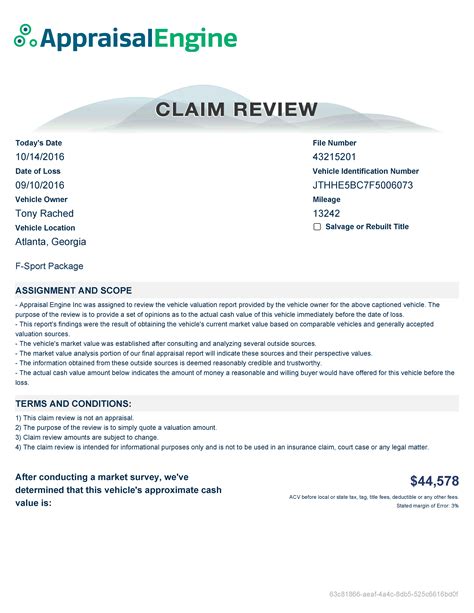

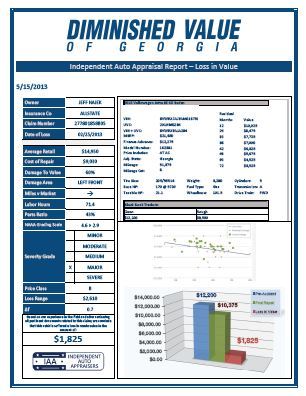

To file a diminished value claim, you’ll need to gather several documents, including: * Police report: A copy of the police report from the accident. * Repair estimates: Estimates from repair shops detailing the cost of repairs. * Repair receipts: Receipts for the repairs completed. * Vehicle history report: A report from a service like Carfax or AutoCheck detailing the vehicle’s history. * Appraisal report: A report from a certified appraiser detailing the vehicle’s value before and after the accident. * Photos of the vehicle: Photos of the vehicle before and after the accident.

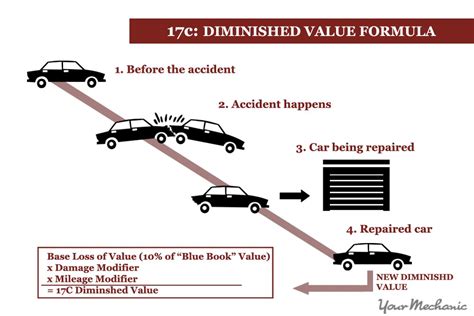

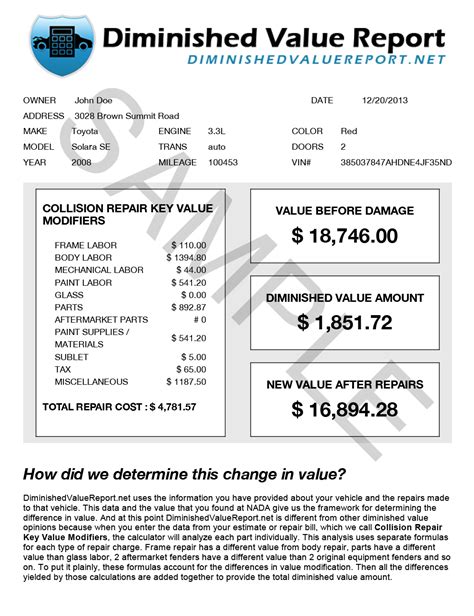

Calculating Diminished Value

To calculate diminished value, you’ll need to determine the vehicle’s value before and after the accident. This can be done using several methods, including: * NADA guides: Using the National Automobile Dealers Association (NADA) guides to determine the vehicle’s value. * Kelley Blue Book: Using Kelley Blue Book to determine the vehicle’s value. * Appraisal report: Using an appraisal report from a certified appraiser.

| Method | Description |

|---|---|

| NADA guides | Using the NADA guides to determine the vehicle's value. |

| Kelley Blue Book | Using Kelley Blue Book to determine the vehicle's value. |

| Appraisal report | Using an appraisal report from a certified appraiser. |

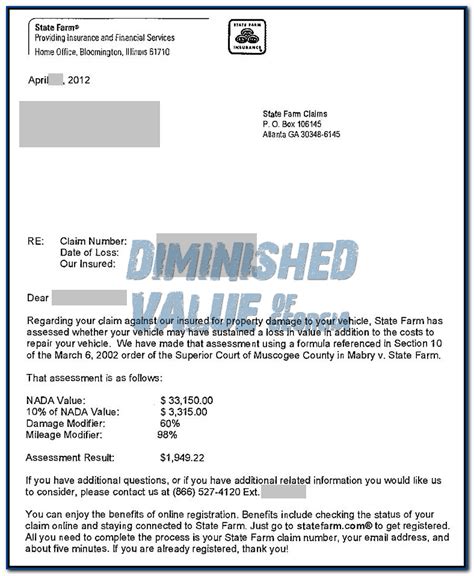

Filing the Claim

Once you have gathered all the necessary documents and calculated the diminished value, you can file the claim with the at-fault party’s insurance company. Be sure to include all the supporting documentation and a clear explanation of the claim. It’s also a good idea to keep a record of all correspondence with the insurance company.

📝 Note: It's essential to keep detailed records of all correspondence with the insurance company, including dates, times, and the names of the people you speak with.

Negotiating the Settlement

After filing the claim, the insurance company will review the documentation and may make a settlement offer. It’s essential to carefully review the offer and negotiate if necessary. Consider hiring a public adjuster or attorney to help with the negotiation process.

Conclusion and Next Steps

Filing a diminished value claim can be a complex and time-consuming process. However, with the right documentation and support, you can recover the loss in value to your vehicle. Remember to stay organized and keep detailed records throughout the process. If you’re unsure about any aspect of the process, consider seeking the help of a professional.

What is diminished value?

+

Diminished value is the decrease in value of a vehicle after an accident, even after repairs.

How is diminished value calculated?

+

Diminished value can be calculated using several methods, including NADA guides, Kelley Blue Book, and appraisal reports.

What documentation is required for a diminished value claim?

+

The required documentation includes police reports, repair estimates, repair receipts, vehicle history reports, appraisal reports, and photos of the vehicle.