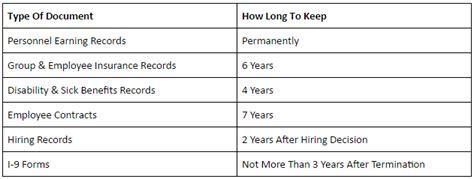

Paperwork

5 Ways Delegate Insurance

Introduction to Delegate Insurance

Delegate insurance is a type of insurance that allows individuals or organizations to transfer risk to another party, typically an insurance company. This type of insurance is commonly used in the context of events, conferences, and meetings, where the organizer wants to protect themselves against unforeseen circumstances that may lead to financial losses. In this article, we will explore 5 ways to delegate insurance, highlighting the benefits and key considerations for each approach.

Understanding the Importance of Delegate Insurance

Before diving into the different ways to delegate insurance, it’s essential to understand the importance of this type of coverage. Unexpected events can happen at any time, and without adequate insurance, the financial consequences can be severe. Delegate insurance provides a safety net, allowing organizers to focus on their events without worrying about potential risks. Whether it’s a cancellation due to unforeseen circumstances or liability issues, delegate insurance can help mitigate these risks.

5 Ways to Delegate Insurance

Here are 5 ways to delegate insurance, each with its unique benefits and considerations: * Event Cancellation Insurance: This type of insurance provides coverage in the event of cancellation due to unforeseen circumstances, such as natural disasters, terrorism, or speaker cancellations. * Liability Insurance: This type of insurance provides coverage in the event of accidents or injuries to attendees, protecting the organizer against financial losses. * Property Insurance: This type of insurance provides coverage for damage or loss of property, such as equipment or merchandise, during the event. * Travel Insurance: This type of insurance provides coverage for attendees who may need to cancel their travel plans due to unforeseen circumstances. * Cyber Insurance: This type of insurance provides coverage in the event of a data breach or cyber-attack, protecting the organizer against financial losses and reputational damage.

Benefits of Delegate Insurance

The benefits of delegate insurance are numerous, including: * Financial protection: Delegate insurance provides a safety net against unforeseen circumstances, protecting the organizer against financial losses. * Reduced stress: With delegate insurance, organizers can focus on their events without worrying about potential risks. * Increased confidence: Delegate insurance can provide organizers with the confidence to host events, knowing that they are protected against unforeseen circumstances. * Compliance: In some cases, delegate insurance may be required by law or by the venue, making it an essential consideration for organizers.

Key Considerations

When considering delegate insurance, there are several key factors to keep in mind: * Policy terms: Carefully review the policy terms and conditions to ensure that they meet your needs. * Premium costs: Compare premium costs from different insurance providers to ensure that you are getting the best value for your money. * Coverage limits: Ensure that the coverage limits are sufficient to protect against potential losses. * Exclusions: Carefully review the exclusions to ensure that you understand what is not covered.

📝 Note: It's essential to work with a reputable insurance provider to ensure that you are getting the right coverage for your needs.

Conclusion and Final Thoughts

In conclusion, delegate insurance is an essential consideration for organizers who want to protect themselves against unforeseen circumstances. By understanding the different types of delegate insurance and carefully considering the benefits and key factors, organizers can make informed decisions about their insurance needs. Whether you’re hosting a small meeting or a large conference, delegate insurance can provide a safety net and peace of mind, allowing you to focus on what matters most – delivering a successful event.

What is delegate insurance?

+

Delegate insurance is a type of insurance that allows individuals or organizations to transfer risk to another party, typically an insurance company.

Why is delegate insurance important?

+

Delegate insurance provides a safety net against unforeseen circumstances, protecting the organizer against financial losses and reputational damage.

What types of delegate insurance are available?

+

There are several types of delegate insurance available, including event cancellation insurance, liability insurance, property insurance, travel insurance, and cyber insurance.