File LLC Yourself

Introduction to Forming an LLC

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful consideration and planning. An LLC offers personal liability protection, tax benefits, and flexibility in management structure, making it a popular choice for entrepreneurs and small business owners. In this article, we will guide you through the steps to form an LLC yourself, highlighting key considerations and potential pitfalls to avoid.

Benefits of Forming an LLC

Before diving into the formation process, it’s essential to understand the benefits of forming an LLC. These include: * Personal Liability Protection: LLCs provide owners (known as members) with personal liability protection, shielding their personal assets from business-related risks and debts. * Tax Benefits: LLCs can elect to be taxed as pass-through entities, avoiding double taxation and reducing the overall tax burden. * Flexibility in Management Structure: LLCs can be managed by their members (member-managed) or by appointed managers (manager-managed), allowing for flexibility in decision-making and control. * Credibility and Legitimacy: Forming an LLC can enhance a business’s credibility and legitimacy, making it more attractive to customers, investors, and partners.

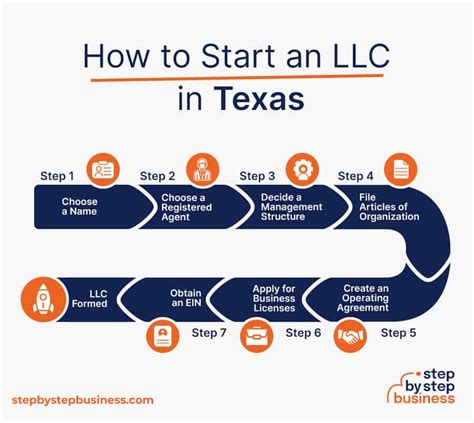

Steps to Form an LLC Yourself

Forming an LLC yourself requires careful planning and attention to detail. Here are the steps to follow: * Choose a Business Name: Select a unique and memorable name for your LLC, ensuring it complies with state regulations and is available as a web domain. * Conduct a Name Search: Verify the availability of your desired business name using the state’s business database and ensure it doesn’t infringe on existing trademarks. * Prepare and File Articles of Organization: Draft and submit the Articles of Organization to the state, providing essential information about your LLC, such as its name, address, and management structure. * Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is required for tax purposes and opening a business bank account. * Create an Operating Agreement: Develop an operating agreement that outlines the ownership, management, and operational procedures of your LLC. * Obtain Necessary Licenses and Permits: Secure any required licenses and permits to operate your business, depending on your industry and location.

Key Considerations and Potential Pitfalls

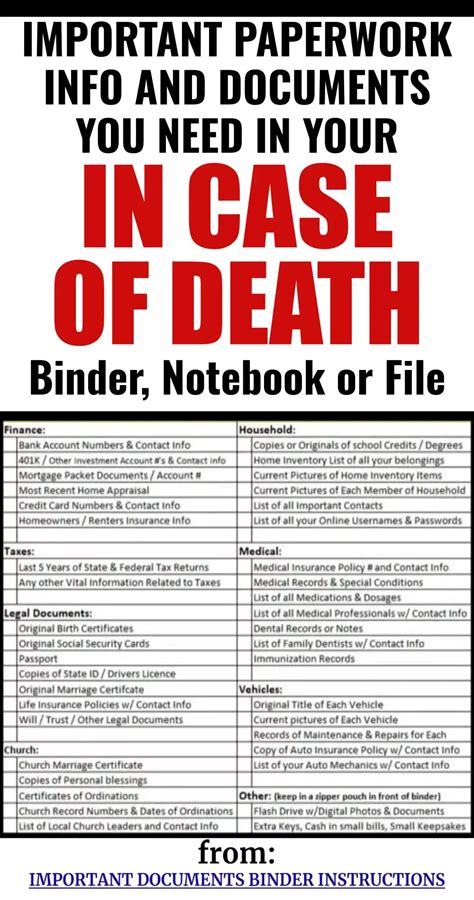

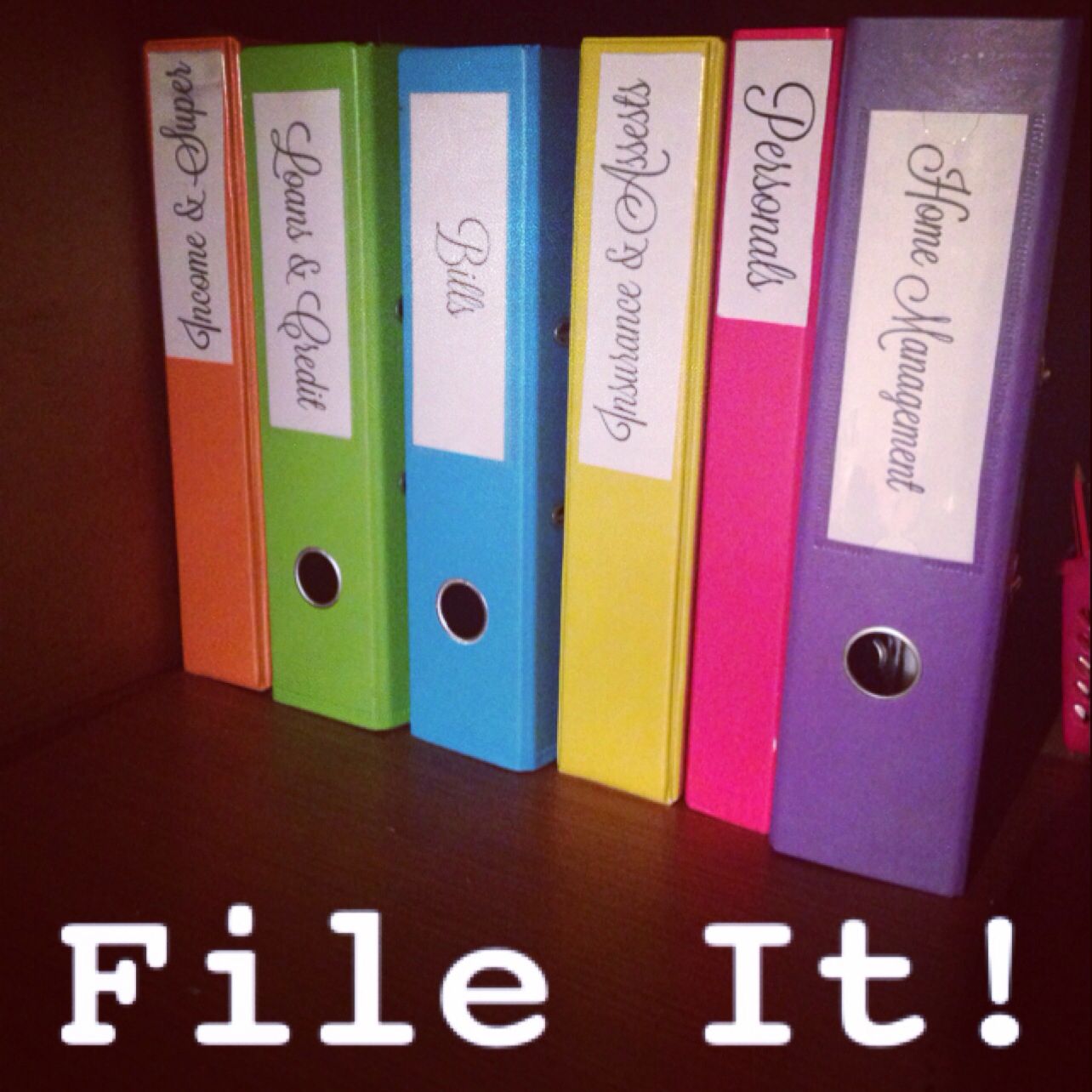

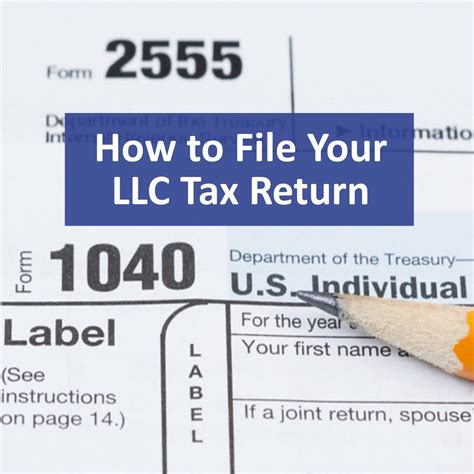

When forming an LLC yourself, it’s crucial to be aware of potential pitfalls and key considerations, such as: * Compliance with State Regulations: Ensure you comply with state-specific requirements, such as annual report filings and franchise tax payments. * Tax Obligations: Understand your tax obligations, including federal, state, and local taxes, and ensure you meet all filing deadlines. * Insurance and Risk Management: Consider obtaining liability insurance and developing a risk management strategy to protect your business and personal assets. * Record-Keeping and Accounting: Maintain accurate and detailed records, including financial statements, meeting minutes, and membership records.

📝 Note: It's essential to consult with an attorney or accountant to ensure you comply with all state and federal regulations and take advantage of available tax benefits.

Managing and Maintaining Your LLC

Once your LLC is formed, it’s crucial to manage and maintain it properly to ensure continued compliance and success. This includes: * Conducting Regular Meetings: Hold meetings to discuss business operations, make decisions, and maintain a record of proceedings. * Maintaining Accurate Records: Keep detailed records of financial transactions, membership changes, and business decisions. * Filing Annual Reports: Submit annual reports to the state, providing updated information about your LLC’s management, ownership, and business activities. * Reviewing and Updating the Operating Agreement: Periodically review and update the operating agreement to reflect changes in your business, such as new members or management structure.

| State | Filing Fee | Annual Report Fee |

|---|---|---|

| California | $70 | $20 |

| New York | $200 | $9 |

| Florida | $125 | $138.75 |

To maintain a successful and compliant LLC, it’s essential to stay informed about state regulations, tax obligations, and best practices for managing and maintaining your business.

In final thoughts, forming an LLC yourself requires careful planning, attention to detail, and ongoing maintenance to ensure compliance and success. By understanding the benefits, steps, and key considerations involved in forming an LLC, you can create a solid foundation for your business and protect your personal assets.

What is the primary benefit of forming an LLC?

+

The primary benefit of forming an LLC is personal liability protection, which shields owners’ personal assets from business-related risks and debts.

What is the difference between a member-managed and manager-managed LLC?

+

A member-managed LLC is managed by its owners (members), while a manager-managed LLC is managed by appointed managers, who may or may not be members.

How do I obtain an EIN for my LLC?

+

You can apply for an EIN online through the IRS website, by phone, or by mail, providing required information about your LLC, such as its name, address, and management structure.

Related Terms:

- Make LLC for free