Bond Without Paperwork Option

Introduction to Bond Without Paperwork Option

In the digital age, various industries have adapted to reduce paperwork and increase efficiency. The bond industry is no exception, with the introduction of bond without paperwork options. This innovative approach allows individuals and organizations to acquire bonds without the hassle of physical documentation. In this article, we will delve into the world of bonds, exploring the benefits and process of obtaining bonds without paperwork.

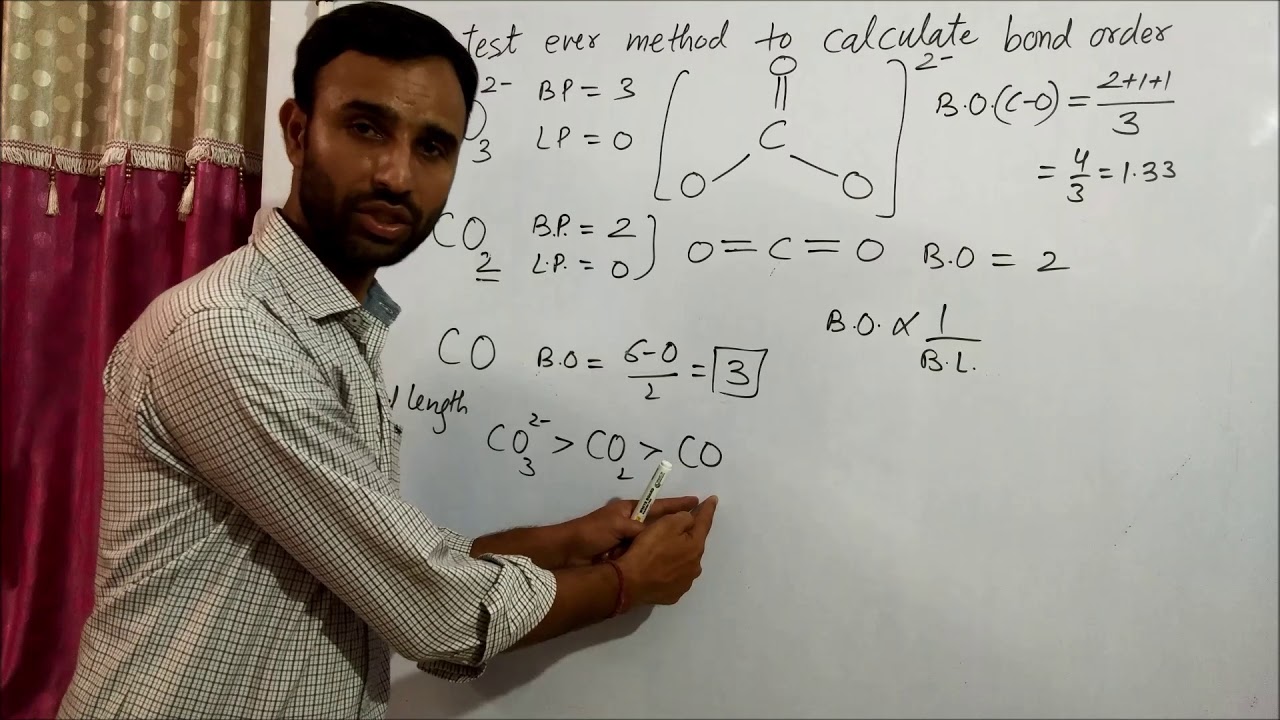

Understanding Bonds

Before we dive into the bond without paperwork option, it’s essential to understand what bonds are and their significance. Bonds are debt securities issued by borrowers to raise capital. They represent a loan made by an investor to a borrower, with the promise of repayment with interest. Bonds are commonly used by corporations, governments, and other entities to finance their operations or projects. The bond market offers a wide range of options, including government bonds, corporate bonds, municipal bonds, and more.

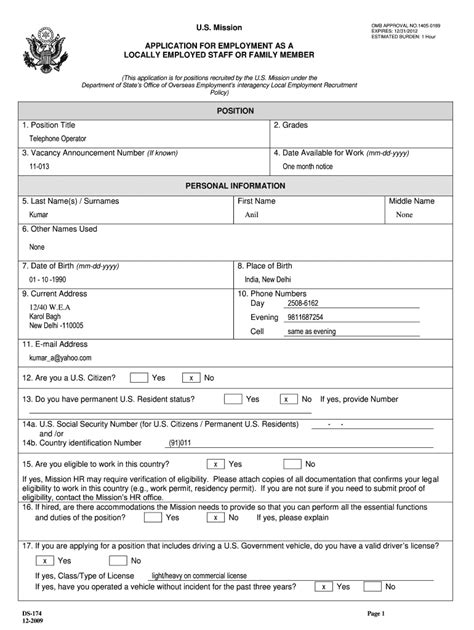

Traditional Bond Acquisition Process

Traditionally, acquiring bonds involves a lengthy process with extensive paperwork. Investors would need to: * Research and select the desired bond * Contact a broker or financial institution * Fill out application forms * Provide identification and financial documents * Wait for the application to be processed * Receive the bond certificate or confirmation

This process can be time-consuming and may deter some investors, especially those who value convenience and efficiency.

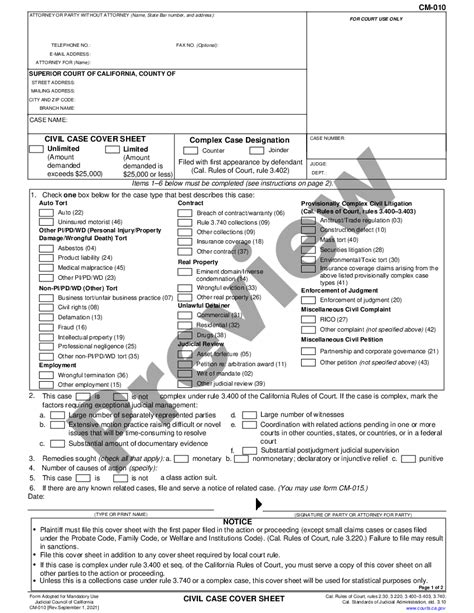

Bond Without Paperwork Option

The bond without paperwork option eliminates the need for physical documentation, making it easier for investors to acquire bonds. This digital approach allows investors to: * Research and select bonds online * Apply for bonds through a digital platform * Upload required documents electronically * Receive bond confirmation and statements digitally

The bond without paperwork option offers several benefits, including: * Convenience: Investors can apply for bonds from anywhere, at any time, as long as they have an internet connection. * Speed: The digital application process is faster than traditional methods, reducing the time it takes to acquire bonds. * Cost-effective: The lack of physical documentation and manual processing reduces costs for both investors and issuers. * Environmentally friendly: The reduction in paperwork minimizes the environmental impact of the bond acquisition process.

How to Acquire Bonds Without Paperwork

To acquire bonds without paperwork, investors can follow these steps: * Research and select the desired bond through online platforms or financial websites * Create an account on the platform or website * Fill out the digital application form and upload required documents * Review and agree to the terms and conditions * Confirm the application and receive digital confirmation

📝 Note: Investors should ensure they understand the terms and conditions of the bond, including the interest rate, maturity date, and any associated risks.

Benefits for Investors

The bond without paperwork option offers numerous benefits for investors, including: * Easy access: Investors can access a wide range of bonds from anywhere in the world. * Diversification: The digital platform allows investors to diversify their portfolio by investing in different types of bonds. * Real-time updates: Investors can receive real-time updates on their bond portfolio, including interest payments and maturity dates. * Low costs: The digital platform reduces costs associated with traditional bond acquisition methods.

Benefits for Issuers

The bond without paperwork option also offers benefits for issuers, including: * Increased reach: The digital platform allows issuers to reach a wider audience, increasing the potential for investment. * Reduced costs: The lack of physical documentation and manual processing reduces costs for issuers. * Faster processing: The digital application process is faster than traditional methods, allowing issuers to access capital quickly. * Improved efficiency: The digital platform streamlines the bond issuance process, improving efficiency and reducing the risk of errors.

Security and Risk Management

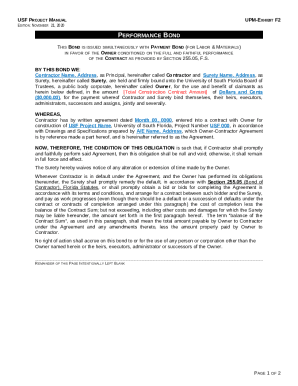

When acquiring bonds without paperwork, investors should be aware of the potential risks and take steps to manage them. These risks include: * Credit risk: The risk that the issuer defaults on the bond. * Interest rate risk: The risk that changes in interest rates affect the value of the bond. * Liquidity risk: The risk that the investor is unable to sell the bond quickly enough or at a fair price.

To manage these risks, investors can: * Diversify their portfolio: Invest in a range of bonds to minimize risk. * Conduct thorough research: Research the issuer and the bond to understand the associated risks. * Monitor the market: Keep up-to-date with market trends and changes in interest rates.

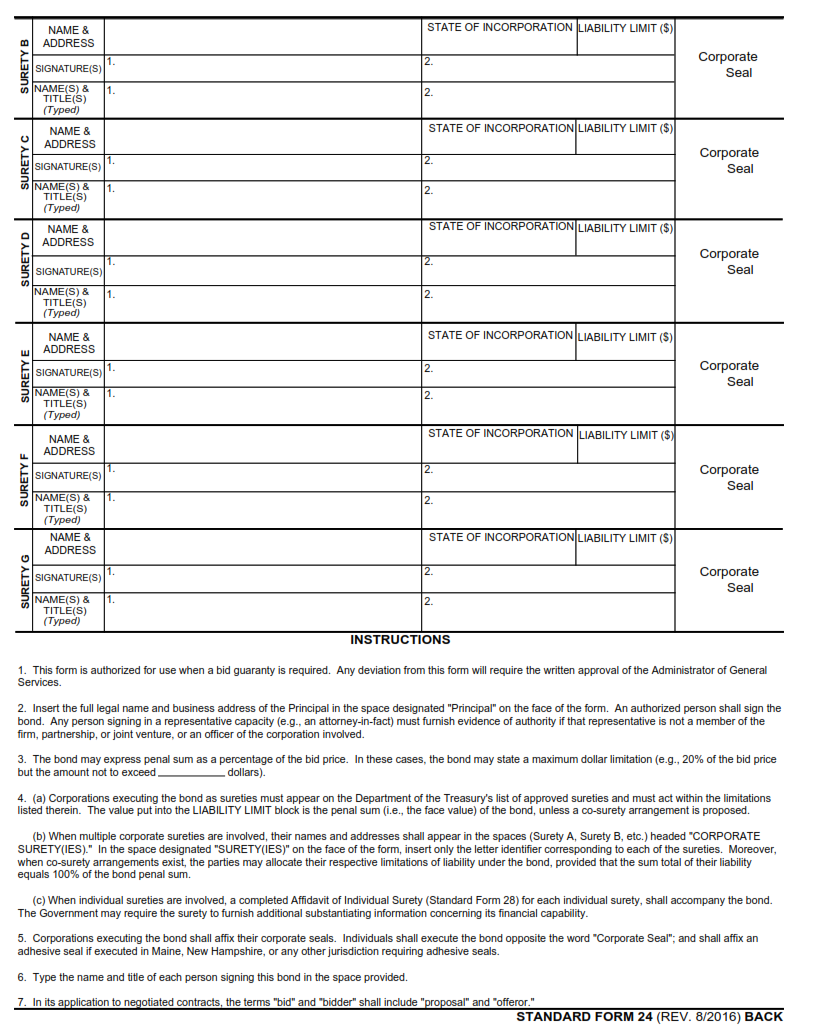

| Type of Bond | Description | Risk Level |

|---|---|---|

| Government Bond | Issued by governments to finance their operations | Low |

| Corporate Bond | Issued by corporations to finance their operations | Medium |

| Municipal Bond | Issued by municipalities to finance infrastructure projects | Low to Medium |

In summary, the bond without paperwork option offers a convenient, efficient, and cost-effective way for investors to acquire bonds. By understanding the benefits and process of obtaining bonds without paperwork, investors can make informed decisions and manage potential risks.

What is the bond without paperwork option?

+

The bond without paperwork option is a digital approach that allows investors to acquire bonds without the need for physical documentation.

What are the benefits of the bond without paperwork option?

+

The benefits of the bond without paperwork option include convenience, speed, cost-effectiveness, and environmental friendliness.

How do I acquire bonds without paperwork?

+

To acquire bonds without paperwork, investors can research and select bonds online, create an account on a digital platform, fill out the digital application form, and upload required documents.

The world of bonds is constantly evolving, and the bond without paperwork option is an exciting development that offers numerous benefits for investors and issuers. As the bond market continues to grow and adapt to new technologies, it’s essential for investors to stay informed and take advantage of innovative solutions like the bond without paperwork option. By doing so, investors can navigate the bond market with confidence, making informed decisions that align with their financial goals and risk tolerance. Ultimately, the bond without paperwork option is a significant step forward in the bond industry, providing a more efficient, convenient, and cost-effective way for investors to access the bond market.