Pick Up Brother's Probate Paperwork

Understanding the Process of Probate

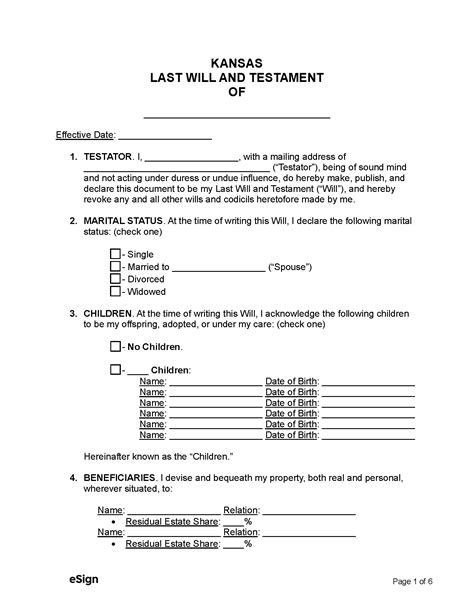

When a person passes away, their estate, which includes all their assets, properties, and belongings, must go through a legal process called probate. Probate is a court-supervised process that ensures the deceased person’s assets are distributed according to their will or the laws of the state if they did not leave a will. The process involves several steps, including the appointment of an executor or personal representative, the gathering of assets, the payment of debts, and the distribution of the remaining assets to the beneficiaries. In this context, picking up a brother’s probate paperwork is a crucial step in initiating the probate process, especially if you are the named executor or are involved in managing your brother’s estate.

Why Is Probate Paperwork Important?

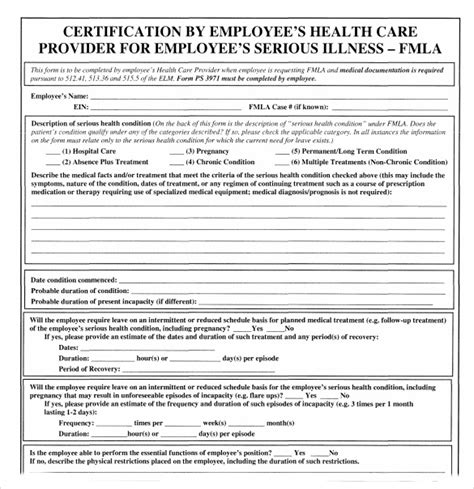

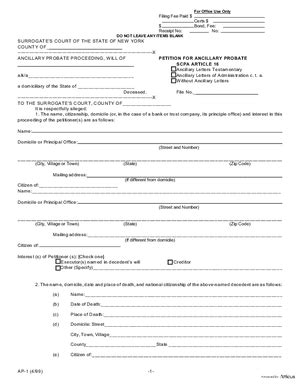

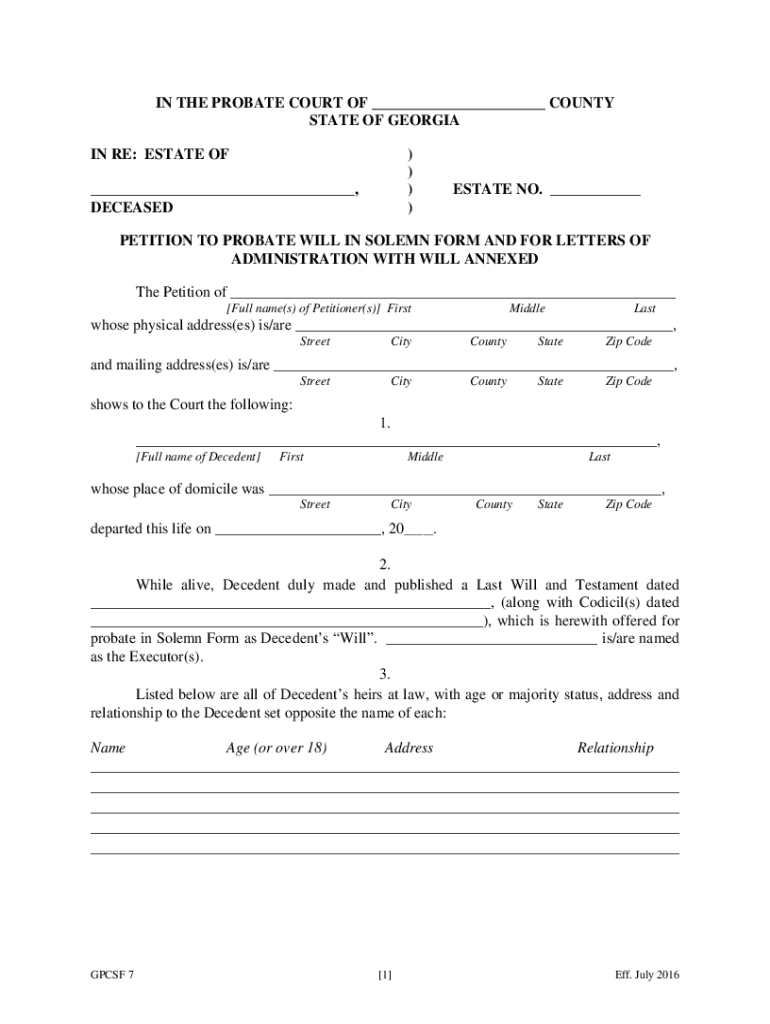

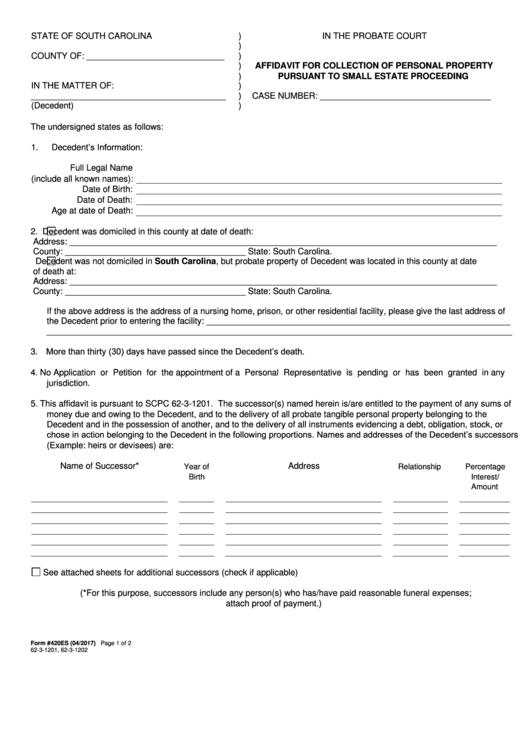

Probate paperwork is essential because it provides the legal framework for handling the deceased person’s estate. This paperwork typically includes the will, if there is one, along with petitions to open probate, notices to heirs and beneficiaries, and inventories of the estate’s assets. Accurate and complete paperwork is vital to ensure that the probate process proceeds smoothly and that all parties involved are protected. As the person tasked with picking up your brother’s probate paperwork, you will be responsible for ensuring that all necessary documents are filed with the court and that the process moves forward as required by law.

Steps to Pick Up Probate Paperwork

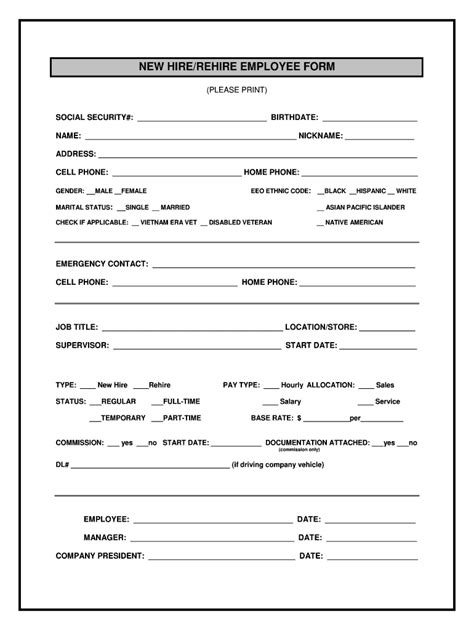

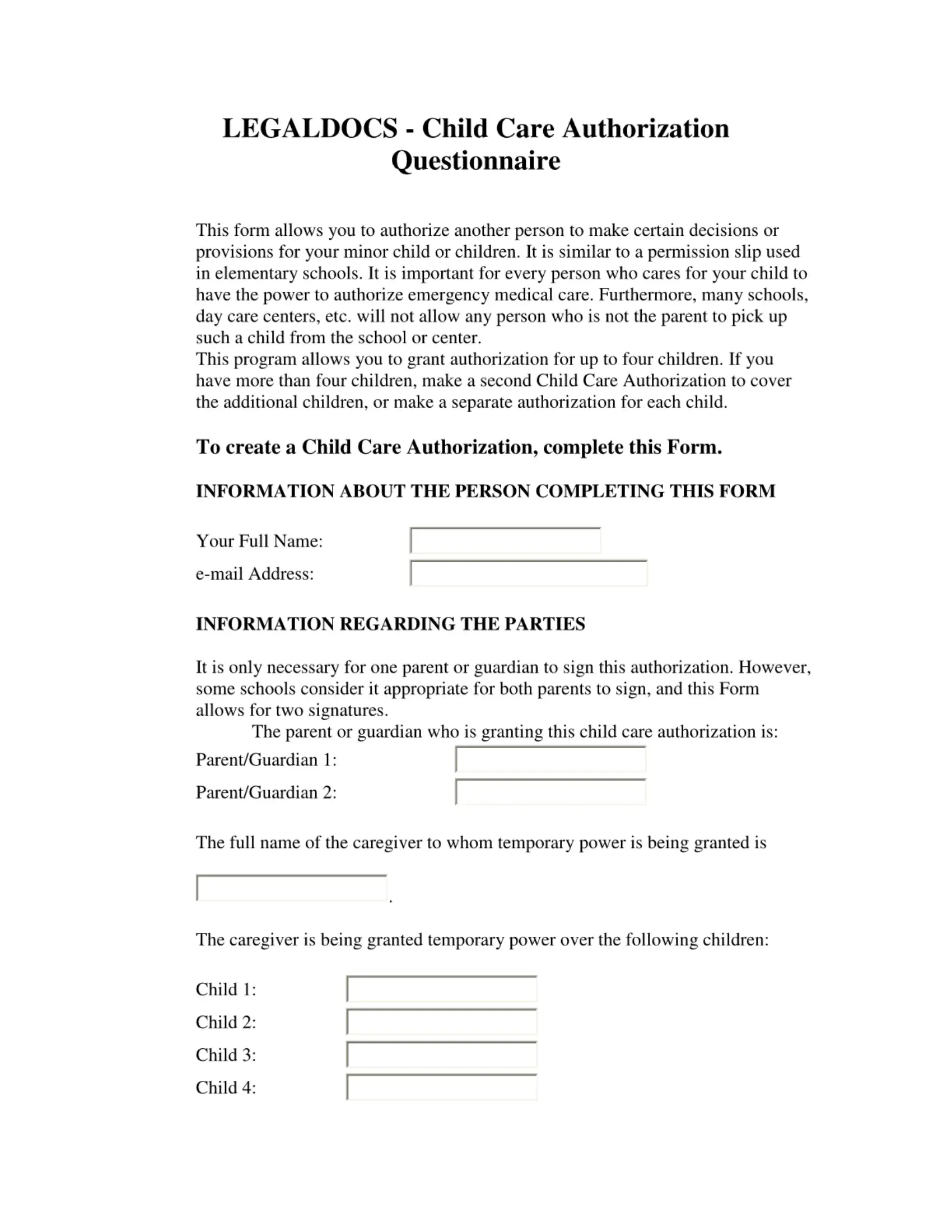

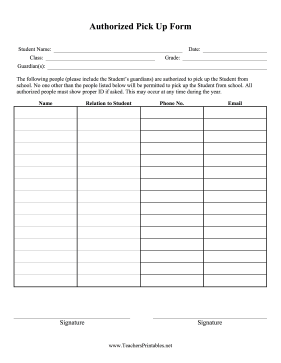

Picking up probate paperwork involves several steps: - Locate the Relevant Court: The first step is to identify the correct court where the probate case will be filed. This is usually the court in the county where the deceased person lived. - Gather Required Documents: You will need to gather various documents, including the death certificate, the will (if there is one), and any other documents that list the deceased person’s assets and debts. - File the Petition: You or your attorney will need to file a petition with the court to open probate. This petition will request that the court appoint an executor (if there is a will) or a personal representative (if there is no will) to manage the estate. - Notice to Heirs and Beneficiaries: Once the court opens the probate case, you will need to provide notice to all heirs and beneficiaries as named in the will or as determined by state law if there is no will.

Managing the Probate Process

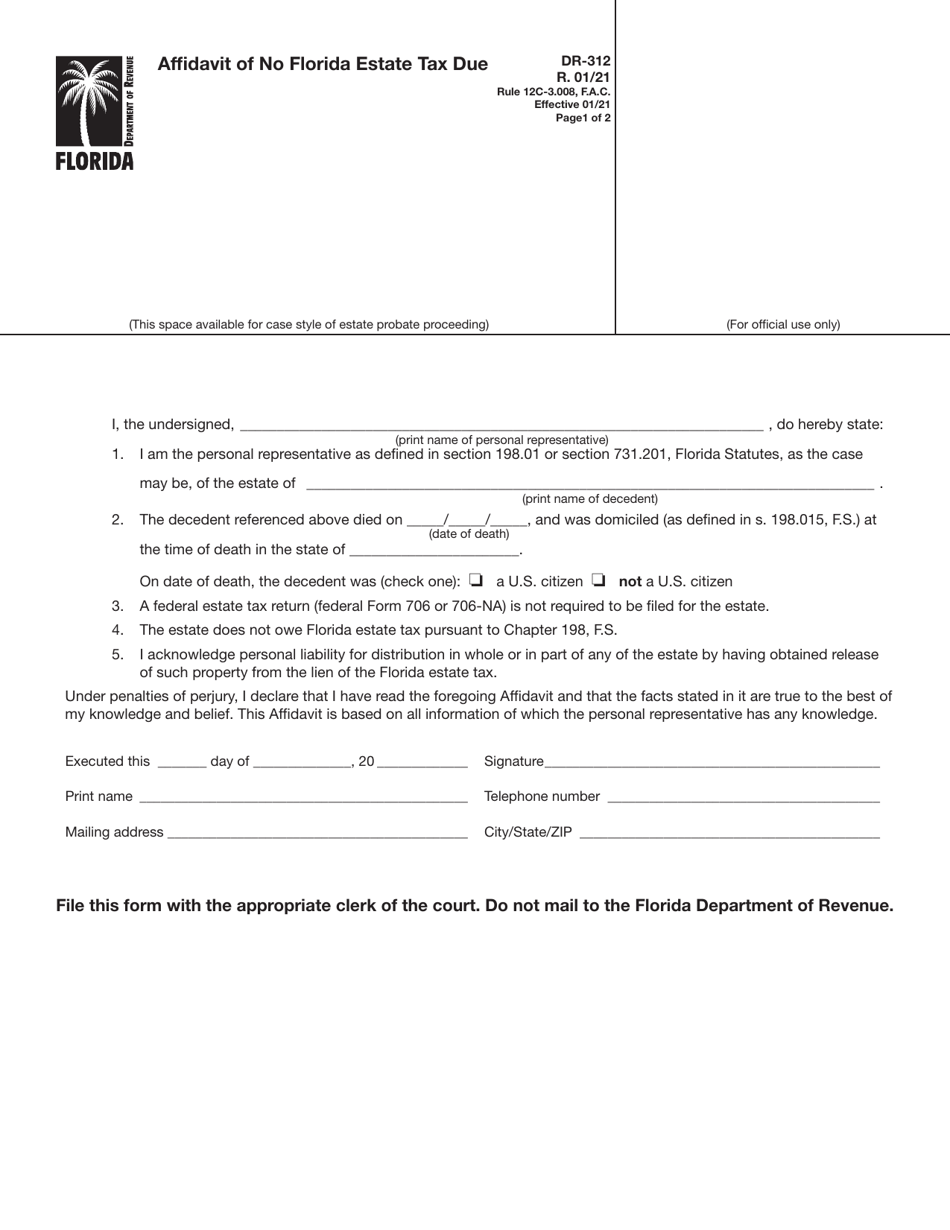

After picking up the probate paperwork and initiating the probate process, your role will involve several key responsibilities: - Inventory of Assets: You will need to create a detailed inventory of the estate’s assets, including real estate, bank accounts, investments, and personal property. - Paying Debts: The estate’s debts must be paid before any distributions can be made to beneficiaries. This includes funeral expenses, taxes, and any outstanding debts the deceased person had. - Distribution of Assets: Once debts are paid, you will distribute the remaining assets according to the will or state laws. - Finalizing the Estate: After all distributions are made, you will need to file final paperwork with the court to close the estate.

📝 Note: It's highly recommended to work with an attorney who specializes in probate law to ensure that all legal requirements are met and that the process is handled correctly.

Challenges in the Probate Process

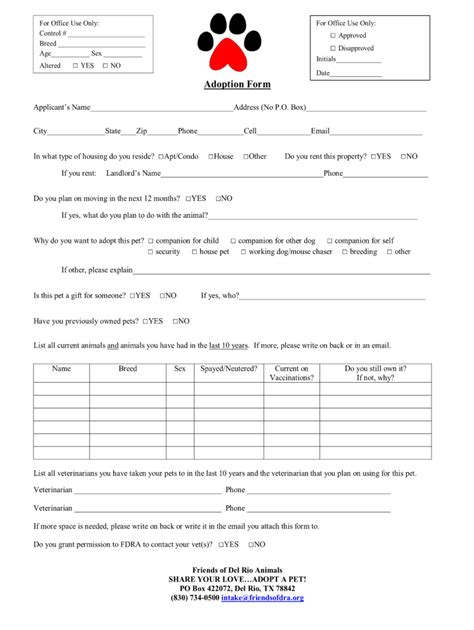

While the probate process is designed to ensure that a deceased person’s estate is handled fairly and legally, it can sometimes be complex and time-consuming. Challenges may include: - Contested Wills: If there are disputes over the will’s validity or the distribution of assets, the probate process can become lengthy and costly. - Missing or Unknown Heirs: Locating all heirs and beneficiaries can sometimes be difficult, especially in cases where the deceased person had a large or complicated family. - Insufficient Assets: If the estate’s assets are not sufficient to pay all debts, decisions must be made about which debts to prioritize, which can be challenging.

| Step in Probate Process | Description |

|---|---|

| Filing the Petition | Requesting the court to open probate and appoint an executor or personal representative. |

| Notifying Heirs and Beneficiaries | Informing all parties who have an interest in the estate about the probate case. |

| Inventory of Assets | Listing all assets of the estate to determine its value and for distribution purposes. |

| Paying Debts | Settling the estate's debts before distributing assets to beneficiaries. |

| Distributing Assets | Dividing the remaining assets among beneficiaries according to the will or state laws. |

In summary, picking up a brother’s probate paperwork is the initial step in a lengthy legal process designed to ensure that the deceased person’s estate is managed and distributed according to their wishes or the law. Understanding the probate process, managing its various steps, and being prepared for potential challenges are crucial for successfully navigating this complex and often emotional journey.

What is the purpose of probate?

+

The purpose of probate is to ensure that a deceased person’s estate is distributed according to their will or the laws of the state, and that all debts and taxes are paid before any distributions are made to beneficiaries.

Who is responsible for picking up probate paperwork?

+

Typically, the executor named in the will or a personal representative appointed by the court is responsible for picking up and managing the probate paperwork.

How long does the probate process take?

+

The length of the probate process can vary significantly depending on the complexity of the estate, the presence of a will, and the efficiency of the court system. It can range from a few months to several years.