Paperwork

Sue IRS for Loss

Introduction to Suing the IRS for Loss

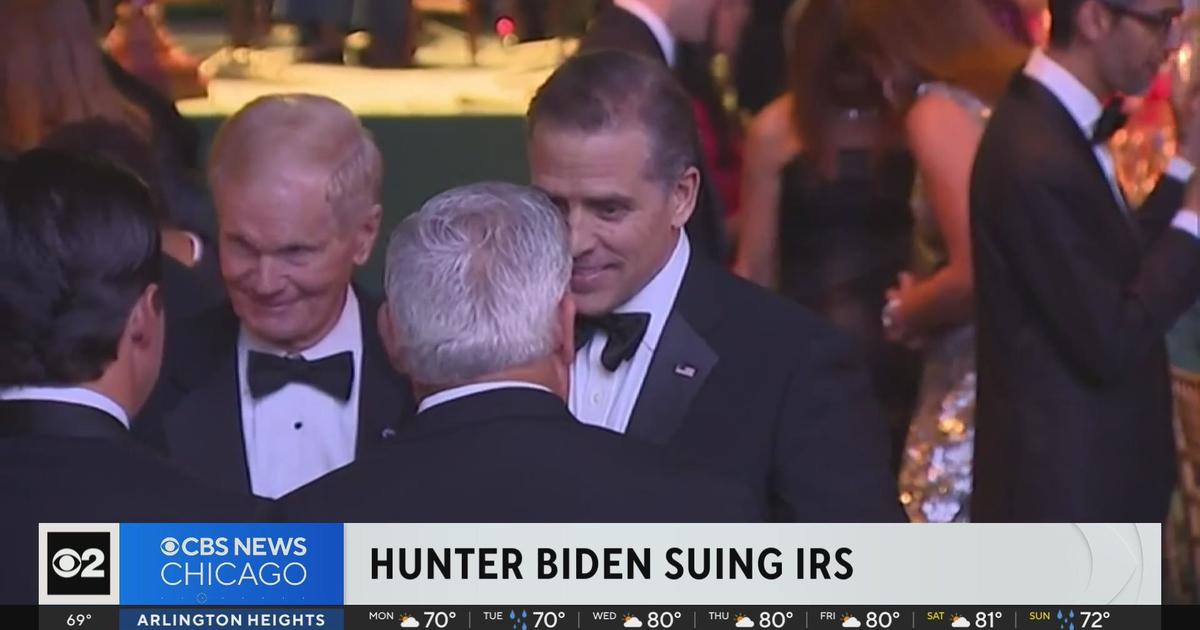

When dealing with the Internal Revenue Service (IRS), taxpayers often feel overwhelmed and frustrated, especially if they believe they have been wrongly treated or suffered a loss due to the IRS’s actions or inactions. The possibility of suing the IRS for loss is an option that some taxpayers may consider, but it’s a complex and serious step that requires careful consideration and professional advice. In this article, we will explore the process, requirements, and considerations involved in suing the IRS for loss.

Understanding the Basics

Before proceeding with a lawsuit against the IRS, it’s essential to understand the basics of the process. The IRS is a federal agency responsible for collecting taxes and enforcing tax laws. While the IRS has a significant amount of power, it is not immune to lawsuits. However, suing the IRS can be challenging due to the various protections and limitations imposed by federal laws and regulations. Taxpayers must have a valid claim and meet specific requirements to successfully sue the IRS for loss.

Types of Claims Against the IRS

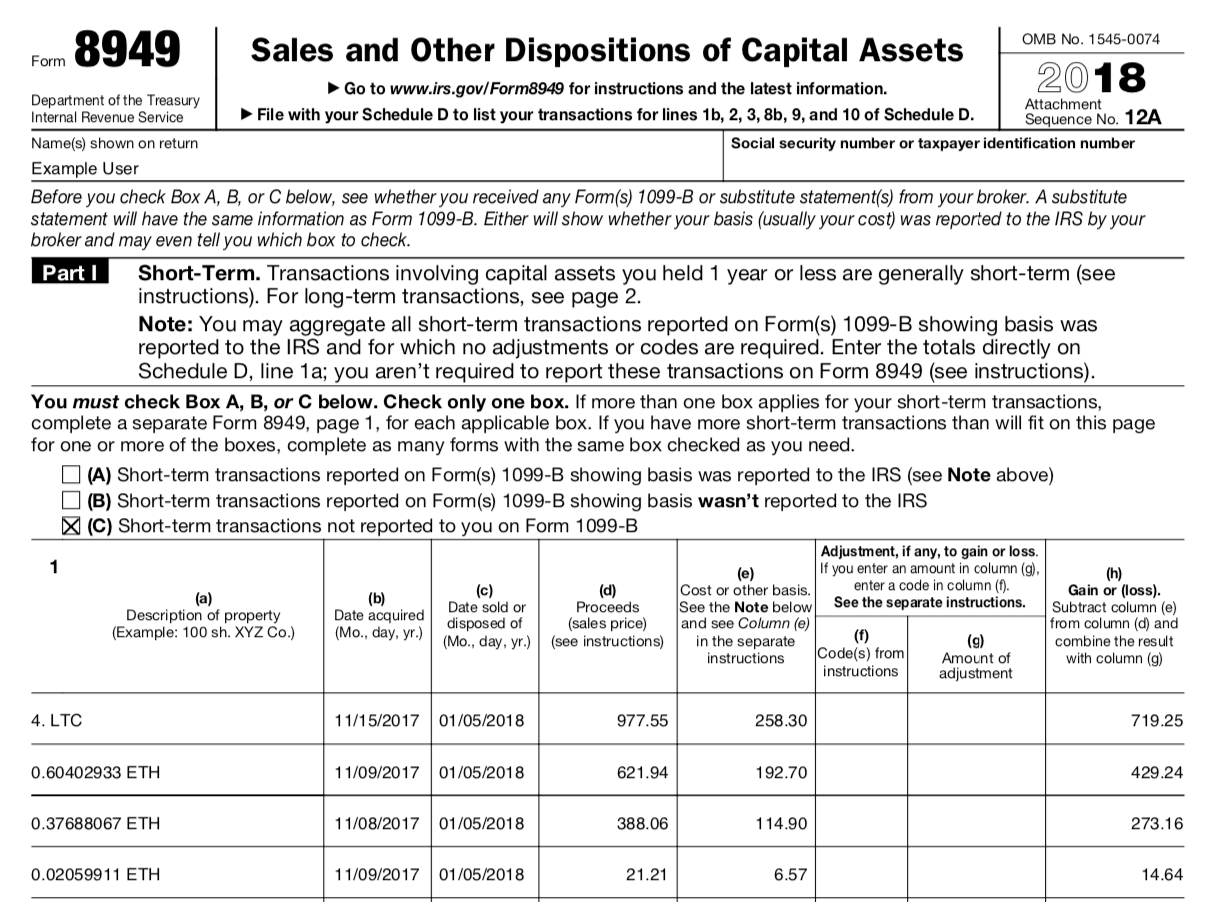

There are several types of claims that taxpayers can file against the IRS, including: * Refund claims: Taxpayers can file a claim for a refund if they believe they overpaid their taxes or are entitled to a refund due to an error or miscalculation. * Damage claims: Taxpayers can file a claim for damages if they suffered a loss due to the IRS’s negligence, recklessness, or intentional misconduct. * Equitable relief claims: Taxpayers can file a claim for equitable relief if they believe the IRS’s actions or inactions resulted in an unfair or unjust outcome.

Requirements for Suing the IRS

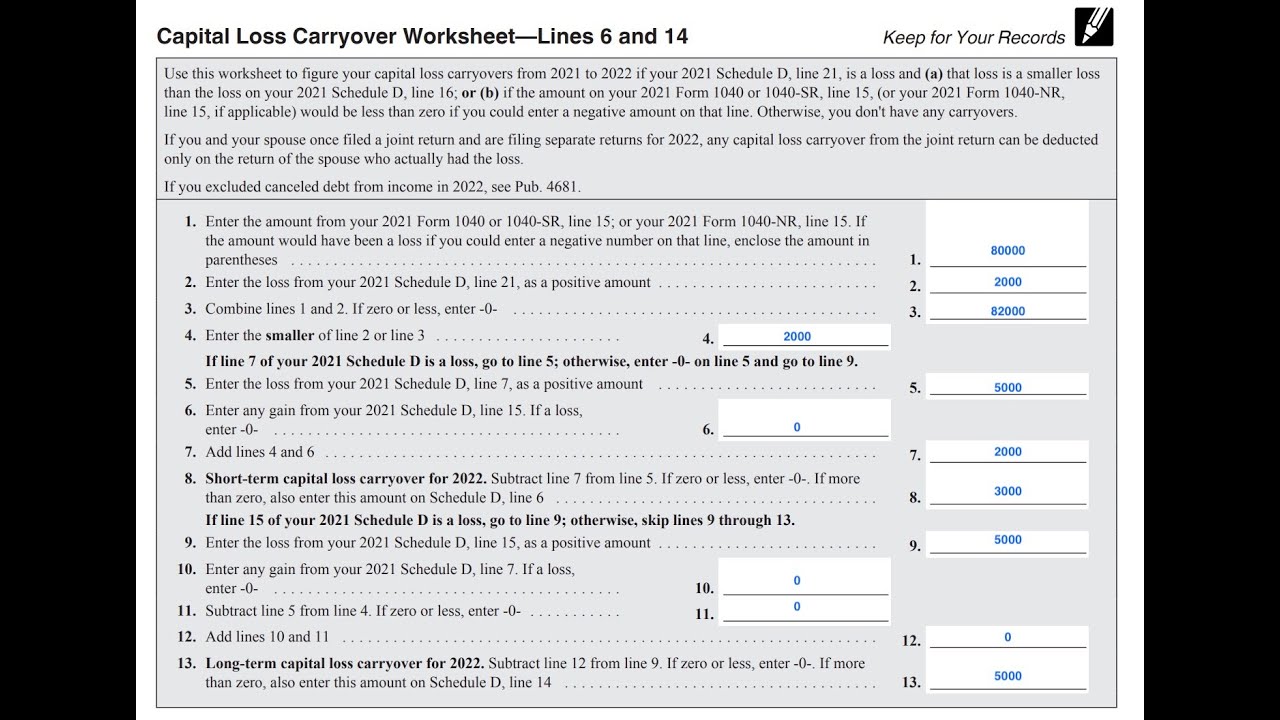

To sue the IRS for loss, taxpayers must meet specific requirements, including: * Exhausting administrative remedies: Taxpayers must first attempt to resolve their issue through the IRS’s administrative process, including filing a claim with the IRS and waiting for a response. * Filing a claim with the IRS: Taxpayers must file a claim with the IRS, which must include a detailed description of the claim, the amount of the claim, and supporting documentation. * Waiting for a response: Taxpayers must wait for a response from the IRS, which can take several months or even years. * Filing a lawsuit: If the IRS denies the claim or fails to respond, taxpayers can file a lawsuit in federal court.

Process of Suing the IRS

The process of suing the IRS involves several steps, including: * Filing a complaint: Taxpayers must file a complaint with the federal court, which must include a detailed description of the claim, the amount of the claim, and supporting documentation. * Serving the IRS: Taxpayers must serve the IRS with the complaint and summons, which can be done through certified mail or in-person service. * Waiting for a response: The IRS must respond to the complaint, which can take several months or even years. * Discovery and trial: The case will proceed to discovery and trial, where both parties will present evidence and arguments to support their position.

Considerations and Risks

Suing the IRS for loss can be a complex and risky process. Taxpayers must consider the following: * Costs and fees: Suing the IRS can be expensive, and taxpayers may be responsible for paying costs and fees, including attorney’s fees. * Time and effort: Suing the IRS can be time-consuming and require significant effort, including gathering documentation and evidence. * Risk of losing: Taxpayers may lose their case, which can result in additional costs and fees. * Impact on tax obligations: Suing the IRS may impact taxpayers’ tax obligations, including the potential for additional penalties and interest.

🚨 Note: Taxpayers should carefully consider their options and seek professional advice before suing the IRS for loss.

Alternatives to Suing the IRS

Before suing the IRS, taxpayers should consider alternative options, including: * IRS appeals: Taxpayers can appeal an IRS decision to the IRS Appeals Office. * Taxpayer Advocate Service: Taxpayers can contact the Taxpayer Advocate Service, which provides free assistance to taxpayers who are experiencing problems with the IRS. * Mediation and arbitration: Taxpayers can participate in mediation and arbitration programs, which can help resolve disputes with the IRS.

Conclusion and Final Thoughts

Suing the IRS for loss can be a complex and challenging process. Taxpayers must carefully consider their options and seek professional advice before proceeding with a lawsuit. While suing the IRS may be necessary in some cases, it’s essential to understand the requirements, process, and risks involved. By exploring alternative options and seeking professional advice, taxpayers can make informed decisions and achieve a successful outcome.

What are the requirements for suing the IRS for loss?

+

To sue the IRS for loss, taxpayers must exhaust administrative remedies, file a claim with the IRS, wait for a response, and file a lawsuit in federal court.

What are the alternatives to suing the IRS?

+

Alternatives to suing the IRS include IRS appeals, Taxpayer Advocate Service, and mediation and arbitration programs.

What are the risks and considerations involved in suing the IRS?

+

The risks and considerations involved in suing the IRS include costs and fees, time and effort, risk of losing, and impact on tax obligations.