1040 Tax Paperwork Guide

Introduction to 1040 Tax Paperwork

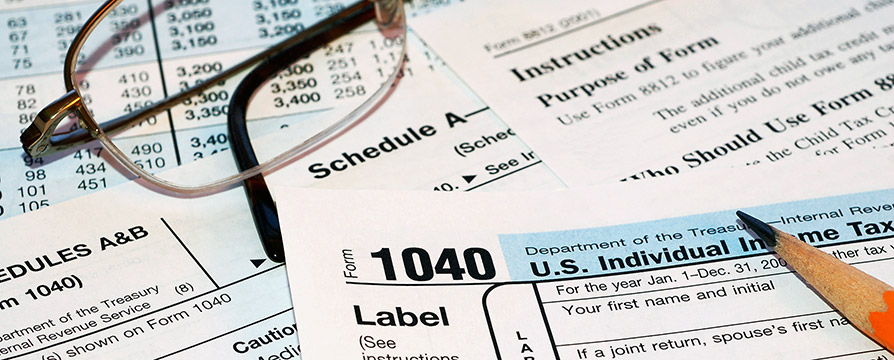

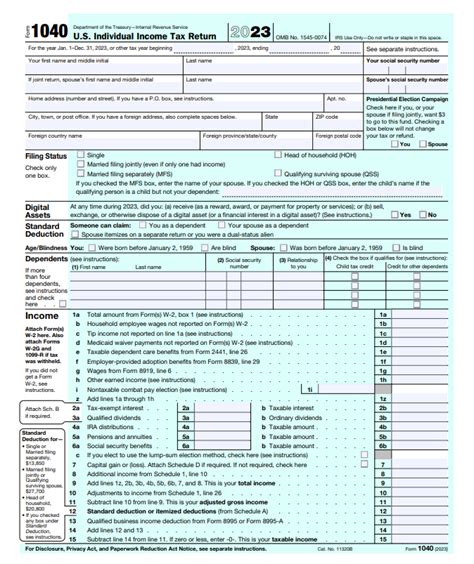

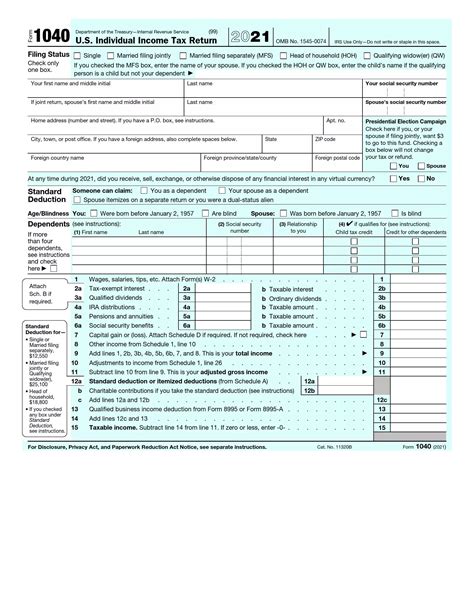

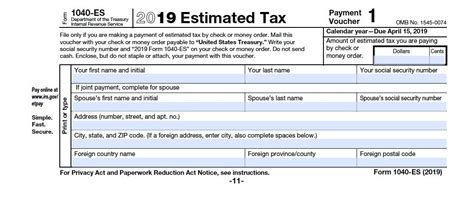

The 1040 tax form is a crucial document for United States taxpayers, used to report their income and claim deductions and credits. The form is typically filed with the Internal Revenue Service (IRS) on a yearly basis, and its complexity can vary depending on the individual’s or family’s financial situation. In this guide, we will walk you through the process of completing the 1040 tax paperwork, highlighting key sections, and providing tips for a smooth and accurate filing experience.

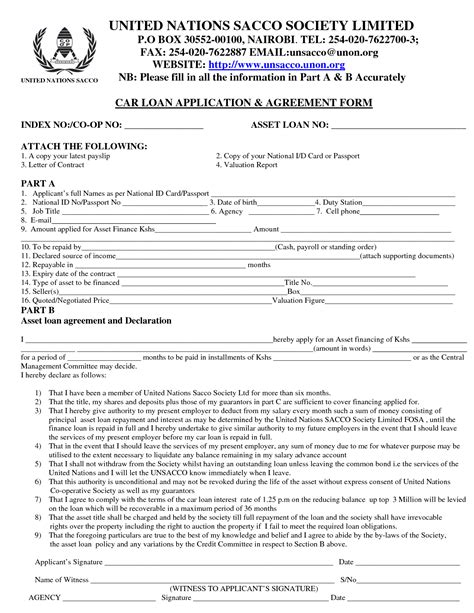

Understanding the 1040 Tax Form

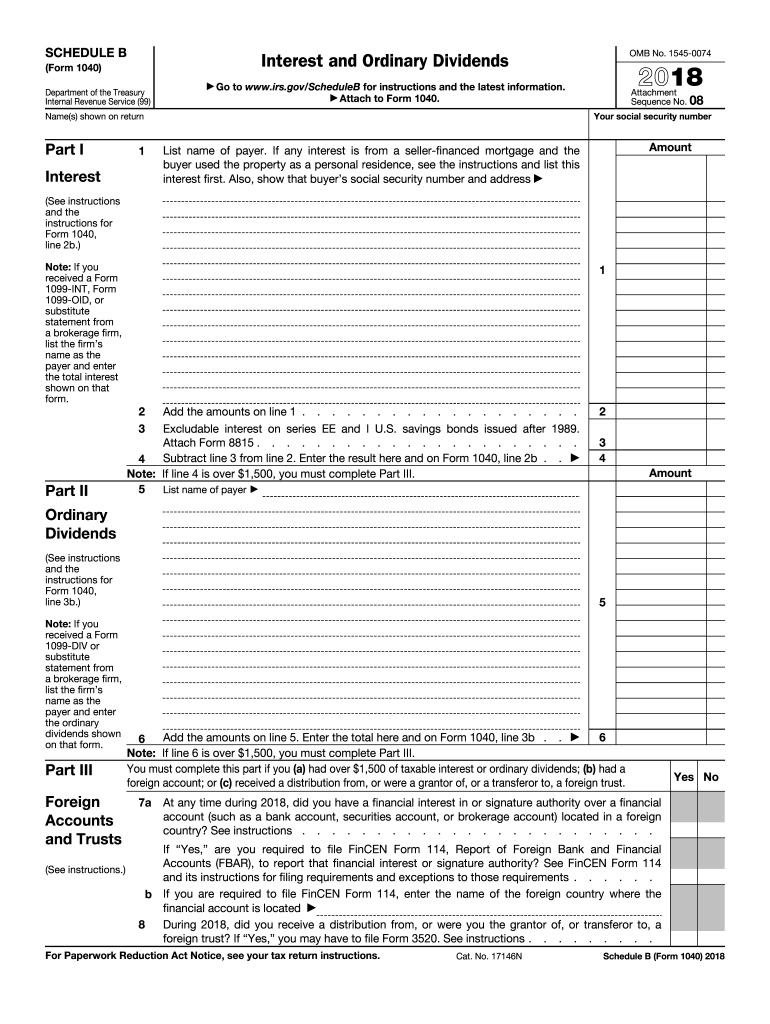

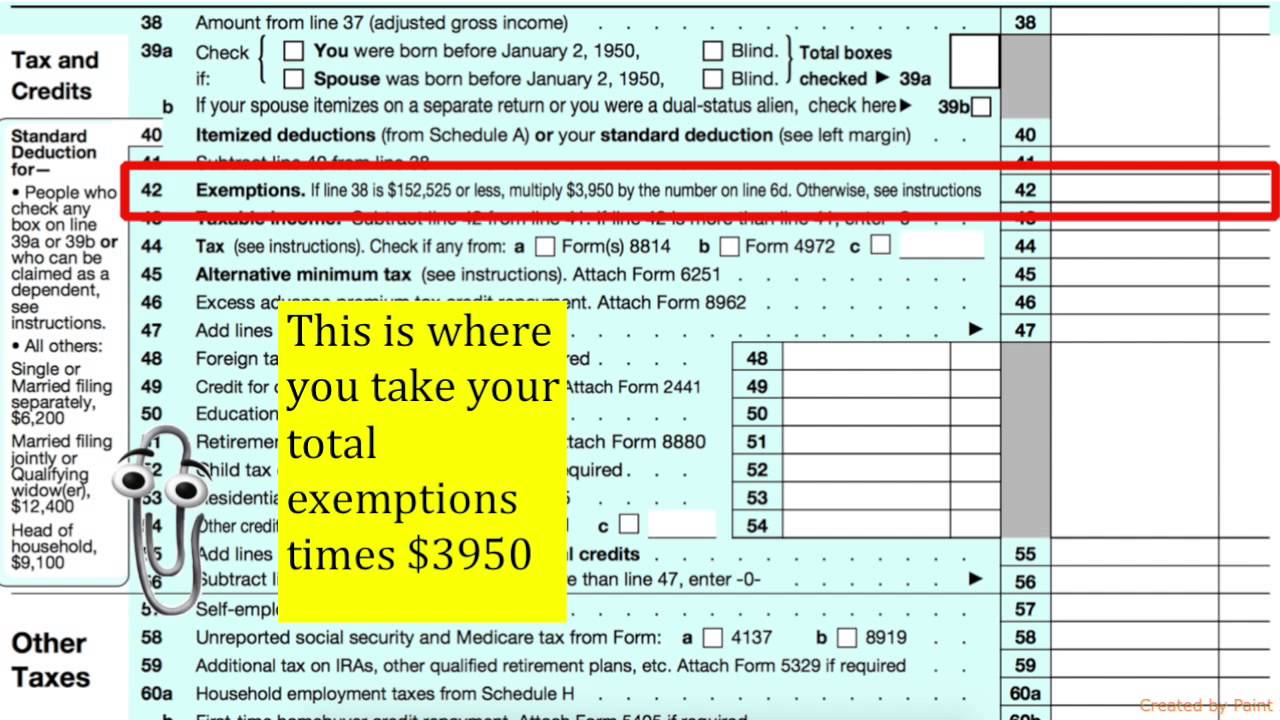

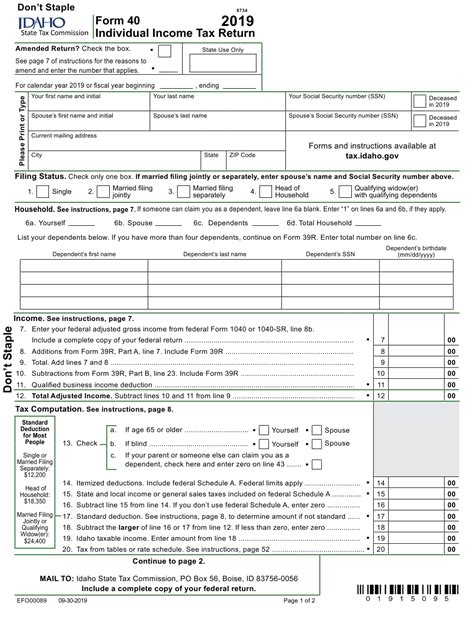

The 1040 tax form is divided into several sections, each designed to capture specific information about the taxpayer’s income, deductions, and credits. The form is typically accompanied by various schedules and attachments, which provide additional details and support for the information reported on the main form. Some of the key sections and schedules include: * Income: This section reports the taxpayer’s income from various sources, such as wages, salaries, tips, and self-employment income. * Deductions and Credits: This section allows taxpayers to claim deductions and credits that can reduce their taxable income and lower their tax liability. * Dependents: This section provides information about the taxpayer’s dependents, including their relationship, age, and residency status. * Signature: This section requires the taxpayer’s signature, confirming that the information reported on the form is accurate and complete.

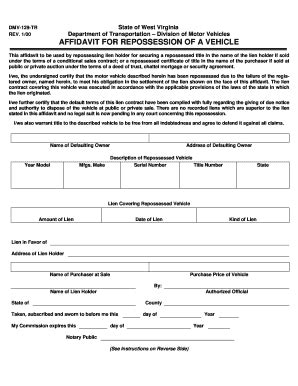

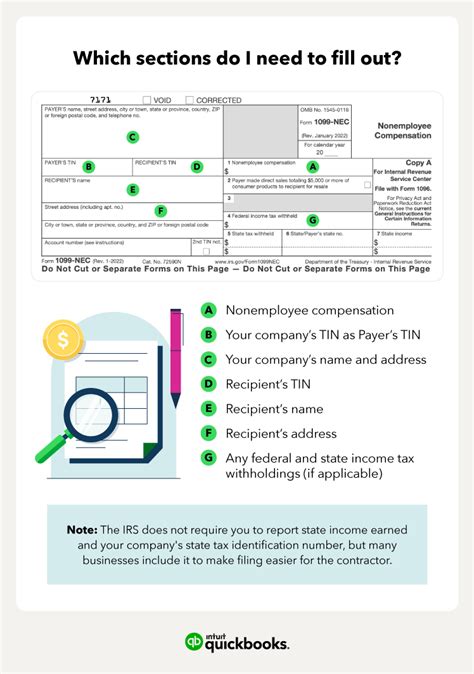

Preparing for the 1040 Tax Paperwork

Before starting the 1040 tax paperwork, it is essential to gather all necessary documents and information. Some of the key items to collect include: * W-2 forms: These forms report the taxpayer’s income and taxes withheld from their employer. * 1099 forms: These forms report income from self-employment, freelance work, or other sources. * Receipts and invoices: These documents support deductions and credits claimed on the form. * Identification documents: These documents, such as a driver’s license or passport, verify the taxpayer’s identity and residency status. * Dependent information: This information includes the dependent’s name, age, and relationship to the taxpayer.

Completing the 1040 Tax Paperwork

Once all necessary documents and information are gathered, the taxpayer can begin completing the 1040 tax paperwork. The following steps outline the general process: * Report income: Enter income from all sources, including wages, salaries, tips, and self-employment income. * Claim deductions and credits: Claim deductions and credits that apply to the taxpayer’s situation, such as the standard deduction, mortgage interest, or charitable donations. * Report dependents: Provide information about the taxpayer’s dependents, including their relationship, age, and residency status. * Sign and date the form: Confirm that the information reported on the form is accurate and complete by signing and dating the form.

Tips and Reminders

To ensure a smooth and accurate filing experience, keep the following tips and reminders in mind: * Double-check calculations: Verify that all calculations are accurate and complete to avoid errors or delays in processing the return. * Use correct forms and schedules: Use the correct forms and schedules to report income, deductions, and credits. * Keep records and documentation: Keep accurate records and documentation to support deductions and credits claimed on the form. * Seek professional help if needed: If the taxpayer is unsure about any aspect of the 1040 tax paperwork, consider seeking help from a tax professional or the IRS.

📝 Note: The IRS provides various resources and tools to help taxpayers complete the 1040 tax paperwork, including the IRS website, tax software, and local tax assistance centers.

Common Mistakes to Avoid

When completing the 1040 tax paperwork, it is essential to avoid common mistakes that can delay processing or result in errors. Some of the most common mistakes include: * Inaccurate or incomplete information: Failing to report income, deductions, or credits accurately or completely. * Incorrect forms and schedules: Using incorrect forms or schedules to report income, deductions, or credits. * Math errors: Making calculation errors that can result in incorrect tax liability or refund amounts. * Missing signatures or dates: Failing to sign and date the form, which can delay processing or result in errors.

Conclusion and Final Thoughts

Completing the 1040 tax paperwork can seem daunting, but by gathering all necessary documents and information, following the steps outlined above, and avoiding common mistakes, taxpayers can ensure a smooth and accurate filing experience. Remember to double-check calculations, use correct forms and schedules, and keep accurate records and documentation to support deductions and credits claimed on the form. If unsure about any aspect of the 1040 tax paperwork, consider seeking help from a tax professional or the IRS.

What is the deadline for filing the 1040 tax form?

+

The deadline for filing the 1040 tax form is typically April 15th of each year, but it may be extended in certain circumstances, such as if the taxpayer is living abroad or has been affected by a natural disaster.

Can I file the 1040 tax form electronically?

+

Yes, the IRS allows taxpayers to file the 1040 tax form electronically using tax software or the IRS website. Electronic filing can help reduce errors and speed up processing times.

What happens if I make a mistake on the 1040 tax form?

+

If you make a mistake on the 1040 tax form, you may need to file an amended return using Form 1040X. The IRS will review the amended return and adjust your tax liability accordingly. It is essential to correct mistakes promptly to avoid penalties and interest.