HSA for FMLA Paperwork Costs

Understanding HSA for FMLA Paperwork Costs

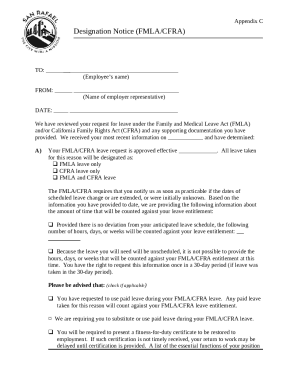

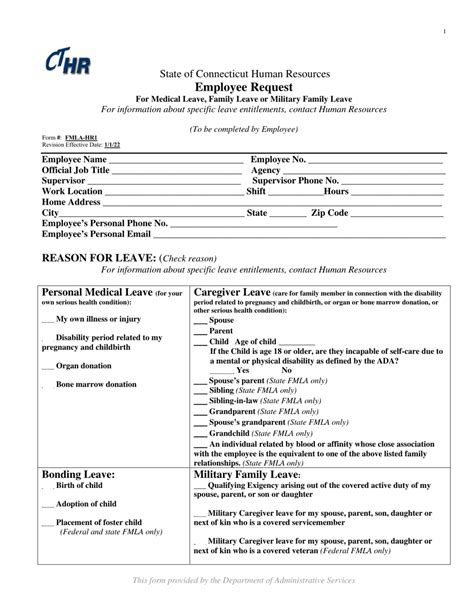

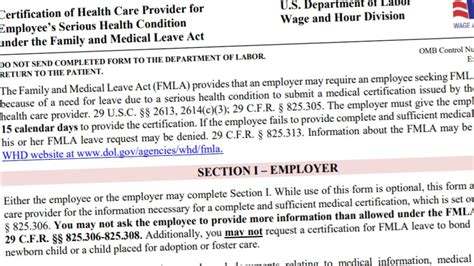

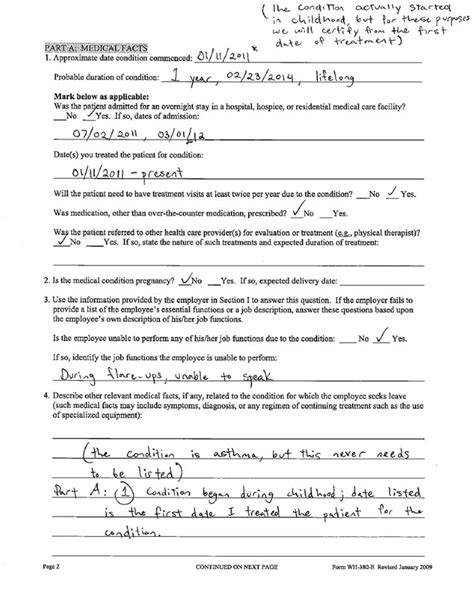

When it comes to managing employee leave and benefits, companies often face a myriad of paperwork and associated costs. One of the key challenges is navigating the Family and Medical Leave Act (FMLA) and its requirements. The FMLA is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. To mitigate some of the financial impacts of managing FMLA, including paperwork costs, many employers explore the use of Health Savings Accounts (HSAs). In this article, we will delve into how HSAs can be utilized to help offset the costs associated with FMLA paperwork and other related expenses.

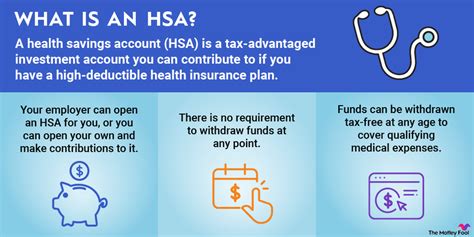

What are HSAs and How Do They Work?

HSAs are tax-advantaged accounts that allow individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. These accounts are portable, meaning they stay with the individual even if they change jobs. Contributions to HSAs are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. Given their flexibility and tax benefits, HSAs have become a popular tool for managing healthcare costs.

Link Between HSAs and FMLA

While HSAs are primarily designed for medical expenses, they can indirectly help employers manage the financial aspects of FMLA, including paperwork costs. For instance, by offering HSAs as part of their benefits package, employers can promote a culture of health and wellness, potentially reducing the need for FMLA leave. Additionally, the funds in an HSA can be used for expenses related to the employee’s or their family member’s health condition that necessitates FMLA leave, such as copays, deductibles, and certain over-the-counter medications.

Utilizing HSAs for FMLA Paperwork Costs

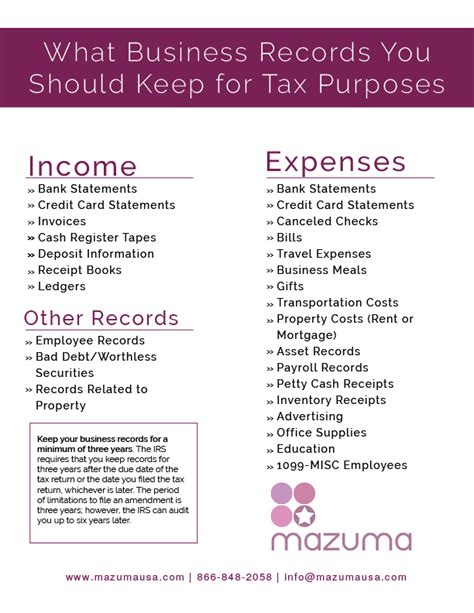

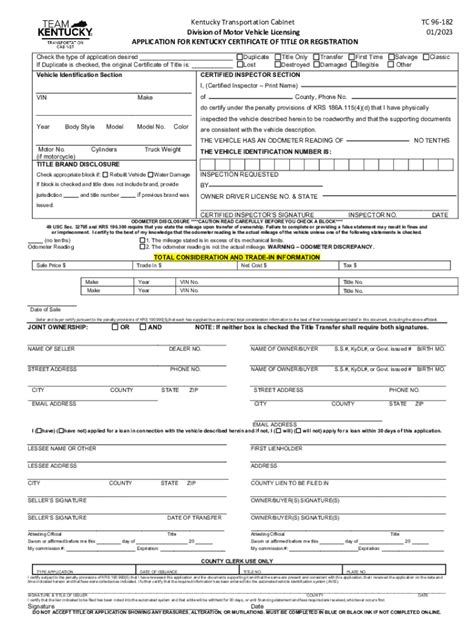

Although HSAs cannot be used directly to pay for administrative costs like paperwork, employers can consider the overall benefits package and how it impacts their bottom line. Here are a few ways HSAs might indirectly help with managing FMLA paperwork costs: - Reduced Need for Leave: By promoting health and wellness through HSAs, employers might see a reduction in the number of employees needing to take FMLA leave, thereby reducing the associated paperwork and administrative costs. - Employee Retention: Offering HSAs can improve employee satisfaction and retention. Since the cost of hiring and training new employees is high, anything that reduces turnover can indirectly save an employer money, including on administrative tasks like managing FMLA paperwork. - Efficiency in Benefits Administration: Employers who offer HSAs often have a more streamlined benefits administration process, which can extend to other areas, including FMLA management. This efficiency can help reduce errors and the overall time spent on paperwork.

Steps to Implement HSA for FMLA Management

To effectively use HSAs as part of an overall strategy to manage FMLA and its associated costs, employers can follow these steps: - Assess Current Benefits: Evaluate the current health benefits package to determine if an HSA-eligible HDHP is a good fit for the company and its employees. - Communicate Benefits: Clearly communicate the benefits of HSAs to employees, including how they can be used to manage health expenses and potentially reduce the need for FMLA leave. - Streamline Administration: Implement efficient administration processes for all benefits, including HSAs and FMLA, to reduce paperwork and associated costs. - Monitor and Adjust: Continuously monitor the effectiveness of the benefits package and make adjustments as necessary to ensure it is meeting the needs of both the employees and the company.

📝 Note: It's essential for employers to consult with legal and financial advisors to ensure compliance with all relevant laws and regulations when implementing or modifying benefits packages.

Benefits and Drawbacks of Using HSAs for FMLA Management

Like any strategy, using HSAs to help manage FMLA and its associated costs comes with both benefits and drawbacks. - Benefits: - Promotes health and wellness among employees. - Can reduce the need for FMLA leave. - Offers a tax-advantaged way for employees to save for medical expenses. - Drawbacks: - HSAs must be paired with HDHPs, which may have higher deductibles that could be a burden for some employees. - Not all medical expenses related to FMLA leave may be eligible for reimbursement from an HSA. - Requires education and communication to ensure employees understand how to use HSAs effectively.

| Aspect | Benefits | Drawbacks |

|---|---|---|

| Employee Health | Promotes health and wellness | Higher deductibles may burden some employees |

| Financial | Tax advantages for contributions and growth | Limitations on eligible expenses |

| Administrative | Streamlined benefits administration | Requires employee education on HSA use |

To manage the challenges associated with FMLA paperwork costs effectively, employers should consider a multifaceted approach that includes efficient administration processes, clear communication with employees, and a benefits package that supports employee health and wellness. By understanding how HSAs can fit into this approach, employers can better navigate the complexities of managing FMLA and its associated costs.

In essence, while HSAs are not a direct solution to managing FMLA paperwork costs, they can be a valuable component of an overall strategy to promote employee health, reduce the need for leave, and streamline benefits administration. By leveraging the benefits of HSAs and ensuring compliance with all relevant laws and regulations, employers can create a more supportive and efficient work environment.

Can HSA funds be used directly for FMLA paperwork costs?

+

No, HSA funds cannot be used directly for administrative costs like FMLA paperwork. They are designed for qualified medical expenses.

How can offering HSAs reduce the need for FMLA leave?

+

By promoting health and wellness, HSAs can help reduce the incidence of health conditions that necessitate FMLA leave, thus indirectly reducing the need for such leave.

Are all employers required to offer HSAs to their employees?

+

No, offering HSAs is not mandatory for employers. However, it can be a valuable addition to a benefits package, especially for employees with HDHPs.