5 Ways File LLC

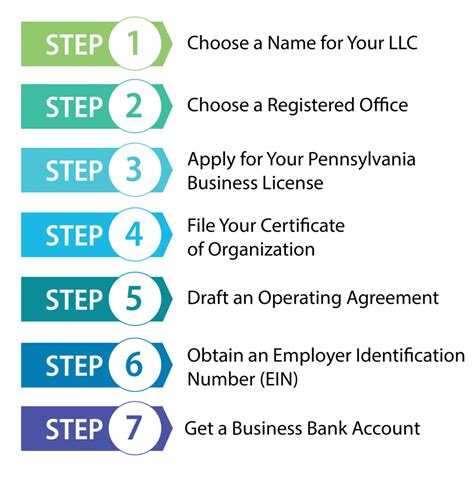

Introduction to Forming a Limited Liability Company (LLC)

Forming a Limited Liability Company (LLC) can be a complex process, but it provides numerous benefits, including personal liability protection, tax advantages, and flexibility in management structure. For individuals looking to start a business, understanding the steps to form an LLC is crucial. This guide will walk through the process, highlighting key considerations and options available to entrepreneurs.

Step 1: Choose a Business Name

When forming an LLC, the first step is to choose a unique and compliant business name. The name must include the phrase “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” It’s essential to ensure the name is not already in use by searching the state’s business database. Additionally, it’s recommended to check for domain name availability to maintain a consistent online presence.

Some key points to consider when choosing a business name include: - Uniqueness: The name must be distinct from other businesses in the state. - Compliance: The name must comply with the state’s naming requirements. - Domain Availability: It’s beneficial to have a matching domain name for the business.

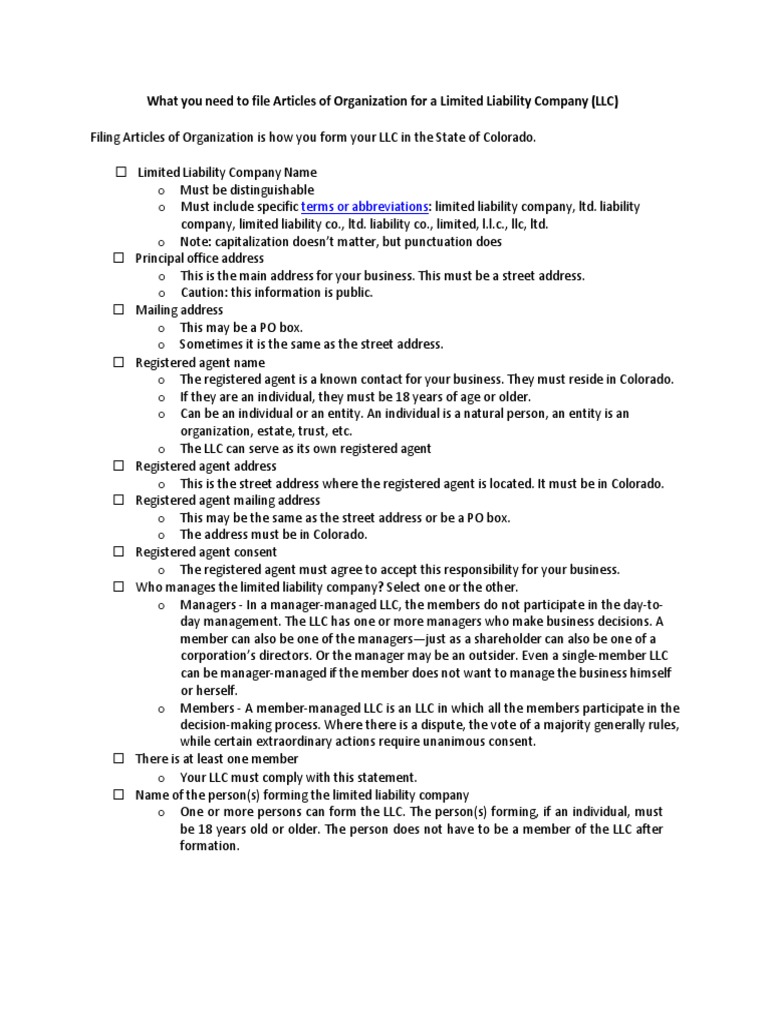

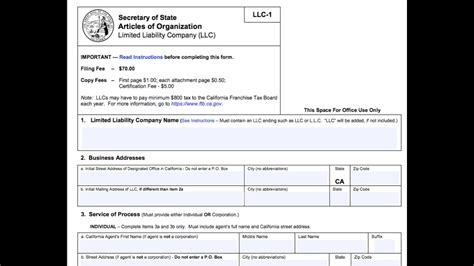

Step 2: File Articles of Organization

After selecting a business name, the next step is to file the Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and management structure. The filing process typically requires a fee, which varies by state. It’s crucial to carefully review the Articles of Organization to ensure accuracy and completeness, as this document serves as the foundation of the LLC’s legal existence.

Step 3: Obtain an EIN

An Employer Identification Number (EIN) is a unique identifier assigned to the LLC by the Internal Revenue Service (IRS). It’s used for tax purposes and is required for opening a business bank account, hiring employees, and filing tax returns. The application process for an EIN is straightforward and can be completed online through the IRS website. Having an EIN is essential for separating personal and business finances, which helps in maintaining the LLC’s liability protection.

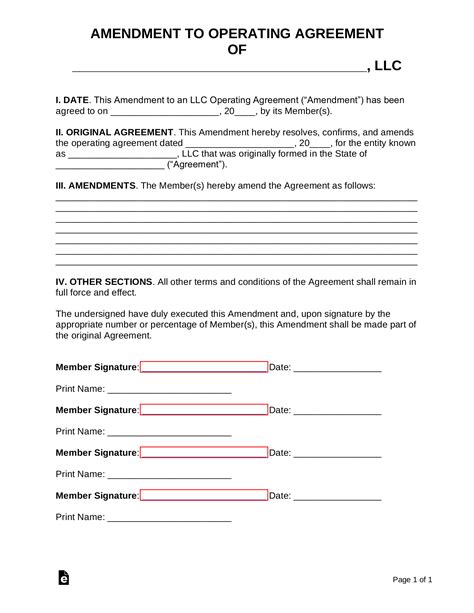

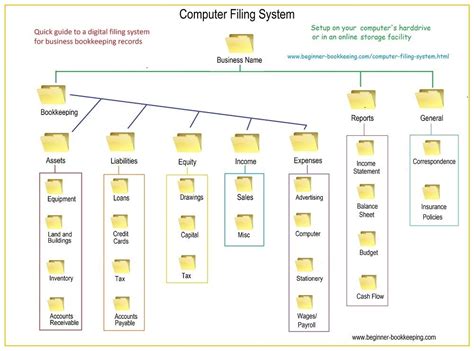

Step 4: Create an Operating Agreement

An operating agreement is a document that outlines the ownership, management, and operation of the LLC. While not all states require an operating agreement, it’s highly recommended to have one in place. This agreement helps prevent disputes among members by clearly defining their roles, responsibilities, and expectations. Key elements of an operating agreement include: - Ownership Percentage: The percentage of ownership each member has in the LLC. - Management Structure: The management structure of the LLC, including the roles and responsibilities of members and managers. - Profit and Loss Distribution: How profits and losses will be distributed among members.

Step 5: Comply with Ongoing Requirements

After forming the LLC, there are ongoing requirements that must be met to maintain its legal status. These include filing annual reports with the state, maintaining a registered agent, and complying with tax obligations. Failure to comply with these requirements can result in fines, penalties, and even the dissolution of the LLC. It’s essential to stay informed about the specific requirements in the state where the LLC is formed.

| State | Annual Report Filing Fee |

|---|---|

| California | $20 |

| New York | $9 |

| Florida | $138.75 |

💡 Note: The annual report filing fees vary by state, and it's crucial to check with the state's business registration office for the most accurate and up-to-date information.

In conclusion, forming an LLC involves several steps, from choosing a compliant business name to complying with ongoing requirements. By understanding these steps and taking the time to carefully plan and execute the formation process, entrepreneurs can establish a solid foundation for their businesses. This foundation is crucial for protecting personal assets, attracting investors, and achieving long-term success. Ultimately, the key to a successful LLC is careful planning, compliance with legal requirements, and a deep understanding of the business’s operational and financial needs.

What is the primary benefit of forming an LLC?

+

The primary benefit of forming an LLC is personal liability protection, which separates personal assets from business assets, protecting them in case the business is sued or incurs debt.

How do I file Articles of Organization?

+

Articles of Organization are typically filed with the state’s business registration office. The process can be done online, by mail, or in person, depending on the state’s requirements. It’s recommended to consult with an attorney or use a business formation service to ensure the process is completed correctly.

Do I need an operating agreement for my LLC?

+

While not all states require an operating agreement, it’s highly recommended to have one in place. An operating agreement helps prevent disputes among members by clearly defining their roles, responsibilities, and expectations, and it can provide additional protection in case of legal issues.