Tax Paperwork Needed

Understanding the Basics of Tax Paperwork

When it comes to dealing with taxes, one of the most daunting tasks for many individuals and businesses is navigating the complex world of tax paperwork. The process involves gathering, organizing, and submitting various documents to ensure compliance with tax laws and regulations. Failure to properly manage tax paperwork can lead to delays, penalties, and even audits. Therefore, it’s essential to understand what tax paperwork is needed and how to efficiently manage it.

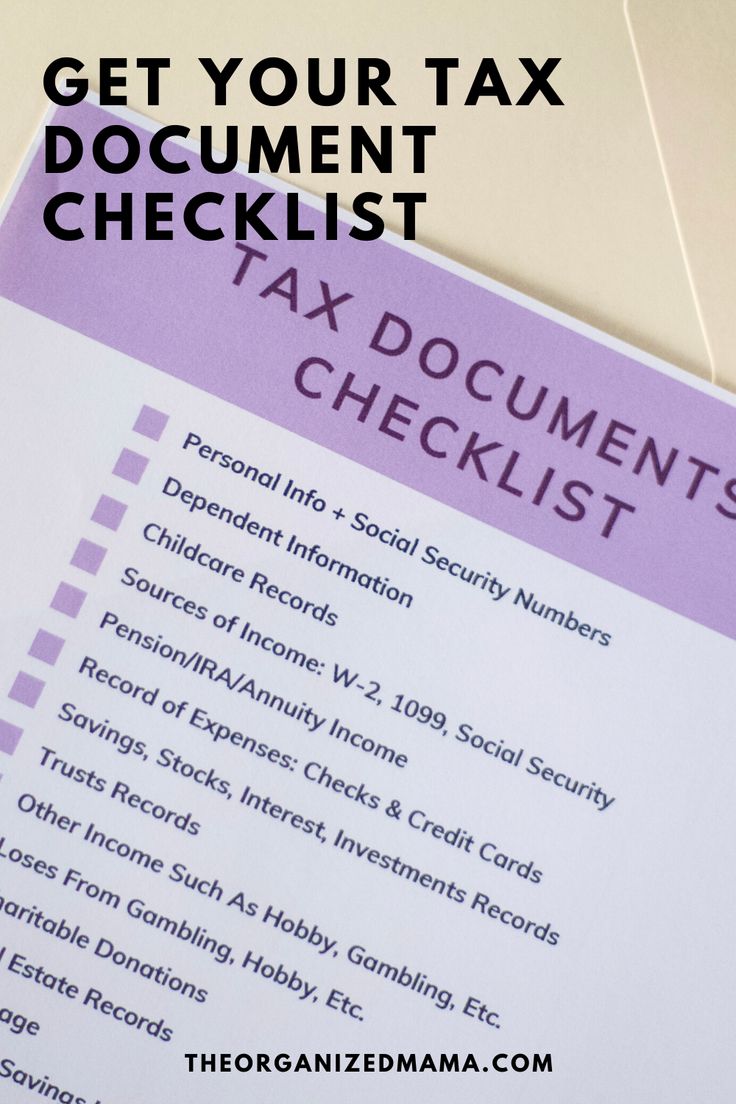

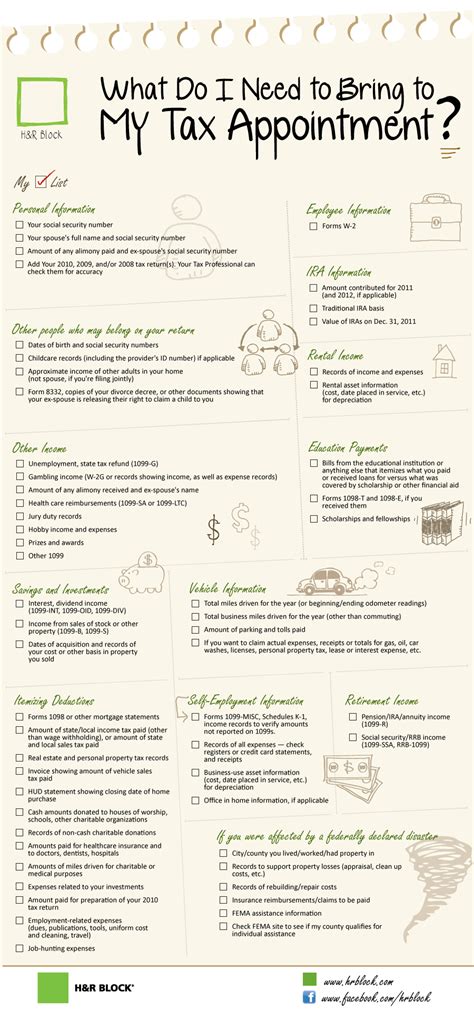

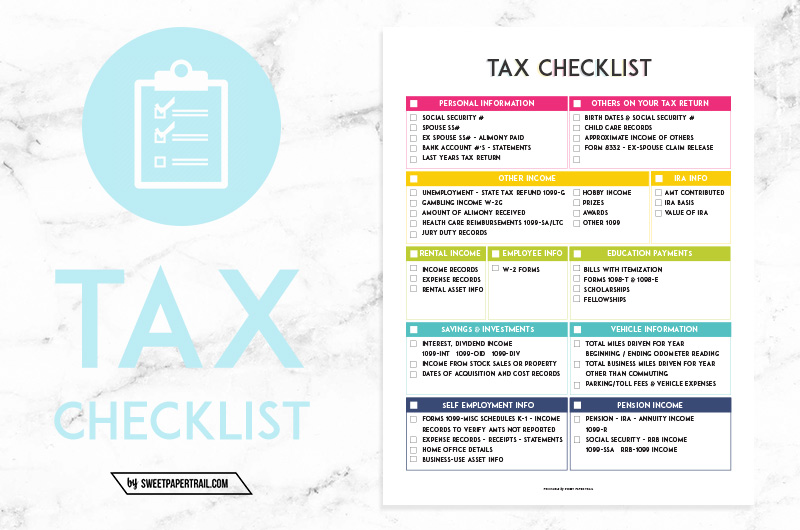

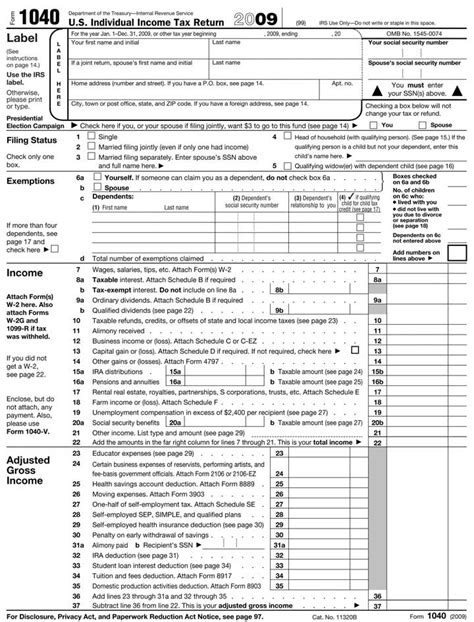

Types of Tax Paperwork

There are several types of tax paperwork that individuals and businesses may need to handle. These include: - W-2 Forms: Used by employers to report wages, tips, and other compensation paid to employees, as well as taxes withheld. - 1099 Forms: Issued to report various types of income, such as freelance work, interest, dividends, and capital gains distributions. - Business Expense Records: Essential for businesses to deduct expenses on their tax returns, these can include receipts, invoices, and bank statements. - Charitable Donation Receipts: Needed to claim deductions for charitable contributions. - Mileage Logs: For individuals and businesses that use vehicles for work or business purposes, these logs help calculate deductible mileage.

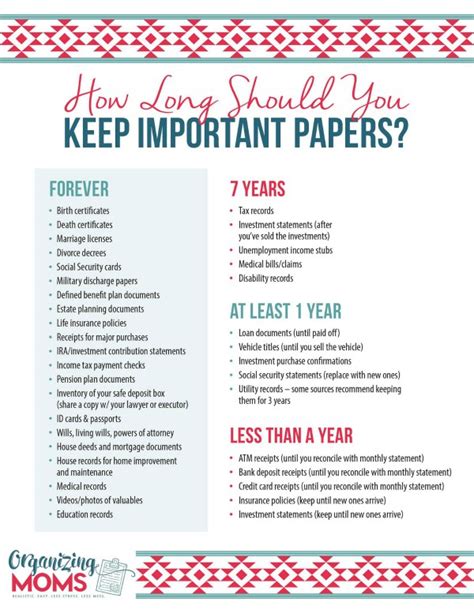

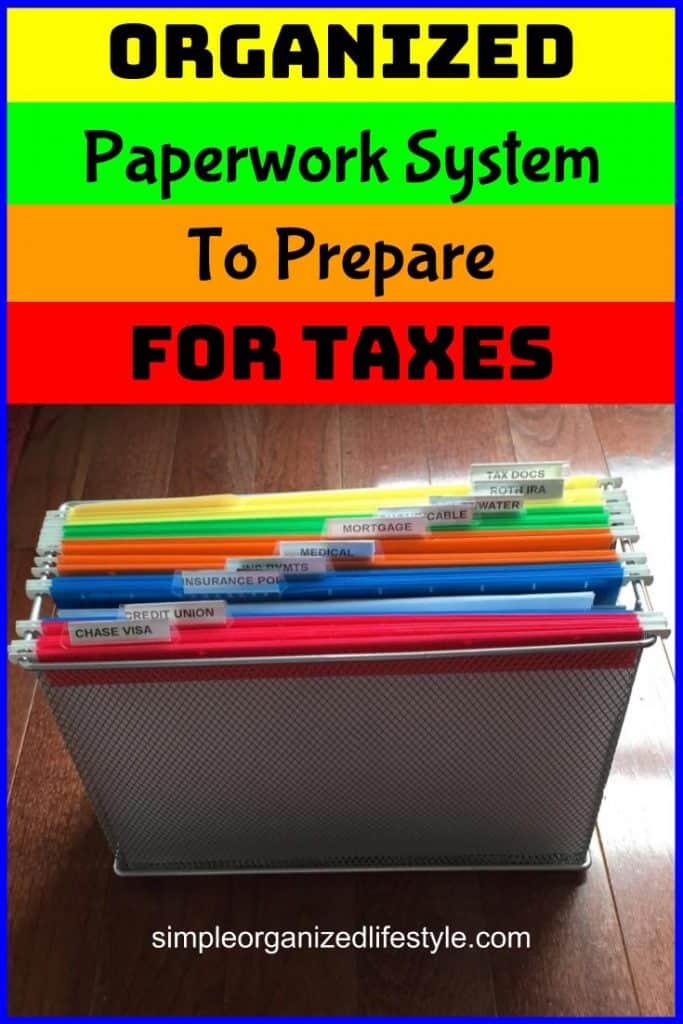

Organizing Tax Paperwork

Effective organization is key to managing tax paperwork efficiently. Here are some steps to follow: - Designate a Specific Storage Area: Choose a secure and easily accessible place to store all tax-related documents. - Use Folders and Labels: Organize documents into categorized folders (e.g., income, expenses, donations) for easy retrieval. - Digitize Documents: Consider scanning paper documents and storing them digitally to save space and enhance security. - Set Reminders: Use a calendar or reminders on your phone to keep track of important tax deadlines.

Importance of Accurate Record-Keeping

Accurate and detailed record-keeping is crucial for several reasons: - Avoids Penalties: Incomplete or inaccurate tax returns can result in penalties and fines. - Supports Audits: In the event of an audit, well-organized records can provide the necessary evidence to support tax returns. - Maximizes Deductions: Proper documentation ensures that all eligible deductions and credits are claimed, potentially reducing tax liability.

Tax Paperwork for Businesses

For businesses, the scope of necessary tax paperwork expands significantly. This includes: - Employment Tax Returns: Such as Form 941 to report employment taxes. - Business Income Tax Returns: Forms like the 1120 for corporations or 1065 for partnerships. - Sales Tax Records: Depending on the jurisdiction, businesses may need to collect and remit sales taxes. - Asset Depreciation Records: To calculate depreciation deductions for business assets.

📝 Note: Businesses should consult with a tax professional to ensure compliance with all tax laws and regulations, as the specific requirements can vary widely depending on the business type, size, and location.

Digital Tools for Managing Tax Paperwork

The advent of digital tools has made managing tax paperwork more efficient than ever. Some key benefits include: - Automated Organization: Many tools can automatically categorize and store documents. - Secure Storage: Digital storage solutions provide robust security features to protect sensitive information. - Accessibility: Documents can be accessed from anywhere, at any time, facilitating collaboration with tax professionals. - Reminders and Notifications: Tools can send reminders for upcoming deadlines and notify users of updates or changes in tax laws.

Conclusion Summary

In essence, managing tax paperwork requires a thorough understanding of the types of documents needed, a systematic approach to organization, and the utilization of digital tools to streamline the process. By prioritizing accurate record-keeping and leveraging technology, individuals and businesses can navigate the complexities of tax season with greater ease and confidence, ultimately ensuring compliance and maximizing their tax savings.

What are the most common types of tax paperwork for individuals?

+

The most common types include W-2 forms for employment income, 1099 forms for other types of income, and records of charitable donations and business expenses.

How can I ensure my tax paperwork is organized efficiently?

+

Designate a specific storage area, use folders and labels, consider digitizing documents, and set reminders for important deadlines to ensure your tax paperwork is organized efficiently.

What are the consequences of not maintaining accurate tax records?

+

Inaccurate or incomplete tax records can lead to penalties, fines, and even audits. Additionally, it may result in missing out on eligible deductions and credits, potentially increasing tax liability.