Locking Interest Rate Without Signing

Introduction to Interest Rate Locks

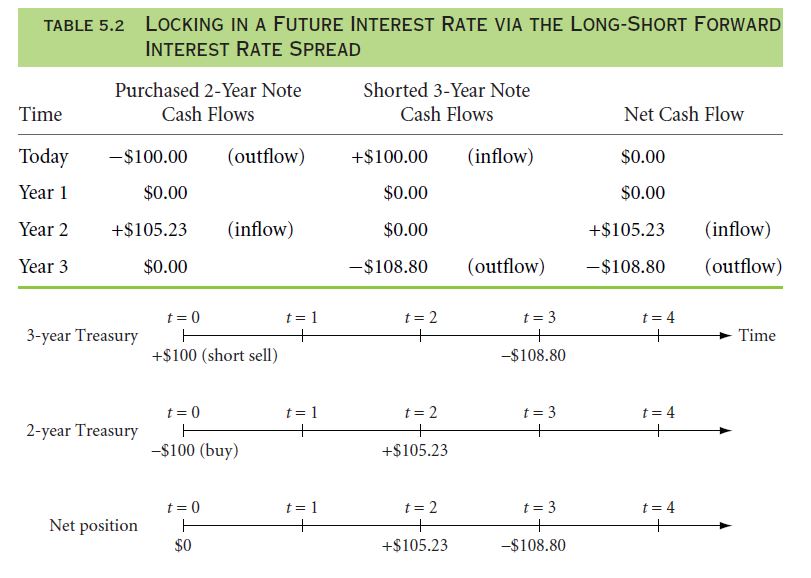

When considering a mortgage, one of the most critical factors is the interest rate. A lower interest rate can save you thousands of dollars over the life of the loan. However, interest rates can fluctuate daily, making it challenging to predict what rate you’ll get when your loan is finalized. This is where an interest rate lock comes in – a commitment from a lender to give you a specific interest rate for a certain period. But can you lock in an interest rate without signing any documents? The answer involves understanding how interest rate locks work and the conditions under which they are offered.

Understanding Interest Rate Locks

An interest rate lock is a lender’s promise to lend at a specific interest rate for a set period, usually ranging from 15 to 60 days. This lock protects you from potential interest rate increases that could happen before your loan closes. In exchange for this guarantee, you might face penalties if you decide to cancel or change your loan application. Interest rate locks are typically offered once you’ve applied for a loan and the lender has reviewed your creditworthiness.

Locking Interest Rate Without Signing

The concept of locking an interest rate without signing might seem appealing, as it would allow you to secure a favorable rate without making a commitment. However, in practice, lenders usually require some form of agreement or understanding before locking in a rate. This could be in the form of a loan application, a pre-approval letter, or at the very least, a verbal agreement to proceed with the loan process.

Lenders are cautious about locking in rates without any commitment because they face risks if interest rates rise while the lock is in place. If you were to lock in a rate without signing and then interest rates increased, the lender would still have to offer you the lower locked rate, potentially at a loss to them.

Verbal vs. Written Locks

Some lenders might offer a verbal interest rate lock, especially if you’re in the early stages of your mortgage application. A verbal lock is based on a conversation with the lender and their agreement to hold a rate for you. However, verbal agreements are not always enforceable and can be less reliable than a written lock. A written lock, on the other hand, is a formal agreement that outlines the terms of the lock, including the interest rate, the duration of the lock, and any conditions that must be met for the lock to remain in place.

When Can You Lock the Rate Without Signing?

There might be situations where a lender locks in an interest rate without requiring you to sign extensive paperwork immediately. For instance, if you’ve just started your loan application and rates are volatile, a lender might offer a temporary rate lock to encourage you to proceed with your application. This is more likely to happen in competitive markets where lenders are eager to secure borrowers.

💡 Note: Even in such cases, the lender will likely require some form of initial commitment or application before locking the rate.

Benefits and Risks of Locking the Interest Rate

Locking in an interest rate can offer several benefits, including protection against rising interest rates and the ability to budget your mortgage payments more accurately. However, there are also potential downsides. If interest rates fall after you’ve locked in your rate, you could end up paying more than necessary. Additionally, extending the lock period or making significant changes to your loan application might incur additional fees.

Alternatives to Locking the Rate

If you’re unsure about locking in an interest rate or prefer not to make a commitment, there are alternatives to consider: - Floating Rate: You can choose to float your rate, meaning you don’t lock it in and take the risk that rates might go up or down. This approach is risky but could pay off if rates decrease. - Rate Cap: Some lenders offer a rate cap, which limits how high your interest rate can go but allows it to decrease if market rates fall.

Conclusion

In summary, while it’s theoretically possible to discuss interest rate locks without immediately signing documents, securing a lock typically requires some level of commitment or application process. Understanding the terms and conditions of an interest rate lock, including its duration, rate, and any associated fees, is crucial for making informed decisions about your mortgage. Whether or not to lock in an interest rate depends on your financial situation, the current market conditions, and your risk tolerance.

What is an interest rate lock in mortgage terms?

+

An interest rate lock is a lender’s guarantee to lend at a specific interest rate for a set period, usually ranging from 15 to 60 days, protecting the borrower from potential increases in interest rates before the loan closes.

Can I lock in an interest rate without signing any documents?

+

While lenders might discuss interest rate locks without immediate signatures, securing a lock typically requires a loan application or some form of commitment. Verbal locks are possible but less common and reliable.

What are the benefits of locking in an interest rate?

+

Locking in an interest rate offers protection against rising rates, allowing for more accurate budgeting of mortgage payments. However, if rates fall, you might end up paying more than necessary.