Claim PPI Without Paperwork

Introduction to PPI Claims

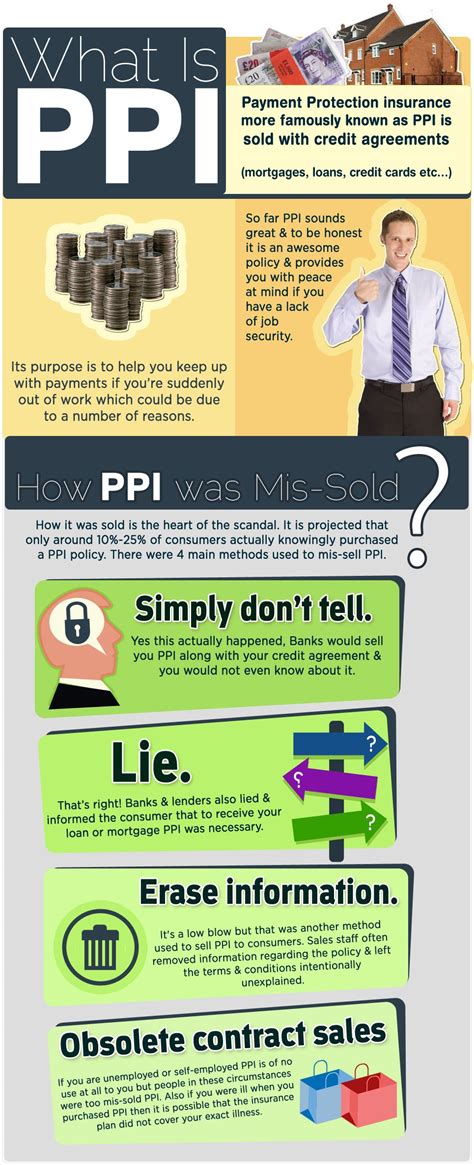

Payment Protection Insurance (PPI) has been a widely discussed topic in the financial sector, especially in the context of mis-selling by banks and other financial institutions. Many individuals have been affected by the mis-selling of PPI policies, which were often added to loans, credit cards, and mortgages without the consumer’s knowledge or consent. The process of claiming back PPI premiums can be complex, but it is possible to claim PPI without paperwork, thanks to the efforts of the Financial Conduct Authority (FCA) and the introduction of stricter regulations.

Understanding PPI Mis-Selling

To understand how to claim PPI without paperwork, it’s essential to grasp the concept of PPI mis-selling. PPI policies were designed to cover loan repayments in the event of illness, death, or unemployment. However, many consumers were sold PPI policies that they did not need, could not use, or were not eligible for. The mis-selling of PPI policies was widespread, with many consumers being pressured into purchasing these policies or being misled about their benefits.

How to Claim PPI Without Paperwork

Claiming PPI without paperwork is a relatively straightforward process. The first step is to contact the lender or the company that sold the PPI policy to determine if a policy was indeed sold. Consumers can use the FCA’s PPI checklist to help them gather the necessary information. If a PPI policy was sold, the next step is to file a complaint with the lender, explaining why the policy was mis-sold. The lender will then investigate the complaint and determine if the consumer is eligible for a refund.

📝 Note: It's essential to keep records of all communication with the lender, including dates, times, and details of conversations.

Using a Claims Management Company

Some consumers may prefer to use a claims management company to help them claim PPI without paperwork. These companies specialize in handling PPI claims and can help consumers navigate the complex process. However, it’s essential to choose a reputable company that is authorized by the FCA. Consumers should be wary of companies that charge high fees or make unrealistic promises.

Benefits of Claiming PPI Without Paperwork

Claiming PPI without paperwork can have several benefits, including: * Convenience: Consumers do not need to spend hours searching for paperwork or documents to support their claim. * Speed: Claims can be processed quickly, and refunds can be received in a matter of weeks. * Expertise: Claims management companies have experience handling PPI claims and can help consumers navigate the process.

Common Pitfalls to Avoid

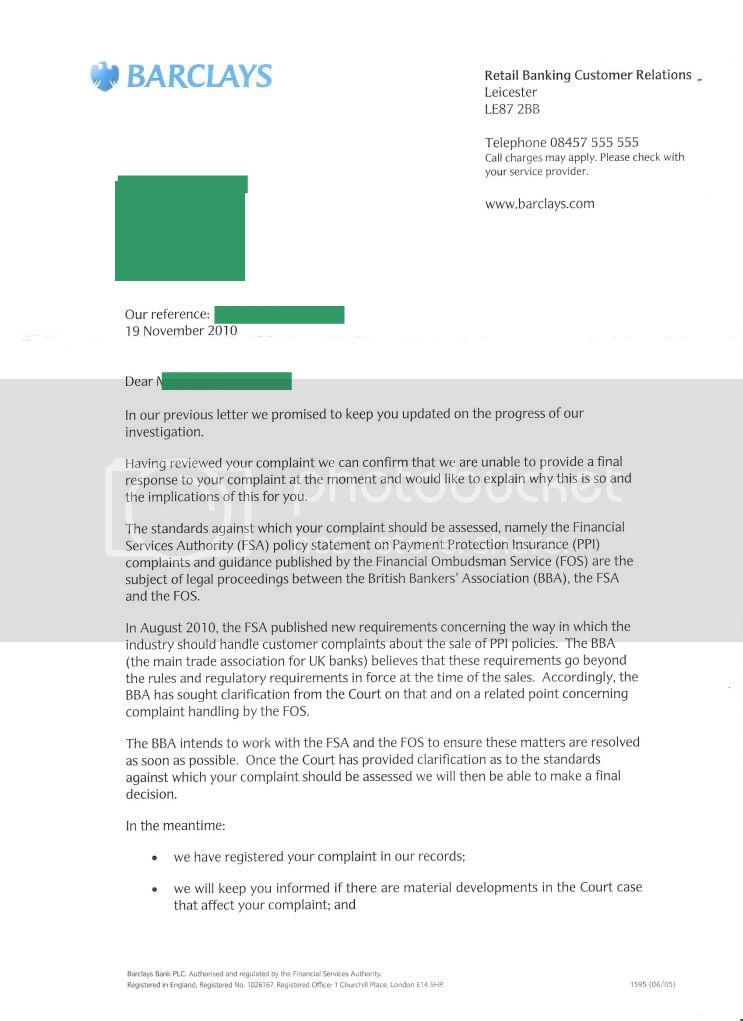

When claiming PPI without paperwork, there are several pitfalls to avoid, including: * Missing deadlines: Consumers should be aware of the deadline for filing PPI claims, which is usually within six years of the policy being sold. * Insufficient information: Consumers should provide as much information as possible to support their claim, including details of the policy and any relevant correspondence. * Unrealistic expectations: Consumers should be realistic about the amount of their refund and the timeframe for receiving it.

Table of PPI Claim Statistics

The following table highlights some key statistics related to PPI claims:

| Year | Number of PPI Claims | Amount Refunded |

|---|---|---|

| 2019 | 1.2 million | £2.3 billion |

| 2020 | 1.1 million | £2.1 billion |

| 2021 | 900,000 | £1.8 billion |

In summary, claiming PPI without paperwork is a viable option for consumers who were mis-sold PPI policies. By understanding the process, using a claims management company, and avoiding common pitfalls, consumers can successfully claim back their PPI premiums.

What is the deadline for filing a PPI claim?

+

The deadline for filing a PPI claim is usually within six years of the policy being sold. However, this deadline may vary depending on the circumstances of the claim.

Can I claim PPI without paperwork if I no longer have my policy documents?

+

Yes, it is possible to claim PPI without paperwork, even if you no longer have your policy documents. You can contact your lender or a claims management company to help you determine if you have a valid claim.

How long does it take to receive a PPI refund?

+

The timeframe for receiving a PPI refund can vary depending on the complexity of the claim and the efficiency of the lender or claims management company. However, most refunds are received within a few weeks or months of the claim being filed.