Make PPI Claim Without Paperwork

Introduction to PPI Claims

Payment Protection Insurance (PPI) has been a widely discussed topic in the financial sector, especially in the context of mis-selling. Many individuals have been affected by the mis-selling of PPI policies, which were often added to loans, credit cards, and mortgages without the consumer’s knowledge or consent. The process of making a PPI claim can seem daunting, especially for those who no longer have the relevant paperwork. However, it is still possible to make a claim without the original documents.

Understanding PPI and Its Mis-Selling

PPI was designed to cover loan or credit card payments if the policyholder became unable to work due to illness, accident, or unemployment. While the concept seems beneficial, the reality is that many policies were mis-sold to individuals who did not need them or would not be eligible to claim. The mis-selling of PPI has led to a significant number of complaints and claims against financial institutions. Identifying whether you were mis-sold PPI is the first step in the claims process.

Checking for PPI

Before making a claim, you need to determine if you had PPI attached to any of your financial products. This can be done by: - Reviewing old bank statements and loan documents for any mentions of PPI. - Contacting your bank or lender directly to inquire about PPI on your accounts. - Looking for any evidence of PPI premiums being deducted from your payments.

Making a Claim Without Paperwork

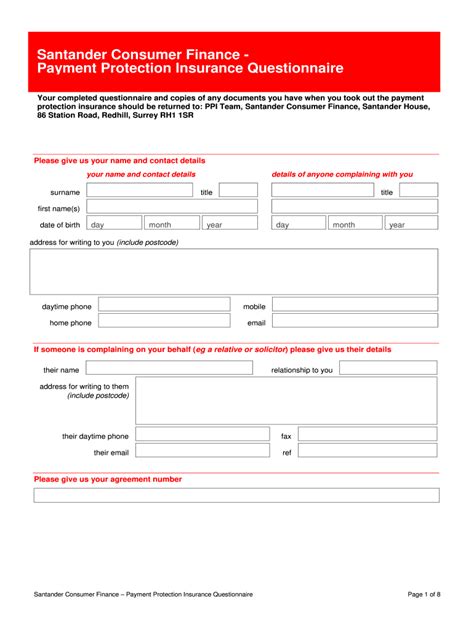

Lack of paperwork should not deter you from making a PPI claim. Here are the steps you can follow: - Contact the Lender: Reach out to your lender or the company that sold you the PPI policy. They are obligated to help you find out if you had PPI and to guide you through the claims process. - Use the Financial Ombudsman Service (FOS): If your lender is unable to find any records or if you disagree with their decision, you can take your case to the FOS. They will investigate and make a decision based on the evidence available. - Seek Professional Help: Consider hiring a claims management company. They can help navigate the process and increase your chances of a successful claim. However, be aware that you will have to pay a fee for their services.

Steps to Make a Claim

Making a PPI claim involves several steps: - Gather Information: Collect as much information as possible about your loan, credit card, or mortgage, including account numbers and the dates you held the products. - Submit Your Claim: Use the information gathered to submit a claim to your lender. They will review your case and make a decision. - Escalate if Necessary: If your claim is rejected, you can escalate it to the FOS.

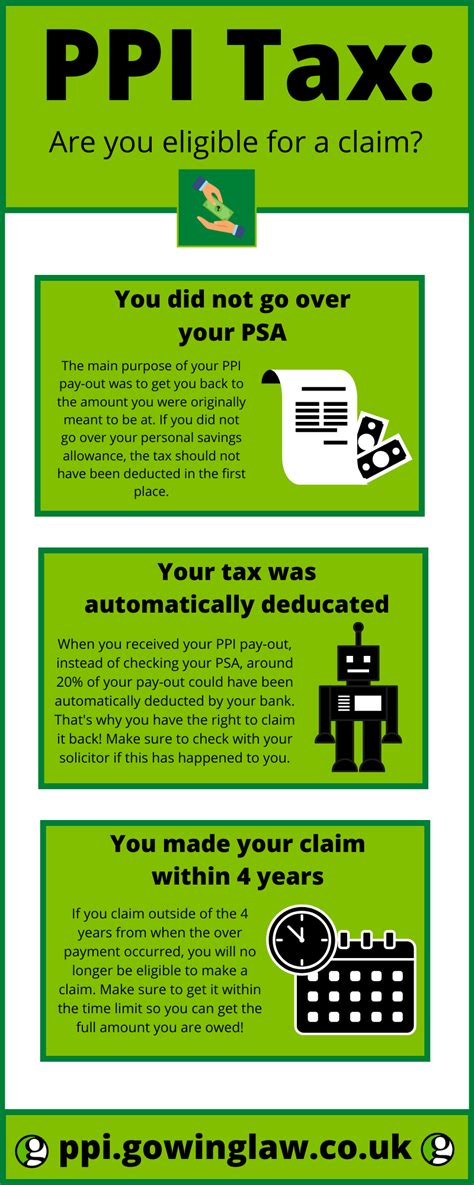

Key Considerations

- Time Limits: There are time limits for making PPI claims. The Financial Conduct Authority (FCA) set a deadline for PPI complaints, but you may still be able to claim if you were not aware that you had PPI or if your claim was previously rejected. - Evidence: While paperwork is helpful, it’s not the only form of evidence. The FOS and lenders can use other records to verify your claim. - Patience: The claims process can be lengthy. Be prepared to wait several months for a decision.

Common Reasons for Claim Rejection

Claims can be rejected for several reasons, including: - Lack of evidence that the PPI was mis-sold. - The claim being made outside the specified time limit. - The policyholder not being eligible for the claim.

📝 Note: Keeping detailed records of your communications with lenders and the FOS can be incredibly beneficial in case your claim is disputed or rejected.

Conclusion of the Claims Process

Making a PPI claim without paperwork requires persistence and patience. Understanding your rights and the process can empower you to pursue your claim successfully. Remember, you do not need to have the original documents to start the process. With the right approach and support, you can navigate the system and potentially receive compensation for mis-sold PPI.

In the end, the process of claiming back mis-sold PPI is designed to provide justice to those who were wrongly sold these policies. By following the steps outlined and seeking help when needed, individuals can reclaim what is rightfully theirs, even without the original paperwork.

What is PPI and how was it mis-sold?

+

PPI, or Payment Protection Insurance, was a policy sold alongside loans and credit cards to cover payments in case of illness, accident, or unemployment. It was often mis-sold to individuals who did not need it, were not eligible, or were not informed about the policy.

Can I make a PPI claim without paperwork?

+

Yes, it is possible to make a PPI claim without the original paperwork. You can contact your lender, use the services of the Financial Ombudsman, or hire a claims management company to help you through the process.

How long does the PPI claims process take?

+

The duration of the PPI claims process can vary significantly. It can take several months from the initial claim to the final decision, especially if the claim is escalated to the Financial Ombudsman Service.