California Repo Men Paperwork Requirements

Understanding the Role of Repo Men in California

In California, repo men, also known as repossession agents, play a crucial role in the process of repossessing vehicles and other assets when individuals fail to meet their financial obligations. The state has specific laws and regulations governing the actions of these agents to protect both the creditors and the debtors. One of the critical aspects of this process is the paperwork requirements that must be fulfilled to ensure the repossession is conducted legally and efficiently.

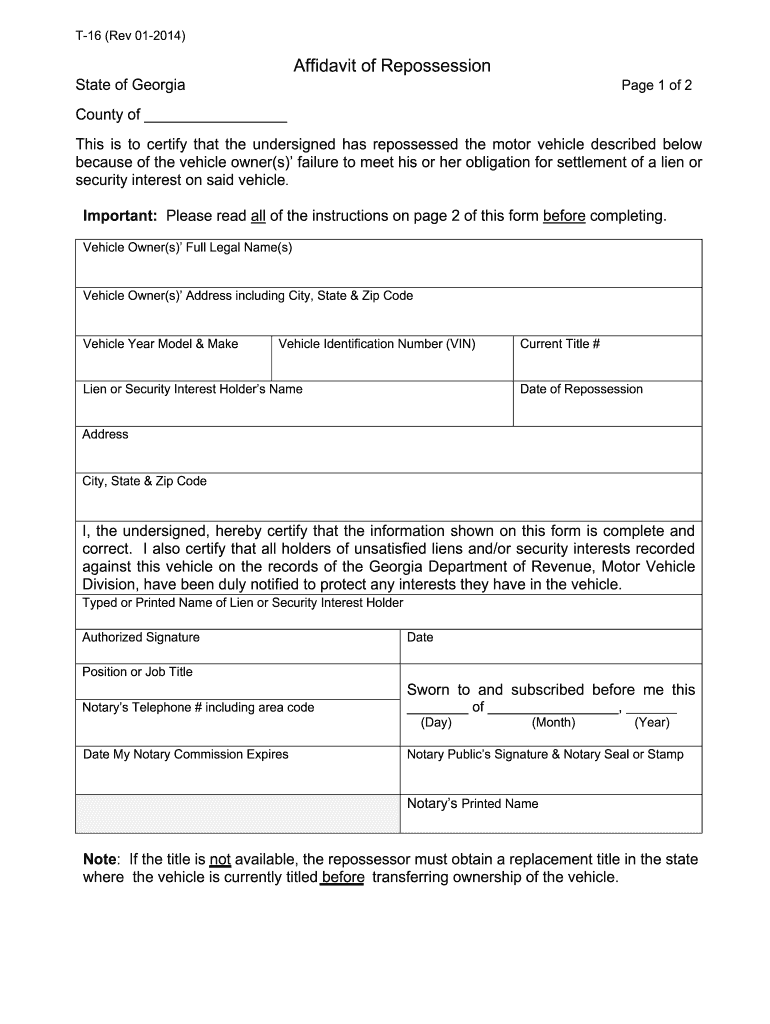

Pre-Repossession Requirements

Before initiating the repossession process, several steps must be taken, including: - Notification to the Debtor: The creditor must send a notice to the debtor stating the intention to repossess the vehicle if payments are not brought up to date. This notice must include specific details such as the amount needed to cure the default and the deadline by which this amount must be paid. - Review of the Loan Agreement: The loan agreement or contract between the creditor and the debtor must be reviewed to ensure it includes a clause allowing for repossession in the event of default. - Compliance with California Law: All actions must comply with California’s repossession laws, which dictate how notifications are given, how the repossession is carried out, and the rights of both parties involved.

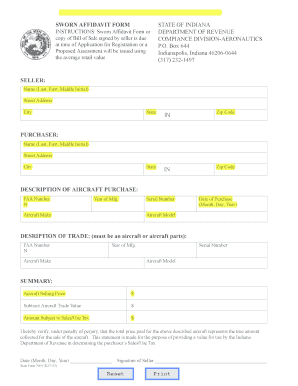

Post-Repossession Requirements

After the vehicle has been repossessed, there are additional paperwork requirements that must be met: - Notice of Intent to Sell: The creditor must send a notice to the debtor stating the intent to sell the repossessed vehicle. This notice must include the date and time of the intended sale, the method of sale (public or private), and an itemized statement of the debtor’s obligations, including the balance due on the loan, any accrued interest, and any costs associated with the repossession and sale. - Accounting of Sale Proceeds: After the sale of the vehicle, the creditor must provide an accounting to the debtor, detailing the sale price, the expenses deducted from the sale proceeds, and any balance still owed by the debtor.

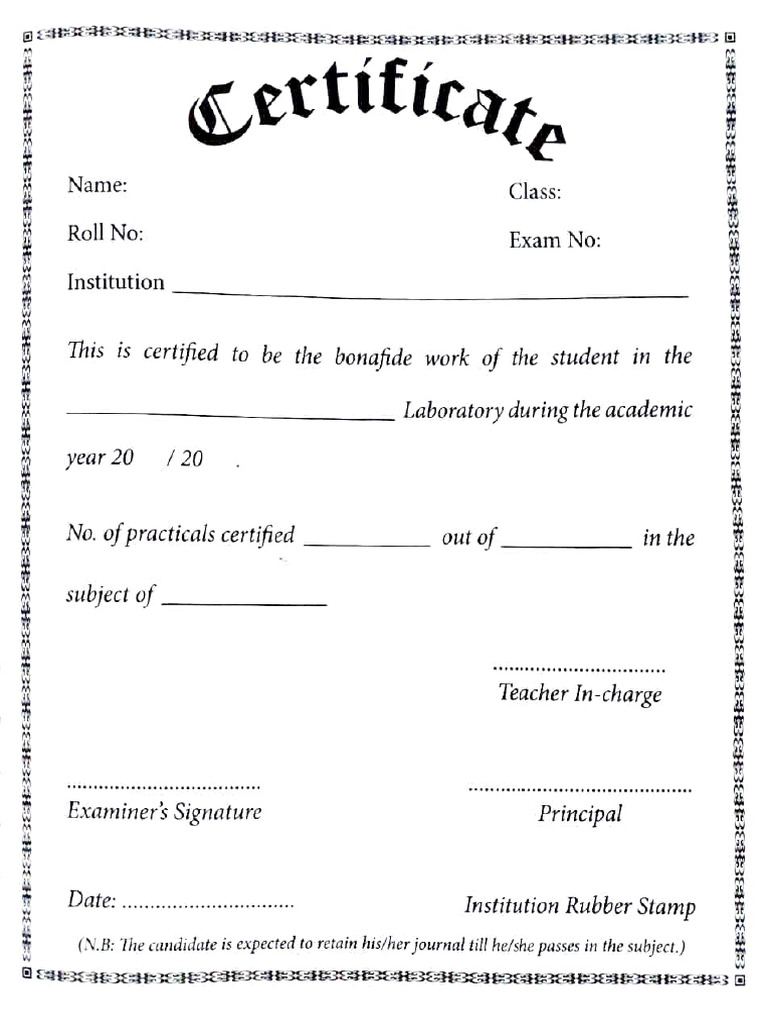

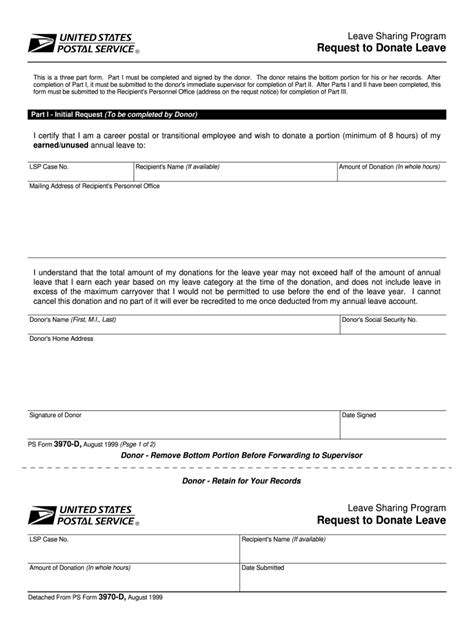

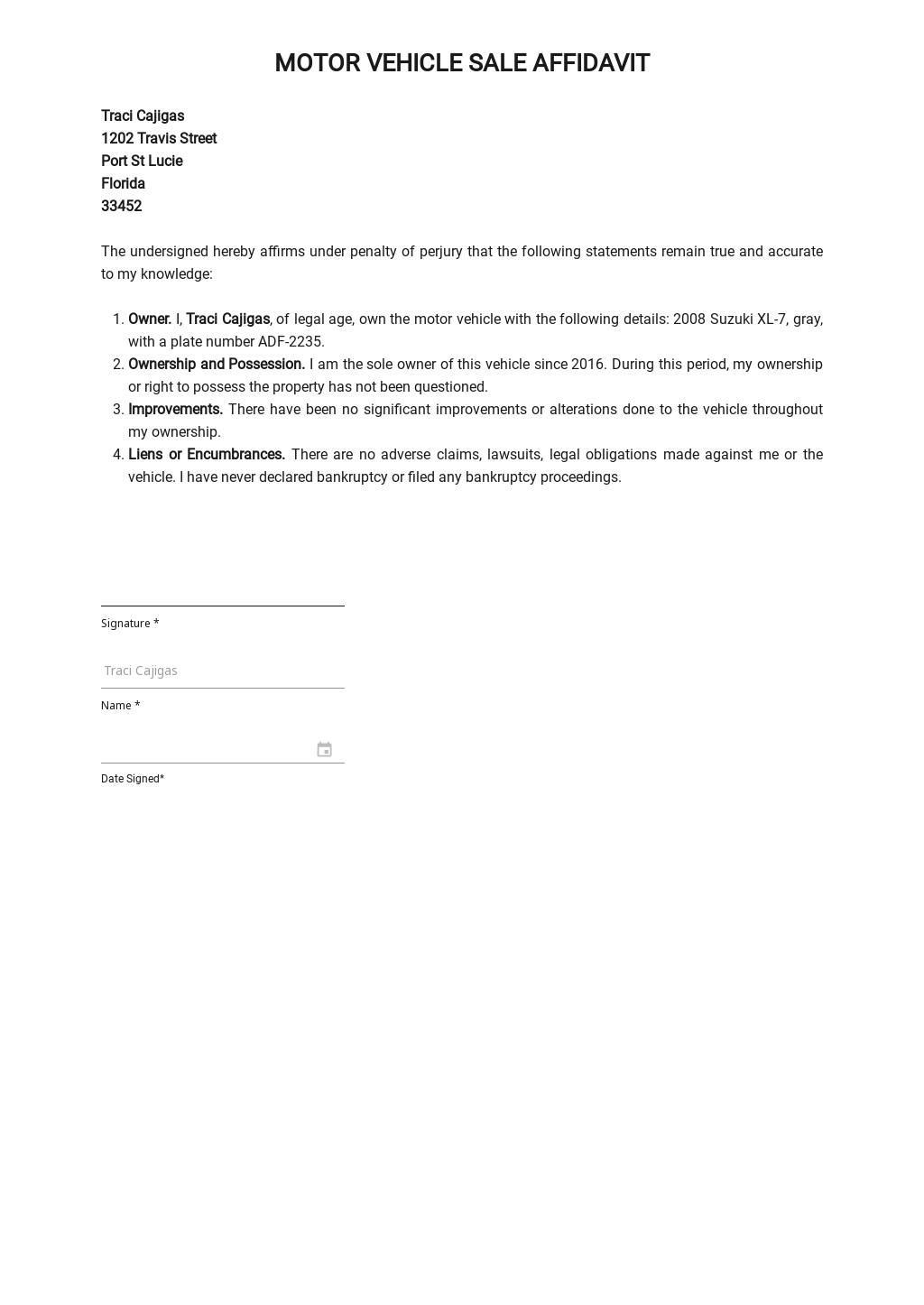

Documentation for Repo Men

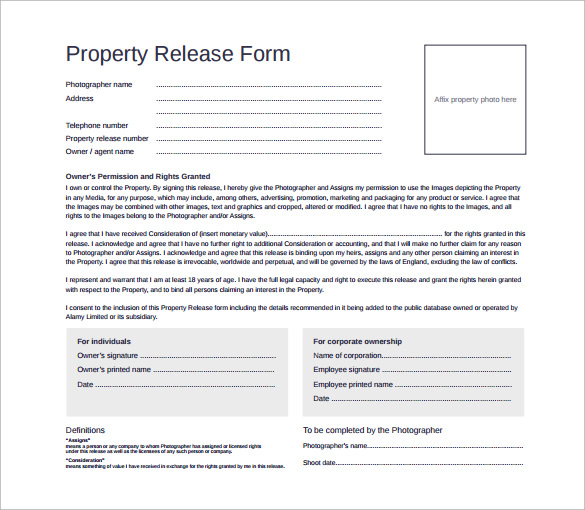

Repo men in California must also maintain specific documentation, including: - Authorization from the Creditor: A written authorization from the creditor to repossess the vehicle. - Proof of Notification: Evidence that the required notifications were sent to the debtor. - Inventory of Personal Effects: If personal effects are found in the vehicle at the time of repossession, an inventory must be made and the debtor notified of the procedure for reclaiming these items.

Regulations and Laws

California’s repossession laws are outlined in the California Commercial Code and the California Civil Code. These laws provide protections for debtors, such as the right to redeem the vehicle before it is sold and the right to any surplus from the sale if the vehicle sells for more than the outstanding debt. For creditors and repo men, these laws provide a framework for legally repossessing vehicles and selling them to recover debts.

📝 Note: It is essential for both creditors and debtors to understand their rights and obligations under California law to navigate the repossession process effectively and avoid potential legal issues.

Conclusion of the Process

In summary, the process of repossession in California involves detailed paperwork requirements and adherence to state laws. Both creditors and debtors must be aware of these requirements to ensure the process is handled fairly and legally. Understanding the role of repo men, the pre and post-repossession requirements, and the regulations governing the process can help alleviate some of the stress associated with vehicle repossession.

What happens to personal items left in a repossessed vehicle in California?

+

The creditor or repossession agency must notify the debtor of the procedure to reclaim personal effects found in the vehicle. The debtor is usually given a reasonable time frame to retrieve these items.

Can a debtor redeem their vehicle after it has been repossessed in California?

+

Yes, California law allows a debtor to redeem their vehicle by paying the outstanding loan balance, plus any accrued interest and fees, before the vehicle is sold. This is known as “right to redeem” or “right to reinstate.”

What are the consequences for a debtor if the sold vehicle does not cover the debt in California?

+

If the sale of the vehicle does not cover the outstanding debt, the debtor may still be liable for the deficiency balance. The creditor can pursue the debtor for this amount, which may involve further legal action.