7 Bankruptcy Forms

Introduction to Bankruptcy Forms

Filing for bankruptcy is a complex process that involves submitting various forms to the court. These forms provide detailed information about the debtor’s financial situation, debts, assets, and other relevant details. The process of filing for bankruptcy can be overwhelming, but understanding the different types of bankruptcy forms is essential to navigate the system successfully. In this article, we will discuss the 7 key bankruptcy forms that individuals and businesses need to be familiar with.

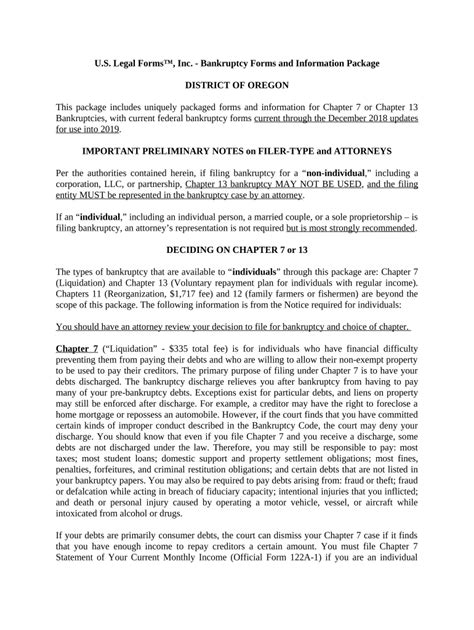

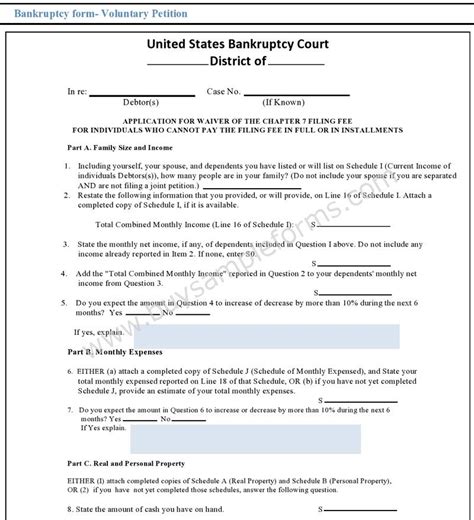

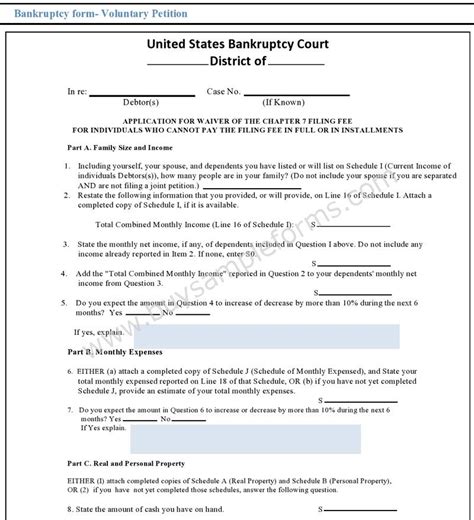

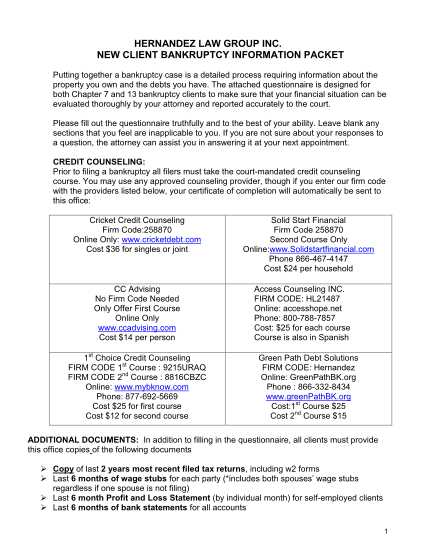

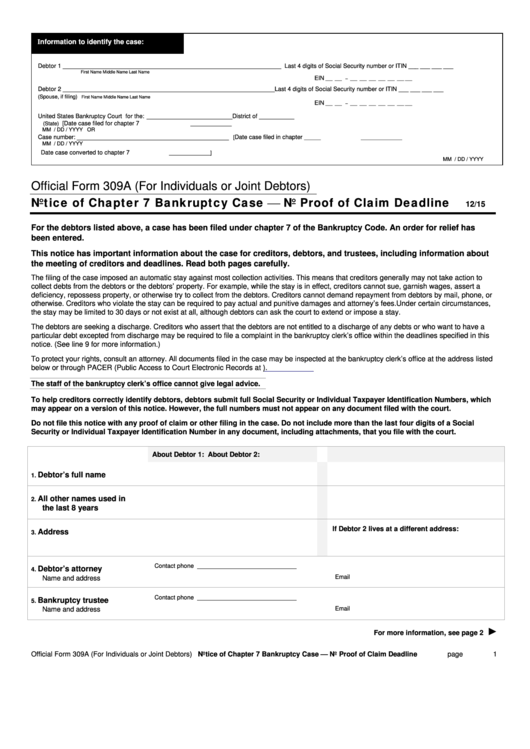

1. Voluntary Petition

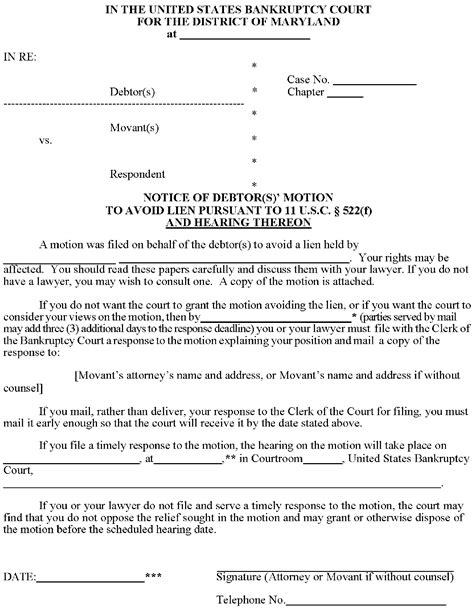

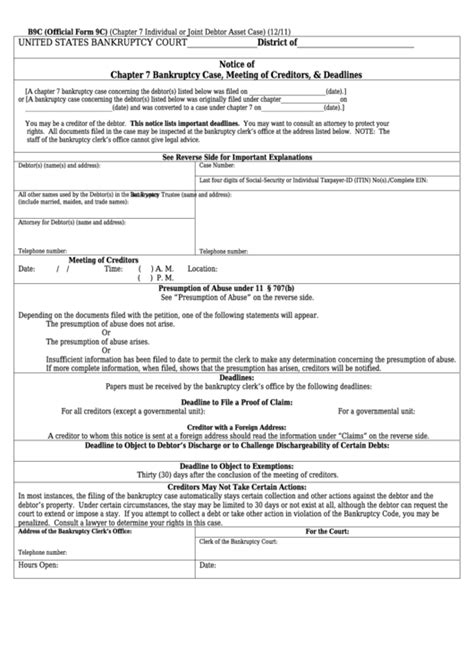

The voluntary petition is the initial form filed with the court to start the bankruptcy process. This form, also known as Form 101, provides basic information about the debtor, including their name, address, and social security number. It also requires the debtor to specify the type of bankruptcy they are filing for, such as Chapter 7 or Chapter 13. The voluntary petition is usually accompanied by other supporting documents, such as a list of creditors, assets, and liabilities.

2. Schedules A/J

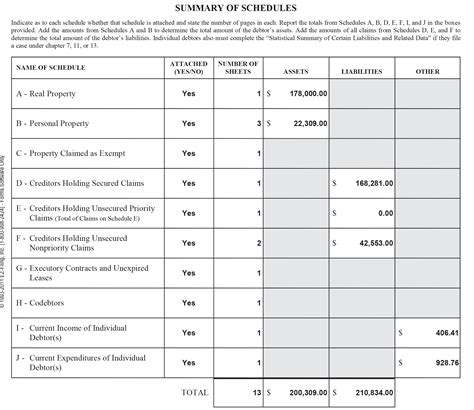

Schedules A/J are a series of forms that provide detailed information about the debtor’s assets, liabilities, and exempt property. Form 106A/J requires the debtor to list all their real property, including their primary residence, vacation homes, and investment properties. This form also asks for information about the property’s value, any outstanding mortgages, and other liens. Form 106J is used to report any potential interests in real property that the debtor may have, such as a timeshare or a leasehold interest.

3. Schedules D and E/F

Schedules D and E/F are used to report the debtor’s secured and unsecured debts. Form 106D requires the debtor to list all their secured creditors, including mortgage lenders, car loan lenders, and other creditors with a security interest in the debtor’s property. Form 106E/F is used to report the debtor’s unsecured debts, such as credit card debt, medical bills, and personal loans. This form also asks for information about the debt’s status, including whether it is disputed or the subject of a pending lawsuit.

4. Schedule G

Schedule G is used to report any executory contracts or unexpired leases that the debtor is a party to. Form 106G requires the debtor to provide information about the contract or lease, including the other party’s name, the contract’s terms, and any outstanding obligations. This form is important because it helps the court determine whether the debtor should be allowed to assume or reject the contract or lease.

5. Schedule H

Schedule H is used to report any co-signers or guarantors of the debtor’s debts. Form 106H requires the debtor to provide information about the co-signer or guarantor, including their name, address, and relationship to the debtor. This form is important because it helps the court determine whether the co-signer or guarantor should be notified of the bankruptcy filing.

6. Statement of Financial Affairs

The Statement of Financial Affairs is a comprehensive form that provides a detailed picture of the debtor’s financial situation. Form 107 requires the debtor to report their income, expenses, assets, and liabilities over the past two years. This form also asks for information about any recent transactions, including gifts, loans, and property transfers.

7. Chapter 13 Plan

The Chapter 13 plan is a detailed proposal that outlines how the debtor intends to repay their debts over time. Form 113 requires the debtor to provide information about their income, expenses, and debt repayment plan, including the amount they will pay each month and the duration of the plan. This form is only required for Chapter 13 bankruptcy cases, which involve a repayment plan.

💡 Note: It is essential to fill out these forms accurately and completely to avoid delays or dismissal of the bankruptcy case.

To illustrate the complexity of these forms, consider the following table:

| Form Number | Form Name | Description |

|---|---|---|

| 101 | Voluntary Petition | Initial form to start the bankruptcy process |

| 106A/J | Schedules A/J | Report real property and exempt property |

| 106D | Schedule D | Report secured debts |

| 106E/F | Schedule E/F | Report unsecured debts |

| 106G | Schedule G | Report executory contracts or unexpired leases |

| 106H | Schedule H | Report co-signers or guarantors |

| 107 | Statement of Financial Affairs | Report income, expenses, assets, and liabilities |

| 113 | Chapter 13 Plan | Propose a debt repayment plan |

In summary, the 7 bankruptcy forms discussed in this article are crucial for individuals and businesses to navigate the bankruptcy process successfully. By understanding the purpose and requirements of each form, debtors can ensure that their bankruptcy case is processed efficiently and effectively.

As we reflect on the key points discussed, it is clear that bankruptcy forms play a vital role in the bankruptcy process. By providing accurate and complete information, debtors can avoid delays or dismissal of their case and move forward with their financial recovery.

What is the purpose of the voluntary petition?

+

The voluntary petition is the initial form filed with the court to start the bankruptcy process. It provides basic information about the debtor and specifies the type of bankruptcy they are filing for.

What is the difference between Schedule D and Schedule E/F?

+

Schedule D is used to report secured debts, while Schedule E/F is used to report unsecured debts. Secured debts are those with a security interest in the debtor’s property, such as a mortgage or car loan. Unsecured debts, on the other hand, do not have a security interest, such as credit card debt or medical bills.

What is the purpose of the Chapter 13 plan?

+

The Chapter 13 plan is a detailed proposal that outlines how the debtor intends to repay their debts over time. It provides information about the debtor’s income, expenses, and debt repayment plan, including the amount they will pay each month and the duration of the plan.