5 GAR Paperwork Tips

Introduction to GAR Paperwork

The Generalized System of Preferences (GSP) and the Generalized Authorisation (GA) are customs procedures that allow for the importation of goods into the European Union (EU) with reduced or eliminated tariffs. One of the key documents required for these procedures is the GAR (Generalized Authorisation for Simplified Procedures) paperwork. The GAR paperwork is a critical component of the customs clearance process, and its accuracy and completeness are essential for ensuring compliance with EU regulations and avoiding potential penalties. In this article, we will provide 5 GAR paperwork tips to help importers and exporters navigate the process with ease.

Understanding GAR Paperwork Requirements

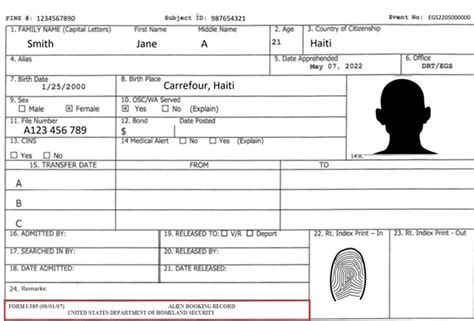

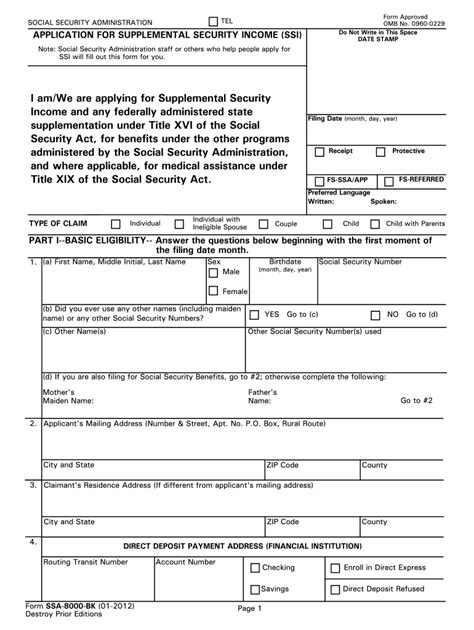

Before we dive into the tips, it’s essential to understand the requirements for GAR paperwork. The GAR is a authorization that allows importers and exporters to use simplified customs procedures, such as the GSP and GA. To obtain a GAR, businesses must meet specific eligibility criteria, including being established in the EU, having a good compliance record, and demonstrating the ability to maintain accurate and complete records. The GAR paperwork typically includes documents such as the GAR application form, commercial invoices, bills of lading, and certificates of origin.

Tip 1: Ensure Accuracy and Completeness of Documents

The first tip for GAR paperwork is to ensure that all documents are accurate and complete. This includes verifying the accuracy of commercial invoices, bills of lading, and certificates of origin. Any errors or omissions can lead to delays or even rejection of the GAR application. It’s essential to double-check all documents for accuracy and completeness before submitting them.

Tip 2: Use Correct Tariff Codes and Classifications

The second tip is to use the correct tariff codes and classifications for the goods being imported or exported. The Harmonized System (HS) code is an international standardized system of names and numbers to classify traded products. Using the correct HS code is crucial for determining the applicable tariffs and ensuring compliance with EU regulations. Businesses should consult the EU’s tariff database or seek the advice of a qualified customs broker to ensure accurate classification.

Tip 3: Maintain Accurate Records

The third tip is to maintain accurate and complete records of all GAR-related documents and transactions. This includes records of commercial invoices, bills of lading, certificates of origin, and any other relevant documents. Accurate record-keeping is essential for demonstrating compliance with EU regulations and for auditing purposes. Businesses should implement a robust record-keeping system to ensure that all documents are properly stored and easily accessible.

Tip 4: Comply with EU Regulations and Standards

The fourth tip is to comply with EU regulations and standards for GAR paperwork. This includes adhering to the EU’s customs legislation, such as the Union Customs Code (UCC), and ensuring that all goods meet EU standards for safety, health, and environmental protection. Businesses should stay up-to-date with the latest EU regulations and standards to avoid any potential non-compliance issues.

Tip 5: Seek Professional Advice

The fifth tip is to seek professional advice from a qualified customs broker or trade consultant. GAR paperwork can be complex, and businesses may benefit from the expertise of a professional who is familiar with EU customs procedures and regulations. A qualified customs broker can help ensure that all documents are accurate and complete, and that businesses are complying with EU regulations and standards.

📝 Note: Businesses should ensure that they have a thorough understanding of GAR paperwork requirements and EU regulations to avoid any potential penalties or delays.

In summary, GAR paperwork is a critical component of the customs clearance process, and its accuracy and completeness are essential for ensuring compliance with EU regulations. By following these 5 GAR paperwork tips, businesses can navigate the process with ease and avoid any potential issues. Whether you’re an importer or exporter, it’s essential to understand the requirements for GAR paperwork and to seek professional advice when needed.

What is the purpose of GAR paperwork?

+

The purpose of GAR paperwork is to provide a generalized authorization for simplified customs procedures, allowing importers and exporters to take advantage of reduced or eliminated tariffs.

What are the eligibility criteria for a GAR?

+

To be eligible for a GAR, businesses must be established in the EU, have a good compliance record, and demonstrate the ability to maintain accurate and complete records.

What are the consequences of non-compliance with EU regulations?

+

Non-compliance with EU regulations can result in penalties, fines, and even the rejection of the GAR application. Businesses should ensure that they comply with all EU regulations and standards to avoid any potential issues.