7 Tax Years

Introduction to Tax Years

When it comes to understanding and managing taxes, one crucial concept to grasp is the idea of a tax year. A tax year, also known as a fiscal year, is a period of 12 months used for tax purposes. It’s essential for individuals, businesses, and governments to comprehend the tax year concept to ensure accurate tax planning, filing, and compliance. In this blog post, we’ll delve into the world of tax years, exploring what they entail, their types, and how they impact taxation.

Understanding Tax Years

A tax year is not necessarily the same as a calendar year, which runs from January 1 to December 31. While many countries and individuals follow the calendar year for tax purposes, some may have different tax years. For instance, a company might have a tax year that runs from April 1 to March 31 of the following year. This discrepancy is crucial because it affects the timing of tax filings, payments, and planning strategies. Understanding the specific tax year applicable to your situation is vital to avoid confusion and potential penalties.

Types of Tax Years

There are primarily two types of tax years: - Calendar Tax Year: This is the most common type, where the tax year coincides with the calendar year (January 1 to December 31). - Fiscal Tax Year: This type of tax year can start on any date and ends 12 months later. It’s commonly used by businesses or individuals with specific financial year requirements.

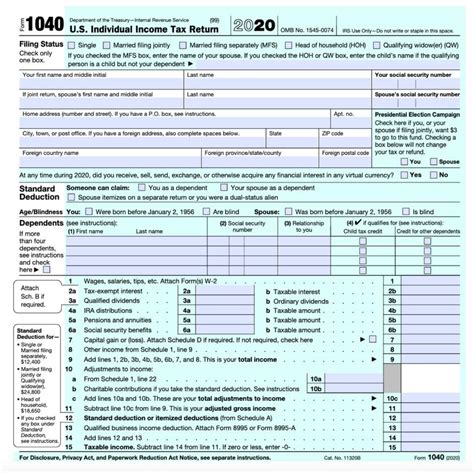

Importance of Tax Years

The concept of a tax year is critical for several reasons: - Tax Filing: It determines when tax returns must be filed. For example, if you follow the calendar year, your tax return for the year 2023 would typically be due in April 2024. - Tax Planning: Understanding your tax year helps in planning tax strategies, such as when to incur expenses or recognize income to minimize tax liabilities. - Compliance: It’s essential for complying with tax laws and regulations. Missing a tax filing deadline can result in penalties and interest on the amount owed.

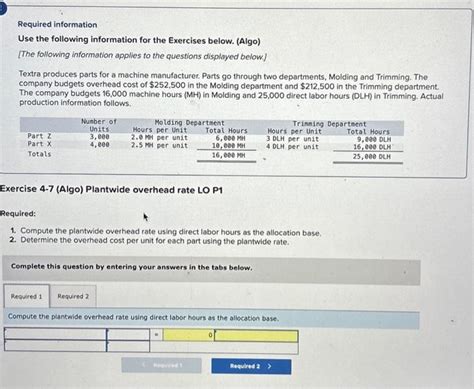

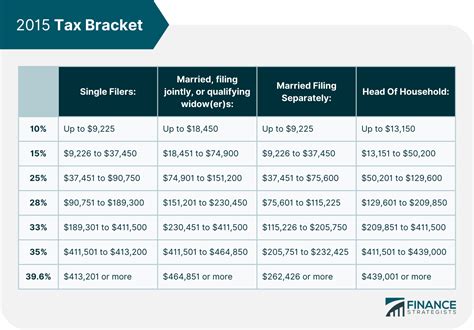

Tax Year and Financial Planning

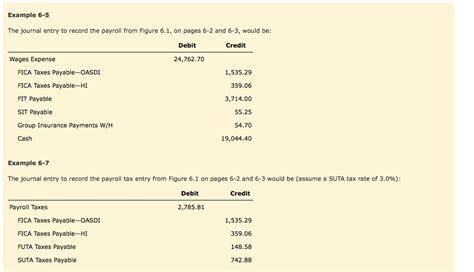

For effective financial planning, considering the tax year is paramount. Here are a few points to consider: - Income Recognition: Timing income recognition can significantly impact your tax liability. For instance, delaying income into the next tax year might reduce your current tax bill if you expect to be in a lower tax bracket. - Expense Management: Managing expenses, such as charitable donations or business expenditures, within the tax year can provide valuable deductions. - Investment Strategies: Tax-efficient investment strategies, such as tax-loss harvesting, should be planned with the tax year in mind to maximize after-tax returns.

Common Challenges and Solutions

Individuals and businesses often face challenges related to tax years, particularly when dealing with multiple tax jurisdictions or changing tax laws. Some common issues include: - Complexity in Tax Compliance: Navigating different tax years and laws can be complex. - Penalties for Non-Compliance: Missing deadlines or incorrectly filing taxes can lead to fines and penalties.

Solutions to these challenges include: - Seeking Professional Advice: Consulting with a tax professional can provide clarity and ensure compliance. - Utilizing Tax Software: Many tax software programs are designed to handle complex tax situations and can guide users through the filing process.

Conclusion and Final Thoughts

In summary, understanding tax years is fundamental to navigating the complex world of taxation. Whether you’re an individual or a business, recognizing the implications of tax years on your financial planning and compliance is crucial. By grasping this concept and planning accordingly, you can minimize tax liabilities, avoid penalties, and ensure smooth financial operations. Remember, tax laws and regulations can change, so staying informed and seeking professional advice when needed is essential for long-term financial health.

What is the difference between a calendar tax year and a fiscal tax year?

+

A calendar tax year runs from January 1 to December 31, while a fiscal tax year can start on any date and ends 12 months later, often used by businesses or individuals with specific financial year requirements.

Why is understanding the tax year important for financial planning?

+

Understanding the tax year is important because it determines when tax returns must be filed, aids in planning tax strategies to minimize liabilities, and is crucial for compliance with tax laws and regulations.

What are some common challenges related to tax years, and how can they be addressed?

+

Common challenges include complexity in tax compliance and penalties for non-compliance. These can be addressed by seeking professional advice and utilizing tax software designed to handle complex tax situations.