Save Old Mortgage Paperwork

Introduction to Saving Old Mortgage Paperwork

When it comes to mortgage paperwork, it’s essential to keep track of all the documents involved in the process. From the initial application to the final closing, there are numerous papers that need to be signed, filed, and stored. While it might be tempting to get rid of old mortgage paperwork once the loan is paid off or refinanced, it’s crucial to save these documents for several reasons. In this article, we’ll explore the importance of saving old mortgage paperwork and provide guidance on what to keep and for how long.

Why Save Old Mortgage Paperwork?

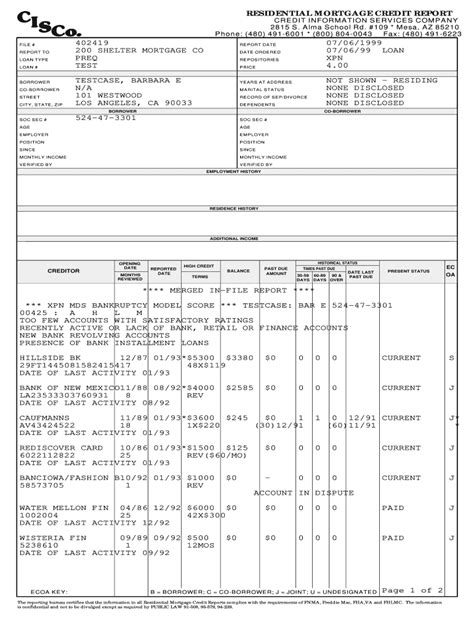

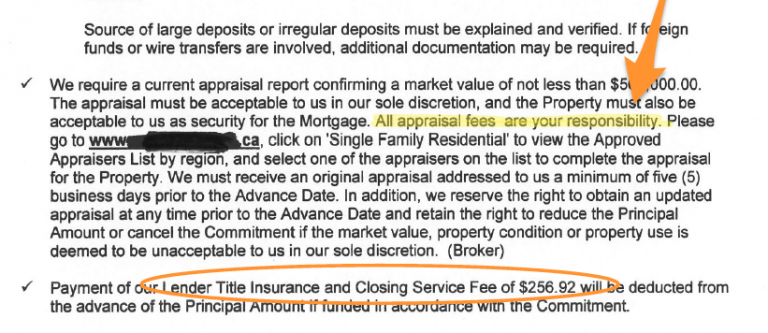

Saving old mortgage paperwork is vital for several reasons: * Tax purposes: Mortgage interest and property tax payments can be deductible on your tax return. Having the original paperwork can help you claim these deductions and provide proof in case of an audit. * Refinancing or selling: If you decide to refinance your mortgage or sell your property, you’ll need to provide documentation from the original loan. This includes the note, deed, and other relevant papers. * Disputes or errors: In case of any disputes or errors with your lender, having the original paperwork can help resolve issues and protect your interests. * Historical records: Mortgage paperwork can serve as a historical record of your property’s ownership and financing history.

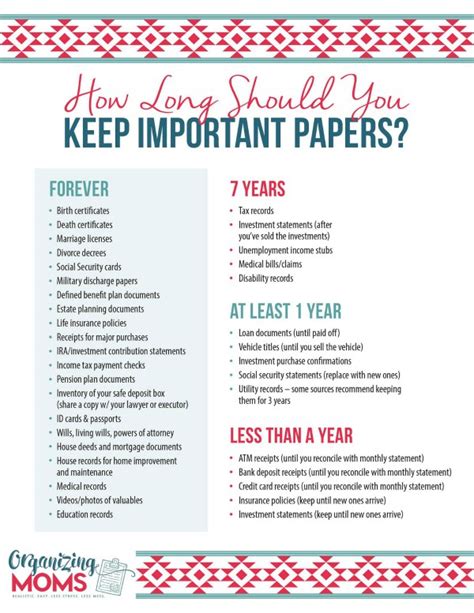

What to Keep and for How Long

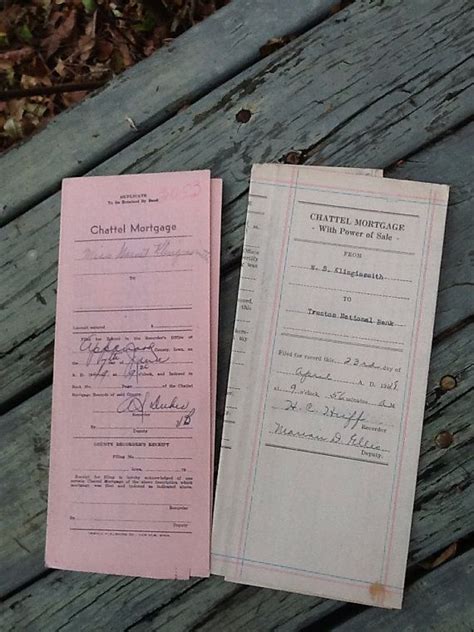

So, what mortgage paperwork should you keep and for how long? Here are some guidelines: * Mortgage note: Keep the original mortgage note for at least 10 years after the loan is paid off. This document proves that you’ve paid off the loan and can be useful in case of any disputes. * Deed: Store the original deed in a safe place, such as a fireproof safe or a safe deposit box. You should keep the deed indefinitely, as it proves ownership of the property. * Property tax records: Keep property tax records for at least 3-5 years after the tax year. This can help you prove payment of property taxes and claim deductions on your tax return. * Appraisals and inspections: Keep appraisals and inspections reports for at least 5-7 years. These documents can be useful if you need to dispute the value of your property or prove its condition. * Loan statements and payment records: Keep loan statements and payment records for at least 3-5 years after the loan is paid off. This can help you prove payment history and resolve any disputes with your lender.

📝 Note: It's essential to keep digital copies of your mortgage paperwork, as well as physical copies. Consider scanning your documents and storing them in a secure online storage service or external hard drive.

Organizing and Storing Mortgage Paperwork

To keep your mortgage paperwork organized and easily accessible, consider the following tips: * Use a filing system: Create a filing system with labeled folders and categories for each type of document. * Store documents in a safe place: Keep your mortgage paperwork in a fireproof safe, safe deposit box, or a secure online storage service. * Make digital copies: Scan your documents and store them in a secure online storage service or external hard drive. * Shred unnecessary documents: Shred any unnecessary or sensitive documents to protect your identity and prevent fraud.

Benefits of Saving Old Mortgage Paperwork

Saving old mortgage paperwork can have several benefits, including: * Peace of mind: Knowing that you have all the necessary documents can give you peace of mind and reduce stress. * Financial protection: Having the original paperwork can help protect your financial interests in case of any disputes or errors. * Historical records: Mortgage paperwork can serve as a historical record of your property’s ownership and financing history. * Tax benefits: Saving old mortgage paperwork can help you claim deductions and credits on your tax return.

Common Mistakes to Avoid

When it comes to saving old mortgage paperwork, there are several common mistakes to avoid: * Not keeping digital copies: Failing to make digital copies of your mortgage paperwork can make it difficult to access or recover the documents in case of an emergency. * Not storing documents in a safe place: Keeping your mortgage paperwork in an insecure location can put it at risk of damage, loss, or theft. * Not shredding unnecessary documents: Failing to shred unnecessary or sensitive documents can put your identity and financial information at risk. * Not keeping records for long enough: Not keeping mortgage paperwork for a sufficient amount of time can make it difficult to resolve disputes or prove payment history.

| Document | Retention Period |

|---|---|

| Mortgage note | 10 years after loan payoff |

| Deed | Indefinitely |

| Property tax records | 3-5 years after tax year |

| Appraisals and inspections | 5-7 years |

| Loan statements and payment records | 3-5 years after loan payoff |

In summary, saving old mortgage paperwork is crucial for tax purposes, refinancing or selling, disputes or errors, and historical records. It’s essential to keep digital copies, store documents in a safe place, and shred unnecessary documents. By following these guidelines and avoiding common mistakes, you can ensure that your mortgage paperwork is organized, accessible, and protected.

What is the importance of saving old mortgage paperwork?

+

Saving old mortgage paperwork is crucial for tax purposes, refinancing or selling, disputes or errors, and historical records. It provides proof of payment history, ownership, and financing terms, and can help resolve disputes or errors.

How long should I keep my mortgage paperwork?

+

The retention period for mortgage paperwork varies depending on the document. Generally, it’s recommended to keep the mortgage note for 10 years after loan payoff, the deed indefinitely, property tax records for 3-5 years after the tax year, appraisals and inspections for 5-7 years, and loan statements and payment records for 3-5 years after loan payoff.

What are the benefits of saving old mortgage paperwork?

+

The benefits of saving old mortgage paperwork include peace of mind, financial protection, historical records, and tax benefits. It provides proof of payment history, ownership, and financing terms, and can help resolve disputes or errors.