5 Tips Unemployment Taxes

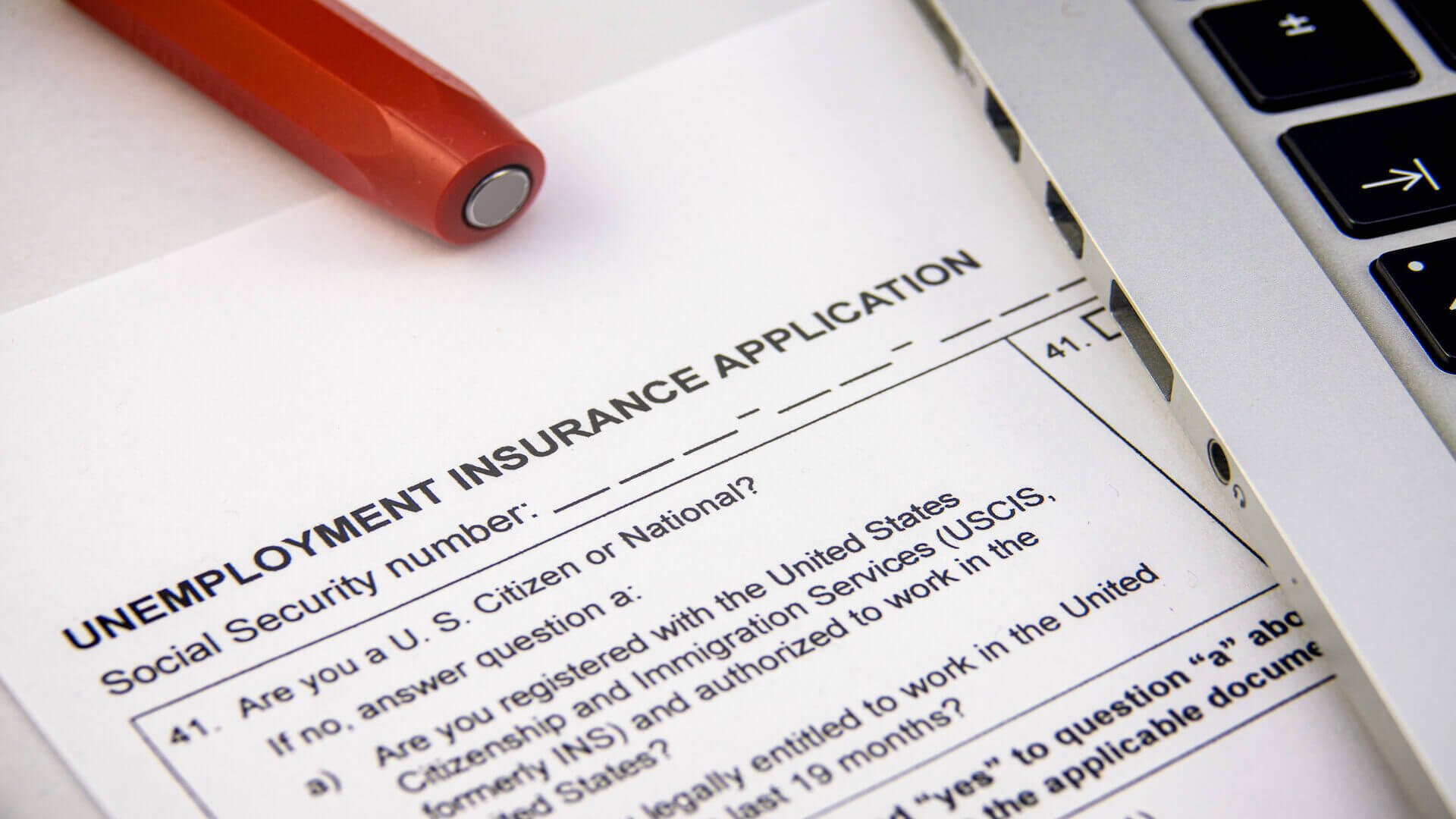

Understanding Unemployment Taxes: A Guide to Navigating the System

Unemployment taxes can be a complex and often misunderstood topic. For individuals who have lost their jobs or are receiving unemployment benefits, it’s essential to understand how these taxes work and how they can impact your financial situation. In this article, we’ll explore five key tips to help you navigate the world of unemployment taxes.

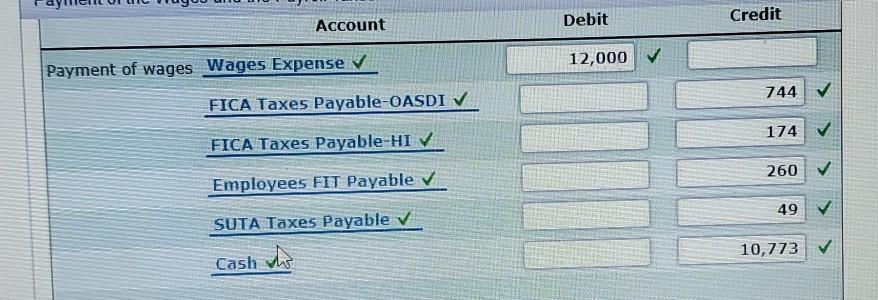

Tip 1: Understand How Unemployment Taxes Work

Unemployment taxes are paid by employers to fund state and federal unemployment insurance programs. These programs provide financial assistance to workers who have lost their jobs through no fault of their own. The taxes are typically a percentage of the employer’s payroll, and the rate can vary depending on the state and the employer’s experience rating. It’s essential to understand that unemployment taxes are not the same as income taxes, although they can impact your income tax return.

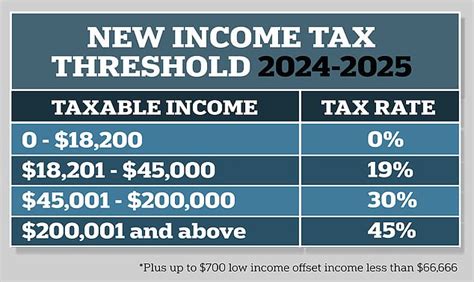

Tip 2: Know Your Tax Obligations

If you’re receiving unemployment benefits, you may be required to pay taxes on those benefits. The amount of taxes you owe will depend on your overall income and tax filing status. You may be able to choose to have taxes withheld from your unemployment benefits, or you may need to make quarterly estimated tax payments to avoid penalties. It’s crucial to understand your tax obligations to avoid any unexpected tax bills or penalties.

Tip 3: Take Advantage of Tax Deductions and Credits

There are several tax deductions and credits that may be available to individuals who are receiving unemployment benefits. For example, you may be able to deduct job search expenses, such as resume preparation and travel costs, on your tax return. You may also be eligible for the Earned Income Tax Credit (EITC), which can provide a refundable tax credit to low-income workers. It’s essential to consult with a tax professional to determine which deductions and credits you may be eligible for.

Tip 4: Keep Accurate Records

Keeping accurate records is crucial when it comes to unemployment taxes. You’ll need to keep track of your unemployment benefits, as well as any taxes that are withheld or paid. You’ll also need to keep records of any job search expenses, education costs, or other deductible expenses. It’s a good idea to keep a separate folder or file for your unemployment tax records, and to make sure you have all the necessary documents and receipts.

Tip 5: Seek Professional Help

Unemployment taxes can be complex, and it’s often helpful to seek professional help to ensure you’re meeting your tax obligations. A tax professional can help you understand your tax situation, identify any available deductions and credits, and ensure you’re in compliance with all tax laws and regulations. They can also help you navigate any tax-related issues that may arise, such as audits or notices from the IRS.

📝 Note: It's essential to understand that unemployment taxes can be complex, and it's often helpful to seek professional help to ensure you're meeting your tax obligations.

In summary, understanding unemployment taxes is crucial for individuals who are receiving unemployment benefits. By following these five tips, you can navigate the complex world of unemployment taxes and ensure you’re meeting your tax obligations. Remember to keep accurate records, take advantage of tax deductions and credits, and seek professional help when needed.

What are unemployment taxes?

+

Unemployment taxes are paid by employers to fund state and federal unemployment insurance programs, which provide financial assistance to workers who have lost their jobs through no fault of their own.

Do I have to pay taxes on my unemployment benefits?

+

Yes, you may be required to pay taxes on your unemployment benefits. The amount of taxes you owe will depend on your overall income and tax filing status.

Can I deduct job search expenses on my tax return?

+

Yes, you may be able to deduct job search expenses, such as resume preparation and travel costs, on your tax return. It’s essential to consult with a tax professional to determine which expenses are eligible.