5 Ways to Deposit Money

Introduction to Depositing Money

Depositing money is a fundamental aspect of personal and business finance, allowing individuals and organizations to store their funds securely and access various financial services. With the advancement of technology, the methods of depositing money have evolved, providing more convenience and flexibility. In this article, we will explore five common ways to deposit money, highlighting their characteristics, benefits, and considerations.

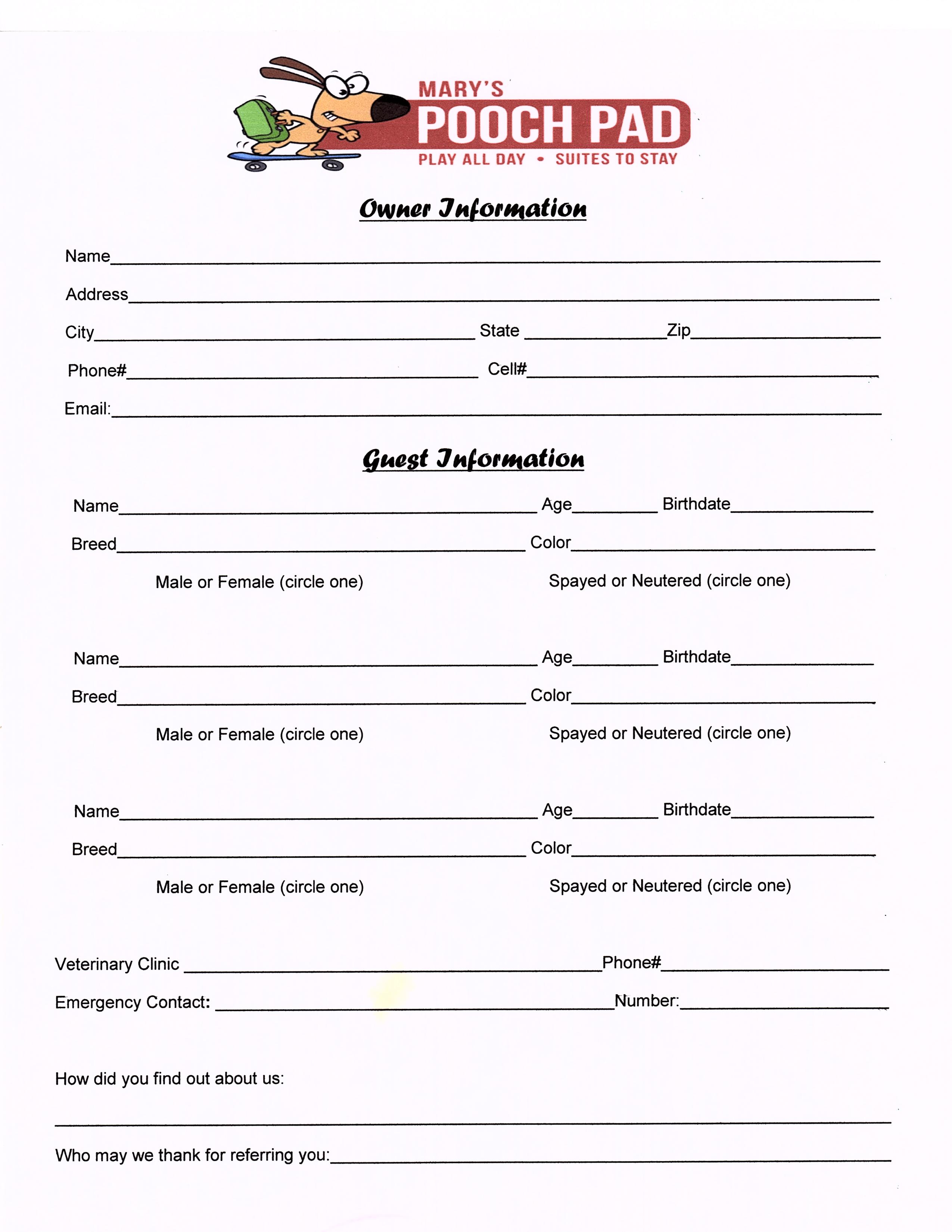

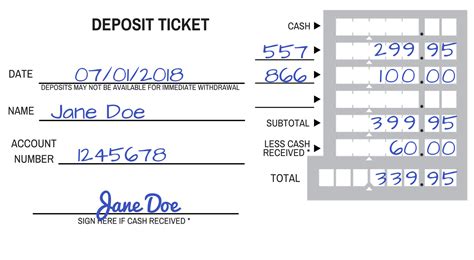

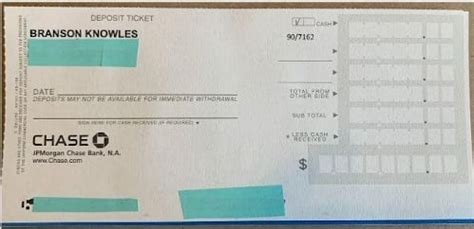

1. Cash Deposit at a Bank Branch

One of the traditional methods of depositing money is by visiting a bank branch in person. This method involves presenting cash to a bank teller, who then credits the amount to the depositor’s account. Cash deposits are often subject to certain limits and may require identification and account verification. This method is suitable for those who prefer face-to-face interaction or need to deposit large amounts of cash.

2. ATM Deposits

Automated Teller Machines (ATMs) provide a convenient way to deposit money outside of regular banking hours. To make an ATM deposit, individuals insert their card, select the deposit option, and follow the on-screen instructions. Some ATMs accept cash and check deposits, while others may only accept checks. It is essential to verify the ATM’s capabilities and any associated fees before making a deposit.

3. Mobile Deposit

With the rise of mobile banking, mobile deposit has become a popular method for depositing checks remotely. This method involves capturing an image of the check using a smartphone app and submitting it to the bank for processing. Mobile deposit is convenient, saves time, and reduces the need for physical visits to a bank branch. However, it may have limitations, such as deposit amount limits and processing times.

4. Direct Deposit

Direct deposit is a method of depositing money electronically from a payer’s account to a recipient’s account. This method is commonly used for payroll, government benefits, and tax refunds. Direct deposit is fast, secure, and eliminates the need for physical checks. It also reduces the risk of lost or stolen checks and provides immediate access to funds.

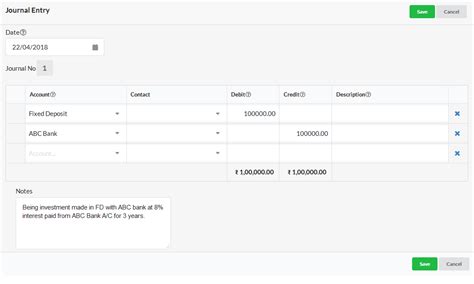

5. Online Deposit

Online deposit allows individuals to transfer funds from one account to another using online banking platforms. This method is convenient, secure, and can be done from anywhere with an internet connection. Online deposit is suitable for transferring funds between accounts, paying bills, and depositing money into investment accounts. However, it may require setup and verification of accounts, and transfer limits may apply.

📝 Note: When depositing money, it is crucial to verify the account details, deposit limits, and any associated fees to avoid errors or unnecessary charges.

In summary, the five ways to deposit money offer varying degrees of convenience, security, and flexibility. Whether you prefer traditional methods like cash deposits or modern approaches like mobile deposit, understanding the characteristics and benefits of each method can help you choose the best option for your financial needs.

What is the safest way to deposit money?

+

Direct deposit is considered one of the safest ways to deposit money, as it eliminates the risk of lost or stolen checks and provides immediate access to funds.

Can I deposit money online?

+

Yes, you can deposit money online using online banking platforms, which allow you to transfer funds from one account to another securely and conveniently.

What are the benefits of mobile deposit?

+

Mobile deposit offers convenience, saves time, and reduces the need for physical visits to a bank branch. It also provides a secure way to deposit checks remotely.