2018 Insurance Paperwork for Taxes

Introduction to Insurance Paperwork for Taxes

When it comes to filing taxes, one of the most crucial aspects is gathering all the necessary documents, including insurance paperwork. The year 2018 brought about several changes in tax laws, and understanding how these changes affect your insurance paperwork is essential for a smooth tax filing process. In this article, we will delve into the world of 2018 insurance paperwork for taxes, exploring what you need to know, the types of insurance that are relevant, and how to navigate the process efficiently.

Understanding the Basics

Before diving into the specifics of insurance paperwork for taxes in 2018, it’s essential to understand the basics. Tax deductions and credits related to insurance can significantly impact your tax return. For instance, health insurance premiums, certain types of life insurance proceeds, and long-term care insurance premiums might offer tax benefits. However, the Tax Cuts and Jobs Act (TCJA), which took effect in 2018, introduced several changes that could affect how these benefits are claimed.

Types of Insurance Relevant to Taxes

Several types of insurance are relevant when considering tax implications: - Health Insurance: Premiums paid for health insurance coverage can be deductible under certain circumstances. The TCJA did not repeal the individual mandate, but it reduced the penalty for not having health insurance to $0, effective in 2019. However, for the 2018 tax year, the mandate was still in effect. - Life Insurance: Generally, the proceeds from a life insurance policy are tax-free to the beneficiary. However, interest earned on cash value accumulation in a life insurance policy might be taxable. - Long-Term Care Insurance: Premiums for long-term care insurance may be deductible as medical expenses, subject to certain limits based on age. - Disability Insurance: Premiums for disability insurance are typically not deductible, but benefits received might be taxable, depending on who paid the premiums.

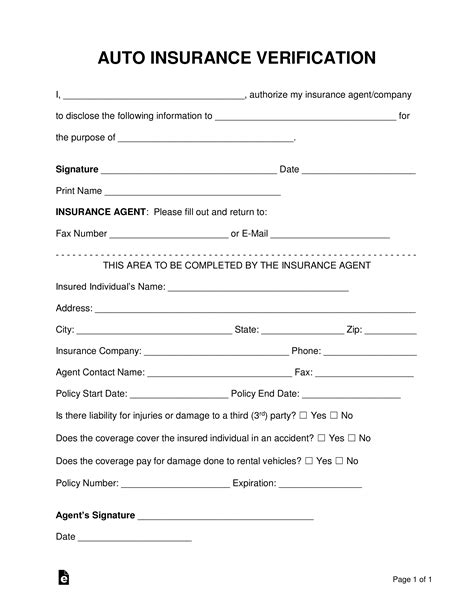

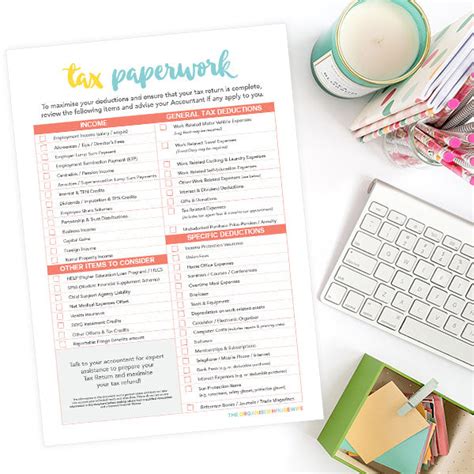

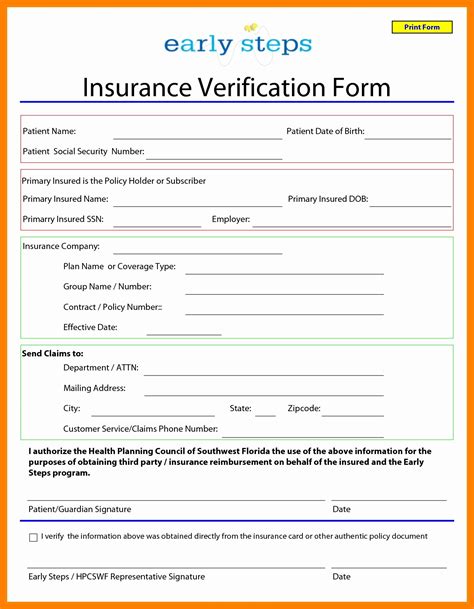

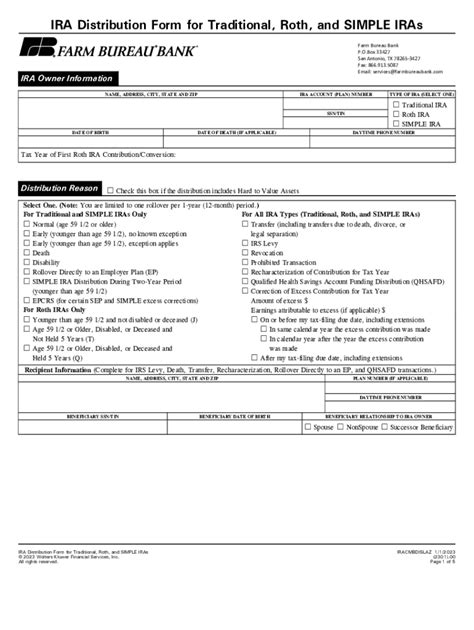

Gathering Necessary Documents

To properly account for your insurance on your tax return, you’ll need to gather specific documents: - Form 1099-LTC for long-term care benefits received. - Form 1099-INT for interest earned on life insurance policies. - Proof of health insurance premiums paid, which might be reported on your W-2 or provided by your insurance company. - Receipts for long-term care insurance premiums, as these may be deductible as medical expenses.

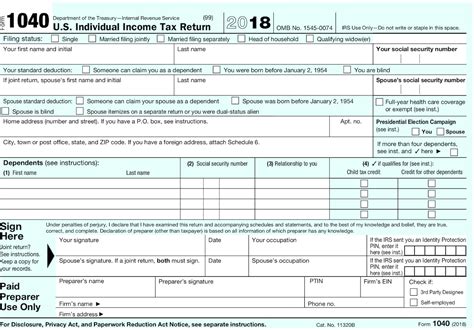

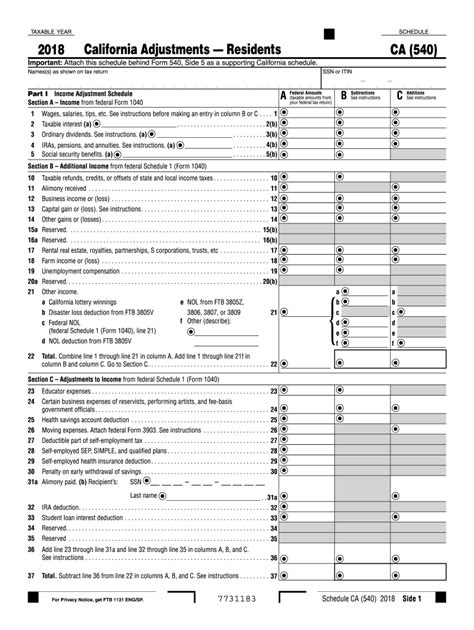

Claiming Deductions and Credits

Claiming deductions and credits related to insurance involves careful consideration of the tax laws and your personal situation: - Itemizing Deductions: You can deduct medical expenses, including certain insurance premiums, if they exceed a certain percentage of your Adjusted Gross Income (AGI). For the 2018 tax year, this threshold was 7.5% of AGI for all taxpayers, thanks to the TCJA. - Premium Tax Credit (PTC): If you purchased health insurance through the Marketplace, you might be eligible for the PTC, which can be claimed directly on your tax return.

Navigating the Tax Filing Process

Navigating the tax filing process with insurance paperwork involves several steps: - Gather All Documents: Ensure you have all necessary forms and receipts before starting your tax return. - Determine Eligibility for Deductions and Credits: Review the tax laws and your situation to identify potential deductions and credits. - Use Tax Software or Consult a Professional: Tax software can guide you through the process, or you might prefer to consult with a tax professional for more complex situations.

📝 Note: Always keep accurate and detailed records of your insurance premiums and benefits, as these will be essential for filing your taxes accurately and taking advantage of available deductions and credits.

Conclusion and Future Planning

In conclusion, managing your 2018 insurance paperwork for taxes requires a thorough understanding of the relevant tax laws and careful planning. By staying informed and organized, you can navigate the process more efficiently and potentially reduce your tax liability. As tax laws continue to evolve, it’s essential to stay updated on changes that could affect your insurance-related tax benefits in future years.

What types of insurance premiums can be deducted on my 2018 tax return?

+

Certain health insurance premiums, long-term care insurance premiums, and potentially a portion of life insurance premiums related to business use can be deducted, subject to specific conditions and limits.

How do I report health insurance premiums on my tax return for 2018?

+

Health insurance premiums may be reported on your W-2 or provided by your insurance company. You can deduct these premiums if you itemize your deductions and they exceed the applicable threshold of your Adjusted Gross Income (AGI).

Are life insurance proceeds taxable?

+

Generally, life insurance proceeds are not taxable to the beneficiary. However, any interest earned on the proceeds might be subject to taxation.