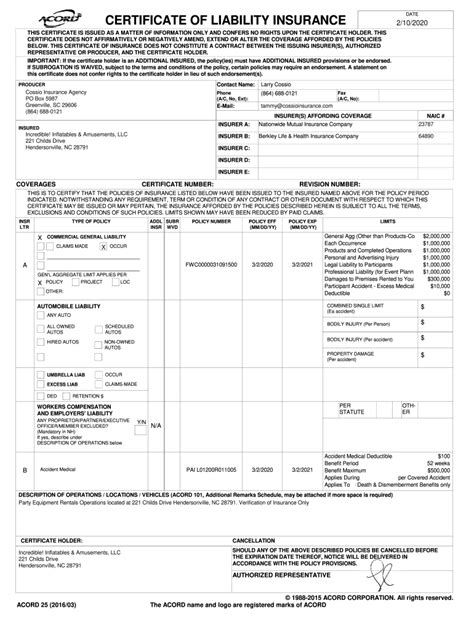

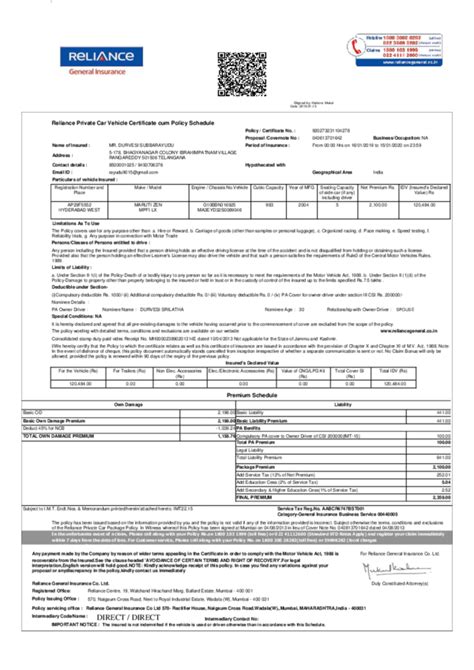

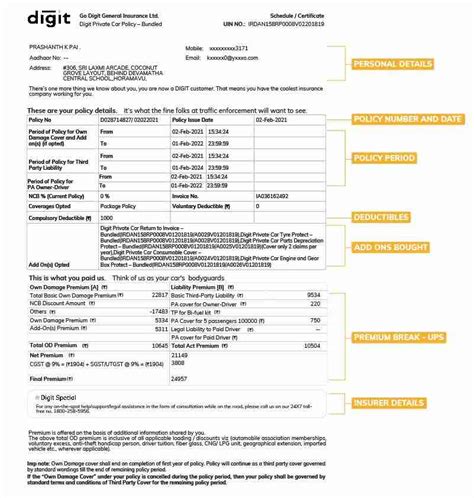

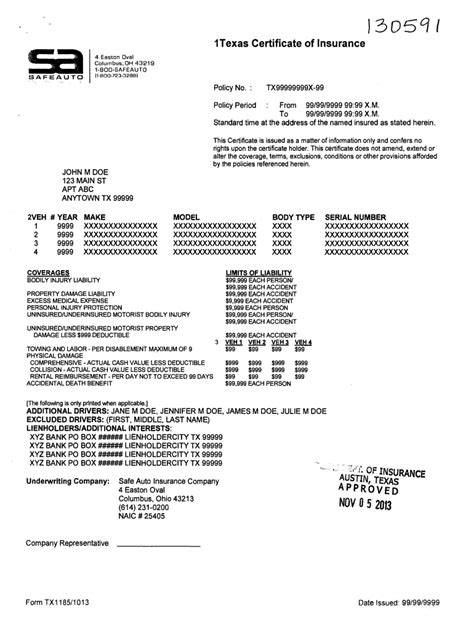

Paperwork

5 Car Insurance Papers

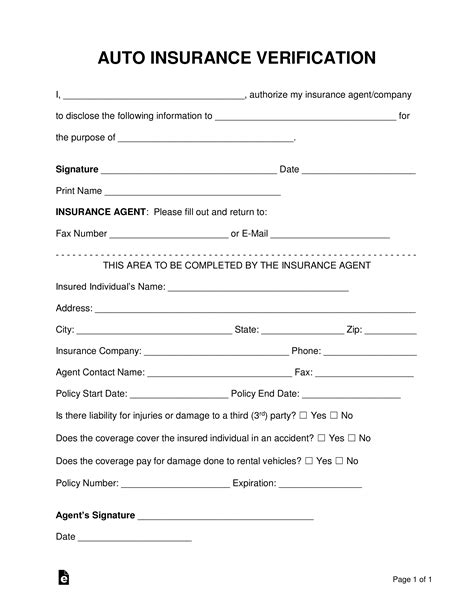

Introduction to Car Insurance Papers

When it comes to car insurance, there are several documents that play a crucial role in ensuring that you are protected in case of an accident or any other unforeseen event. These documents, often referred to as car insurance papers, are essential for verifying the details of your insurance policy, including the coverage, premiums, and terms. In this article, we will delve into the world of car insurance papers, exploring their importance, types, and what you need to know about them.

Types of Car Insurance Papers

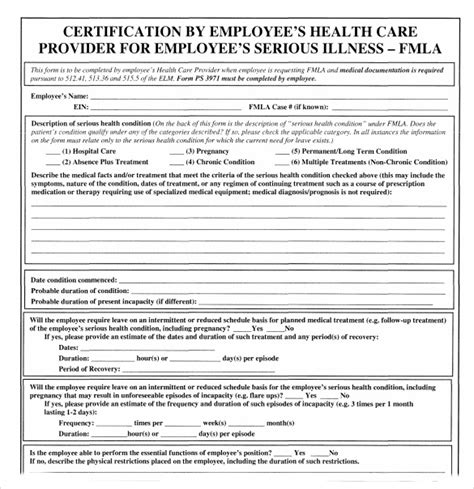

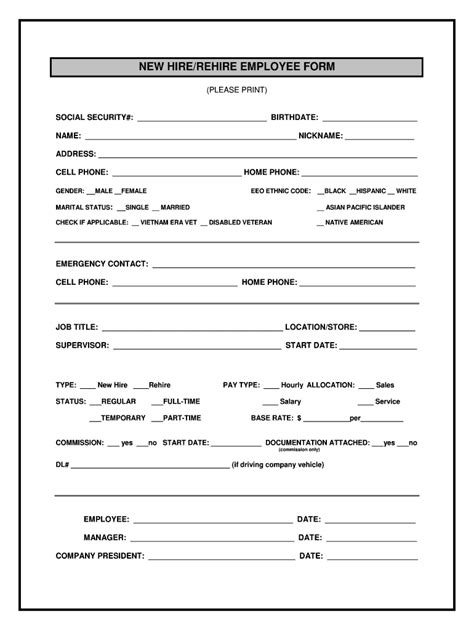

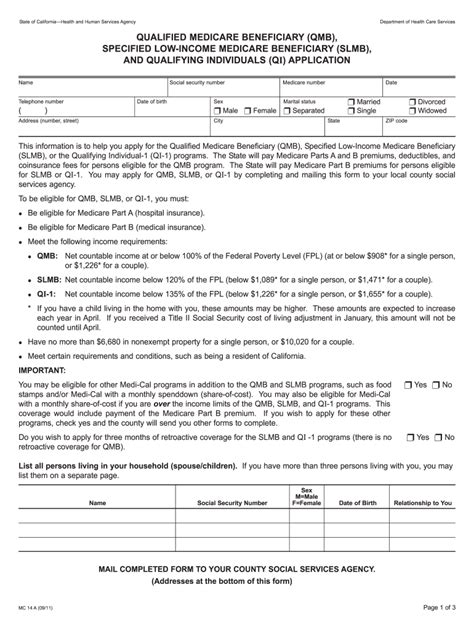

There are several types of car insurance papers that you may encounter, each serving a unique purpose. Here are five key documents: * Insurance Policy Document: This is the primary document that outlines the terms and conditions of your insurance policy, including the coverage, deductibles, and exclusions. * Insurance Card: Also known as a proof of insurance card, this document provides proof that you have an active insurance policy and is often required by law to be carried in your vehicle. * Claim Form: In the event of an accident or other claim, you will need to fill out a claim form to initiate the process of seeking compensation from your insurance provider. * Repair Estimate: If your vehicle requires repairs after an accident, a repair estimate will be provided by the repair shop, outlining the costs and scope of the work needed. * Proof of Insurance Letter: This document is often required by lenders or leasing companies to verify that you have an active insurance policy that meets their requirements.

Importance of Car Insurance Papers

Car insurance papers are essential for several reasons: * Proof of Insurance: They provide proof that you have an active insurance policy, which is often required by law to operate a vehicle. * Policy Details: They outline the terms and conditions of your policy, including the coverage, deductibles, and exclusions. * Claims Process: They are necessary for initiating and processing claims, ensuring that you receive the compensation you are entitled to. * Compliance: They help you comply with regulatory requirements, such as carrying proof of insurance in your vehicle.

How to Obtain Car Insurance Papers

Obtaining car insurance papers is typically a straightforward process: * Contact Your Insurance Provider: Reach out to your insurance provider to request the necessary documents, such as an insurance policy document or proof of insurance card. * Access Online Portal: Many insurance providers offer online portals where you can access and download your insurance documents. * Visit a Local Office: You can also visit a local office of your insurance provider to obtain the necessary documents.

📝 Note: It's essential to keep your car insurance papers up to date and easily accessible, as you never know when you may need them.

Conclusion and Final Thoughts

In conclusion, car insurance papers are a critical aspect of owning and operating a vehicle. They provide proof of insurance, outline policy details, and are necessary for initiating and processing claims. By understanding the different types of car insurance papers and how to obtain them, you can ensure that you are protected in case of an accident or other unforeseen event. Remember to always keep your car insurance papers up to date and easily accessible, and don’t hesitate to reach out to your insurance provider if you have any questions or concerns.

What is the purpose of an insurance policy document?

+

The insurance policy document outlines the terms and conditions of your insurance policy, including the coverage, deductibles, and exclusions.

Why is it essential to carry proof of insurance in my vehicle?

+

Carrying proof of insurance in your vehicle is often required by law and provides proof that you have an active insurance policy, which can help you avoid fines and other penalties.

How do I obtain a proof of insurance letter?

+

You can obtain a proof of insurance letter by contacting your insurance provider or accessing their online portal. They will provide you with a letter that verifies your insurance coverage and meets the requirements of lenders or leasing companies.