5 S Corp Filing Tips

Understanding the Basics of S Corp Filing

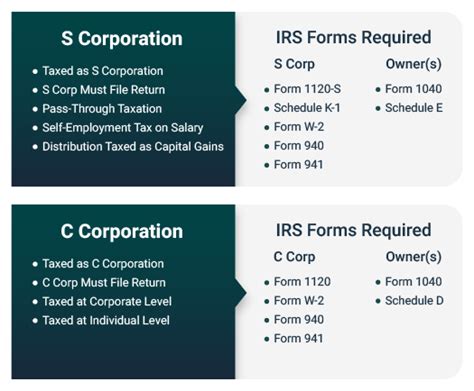

When it comes to forming and maintaining a business, one of the most critical decisions entrepreneurs face is choosing the right business structure. For many, the S Corporation (S Corp) stands out as an attractive option due to its unique blend of liability protection and pass-through taxation. However, navigating the complexities of S Corp filing can be daunting, especially for those new to the business world. In this article, we will delve into the world of S Corp filing, exploring five essential tips to help guide you through the process.

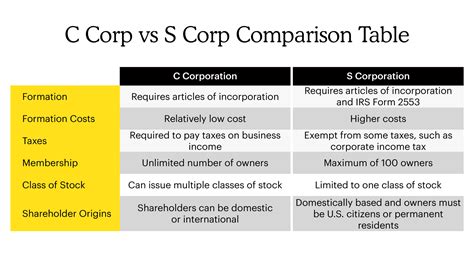

Tip 1: Meet the Eligibility Criteria

Before diving into the filing process, it’s crucial to ensure your business meets the eligibility criteria for S Corp status. The IRS has set forth specific requirements that businesses must adhere to: - The business must be a domestic corporation. - It can have no more than 100 shareholders. - Shareholders can only be U.S. citizens, resident aliens, or certain trusts. - The business can have only one class of stock (though differences in voting rights among shares are permissible). Understanding and complying with these requirements is the first step towards successful S Corp filing.

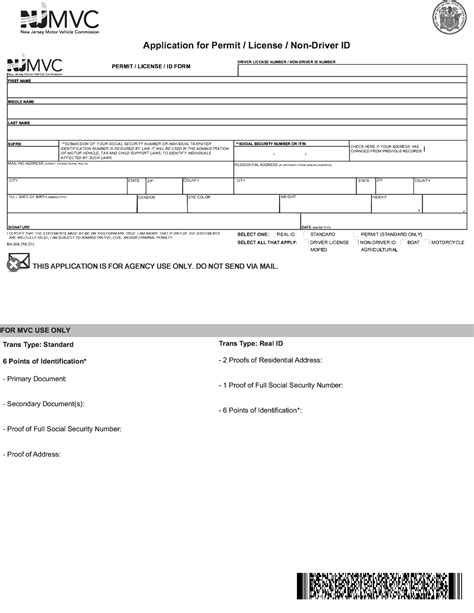

Tip 2: File Articles of Incorporation

To form a corporation, you must file Articles of Incorporation with your state’s business registration agency, usually the Secretary of State’s office. This document provides basic information about your corporation, such as its name, purpose, and structure. While the specific requirements for the Articles of Incorporation vary by state, they generally include: * The corporation’s name and address * The purpose of the corporation * The number and class of shares the corporation is authorized to issue * The names and addresses of the incorporators * The name and address of the registered agent

Tip 3: Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the IRS to identify your business for tax purposes. Obtaining an EIN is a critical step in the S Corp filing process, as it is required for: - Opening a business bank account - Filing tax returns - Hiring employees You can apply for an EIN through the IRS website, and it’s recommended to do so as soon as possible after forming your corporation.

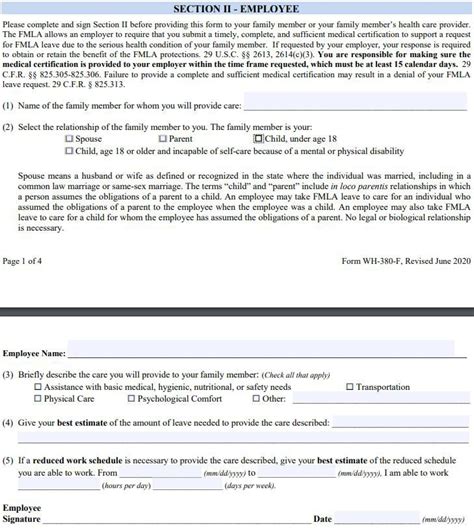

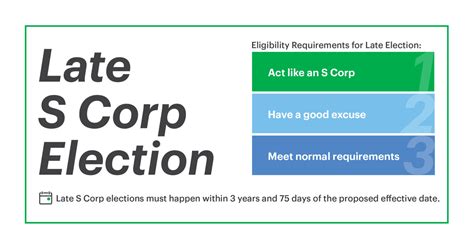

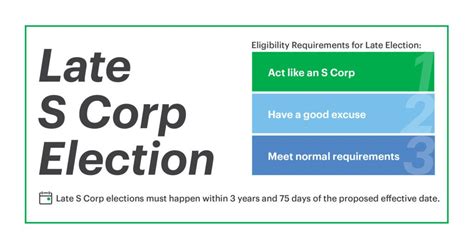

Tip 4: File Form 2553

To elect S Corp status, you must file Form 2553, Election by a Small Business Corporation, with the IRS. This form must be signed by all shareholders and should be filed: - Within 75 days of the corporation’s formation, or - At any time during the tax year prior to which the election is to take effect, provided the corporation has not yet filed its tax return for that year. It’s essential to ensure all information on Form 2553 is accurate and complete, as errors or omissions can lead to delays or even rejection of your S Corp election.

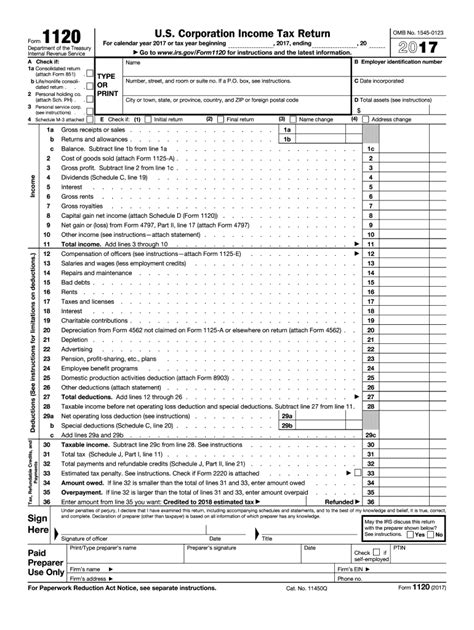

Tip 5: Maintain Compliance

After successfully filing for S Corp status, it’s crucial to maintain ongoing compliance with state and federal regulations. This includes: * Filing annual reports with your state * Holding annual shareholder meetings * Maintaining accurate and detailed corporate records * Filing tax returns (Form 1120S) with the IRS Failure to comply with these requirements can result in penalties, fines, and even the loss of your S Corp status.

📝 Note: Regularly reviewing and updating your corporate bylaws and operating agreement can help ensure you're meeting all necessary compliance requirements.

To further illustrate the importance of maintaining compliance, consider the following table outlining some key annual requirements for S Corps:

| Requirement | Description |

|---|---|

| Annual Reports | Filing annual reports with the state to update business information. |

| Shareholder Meetings | Holding annual meetings to discuss business operations and make decisions. |

| Tax Filings | Filing Form 1120S with the IRS to report corporate income and distribute K-1s to shareholders. |

In the end, navigating the process of S Corp filing requires careful attention to detail and adherence to both state and federal regulations. By understanding the eligibility criteria, filing necessary documents, obtaining an EIN, electing S Corp status through Form 2553, and maintaining ongoing compliance, businesses can reap the benefits of this unique corporate structure. Whether you’re a seasoned entrepreneur or just starting out, ensuring your business is properly set up and maintained is crucial for long-term success and tax efficiency.

What is the main advantage of S Corp status?

+

The main advantage of S Corp status is pass-through taxation, which means corporate income is only taxed at the individual shareholder level, avoiding double taxation.

How many shareholders can an S Corp have?

+

An S Corp can have no more than 100 shareholders, and these shareholders must be U.S. citizens, resident aliens, or certain trusts.

What is the deadline for filing Form 2553?

+

Form 2553 must be filed within 75 days of the corporation’s formation, or at any time during the tax year prior to which the election is to take effect, provided the corporation has not yet filed its tax return for that year.