5 Tax Tips

Introduction to Tax Tips

Understanding tax can be a daunting task, especially with the complex laws and regulations surrounding it. However, being informed about tax tips can help individuals and businesses save money, avoid penalties, and ensure compliance with the law. In this article, we will discuss five essential tax tips that can benefit taxpayers.

Tip 1: Take Advantage of Tax Deductions

Tax deductions are expenses that can be subtracted from taxable income, reducing the amount of tax owed. Common deductions include charitable donations, mortgage interest, and medical expenses. It is essential to keep receipts and records of these expenses to claim them on tax returns. Some other deductions that taxpayers may be eligible for include: * Home office deductions for individuals who work from home * Education expenses for students and lifelong learners * Child care credits for working parents

Tip 2: Utilize Tax Credits

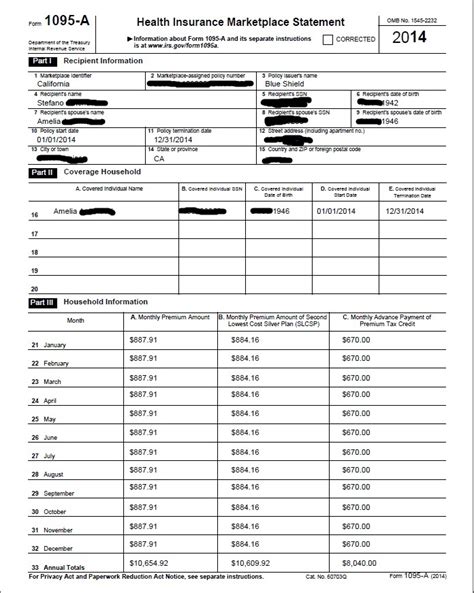

Tax credits are direct reductions to the amount of tax owed, and they can be more beneficial than deductions. Important credits include the Earned Income Tax Credit (EITC) for low-income workers, the Child Tax Credit for families, and the American Opportunity Tax Credit for students. Taxpayers should review their eligibility for these credits and claim them on their tax returns.

Tip 3: Keep Accurate Records

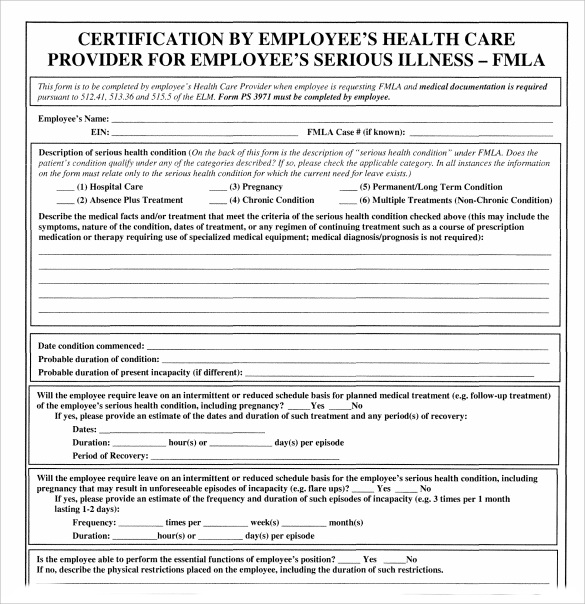

Maintaining accurate and detailed records is crucial for tax purposes. Taxpayers should keep: * Receipts and invoices for business expenses and charitable donations * Bank statements and investment records * W-2 forms and 1099 forms for income verification These records will help taxpayers accurately report their income and claim deductions and credits.

Tip 4: Consider Tax-Deferred Savings Options

Tax-deferred savings options, such as 401(k) and IRA accounts, allow taxpayers to save for retirement while reducing their taxable income. Key benefits of these options include: * Reduced taxable income in the year of contribution * Tax-deferred growth of investment earnings * Penalty-free withdrawals in retirement

Tip 5: Stay Informed About Tax Law Changes

Tax laws and regulations are subject to change, and it is essential for taxpayers to stay informed about these changes. Recent updates may include changes to tax rates, deductions, and credits. Taxpayers can stay up-to-date by: * Visiting the IRS website for news and updates * Subscribing to tax newsletters and publications * Consulting with a tax professional for personalized advice

| Tax Tip | Description |

|---|---|

| Take Advantage of Tax Deductions | Claim deductions for charitable donations, mortgage interest, and medical expenses |

| Utilize Tax Credits | Claim credits for EITC, Child Tax Credit, and American Opportunity Tax Credit |

| Keep Accurate Records | Maintain receipts, bank statements, and income verification documents |

| Consider Tax-Deferred Savings Options | Save for retirement with 401(k) and IRA accounts |

| Stay Informed About Tax Law Changes | Visit the IRS website, subscribe to tax newsletters, and consult with a tax professional |

📝 Note: Tax laws and regulations are subject to change, and it is essential for taxpayers to stay informed about these changes to ensure compliance and maximize tax savings.

In summary, understanding and applying these five tax tips can help individuals and businesses save money, avoid penalties, and ensure compliance with the law. By taking advantage of tax deductions, utilizing tax credits, keeping accurate records, considering tax-deferred savings options, and staying informed about tax law changes, taxpayers can navigate the complex world of taxation with confidence.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces taxable income, while a tax credit directly reduces the amount of tax owed.

How can I stay informed about tax law changes?

+

Visit the IRS website, subscribe to tax newsletters, and consult with a tax professional to stay up-to-date on tax law changes.

What are the benefits of tax-deferred savings options?

+

Tax-deferred savings options, such as 401(k) and IRA accounts, offer reduced taxable income, tax-deferred growth, and penalty-free withdrawals in retirement.