Sole Proprietorship Paperwork Requirements

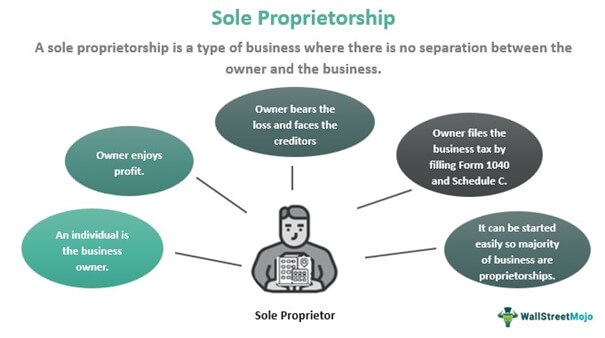

Introduction to Sole Proprietorship

When it comes to starting a business, one of the most common forms of business ownership is a sole proprietorship. This type of business is owned and operated by one individual, who is responsible for all aspects of the business. A sole proprietorship is often considered the simplest form of business to establish, as it requires minimal paperwork and regulatory compliance. However, it is still important to understand the necessary paperwork requirements to ensure that your business is properly established and operated.

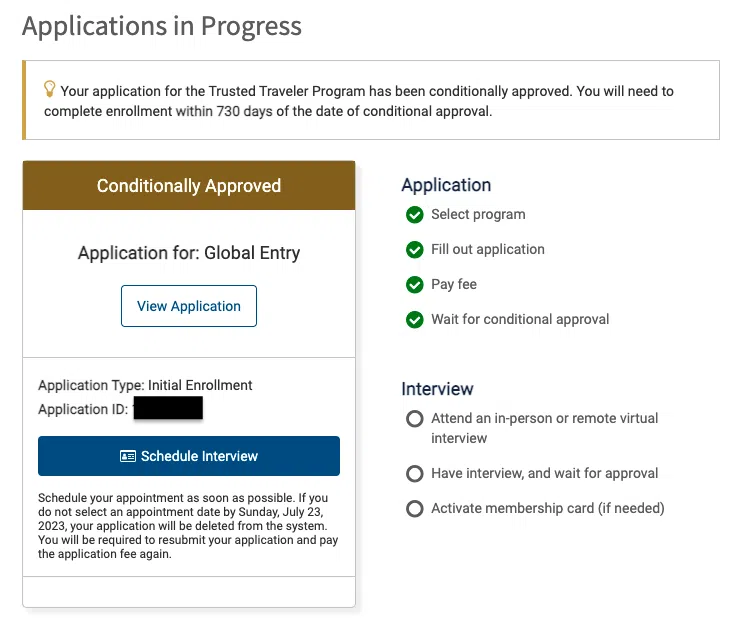

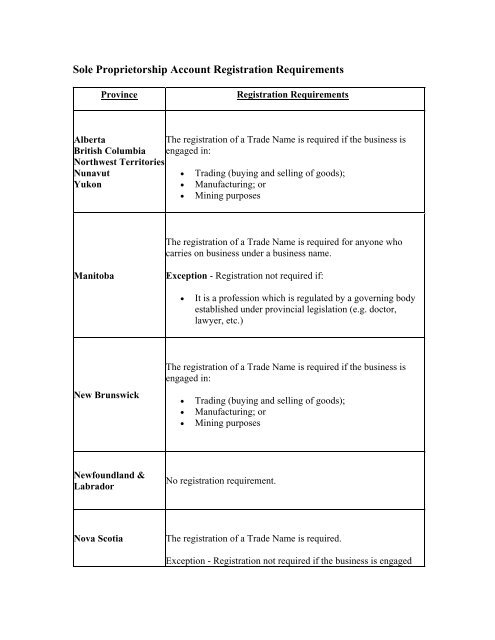

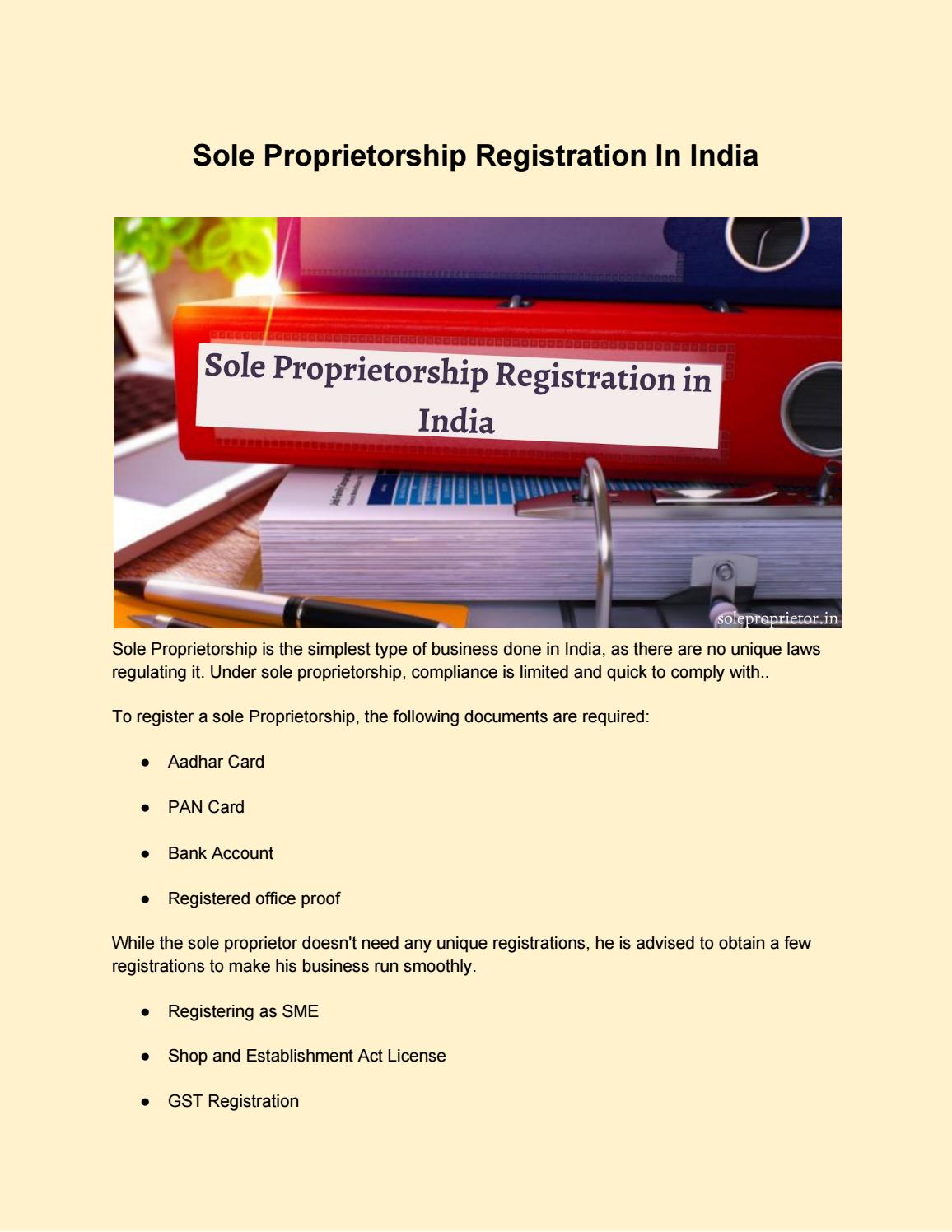

Business Name and Registration

One of the first steps in establishing a sole proprietorship is to choose a business name. The business name should be unique and comply with the naming regulations in your state. Once you have chosen a business name, you will need to register it with the state government. This is typically done by filing a fictitious business name statement, also known as a DBA (doing business as) statement. The registration process typically involves submitting an application and paying a filing fee.

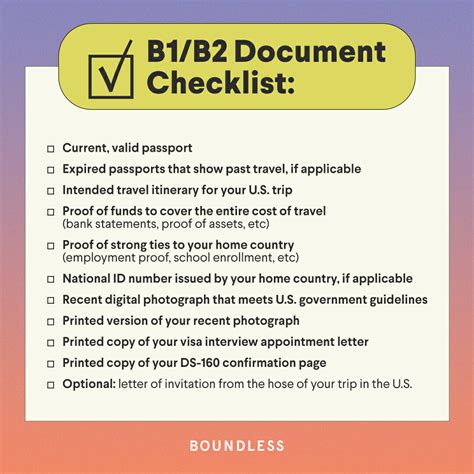

Obtaining Necessary Licenses and Permits

In addition to registering your business name, you will also need to obtain any necessary licenses and permits to operate your business. The types of licenses and permits required will vary depending on the type of business you are operating and the location of your business. Some common licenses and permits include: * Business license: This is a general license that allows you to operate a business in your state or locality. * Sales tax permit: If you sell products or services that are subject to sales tax, you will need to obtain a sales tax permit. * Professional license: If you are operating a business that requires a professional license, such as a law or medical practice, you will need to obtain the necessary license.

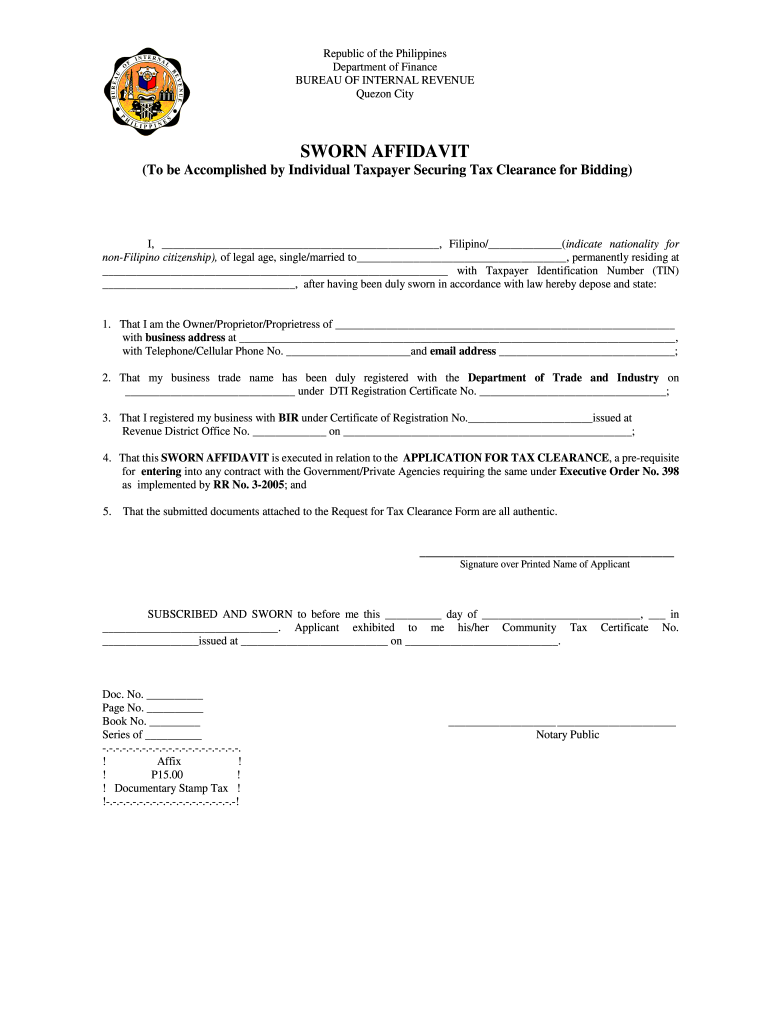

Tax Requirements

As a sole proprietor, you will be responsible for reporting your business income on your personal tax return. You will need to file a Schedule C with your tax return, which will report your business income and expenses. You may also need to make estimated tax payments throughout the year to avoid penalties and interest. Additionally, you may need to obtain an Employer Identification Number (EIN) from the IRS, which is used to identify your business for tax purposes.

Other Paperwork Requirements

In addition to the above requirements, you may also need to comply with other paperwork requirements, such as: * Opening a business bank account: You will need to open a separate business bank account to keep your personal and business finances separate. * Obtaining business insurance: You may want to consider obtaining business insurance to protect your business from liability and other risks. * Keeping accurate records: You will need to keep accurate records of your business income and expenses, as well as any other relevant business documents.

📝 Note: It is always a good idea to consult with an attorney or accountant to ensure that you are complying with all necessary paperwork requirements for your sole proprietorship.

Benefits of Sole Proprietorship

Despite the necessary paperwork requirements, there are many benefits to operating a sole proprietorship. Some of the benefits include: * Easy to establish: A sole proprietorship is often the simplest form of business to establish, as it requires minimal paperwork and regulatory compliance. * Low startup costs: The startup costs for a sole proprietorship are often lower than other forms of business ownership, as you will not need to pay fees to establish a corporation or limited liability company. * Flexibility: As a sole proprietor, you will have complete control over your business and can make decisions quickly and easily. * Tax benefits: A sole proprietorship is often taxed at a lower rate than other forms of business ownership, as you will only need to report your business income on your personal tax return.

Conclusion

In conclusion, while there are necessary paperwork requirements to establish and operate a sole proprietorship, the benefits of this form of business ownership make it an attractive option for many entrepreneurs. By understanding the necessary paperwork requirements and complying with all relevant regulations, you can ensure that your business is properly established and operated. With the flexibility and tax benefits of a sole proprietorship, you can focus on growing your business and achieving your goals.

What is the difference between a sole proprietorship and a limited liability company (LLC)?

+

A sole proprietorship is a business owned and operated by one individual, while an LLC is a separate business entity that can be owned by one or multiple individuals. An LLC provides liability protection for its owners, while a sole proprietorship does not.

Do I need to obtain a business license to operate a sole proprietorship?

+

Yes, you will need to obtain a business license to operate a sole proprietorship. The types of licenses required will vary depending on the type of business you are operating and the location of your business.

How do I report my business income as a sole proprietor?

+

You will need to report your business income on your personal tax return using a Schedule C. You may also need to make estimated tax payments throughout the year to avoid penalties and interest.