Sign Paperwork for Tax Abatement

Understanding Tax Abatement and Its Benefits

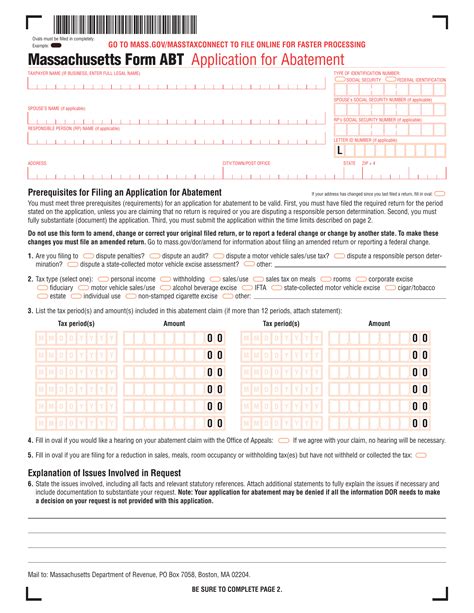

Tax abatement is a reduction or exemption from paying taxes, usually granted by a government entity to encourage economic development, job creation, or investment in a specific area. This incentive can be particularly appealing to businesses looking to expand or relocate, as it can significantly reduce their operational costs. To avail of tax abatement, businesses must sign paperwork that outlines the terms and conditions of the agreement.

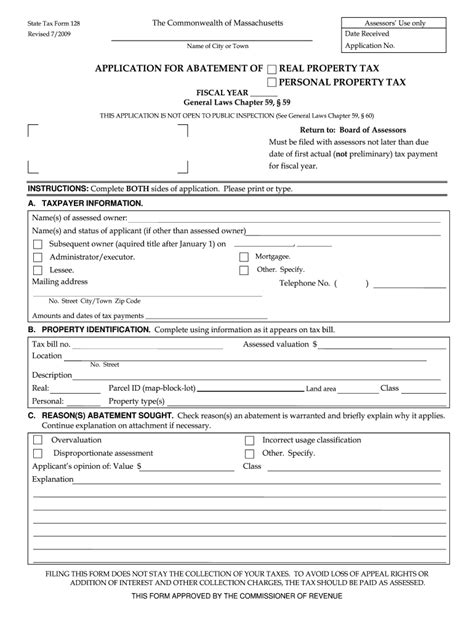

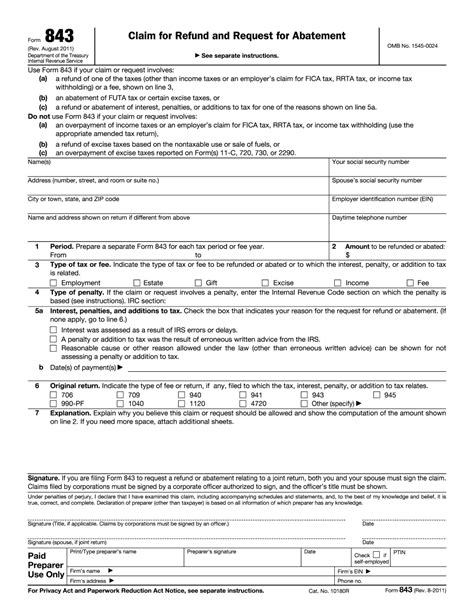

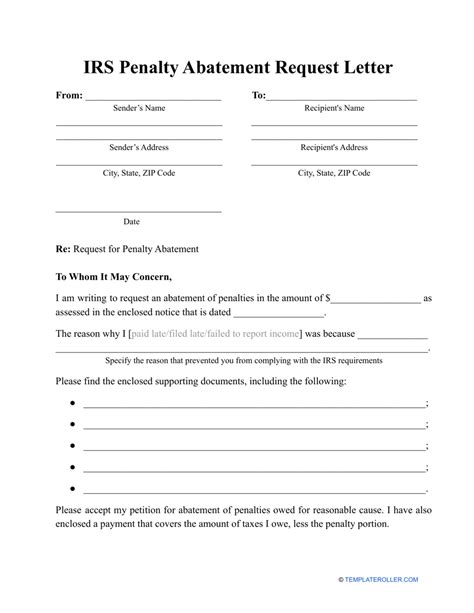

Signing paperwork for tax abatement is a crucial step in the process, as it legally binds the parties involved and outlines the specifics of the agreement. The paperwork typically includes details such as the duration of the abatement, the amount of taxes to be abated, and any conditions that must be met by the business to maintain eligibility for the abatement. It's essential for businesses to carefully review the terms to ensure they understand their obligations and the benefits they will receive.

Steps to Sign Paperwork for Tax Abatement

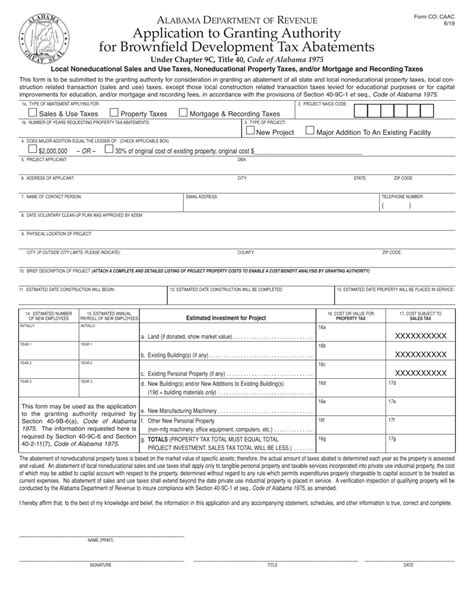

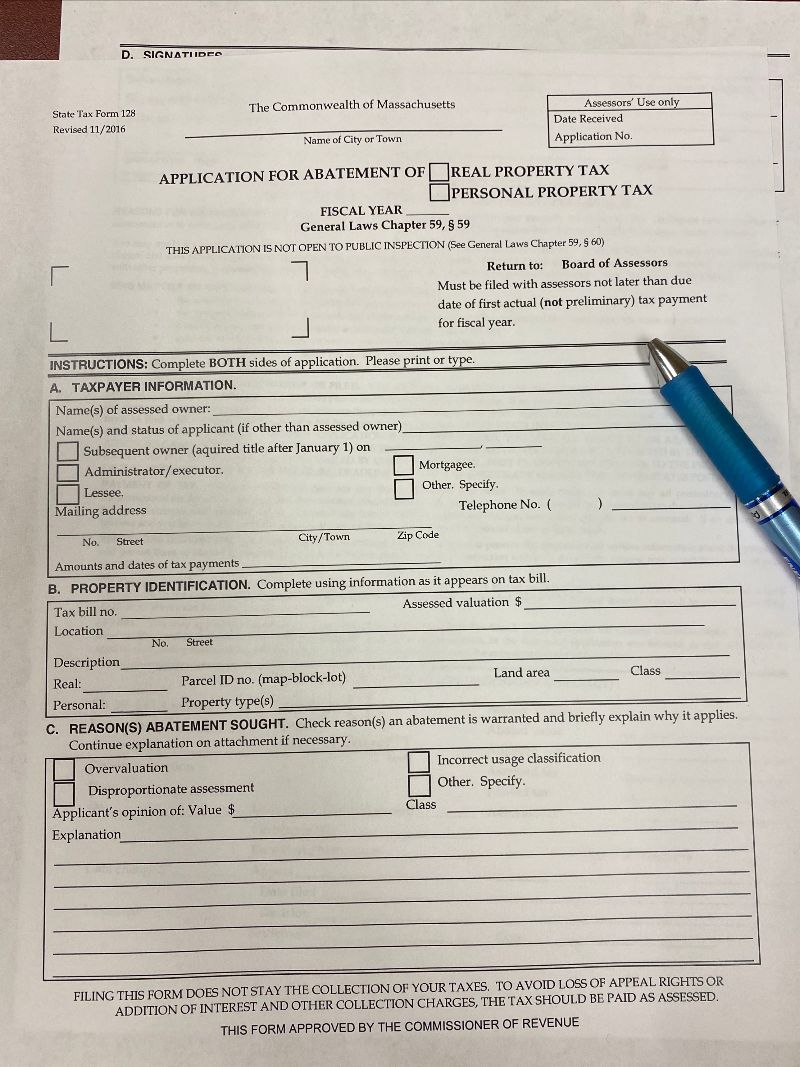

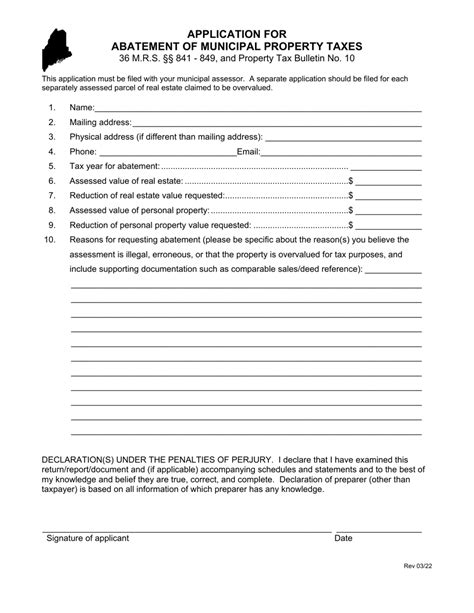

The process of signing paperwork for tax abatement involves several steps: - Application Submission: The business submits an application to the relevant government agency, providing detailed information about the project, including investment amounts, job creation plans, and the potential economic impact. - Review and Approval: The government agency reviews the application, assessing the potential benefits of the project and ensuring it aligns with the economic development goals of the area. - Negotiation of Terms: Once the application is approved, the business and the government agency negotiate the terms of the tax abatement, including the percentage of taxes to be abated and the duration of the agreement. - Signing of the Agreement: After the terms are agreed upon, the business signs the paperwork, which is then countersigned by the government agency, finalizing the tax abatement agreement.

📝 Note: It's crucial for businesses to seek legal counsel during the negotiation and signing process to ensure their interests are protected and they fully understand the obligations and benefits outlined in the agreement.

Benefits of Tax Abatement

Tax abatement offers several benefits to businesses, including: - Reduced Operational Costs: By reducing or eliminating certain taxes, businesses can lower their operational costs, making them more competitive. - Increased Investment: Savings from tax abatement can be reinvested in the business, facilitating expansion, modernization, or hiring more employees. - Job Creation: Tax abatement can lead to job creation, both directly through the business operations and indirectly through the economic stimulus it provides to the local community. - Economic Growth: By attracting businesses and investments, tax abatement can contribute to the overall economic growth of an area, improving infrastructure, services, and the quality of life for residents.

For governments, tax abatement is a tool to attract new businesses, retain existing ones, and stimulate economic growth. While it may result in short-term revenue losses, the long-term benefits of increased economic activity, job creation, and eventual tax payments from the businesses once the abatement period ends can outweigh these costs.

Challenges and Considerations

While tax abatement can be a powerful economic development tool, it also presents challenges and considerations: - Equity and Fairness: There can be concerns about the fairness of tax abatements, as they may be seen to favor certain businesses over others, potentially leading to an uneven playing field. - Revenue Impact: Governments must carefully consider the impact of tax abatements on their revenue streams, ensuring that the benefits of economic growth outweigh the costs of reduced tax income. - Compliance and Monitoring: Businesses receiving tax abatements must comply with the terms of their agreements, which can include requirements for job creation, investment levels, and operational standards. Governments must monitor compliance to ensure the public benefits from these agreements are realized.

| Benefits | Challenges |

|---|---|

| Reduced Operational Costs | Equity and Fairness Concerns |

| Increased Investment | Revenue Impact on Governments |

| Job Creation and Economic Growth | Compliance and Monitoring Requirements |

Despite these challenges, when properly managed and monitored, tax abatement can be a win-win for both businesses and governments, fostering economic development and growth.

In summary, signing paperwork for tax abatement is a significant step for businesses looking to benefit from this economic incentive. It's essential to understand the terms, benefits, and obligations involved to make the most of this opportunity. By doing so, businesses can contribute to and benefit from the economic growth and development of their area, creating a prosperous environment for all stakeholders involved.

What is tax abatement, and how does it work?

+

Tax abatement is a reduction or exemption from paying taxes, granted by a government to encourage economic development. It works by reducing or eliminating certain taxes for a specified period, helping businesses lower their operational costs and invest in their operations or expansion.

What are the benefits of tax abatement for businesses?

+

The benefits include reduced operational costs, increased investment capabilities, job creation, and contribution to economic growth. These incentives can make a business more competitive and facilitate its growth and expansion.

What are some challenges associated with tax abatement?

+

Challenges include concerns about equity and fairness, the impact on government revenue, and the need for compliance and monitoring. Despite these, when managed properly, tax abatement can be a beneficial tool for economic development.