Check IRS Paperwork Status

Introduction to Checking IRS Paperwork Status

The Internal Revenue Service (IRS) is responsible for collecting taxes and administering tax laws in the United States. When dealing with the IRS, whether it’s for personal or business purposes, understanding how to check the status of your paperwork is crucial. This process can help you stay on top of your tax obligations, ensure timely processing of your returns, and resolve any issues promptly. In this article, we’ll delve into the ways to check your IRS paperwork status, the importance of doing so, and provide guidance on how to navigate the IRS system efficiently.

Why Check Your IRS Paperwork Status?

Checking the status of your IRS paperwork is essential for several reasons: - Timely Refunds: If you’re expecting a refund, tracking the status of your return can give you an estimate of when you might receive it. - Issue Resolution: If there are any issues with your paperwork, such as missing information or errors, checking the status can help you identify and resolve these problems sooner. - Compliance: Ensuring that your paperwork is processed and accepted by the IRS helps you maintain compliance with tax laws, avoiding potential penalties or audits. - Planning: Knowing the status of your tax returns can help with financial planning, especially if you’re relying on a refund or need to address any tax debts.

Methods to Check IRS Paperwork Status

The IRS provides several methods to check the status of your paperwork, making it convenient for individuals and businesses to stay informed:

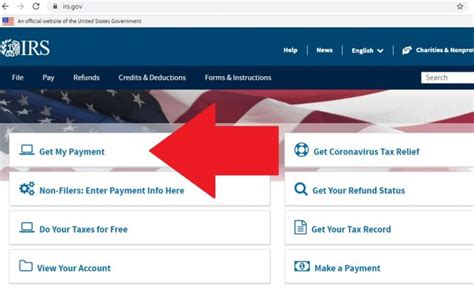

Online

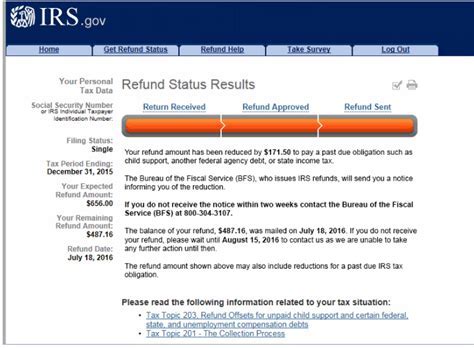

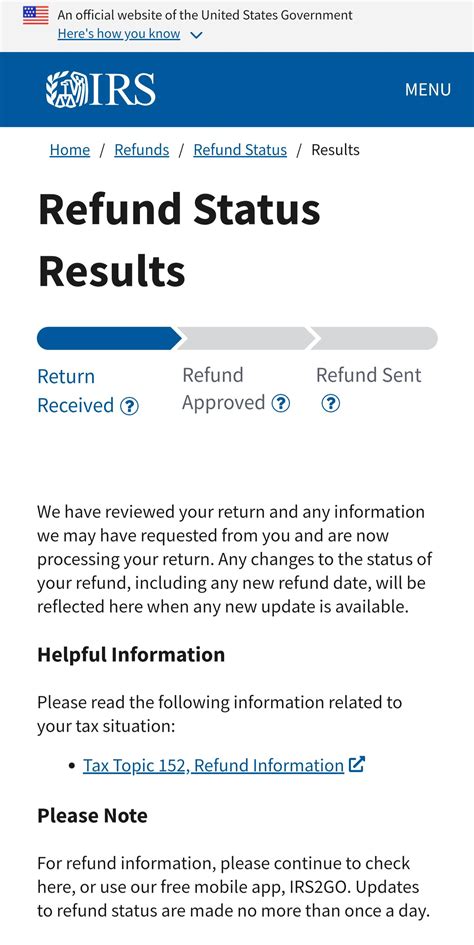

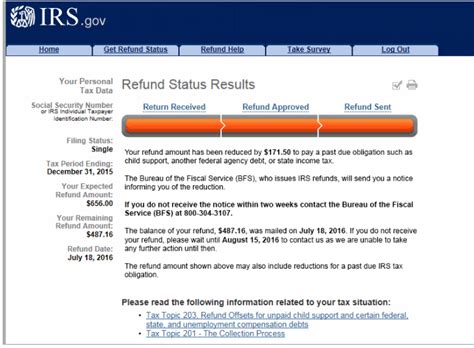

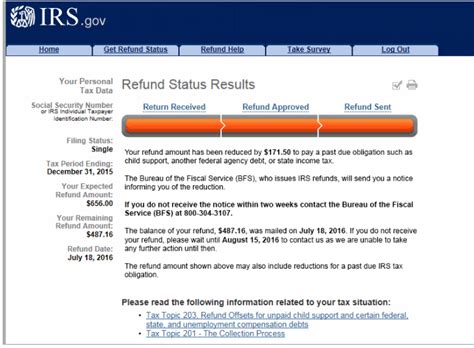

The IRS website (irs.gov) offers a “Where’s My Refund?” tool that allows you to check the status of your tax return. You’ll need to provide your Social Security number, filing status, and the exact refund amount shown on your return. This tool is available 24 hours a day, 7 days a week.

Phone

You can call the IRS refund hotline at 1-800-829-1040 to check on the status of your return. Be prepared to provide the same information as required for the online tool.

In Person

Visiting a local IRS office can also provide you with the status of your paperwork. However, this method may require more time and preparation, as you’ll need to make an appointment and bring identification and a copy of your return.

IRS2Go App

The IRS offers a mobile app, IRS2Go, which allows you to check your refund status, make payments, and find free tax preparation services, among other features.

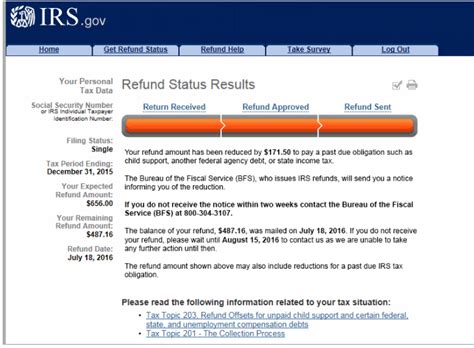

Understanding the Status Messages

When checking your paperwork status, you might come across several status messages: - Return Received: The IRS has received your return and is processing it. - Refund Approved: The IRS has approved your refund, and it’s being processed. - Refund Sent: Your refund has been sent to your bank or mailed to you. - More Information Needed: There’s an issue with your return, and the IRS needs more information from you.

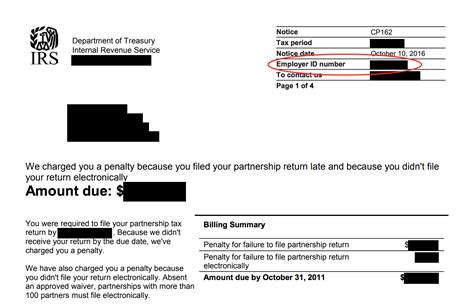

Resolving Issues with Your Paperwork

If there are issues with your paperwork, such as missing information or errors, the IRS will typically notify you. Here are steps to resolve these issues: - Respond Promptly: Address any requests for more information as quickly as possible to avoid delays. - Correct Errors: If you’ve made an error on your return, you may need to file an amended return (Form 1040-X). - Contact the IRS: If you’re unsure about how to resolve an issue, contacting the IRS directly can provide guidance.

📝 Note: Keeping accurate records of all correspondence with the IRS, including dates, times, and details of conversations, can be very helpful in resolving issues efficiently.

Best Practices for Dealing with the IRS

To make dealing with the IRS smoother, consider the following best practices: - Stay Organized: Keep all tax-related documents and correspondence in one place. - Be Patient: Processing times can vary, so it’s essential to be patient and check the status periodically. - Seek Professional Help: If you’re unsure about any part of the process, consider consulting a tax professional.

| Method | Description |

|---|---|

| Online | Use the IRS website to check your refund status. |

| Phone | Call the IRS refund hotline. |

| In Person | Visit a local IRS office. |

| IRS2Go App | Check your refund status and more via the mobile app. |

In summary, checking the status of your IRS paperwork is a straightforward process that can be done through various methods. Staying informed about the status of your tax returns and resolving any issues promptly can help ensure a smooth and compliant experience with the IRS. Whether you’re waiting for a refund, addressing an issue, or simply wanting to stay on top of your tax obligations, understanding how to navigate the IRS system is key.

How long does it take for the IRS to process a tax return?

+

The processing time for tax returns can vary, but the IRS typically processes electronic returns within 2-3 weeks and paper returns within 6-8 weeks.

What if I made a mistake on my tax return?

+

If you’ve made an error, you may need to file an amended return (Form 1040-X). It’s best to address the issue as soon as possible to avoid any delays or penalties.

Can I check the status of my refund if I filed a paper return?

+

Yes, you can check the status of your refund regardless of whether you filed electronically or by paper. However, paper returns may take longer to process.