Paperwork

Organize Bills Easily

Introduction to Bill Organization

Managing bills can be a daunting task, especially when dealing with multiple due dates, varying payment methods, and the risk of late fees. However, with the right strategies and tools, it’s possible to simplify the process and ensure that all bills are paid on time. In this article, we will explore various methods for organizing bills, including the use of budgeting apps, spreadsheets, and traditional paper-based systems.

Understanding the Importance of Bill Organization

Effective bill management is crucial for maintaining a healthy financial situation. Late payments can result in additional fees, damage to credit scores, and even lead to service interruptions. Moreover, keeping track of bills can help individuals identify areas where they can cut back on unnecessary expenses, leading to cost savings and a more sustainable financial future. By implementing a reliable bill organization system, individuals can reduce stress, avoid late fees, and make informed financial decisions.

Methods for Organizing Bills

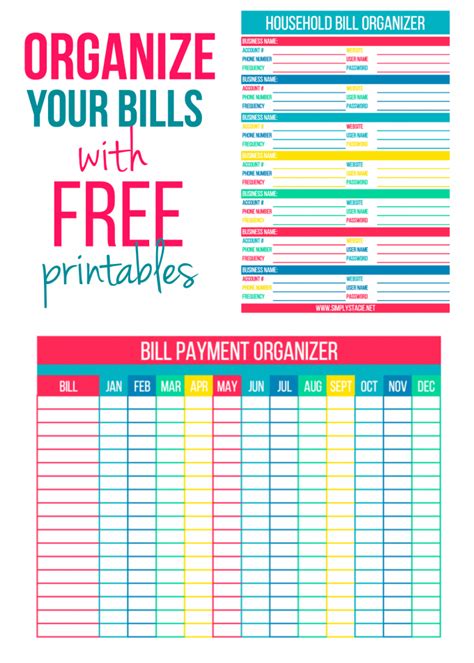

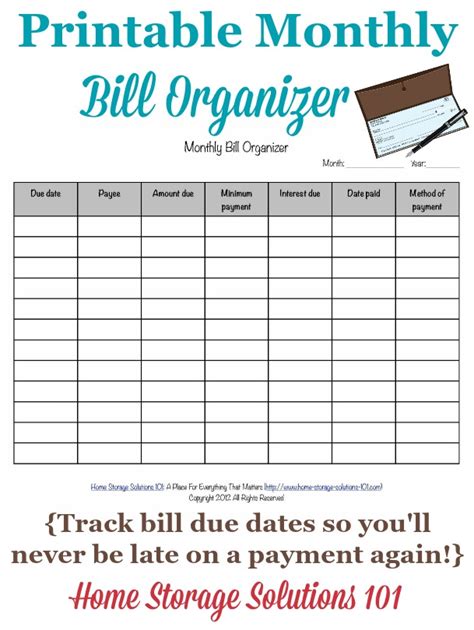

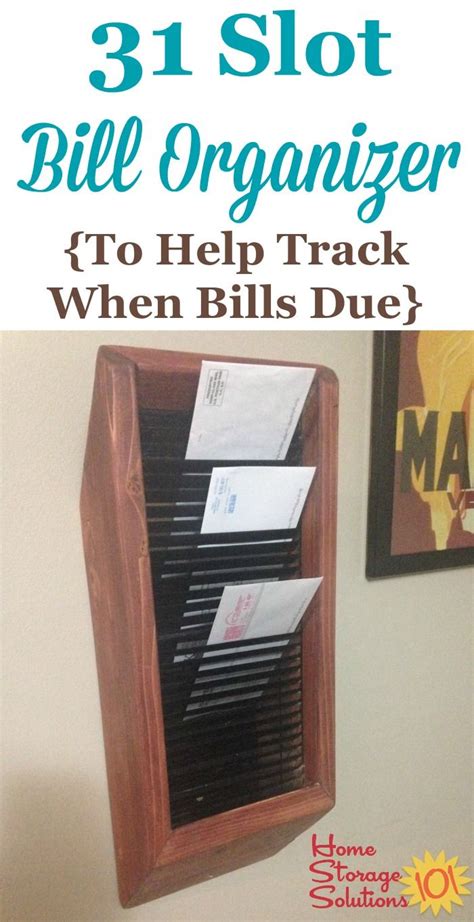

There are several approaches to organizing bills, each with its own advantages and disadvantages. Some of the most popular methods include: * Automated bill payments: Setting up automatic payments through bank accounts or credit cards can ensure that bills are paid on time, eliminating the risk of late fees. * Budgeting apps: Utilizing apps like Mint, You Need a Budget (YNAB), or Personal Capital can provide a centralized platform for tracking bills, creating budgets, and receiving payment reminders. * Spreadsheets: Creating a spreadsheet to track bills can offer a high degree of customization and flexibility, allowing users to categorize expenses, set reminders, and analyze spending patterns. * Paper-based systems: Using a physical calendar, folder, or binder to store bills and payment receipts can provide a tactile approach to bill management, suitable for those who prefer a traditional method.

Implementing a Bill Organization System

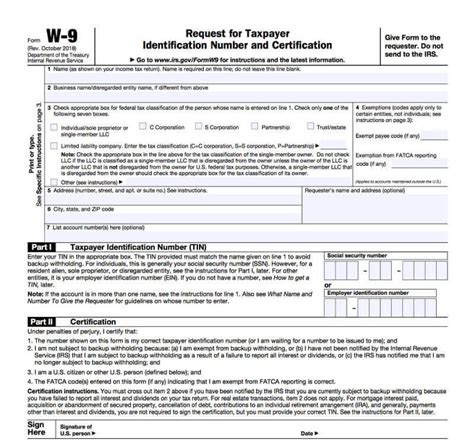

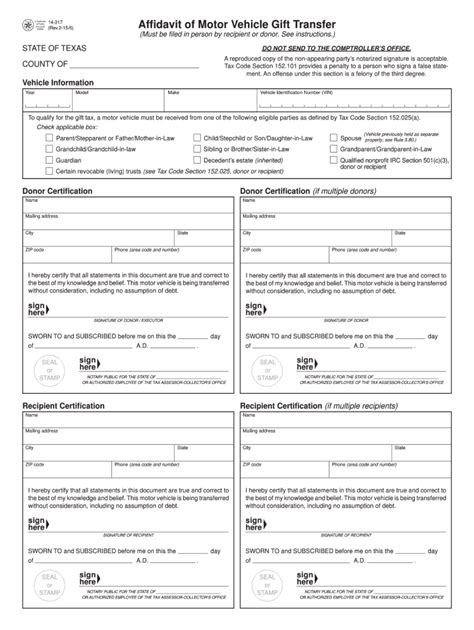

To implement a successful bill organization system, follow these steps: 1. Gather all bills: Collect all current bills, including utility bills, credit card statements, loan documents, and any other recurring expenses. 2. Categorize bills: Group bills into categories, such as housing, transportation, and entertainment, to facilitate budgeting and expense tracking. 3. Set up payment reminders: Establish reminders for each bill, using either automated notifications or manual calendar entries. 4. Prioritize bills: Identify essential bills, such as rent/mortgage and utility payments, and ensure they are paid first. 5. Review and adjust: Regularly review the bill organization system to ensure it remains effective and make adjustments as needed.

💡 Note: It's essential to review and understand the terms and conditions of each bill, including payment due dates, late fees, and any potential penalties.

Benefits of Bill Organization

A well-structured bill organization system offers numerous benefits, including: * Reduced stress: Knowing that bills are under control can alleviate financial anxiety and promote peace of mind. * Improved credit scores: Paying bills on time can positively impact credit scores, leading to better loan terms and lower interest rates. * Increased savings: By identifying areas for cost reduction, individuals can allocate more funds towards savings and investments. * Enhanced financial awareness: Tracking bills and expenses can provide valuable insights into spending habits, enabling informed decisions about financial priorities.

Common Bill Organization Mistakes

When implementing a bill organization system, it’s essential to avoid common pitfalls, such as: * Insufficient tracking: Failing to monitor bills and payments can lead to missed due dates and late fees. * Inadequate budgeting: Not allocating sufficient funds for bills can result in financial shortfalls and stress. * Lack of review: Neglecting to regularly review the bill organization system can lead to inefficiencies and missed opportunities for cost savings.

Conclusion

In conclusion, organizing bills is a critical aspect of maintaining a healthy financial situation. By understanding the importance of bill organization, selecting a suitable method, and implementing a reliable system, individuals can reduce stress, avoid late fees, and make informed financial decisions. Remember to regularly review and adjust the bill organization system to ensure it remains effective and aligned with changing financial priorities.

What is the best method for organizing bills?

+

The best method for organizing bills depends on individual preferences and needs. Automated bill payments, budgeting apps, spreadsheets, and paper-based systems are all viable options.

How often should I review my bill organization system?

+

It’s recommended to review your bill organization system regularly, ideally every 3-6 months, to ensure it remains effective and aligned with changing financial priorities.

What are the benefits of using a budgeting app for bill organization?

+

Budgeting apps offer a centralized platform for tracking bills, creating budgets, and receiving payment reminders. They can also provide valuable insights into spending habits and help identify areas for cost reduction.