5 Tips Credit Insurance

Introduction to Credit Insurance

Credit insurance is a type of insurance policy that protects lenders against losses that may arise when borrowers default on their loans. It is commonly used for credit cards, mortgages, and other types of loans. In this article, we will provide 5 tips on credit insurance that can help you make informed decisions when considering this type of insurance.

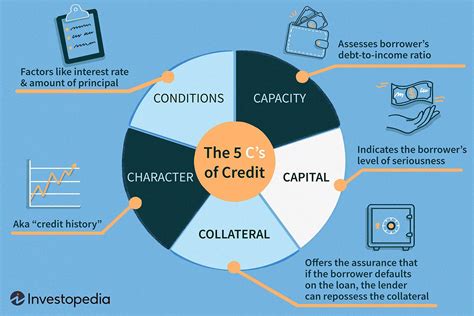

What is Credit Insurance?

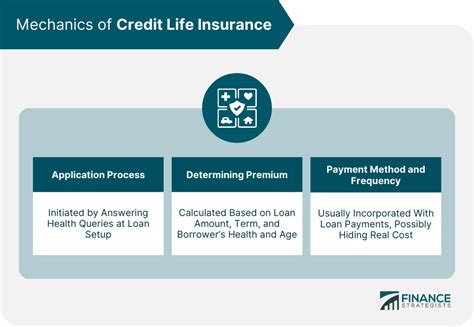

Credit insurance is designed to provide protection to lenders in the event that a borrower is unable to repay their loan. This type of insurance can provide peace of mind for lenders, as it can help to mitigate the risk of default. There are different types of credit insurance, including credit life insurance and credit disability insurance. Credit life insurance pays off the outstanding balance of a loan in the event of the borrower’s death, while credit disability insurance makes payments on the loan if the borrower becomes disabled and is unable to work.

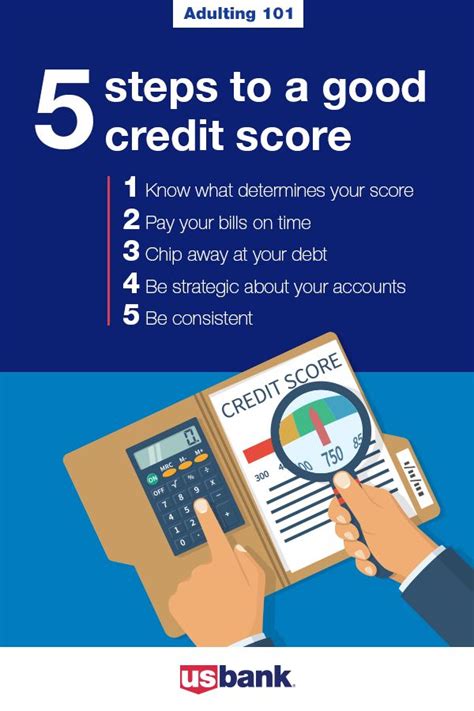

5 Tips for Credit Insurance

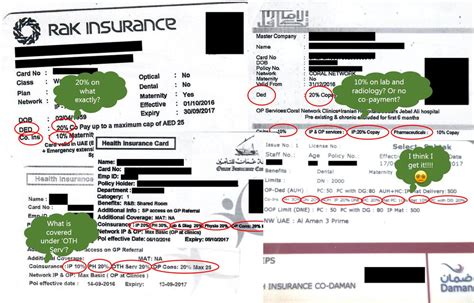

Here are 5 tips to consider when looking at credit insurance: * Tip 1: Understand the Terms and Conditions: Before purchasing credit insurance, it is essential to understand the terms and conditions of the policy. This includes the premium, coverage, and any exclusions or limitations. * Tip 2: Shop Around: It is crucial to shop around and compare different credit insurance policies before making a decision. This can help you find the best policy for your needs and budget. * Tip 3: Consider the Cost: Credit insurance can be expensive, so it is essential to consider the cost and whether it is worth the investment. You should weigh the benefits of the insurance against the cost of the premiums. * Tip 4: Check the Policy’s Coverage: It is vital to check the policy’s coverage and ensure that it meets your needs. This includes checking the amount of coverage, the duration of the policy, and any exclusions or limitations. * Tip 5: Read Reviews and Check Ratings: Finally, it is essential to read reviews and check ratings of different credit insurance providers before making a decision. This can help you find a reputable and reliable provider.

Benefits of Credit Insurance

Credit insurance can provide several benefits, including: * Protection for Lenders: Credit insurance can provide protection for lenders in the event of default, which can help to mitigate the risk of lending. * Peace of Mind: Credit insurance can provide peace of mind for borrowers, as it can help to ensure that their loan is paid off in the event of death or disability. * Flexibility: Credit insurance can be flexible, with different types of policies and coverage options available.

Types of Credit Insurance

There are different types of credit insurance, including:

| Type of Insurance | Description |

|---|---|

| Credit Life Insurance | Pays off the outstanding balance of a loan in the event of the borrower’s death |

| Credit Disability Insurance | Makes payments on the loan if the borrower becomes disabled and is unable to work |

| Credit Unemployment Insurance | Makes payments on the loan if the borrower becomes unemployed |

📝 Note: It is essential to carefully review the terms and conditions of a credit insurance policy before purchasing, as the coverage and exclusions can vary significantly between providers.

In summary, credit insurance can provide protection for lenders and peace of mind for borrowers. By understanding the terms and conditions, shopping around, considering the cost, checking the policy’s coverage, and reading reviews and checking ratings, you can make informed decisions when considering credit insurance. With the right policy, you can enjoy the benefits of credit insurance, including protection, peace of mind, and flexibility.

What is credit insurance?

+

Credit insurance is a type of insurance policy that protects lenders against losses that may arise when borrowers default on their loans.

What are the benefits of credit insurance?

+

Credit insurance can provide protection for lenders, peace of mind for borrowers, and flexibility, with different types of policies and coverage options available.

How do I choose the right credit insurance policy?

+

To choose the right credit insurance policy, you should understand the terms and conditions, shop around, consider the cost, check the policy’s coverage, and read reviews and check ratings.