Real Estate Purchase Paperwork Required

Introduction to Real Estate Purchase Paperwork

When purchasing a property, whether it’s a house, apartment, or commercial building, the process involves a significant amount of paperwork. This can be overwhelming, especially for first-time buyers. Understanding the different types of documents required can help simplify the process and ensure a smooth transaction. In this article, we will delve into the various types of paperwork needed for a real estate purchase, highlighting their importance and the role they play in the buying process.

Pre-Purchase Documents

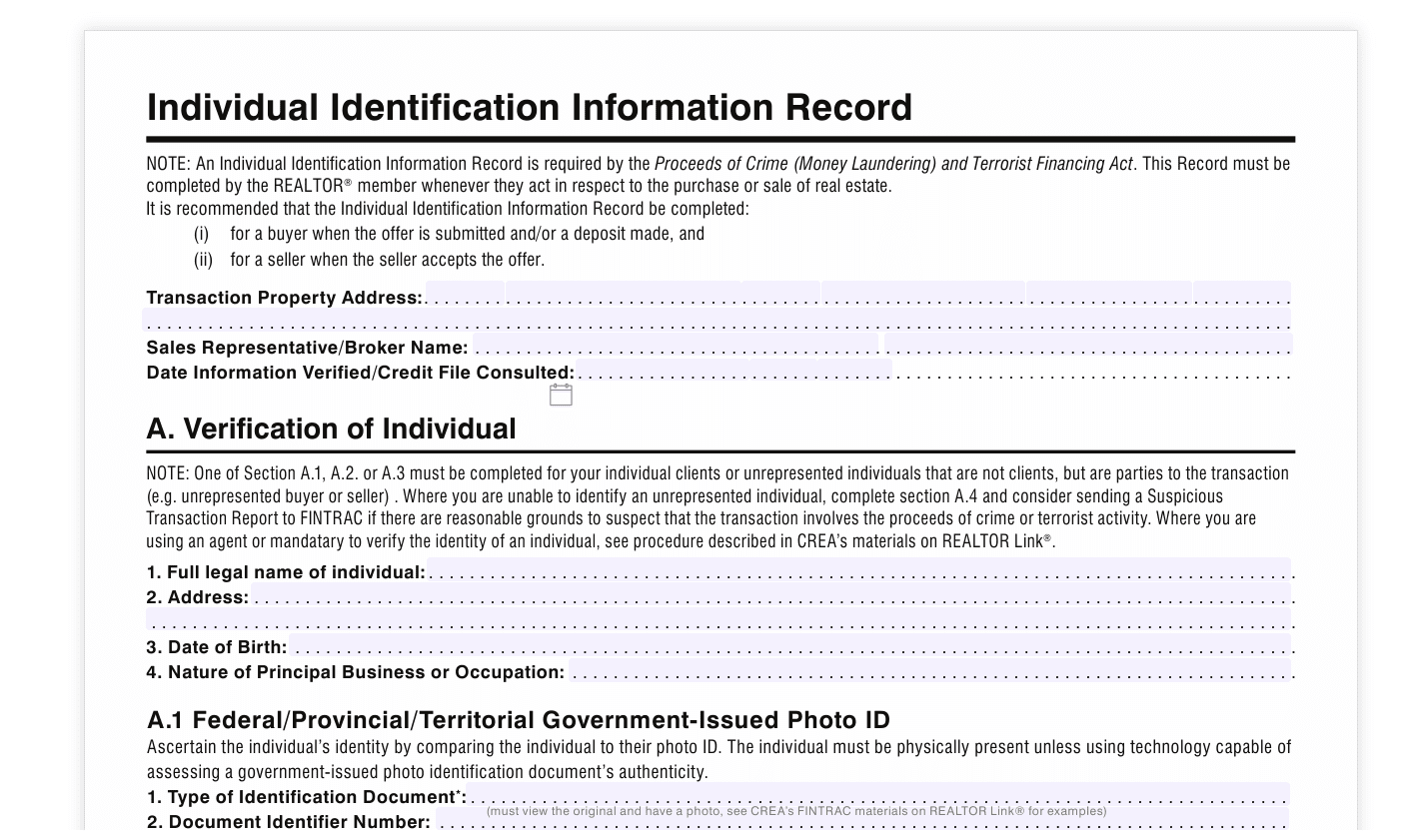

Before the actual purchase, several documents are necessary to initiate the process. These include: - Pre-approval letter: This document is provided by a lender, indicating the amount of money the buyer is eligible to borrow. - Proof of income: Buyers need to show their income through pay stubs, W-2 forms, or tax returns to verify their financial capacity. - Identification documents: A valid government-issued ID, such as a driver’s license or passport, is required for identity verification. - Bank statements: Recent bank statements are needed to show the buyer’s savings and financial stability.

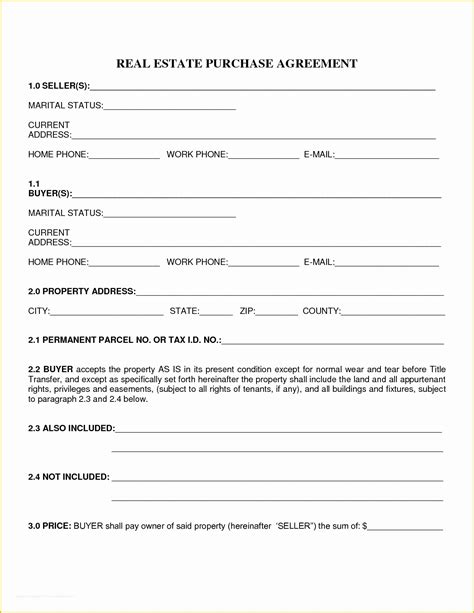

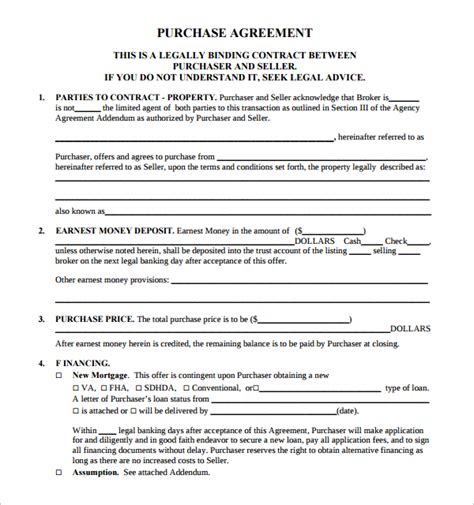

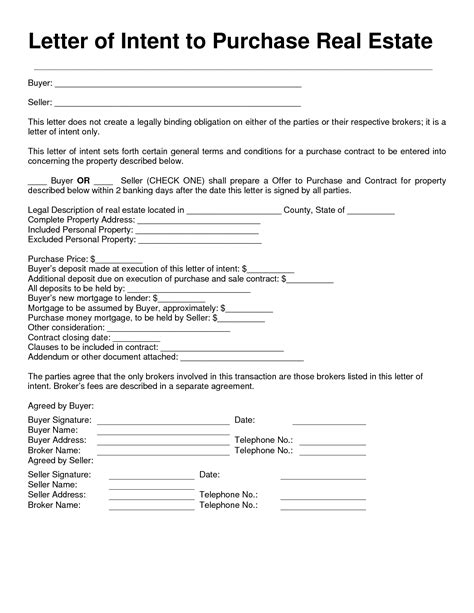

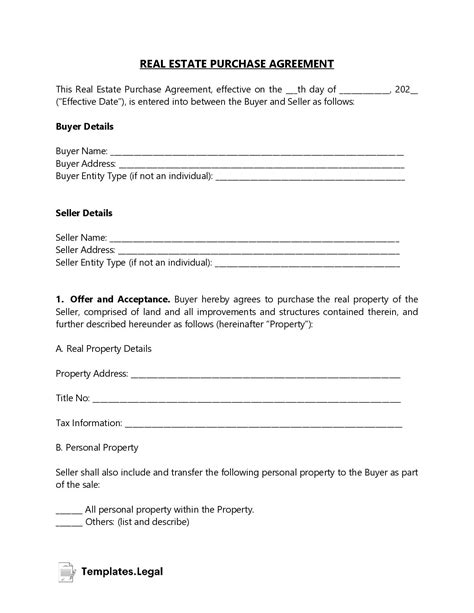

Purchase Agreement

The purchase agreement, also known as the sales contract, is a legally binding document that outlines the terms of the sale. It includes: - Property description: Detailed information about the property, including its address, size, and any included features or appliances. - Purchase price: The agreed-upon price for the property. - Payment terms: How the buyer intends to pay for the property, including financing details. - Contingencies: Conditions that must be met for the sale to proceed, such as a satisfactory home inspection or the buyer’s ability to secure financing. - Closing date: The date by which the sale must be finalized.

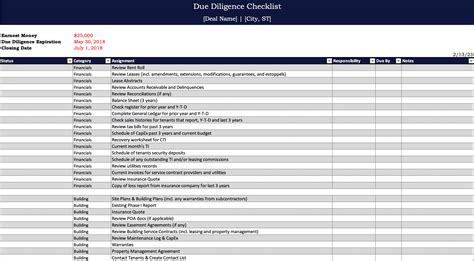

Inspection and Due Diligence Reports

After the purchase agreement is signed, the buyer typically conducts inspections and reviews reports to ensure the property’s condition and value. These may include: - Home inspection report: Identifies any defects or needed repairs in the property. - Termite inspection report: Checks for termite damage or activity. - Environmental reports: Look for signs of environmental hazards such as lead-based paint or asbestos. - Appraisal report: An independent assessment of the property’s value, often required by lenders.

Financing Documents

For buyers who are not paying cash, financing documents are crucial. These include: - Loan application: The formal request for a mortgage loan. - Loan estimate: A document provided by the lender detailing the loan terms, including the interest rate, fees, and monthly payments. - Mortgage note: A promise to pay the lender, outlining the terms of the loan. - Deed of trust: A document that secures the loan with the property, allowing the lender to foreclose if payments are not made.

Closing Documents

At the closing, the final step in the purchase process, several key documents are signed. These include: - Deed: Transfers ownership of the property from the seller to the buyer. - Title: Proves the buyer’s ownership of the property. - Bill of sale: If applicable, transfers ownership of personal property included in the sale, such as appliances. - Closing disclosure: A detailed breakdown of the transaction costs, provided to the buyer at least three days before closing.

| Document | Description |

|---|---|

| Pre-approval letter | Indicates the amount of money the buyer is eligible to borrow. |

| Proof of income | Verifies the buyer's financial capacity. |

| Purchase agreement | Outlines the terms of the sale. |

| Inspection reports | Identify any defects or needed repairs in the property. |

| Financing documents | Include loan applications, estimates, notes, and deeds of trust. |

| Closing documents | Transfer ownership and finalize the sale. |

📝 Note: The specific documents required may vary depending on the location and type of property being purchased. It's essential to work with a real estate agent and attorney to ensure all necessary paperwork is completed accurately and on time.

To finalize the purchase of a property, understanding and completing the necessary paperwork is crucial. From pre-purchase documents to closing, each step and document plays a vital role in ensuring a legitimate and smooth transaction. By being informed and prepared, buyers can navigate the complex process of real estate purchase with confidence.

In the end, the key to a successful real estate transaction lies in meticulous planning, thorough documentation, and compliance with legal requirements. Whether you’re a seasoned buyer or a first-time purchaser, grasping the fundamentals of real estate paperwork will help you make informed decisions and secure your dream property.

What is the first step in the real estate purchase process?

+

The first step typically involves getting pre-approved for a mortgage, which provides an estimate of how much you can borrow.

Why are inspection reports important?

+

Inspection reports are crucial as they help identify any potential issues with the property, allowing buyers to negotiate or back out of the sale if necessary.

What documents are signed at closing?

+