Car Loan Paperwork Timeline

Introduction to Car Loan Paperwork

When purchasing a vehicle, understanding the car loan paperwork timeline is crucial for a smooth and hassle-free experience. The process involves several steps, from pre-approval to finalizing the loan, and each stage requires specific documents and actions. In this article, we will delve into the details of the car loan paperwork timeline, highlighting key milestones, necessary documents, and tips for navigating the process efficiently.

Pre-Approval Stage

The journey begins with the pre-approval stage, where potential buyers assess their creditworthiness and determine how much they can afford to borrow. This stage is vital as it sets the foundation for the subsequent steps. It’s essential to check your credit score and history to understand your financial standing. A good credit score can significantly influence the interest rates and terms offered by lenders.

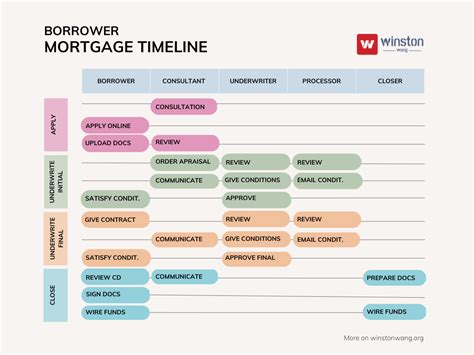

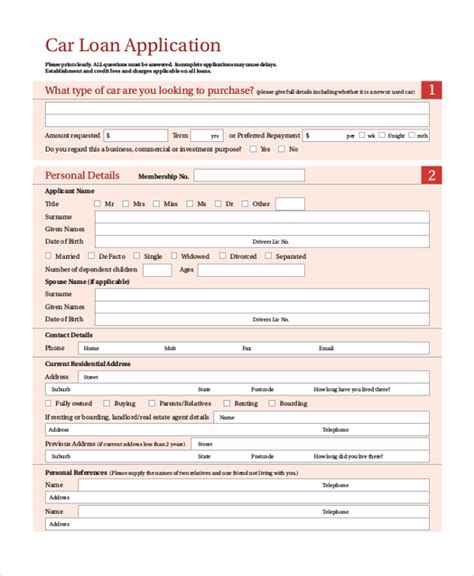

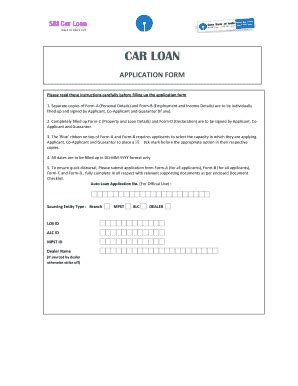

Application and Approval Process

Following pre-approval, the next step is the application and approval process. Here, buyers submit their loan applications to lenders, providing detailed financial information, including income, expenses, and credit history. Lenders review these applications, assessing the risk of lending to the applicant. A thorough review of the loan terms is crucial at this stage to ensure the borrower understands all conditions, including the interest rate, repayment period, and any fees associated with the loan.

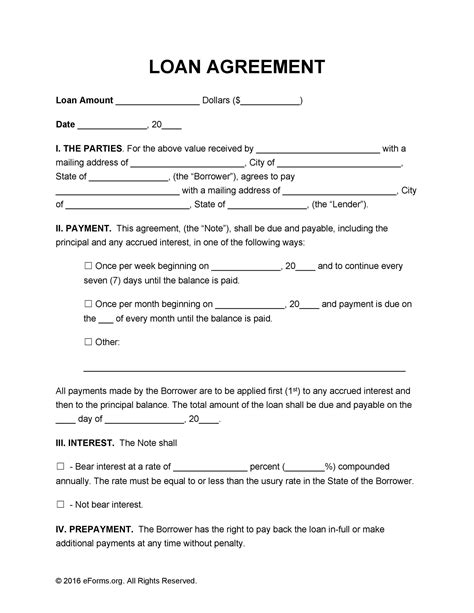

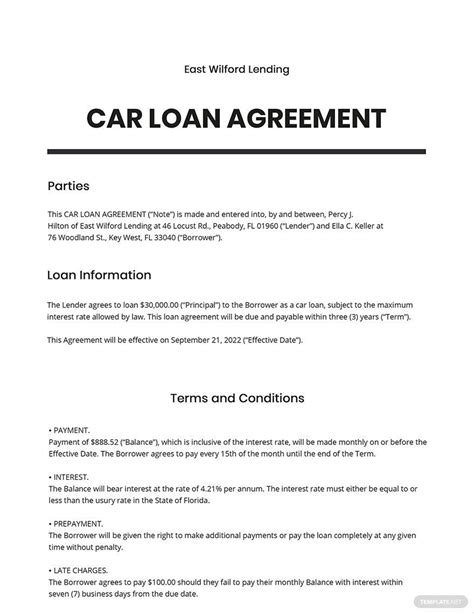

Purchase and Financing Stage

Once the loan is approved, the buyer can proceed to purchase the vehicle. This stage involves finalizing the sale with the dealership or seller and completing the loan paperwork. It’s critical to carefully review all documents, ensuring accuracy and completeness. The sales contract, loan agreement, and any other legal documents should be thoroughly understood before signing.

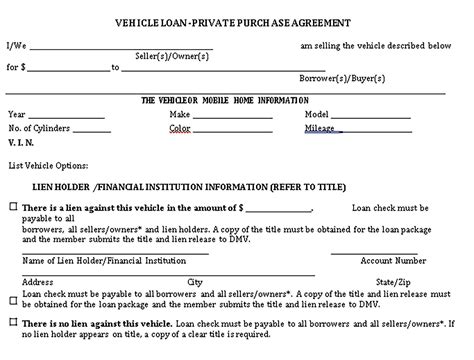

Documentation Required

Throughout the car loan paperwork timeline, various documents are required. These include: - Identification documents: Driver’s license, passport, etc. - Proof of income: Pay stubs, W-2 forms, etc. - Proof of residence: Utility bills, lease agreement, etc. - Credit reports: Obtained by the lender to assess creditworthiness - Vehicle information: Vehicle identification number (VIN), purchase price, etc.

| Document | Description |

|---|---|

| Identification Documents | Verify the borrower's identity |

| Proof of Income | Confirm the borrower's income and ability to repay the loan |

| Proof of Residence | Verify the borrower's address |

| Credit Reports | Evaluate the borrower's credit history and score |

| Vehicle Information | Details about the vehicle being purchased |

Navigating the Process

To navigate the car loan paperwork timeline efficiently, consider the following tips: - Research beforehand: Understand the process, necessary documents, and potential pitfalls. - Compare lenders: Look for the best interest rates and terms. - Read carefully: Ensure all documents are thoroughly reviewed before signing. - Ask questions: Clarify any doubts or concerns with the lender or financial advisor.

📝 Note: Maintaining open communication with the lender and being prepared with all necessary documents can significantly streamline the process.

Final Thoughts

Understanding and navigating the car loan paperwork timeline is a critical aspect of purchasing a vehicle. By being informed, prepared, and diligent, buyers can ensure a smoother, more efficient experience. Whether you’re a first-time buyer or have gone through the process before, staying organized and aware of the timeline and requirements can make all the difference in securing the best possible loan terms and enjoying your new vehicle.

The key to a successful car loan experience lies in thorough preparation, careful document review, and a clear understanding of the process from start to finish. By focusing on these aspects, individuals can better manage their expectations and the overall timeline, leading to a more satisfactory outcome.

What is the first step in the car loan paperwork timeline?

+

The first step is the pre-approval stage, where potential buyers check their credit score and determine how much they can afford to borrow.

What documents are typically required for a car loan application?

+

Commonly required documents include identification, proof of income, proof of residence, credit reports, and vehicle information.

How can I ensure a smooth car loan process?

+

Being prepared with all necessary documents, researching lenders, reading documents carefully, and asking questions can help ensure a smooth process.