5 Escrow Funding Tips

Introduction to Escrow Funding

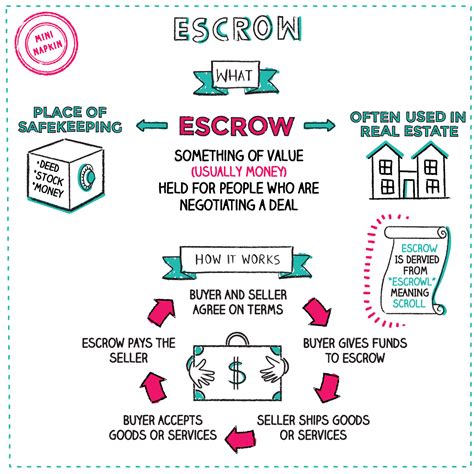

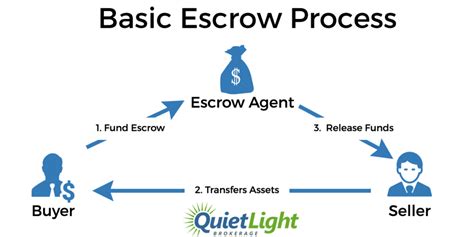

Escrow funding is a financial arrangement where a third-party holds and regulates payment of funds required for two parties involved in a given transaction. It helps ensure that payments are made as agreed upon, reducing the risk of fraud or default. Escrow funding is commonly used in real estate transactions, online purchases, and intellectual property deals. In this article, we will explore five essential tips for navigating escrow funding successfully.

Understanding the Escrow Process

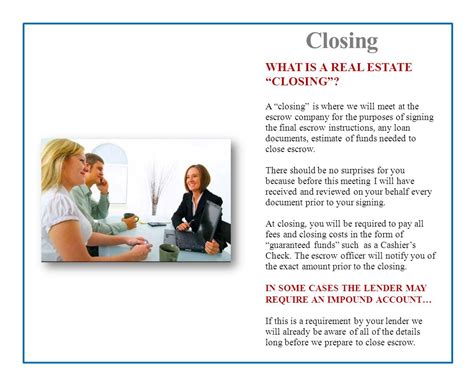

Before diving into the tips, it’s crucial to understand the escrow process. The process typically begins with the buyer and seller agreeing to use an escrow service. The buyer then deposits the payment into an escrow account, and the seller is notified when the payment is secured. The escrow service holds the payment until both parties confirm that the terms of the agreement have been met. Once confirmed, the escrow service releases the payment to the seller. This process ensures a safe and secure transaction for both parties.

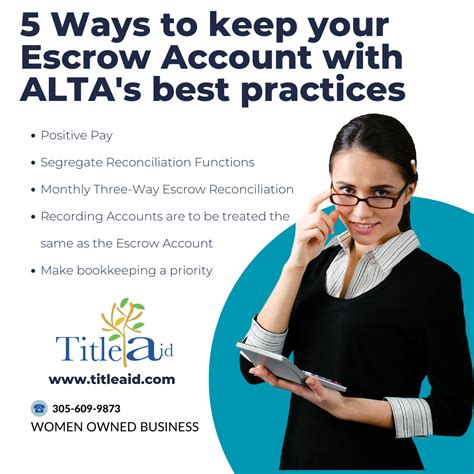

Tip 1: Choose a Reputable Escrow Service

Choosing a reputable escrow service is vital to ensure a smooth transaction. Research the escrow company thoroughly, checking for reviews, ratings, and any complaints filed against them. It’s also essential to verify the company’s license and ensure they are compliant with relevant regulations. A reputable escrow service will provide a secure and reliable platform for your transaction.

Tip 2: Clearly Define the Terms of the Agreement

Clearly defining the terms of the agreement is critical to avoid disputes and ensure a successful transaction. The agreement should include: * The amount to be held in escrow * The conditions for release of the funds * The responsibilities of both parties * The timeline for the transaction * Any penalties or fees associated with the transaction Having a well-defined agreement will help prevent misunderstandings and ensure that both parties are on the same page.

Tip 3: Understand the Fees Associated with Escrow Funding

Escrow services typically charge a fee for their services, which can vary depending on the company and the type of transaction. It’s essential to understand the fee structure and factor it into your transaction costs. Some common fees associated with escrow funding include: * Setup fees * Transaction fees * Holding fees * Release fees Being aware of these fees will help you budget accordingly and avoid any unexpected costs.

Tip 4: Keep Records and Communicate Effectively

Keeping accurate records and communicating effectively with all parties involved is crucial to a successful escrow transaction. Make sure to: * Keep a record of all correspondence and agreements * Communicate clearly and promptly with the escrow service and the other party * Respond to requests and notifications in a timely manner * Be prepared to provide additional information or documentation as required Effective communication and record-keeping will help prevent delays and ensure a smooth transaction.

Tip 5: Be Aware of Potential Risks and Disputes

While escrow funding can provide a secure and reliable platform for transactions, there are still potential risks and disputes that can arise. Be aware of: * The risk of fraud or default by the other party * The potential for disputes over the terms of the agreement * The risk of delays or complications in the transaction process * The potential for additional fees or costs Being aware of these risks and taking steps to mitigate them will help you navigate the escrow process successfully.

📝 Note: It's essential to carefully review the terms of the agreement and understand the escrow process before initiating a transaction.

In summary, escrow funding can provide a secure and reliable platform for transactions, but it’s essential to choose a reputable escrow service, clearly define the terms of the agreement, understand the fees associated with escrow funding, keep records and communicate effectively, and be aware of potential risks and disputes. By following these tips, you can navigate the escrow process successfully and ensure a smooth transaction.

What is escrow funding, and how does it work?

+

Escrow funding is a financial arrangement where a third-party holds and regulates payment of funds required for two parties involved in a given transaction. The process typically begins with the buyer and seller agreeing to use an escrow service, and the buyer deposits the payment into an escrow account. The escrow service holds the payment until both parties confirm that the terms of the agreement have been met, and then releases the payment to the seller.

How do I choose a reputable escrow service?

+

Choosing a reputable escrow service involves researching the company thoroughly, checking for reviews, ratings, and any complaints filed against them. It’s also essential to verify the company’s license and ensure they are compliant with relevant regulations. A reputable escrow service will provide a secure and reliable platform for your transaction.

What are the benefits of using escrow funding?

+

The benefits of using escrow funding include a secure and reliable platform for transactions, reduced risk of fraud or default, and protection for both the buyer and seller. Escrow funding also provides a clear and defined process for the transaction, which can help prevent disputes and ensure a smooth transaction.