Business Paperwork Retention Periods

Introduction to Business Paperwork Retention Periods

When it comes to managing business paperwork, one of the most critical aspects is understanding the retention periods for various documents. Retention periods refer to the length of time that businesses are required to keep specific documents, either by law or for internal record-keeping purposes. These periods can vary significantly depending on the type of document, the industry, and the jurisdiction in which the business operates. In this article, we will delve into the world of business paperwork retention periods, exploring the reasons behind these requirements, the different types of documents, and the implications of non-compliance.

Understanding the Importance of Retention Periods

Retention periods are essential for several reasons: - Compliance with Laws and Regulations: Many laws and regulations mandate the retention of specific documents for certain periods. For example, tax authorities often require businesses to keep financial records for a specified number of years. - Audit and Financial Purposes: Retaining financial documents and records is crucial for audits, tax returns, and financial reporting. - Litigation and Dispute Resolution: In cases of legal disputes, having access to historical documents can be invaluable for proving claims or defending against them. - Internal Governance and Accountability: Document retention helps in maintaining transparency and accountability within an organization, ensuring that decisions and actions can be traced and evaluated.

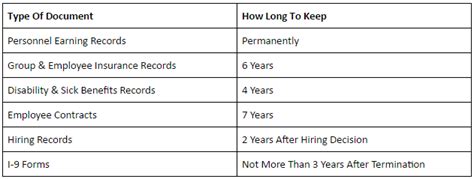

Types of Business Documents and Their Retention Periods

Different types of documents have varying retention periods. Here are some common examples: - Financial Documents: This includes invoices, receipts, bank statements, and tax returns. The retention period for these documents can range from 3 to 7 years, depending on the jurisdiction and the specific regulation. - Employment Records: Documents related to employee hiring, payroll, benefits, and termination typically need to be retained for 4 to 7 years after the employee leaves the company. - Contracts and Agreements: The retention period for contracts can vary, but it’s often recommended to keep them for at least 7 years after the contract expires or is terminated. - Health and Safety Records: For companies in industries that require health and safety protocols, records of accidents, training, and compliance inspections should be kept for 3 to 10 years, depending on the nature of the record.

Electronic vs. Physical Document Retention

With the advancement in technology, many businesses are shifting towards electronic document management systems. This shift brings about several benefits, including: - Space Efficiency: Electronic documents take up virtually no physical space. - Accessibility: Documents can be accessed from anywhere, at any time, provided there is an internet connection. - Security: Electronic documents can be encrypted and password-protected, reducing the risk of unauthorized access.

However, electronic document retention also comes with its own set of challenges, such as ensuring the integrity and authenticity of the documents, and the potential for data loss due to technological failures.

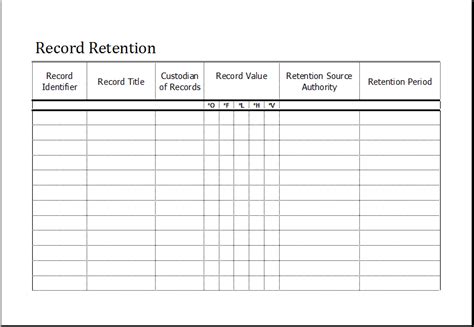

Best Practices for Document Retention

To ensure compliance with retention requirements and to maintain good business practices, consider the following: - Develop a Document Retention Policy: Outline which documents need to be kept, for how long, and how they will be stored. - Use a Centralized Storage System: Whether physical or electronic, having all documents in one place simplifies management and retrieval. - Implement Access Controls: Limit who can access certain documents to protect sensitive information. - Regularly Review and Update Policies: Laws and regulations change, so it’s essential to periodically review and update the document retention policy.

📝 Note: It's crucial to consult with legal and financial advisors to ensure that the document retention policy complies with all relevant laws and regulations.

Conclusion and Future Considerations

In conclusion, understanding and adhering to business paperwork retention periods is vital for compliance, financial health, and legal protection. As businesses continue to evolve and technology advances, the way documents are retained will likely change. However, the core principles of maintaining accurate, accessible, and compliant records will remain essential. By implementing robust document retention policies and staying informed about legal and regulatory requirements, businesses can navigate the complexities of paperwork retention with confidence.

What happens if a business fails to comply with document retention requirements?

+

Failure to comply can result in fines, legal penalties, and in severe cases, business closure. It’s essential to understand and adhere to all applicable laws and regulations.

How often should a document retention policy be reviewed and updated?

+

A document retention policy should be reviewed annually or whenever there are changes in laws, regulations, or business operations. This ensures the policy remains relevant and compliant.

Can electronic documents replace physical ones for retention purposes?

+

Yes, electronic documents can replace physical ones, provided they are stored securely, are easily accessible, and their integrity and authenticity can be guaranteed. It’s also important to ensure that electronic storage complies with all relevant laws and regulations.