Bankruptcy Paperwork Retention Period

Introduction to Bankruptcy Paperwork Retention

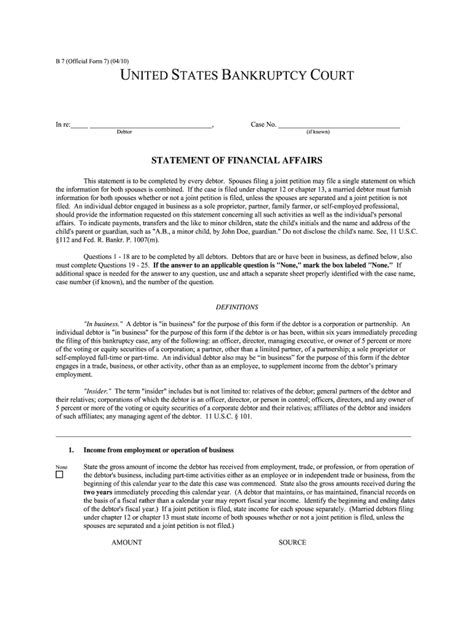

When individuals or businesses file for bankruptcy, they are required to provide extensive documentation to support their claim. This paperwork can include financial records, tax returns, and other relevant documents. After the bankruptcy process is complete, it’s essential to understand the retention period for these documents. The length of time you need to keep bankruptcy paperwork varies depending on the type of bankruptcy, local laws, and the specific requirements of your case. In this article, we will delve into the details of bankruptcy paperwork retention periods, highlighting key considerations and best practices.

Types of Bankruptcy and Retention Periods

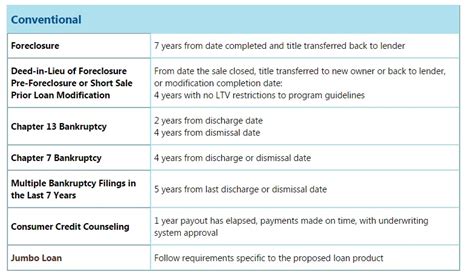

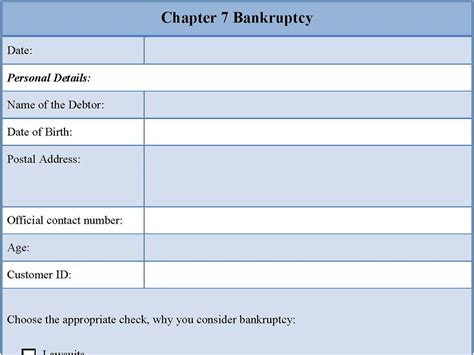

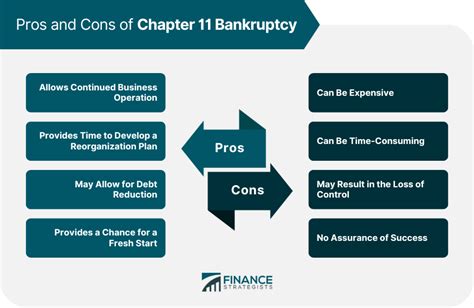

There are several types of bankruptcy, each with its own set of rules and retention requirements. The most common types include Chapter 7, Chapter 11, and Chapter 13. - Chapter 7 Bankruptcy: This is the most common type of bankruptcy and involves the liquidation of assets to pay off creditors. For Chapter 7, it’s generally recommended to keep all bankruptcy-related documents for at least 3 to 5 years after the discharge, as the IRS and other creditors may still have claims during this period. - Chapter 11 Bankruptcy: This type of bankruptcy is usually filed by businesses and involves reorganizing debts to become solvent again. The retention period for Chapter 11 can be longer, often 5 to 7 years, due to the complexity of business financial records and potential audits. - Chapter 13 Bankruptcy: This involves creating a repayment plan to pay off debts over time. The recommended retention period for Chapter 13 bankruptcy documents is typically 5 to 7 years after the completion of the repayment plan, to ensure all payments are accounted for and disputes can be resolved.

Important Documents to Retain

Several documents are crucial to retain during and after the bankruptcy process. These include: * Bankruptcy petition: The initial document filed with the court to start the bankruptcy process. * Schedules and statements: Detailed lists of assets, liabilities, income, and expenses. * Discharge order: The court order that officially discharges debts. * Financial records: Bank statements, tax returns, and any other financial documents submitted during the bankruptcy process. * Communication with creditors and the court: All correspondence, including letters, emails, and court notices.

Best Practices for Document Retention

To manage bankruptcy paperwork effectively, consider the following best practices: * Digital and Physical Storage: Keep both digital and physical copies of documents. Digital copies can be stored on secure cloud services, while physical copies should be kept in a safe, fireproof location. * Organization: Use a filing system that allows easy access to specific documents. This can be particularly useful if you need to retrieve information quickly. * Security: Ensure that all documents are stored securely to protect sensitive financial information from identity theft or other breaches. * Regular Review: Periodically review your stored documents to ensure they remain relevant and to dispose of any unnecessary paperwork securely.

Why Retention Matters

Retention of bankruptcy paperwork is crucial for several reasons: * Audits and Disputes: In case of an audit or dispute with creditors, having all necessary documents readily available can significantly simplify the process and protect your interests. * Financial Planning: Retained documents can provide valuable insights into your financial history, helping with future financial planning and decision-making. * Compliance: Keeping required documents for the appropriate period ensures compliance with legal and regulatory requirements, avoiding potential penalties.

Consequences of Inadequate Retention

Failing to retain necessary bankruptcy documents can lead to several issues: * Legal Complications: Without proper documentation, you may face legal challenges, including the reopening of bankruptcy cases or disputes over discharged debts. * Financial Risks: Inadequate records can make it difficult to prove financial transactions or the status of debts, potentially leading to financial losses. * Regulatory Penalties: Non-compliance with document retention requirements can result in fines or other penalties.

📝 Note: It's essential to consult with a legal or financial advisor to determine the specific retention requirements for your bankruptcy case, as local laws and individual circumstances can affect these guidelines.

To summarize, the retention period for bankruptcy paperwork varies depending on the type of bankruptcy and local regulations. It’s crucial to understand these requirements and implement best practices for document management to ensure compliance, facilitate future financial planning, and protect against potential disputes or audits. By retaining the necessary documents for the appropriate period, individuals and businesses can navigate the aftermath of bankruptcy more effectively.

What is the general recommendation for retaining Chapter 7 bankruptcy documents?

+

It’s generally recommended to keep Chapter 7 bankruptcy documents for at least 3 to 5 years after the discharge.

Why is it important to retain bankruptcy paperwork?

+

Retaining bankruptcy paperwork is crucial for audits, disputes, financial planning, and compliance with legal and regulatory requirements.

What are the consequences of not retaining bankruptcy documents adequately?

+

The consequences can include legal complications, financial risks, and regulatory penalties.