7 Tips Mortgage Paperwork

Introduction to Mortgage Paperwork

When navigating the process of obtaining a mortgage, one of the most daunting tasks can be understanding and managing the extensive amount of paperwork involved. Mortgage paperwork encompasses a wide range of documents, from the initial application to the final closing documents. Each document serves a crucial purpose, providing lenders with the necessary information to assess the borrower’s creditworthiness and ensuring that the transaction is legally binding. In this article, we will delve into 7 key tips for handling mortgage paperwork efficiently, aiming to make the mortgage process smoother and less overwhelming for borrowers.

Understanding the Basics

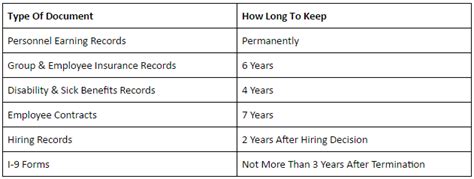

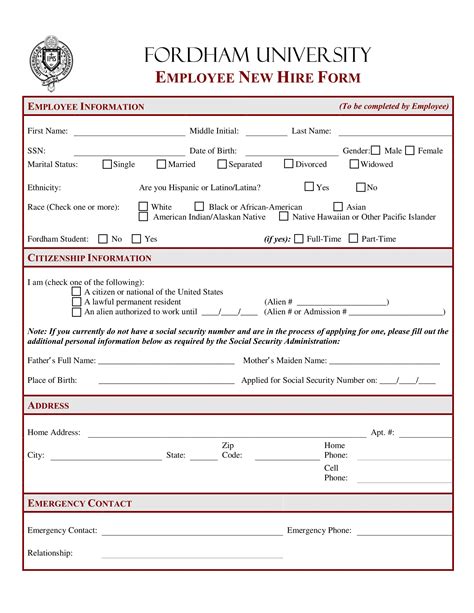

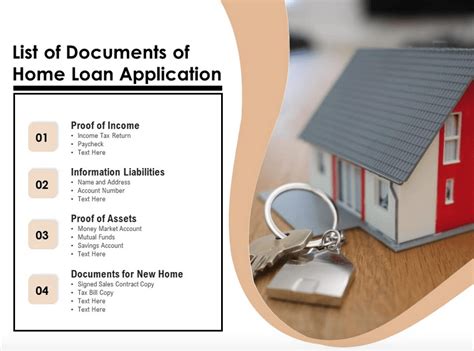

Before diving into the tips, it’s essential to have a basic understanding of what mortgage paperwork entails. This includes, but is not limited to, loan applications, credit reports, income verification documents (such as pay stubs and W-2 forms), bank statements, identification documents (like driver’s licenses and passports), and title reports. Each of these documents plays a vital role in the mortgage application process.

Tips for Managing Mortgage Paperwork

Here are seven tips to help borrowers manage their mortgage paperwork more effectively:

- Stay Organized: Keeping all documents in a centralized and easily accessible location can significantly reduce stress and make the process more manageable. Consider using a folder or digital storage solution where you can keep scanned copies of your documents.

- Understand What’s Required: Different lenders may have slightly varying requirements, so it’s crucial to understand exactly what documents are needed for your specific situation. Asking your lender for a checklist can be incredibly helpful.

- Accuracy is Key: Ensure that all information provided is accurate and truthful. Inaccuracies or omissions can lead to delays or even denial of the mortgage application.

- Act Promptly: When a lender requests additional documentation, it’s essential to respond as quickly as possible. Delays can slow down the entire process, potentially impacting the closing date.

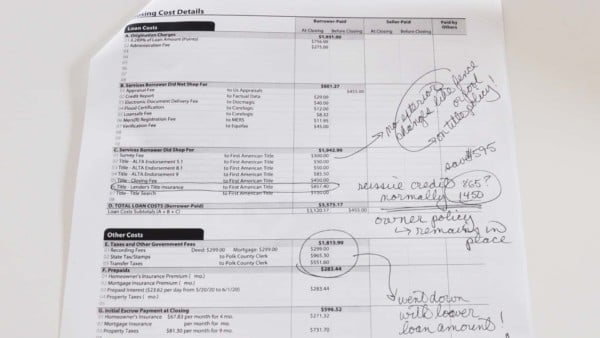

- Review Documents Carefully: Before signing any documents, review them carefully. This includes understanding the terms of the loan, the interest rate, and any fees associated with the mortgage.

- Seek Professional Advice: If you’re unsure about any part of the process, don’t hesitate to seek advice from a professional, such as a mortgage broker or financial advisor.

- Digital Documentation: Many lenders now offer digital platforms for uploading and signing documents. Taking advantage of these can streamline the process and reduce paperwork clutter.

Common Challenges and Solutions

Despite the best preparations, challenges can arise. For instance, missing documents or errors in credit reports can cause significant delays. In such cases, staying calm and communicating clearly with your lender is crucial. Often, issues can be resolved by providing additional information or correcting errors in a timely manner.

| Challenge | Solution |

|---|---|

| Missing Documents | Immediately notify your lender and provide the required documents as soon as possible. |

| Errors in Credit Reports | Dispute the error with the credit bureau and provide corrected information to your lender. |

📝 Note: Maintaining open communication with your lender throughout the process can help mitigate many of the common challenges associated with mortgage paperwork.

Conclusion and Final Thoughts

In conclusion, managing mortgage paperwork requires a combination of organization, understanding, and timely action. By following these tips and being prepared for potential challenges, borrowers can make the mortgage application process less daunting and more efficient. Remember, the key to a successful mortgage application is in the details, and taking the time to understand and manage your paperwork can make all the difference in securing your dream home.

What is the most important document in the mortgage application process?

+

The loan application is often considered the most crucial document, as it provides the lender with the initial information needed to assess the borrower’s eligibility for a mortgage.

How long does the mortgage application process typically take?

+

The duration of the mortgage application process can vary significantly depending on several factors, including the type of loan, the borrower’s financial situation, and the efficiency of the lender. On average, it can take anywhere from a few weeks to a couple of months.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications. This can streamline the process, allowing you to upload documents and track the status of your application digitally.